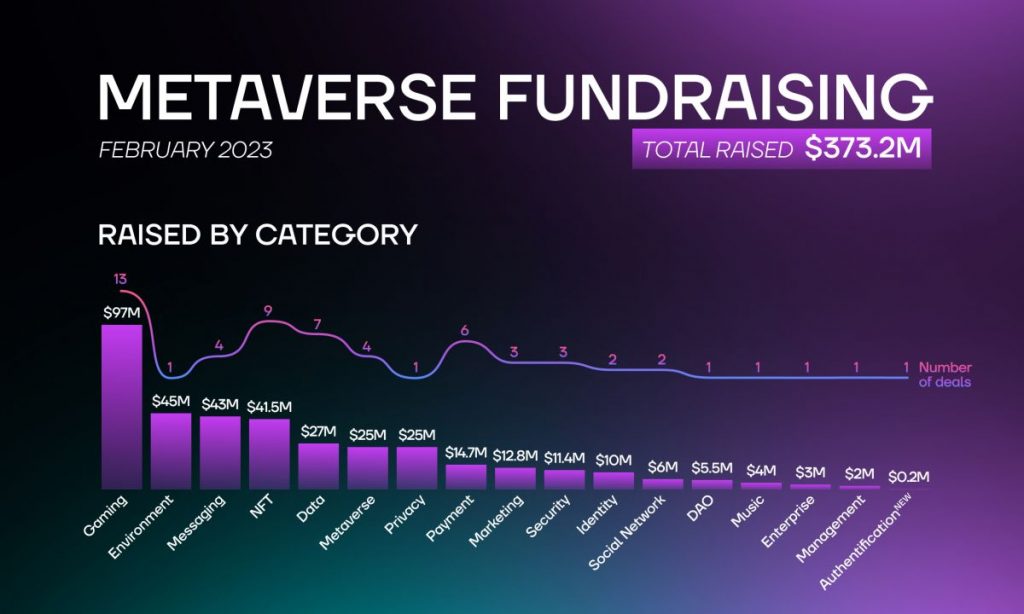

In February 2023, angel buyers, VC funds, and banks confirmed us their curiosity in web3, having invested $373.2 million in 60 startups.

This month, the main industries are gaming, surroundings, and messaging. 13 gaming startups acquired $97 million in funding, with the checklist truly that includes a number of massively multiplayer video games. In January, gaming firms raised $21 million, and in November of 2022, $53 million. We will observe that the height of the gaming trade occurred in August when nineteen startups acquired $466 million.

An surroundings startup referred to as Carbonplace acquired $45 million. The trade was additionally current within the earlier month when three surroundings firms raised $14.3 million.

4 messaging startups bought $43 million from VC funds and angels. In January, the trade noticed two startups obtain a complete of $8.3 million. In November, one messaging firm raised $10 million. The trade is evolving, and we’d see higher client curiosity as web3 turns into much less area of interest.

9 NFT-related startups come subsequent, with the results of $41.5 million raised altogether. After all, the quantity isn’t as spectacular because it was in August when NFT firms acquired $186.4 million. Nevertheless, the rounds imply that the trade remains to be rising even if the NFT bubble burst by the tip of 2022.

Gaming Business Developments

Large multiplayer on-line roleplaying NFT-based sport Worldwide Webb raised $10 million in a Sequence A spherical led by Pantera Capital. The startup will use the funds to develop the group, combine extra NFTs into the sport, and kind partnerships with manufacturers. As well as, the studio plans to launch a browser-based sport referred to as “Blockbusterz” within the upcoming weeks.

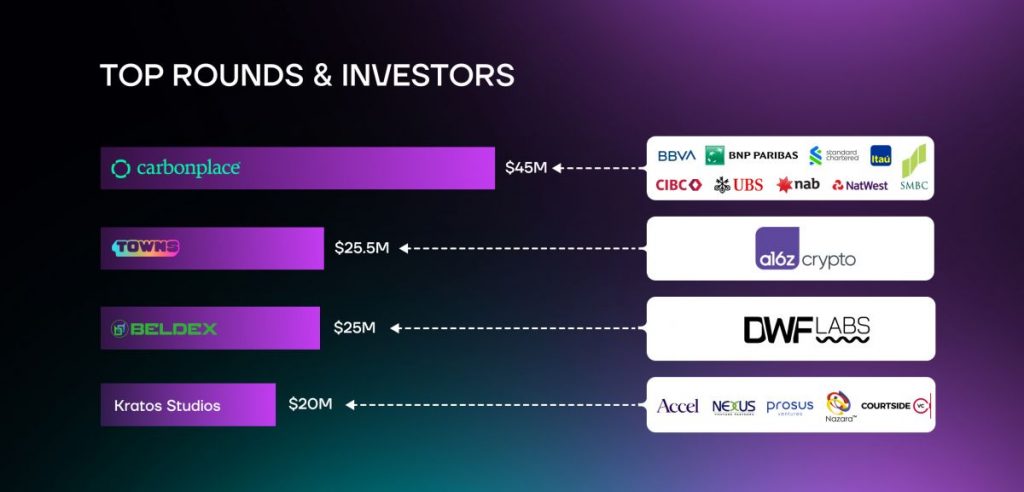

India-based Kratos Studio raised $20 million in a seed spherical led by Accel. Among the many different individuals are Prosus Ventures, Nexus Enterprise Companions, Courtside Ventures, and Nazara Applied sciences. Notably, the startup additionally acquired a sub-DAO of Yield Guild Video games DAO, IndiGG.

