In its Aug. 1 monetary outcomes, enterprise intelligence agency MicroStrategy stated it acquired substantial Bitcoin throughout Q2 2023.

Andrew Kang, Chief Monetary Officer at MicroStrategy, stated:

“The addition within the second quarter of 12,333 bitcoins [is] the most important enhance in a single quarter since Q2 2021. We effectively raised capital… and used money from operations to proceed to extend bitcoins on our stability sheet.”

In a separate presentation, the agency stated that the 12,333 BTC it purchased was bought for $347 million at a median of $28,136 per Bitcoin.

Nonetheless, these numbers solely characterize the corporate’s newest additions, not the entire quantity of Bitcoin it acquired. MicroStrategy stated that, as of July 31, 2023, it had acquired 152,800 BTC for $4.53 billion or $29,672 per Bitcoin.

Regardless of these excessive estimates, the corporate stated that the carrying worth (the unique value of the asset, much less any depreciation, amortization or impairment prices) of its Bitcoin was simply $2.3 billion. That quantity displays cumulative impairment losses of $2.196 billion since MicroStrategy’s first buy and a median carrying quantity per Bitcoin of $15,251.

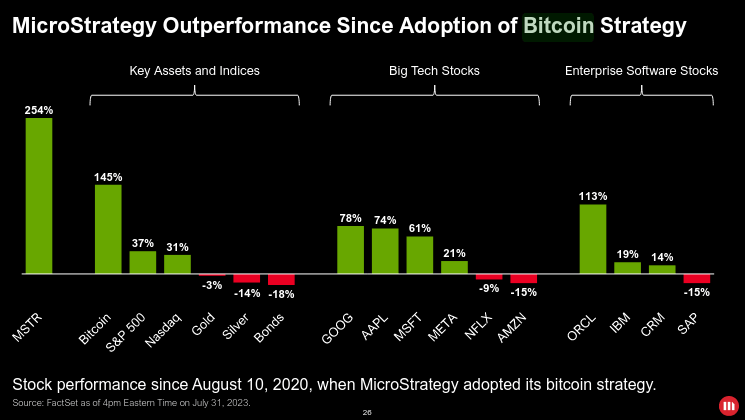

MicroStrategy famous elsewhere that Bitcoin and its personal MSTR inventory have outperformed quite a few different indexes and belongings. MSTR has gained 254% because it adopted its Bitcoin technique in August 2020, whereas Bitcoin itself has gained 145% since that date.

MicroStrategy in any other case reported whole revenues of $120.4 million in Q2 2023, which represents a 1% lower in income year-over-year.

Bitcoin within the larger image

Kang additionally positioned MicroStrategy’s purchases inside broader business developments, resembling growing curiosity from institutional buyers and regulatory readability round Bitcoin.

Kang additionally stated that MicroStrategy is seeing progress relating to Bitcoin accounting practices. In Might, the corporate submitted a letter to the Monetary Accounting Requirements Board (FASB) expressing assist for a good worth accounting for crypto belongings. It stated this could permit it to supply a “extra related view” of its Bitcoin holdings.

In its firm profile, Microstrategy known as Bitcoin a “reliable retailer of worth” and described Bitcoin acquisition as certainly one of its two important methods alongside its enterprise software program enterprise.

The publish MicroStrategy made largest Bitcoin buy since 2021 in Q2 2023 amid slight income lower appeared first on StarCrypto.