MobileCoin, the startup identified for constructing Sign’s crypto funds function, has appointed a brand new CEO as it really works on increasing its encrypted cash switch service to international customers in want of a extra fashionable remittance answer. Sara Drakeley is taking the helm as MobileCoin’s new chief govt officer. Changing her earlier function because the agency’s chief expertise officer is Henry Holtzman, former chief innovation officer at MIT Media Lab.

In an interview with starcrypto, Drakeley remarked on the important thing function Bob Lee performed in shaping the event of MobileCoin. Lee, who was killed in a deadly stabbing in April, was the CTO of Sq. and creator of the Money App earlier than becoming a member of MobileCoin as chief product officer as a result of he noticed the potential for crypto to allow peer-to-peer transactions on a worldwide scale.

“Money App is barely within the U.S. and what we’re constructing is international,” mentioned Drakeley. “The opposite factor [Lee] acknowledged is that with the normal monetary system, it’s so sophisticated. He would say: ‘You realize, you suppose blockchain is sophisticated. Have a look at the normal monetary system. There are all of those middlemen. You suppose issues are settling immediately, however truly, it’s simply queuing up and these large machines will finally settle at night time.”

“With blockchain, you simply have a single transaction between two events. It’s manner less complicated,’” Drakeley added.

MobileCoin, which has raised over $100 million from traders together with Binance Labs, plans to ultimately monetize via transaction charges and value-added providers, equivalent to lending. “When you’ve acquired a base financial system and cash shifting via a system, there are many methods to monetize it,” Drakeley mentioned.