Large multiplayer on-line sport Chainmonsters raised $1.5 million. The sport will quickly be launched on the Epic Video games Retailer.

Curio raised $2.9 million in a seed spherical led by Bain Capital Crypto. TCG Crypto, Robotic Ventures, Smrti Lab, Formless Capital, and angel buyers backed the spherical. The corporate will proceed growing its blockchain-based video games.

“Regardless of the large progress and innovation we have now seen within the on-chain gaming area, we haven’t seen that many inventions that would actually differentiate the on-chain gameplay expertise from that of conventional video games,”

famous the co-founder of Curio, Yija Chen.

Azra Video games raised $10 million in an prolonged seed spherical. Andreessen Horowitz, NFX, Coinbase Ventures, Play Ventures, and Franklin Templeton Investments participated within the spherical. The corporate will use the funds to develop the NFT-themed Legions & Legends.

Yield Guild Video games raised $13.8 million in a personal token sale led by DWF Labs. Among the many different individuals are a16z Crypto, Sangha Capital Fund, Galaxy Interactive, Sanctor Capital, and former company lawyer at Google David Lee. The corporate will use the funds to proceed growing its initiatives.

“The token buy alerts the arrogance of our companions in YGG’s mission of empowering avid gamers by way of web3 gaming,”

mentioned the co-founder of YGG, Gabby Dizon.

Gaming-focused infrastructure startup Nefta raised $5 million in a seed spherical led by Play Ventures. Polygon Ventures, Sfermion, SevenX Ventures, and Picus Capital are among the many different individuals. The corporate plans to develop its group and scale its providing in keeping with the demand for the product.

Empires Not Vampires raised $1 million in a seed spherical led by Shima Capital. Zee Prime Capital, Firex Capital, FOMOCraft Ventures, Firex Capital, Starter Capital, and Devmons participated within the spherical. The startup will use the funds to develop its blockchain-based multiplayer sport, Paradise Tycoon.

The NFT Gaming Firm, Inc. introduced the pricing of its $7 million preliminary public providing. The startup permits customers to mint distinctive cross-game avatars.

The decentralized gaming platform within the Polkadot ecosystem, Ajuna, raised $5 million in a personal financing spherical led by CMCC World.

Tower Pop, the sport studio behind Omega Royale, raised $2.1 million from Play Ventures, Agnitio Capital, and Santiago R. Santos. The studio will use the funds to develop its web3 Battle Royale sport.

“We’re creating one thing fully new, one thing that has by no means been performed earlier than within the

gaming world: a Battle Royale Tower Protection sport using the blockchain,”mentioned the founders of Tower Pop.

Web3 cellular gaming growth studio and writer Mino Video games raised $15 million in a spherical led by Normal Crypto. Among the many different individuals are Collab + Foreign money, Enhance VC, Konvoy Ventures, and Earl Gray Capital. The studio makes use of web3 to construct a direct relationship between the group and the developer.

Bibliotheca DAO, the group behind the massively multiplayer on-chain sport Loot Realms, acquired $3,970,473 in a public token sale. In accordance with the Decentralized Autonomous Group, the individuals will probably be refunded 84.25% of their investments.

Metaverse Business Developments

Avalon Corp., a gaming studio that develops an interoperable metaverse, raised $13 million in a spherical led by Bitkraft Ventures, Hashed, Delphi Digital, and Mechanism Capital. The opposite buyers embrace Coinbase Ventures, Yield Guild Video games, Avocado Guild, Advantage Circle, and Morningstar Ventures.

Phi, an on-chain immersive social gaming world, raised $2 million in a seed spherical led by Chapter One and Delphi Digital. Polygon Ventures, Stani Kulechov, and different famous angel buyers backed the spherical. The startup plans to speed up the event of UI and UX and add new social and gaming options.

Play-to-own Martian metaverse sport Million in Mars acquired $3.5 million in a spherical led by Widus Companions and Nice South Gate. Solana Basis additionally participated within the spherical. The sport studio will use the funds so as to add extra methods and environments to its digital model of Mars.