Privateness and regulation

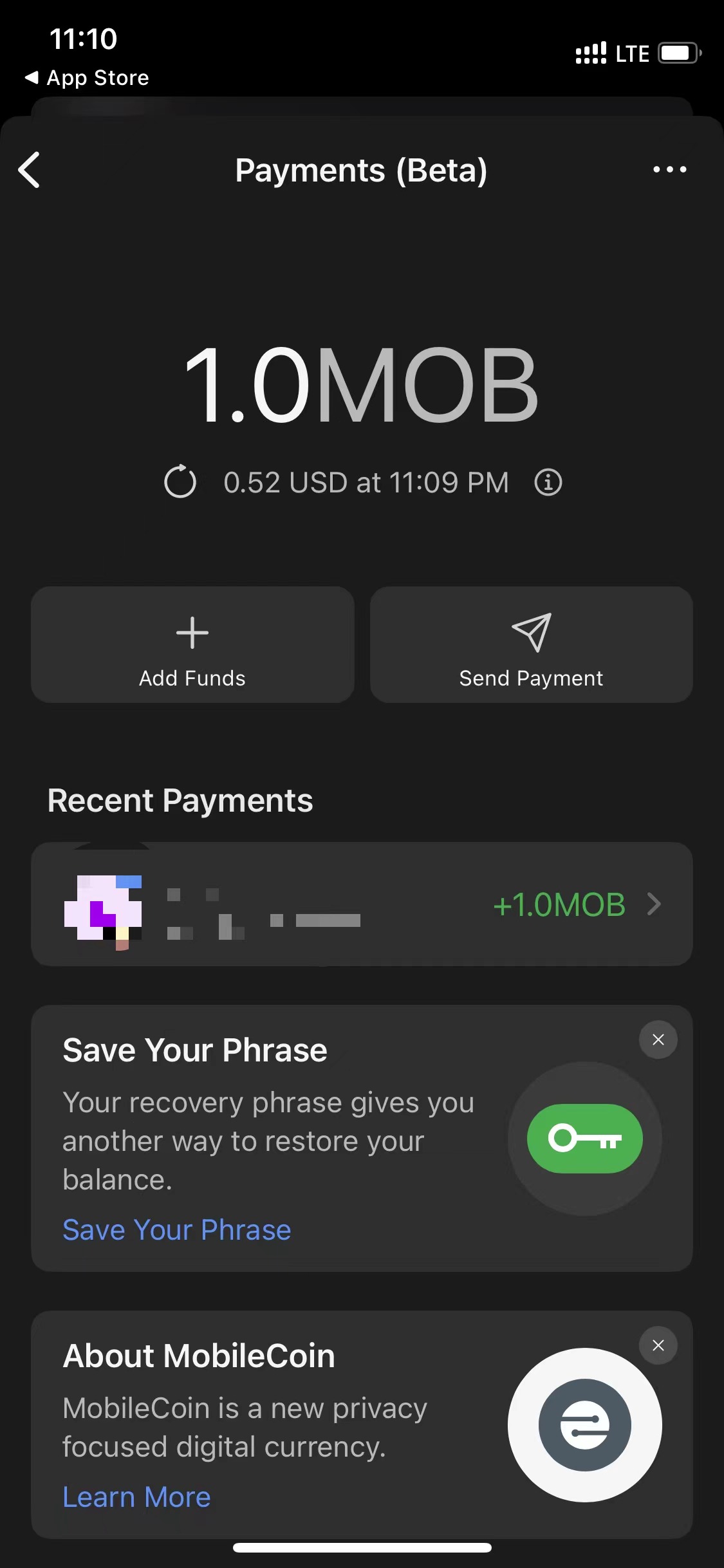

In 2021, Sign, the end-to-end messenger widespread amongst privacy-conscious customers, launched the beta model of the MobileCoin-powered funds answer. The function has formally come out of the testing section, permitting any consumer all over the world to immediately ship MobileCoin’s native Mob token to different Sign customers with negligible community charges — all with out leaving any identifiable trails behind.

The mix of encrypted messages and nameless transactions has raised fairly a number of eyebrows. Some fear that the expertise may very well be leveraged by felony organizations to speak, make funds and finally evade investigations. To this point, Moby, MobileCoin’s standalone funds app, has partnered with Paybis, which carries out the usual Know Your Buyer and Anto-Cash Laundering procedures within the conversion between crypto and fiat.

What the crypto pockets on Sign appears like when it’s first activated / Picture: starcrypto

As for regulating on-chain exercise, Drakeley mentioned she feels “promising” about a number of the technological developments that guarantee folks’s rights to “security and safety” whereas nonetheless permitting them to “abide by the compliance and rules.”

“Identification on-chain is a extremely sizzling matter proper now, and plenty of persons are and invested in how that’s going to develop, with the belief that id is a part of the way you finally resolve AML and KYC. It’s crucial, I believe, to regulators that there’s a holistic id verification answer,” she noticed.

“There are different items of metadata that you could connect to a transaction that may assist set up belief. And that may assist set up that danger profile. These are issues you’ll be able to connect even in a manner that also protects folks’s folks’s knowledge,” the CEO added.

Crypto cost wave

Drakeley, who labored at SpaceX and Disney Animation Studios earlier than becoming a member of web3, is entering into her new function at a time when crypto funds are producing loads of curiosity from traders and builders.

Nigerian startup Kotani, for instance, lately raised $2 million to assist African migrant staff ship cash dwelling through stablecoins. a16z-backed Eco is a participant out of San Francisco touting its crypto-based “international Venmo.”

The differentiator of MobileCoin, in response to Drakeley, is that it helps “non-public” transactions, a distinction to different blockchain-based cash actions of which particulars are publicly accessible on-chain. “Are you able to think about in the event you go to a espresso store, and also you pay to your espresso, and in that immediate with that one cost, the barista is aware of your wage?” mentioned Drakeley, including that, in contrast to some Ethereum scaling options, MobileCoin’s community is quick and low-cost sufficient to help microtransactions.

“We as an business have constructed so many applied sciences that don’t have privateness, the place it’s so onerous so as to add that privateness again in. You possibly can see how a lot effort has gone into attempting so as to add a Layer 2 of privateness to Ethereum. Even with all that effort, it’s nonetheless not likely fixing the issue, since you’ve additionally acquired the excessive charges and the period of time it takes for a transaction to settle,” she mentioned.

To make crypto funds sensible for day-to-day situations, MobileCoin has spent the final 5 years engaged on its privacy-preserving protocol, initially primarily based on the Stellar blockchain, to energy blockchain transactions that may run even on low-bandwidth cellular gadgets. The concentrate on low vitality consumption, particularly, has helped Moby garner curiosity in creating nations with a big remittance influx, equivalent to Mexico, Nigeria and the Philippines, in response to Drakeley.