Marwari acquired $6.5 million from Blockchange Ventures, Decasonic, Abies Ventures, Prima Capital, Anfield, Outlier Ventures, and Accord Ventures. The corporate develops options that allow quick 3D content material supply for metaverse-ready property.

NFT Business Developments

Lifeform, a 3D digital human avatars editor, raised $5 million in a Sequence A spherical led by Geek Cartel. KuCoin Labs, Foresight Ventures, DHVC, K24 Ventures, and One other Worlds backed the spherical.

AI-powered NFT buying and selling startup NeoSwap AI raised $2 million in a pre-seed spherical led by Digital Asset Capital Administration and AngelHub. Among the many different buyers are Gossamer Capital, Cavalry Asset Administration, Dhuna Ventures, Stacks Ventures, and several other angels.

NFT lending protocol PaprMeme acquired $3 million from Coinbase Ventures.

Web3 fantasy sports activities sport platform Unagi raised $5 million in an equity-based seed spherical led by Sisu Sport Ventures. Sfermion, 2B Ventures, UOB Ventures, Signum Capital, and Machame are among the many buyers.

Artwork gallery platform Botto acquired funding in a strategic spherical led by Variant.

Creator of designer toys, attire, and NFTs Superplastic acquired $20 million in an prolonged Sequence A spherical led by Amazon Alexa Fund. Among the many buyers are Google Ventures, Galaxy Digital, Kering, Sony Japan, and Animoca Manufacturers. The corporate will use the funds to develop “The Janky & Guggimon Present” collection and movies for Amazon.

“As we develop the Alexa Fund to handle a wider vary of client applied sciences that embrace ambient computing, good units, and the way forward for leisure, we’re very excited so as to add Superplastic to our portfolio,”

mentioned the director of the Alexa Fund, Paul Bernard, in a press launch.

Finiliar Studios raised $500,000 in a pre-seed spherical backed by IDEO CoLab Ventures, Wave Monetary, and angel buyers. The startup goals to develop software program and artistic IP for its ecosystem. So, Finiliar will use the funds to create a set of purposes, integrations, and different merchandise.

Non-custodial NFT index and algorithmic lending protocol Fungify raised $6 million in a spherical led by Citizen X. Among the many different individuals are Distributed World, Anagram, Taureon Capital, Infinity Ventures Crypto, Circulation Ventures, and several other angel buyers. The startup will reportedly launch when it concludes safety audits this spring or summer season.

NFT platform Collector Crypt raised an undisclosed quantity in a seed spherical backed by GSR, Large Mind Holdings, Genesis Block Ventures, StarLaunch, Grasp Ventures Funding Administration, FunFair Ventures, and Telos. The startup integrates bodily possession into web3 digital marketplaces.

Music Business Developments

Web3 music platform Vault raised $4 million in a Sequence A spherical led by Placeholder VC. Among the many different buyers are Alleycorp, Bullpen Capital, and Everblue Administration. The platform permits artists to show their music into limited-edition NFTs and supply experiences to their followers.

Social Community Business Developments

Zion, a social community constructed on “Web5” requirements with the Bitcoin Lightning Community, acquired $6 million in a spherical led by XBTO Humla Ventures. Among the many different individuals are Kingsway Capital, UTXO Administration, Bitcoiner Ventures, and Tony Robbins.

Indian brief video-sharing platform Chingari acquired an undisclosed quantity from Aptos Labs.

DAO Business Developments

Stider raised $5.5 million in an prolonged seed spherical led by Makers Fund and Material Ventures. The startup goals to revolutionize the best way mental properties are developed and owned. Among the many different individuals are Shima Capital, Sfermion, and Magic Eden. It’s price noting that Stider was based by former EA Video games and Jam Metropolis executives, Andreessen Horowitz companions, and different trade consultants.

Surroundings Business Developments

Carbonplace, the London-based world carbon credit score transaction community, raised $45 million in a strategic spherical. 9 banks participated, together with BBVA, BNP Paribas, Normal Chartered, CIBC, Itaú Unibanco, NatWest, Nationwide Australia Financial institution, SMBC, and UBS. The corporate will use the funds to scale the platform and develop the group.

Privateness Business Developments

Beldex acquired $25 million from web3 funding agency DWF Labs. The funds will probably be used for analysis and growth.

Id Business Developments

EthSign, a decentralized digital settlement signing platform, acquired an undisclosed quantity from Animoca Manufacturers.

Title service community SPACE ID raised $10 million in a strategic spherical led by Polychain Capital and dao5. The startup plans to make use of the funds to speed up the event of its title service and different merchandise.

Enterprise Business Developments

3RM raised $3 million in a spherical led by Distributed World. Among the many different buyers are Shima Capital, Large Mind Holdings, and Metareal. The startup will use the funds to construct buyer relationship administration instruments.

Cost Business Developments

Web3 pockets infrastructure startup Portal acquired $5.3 million. The spherical noticed participation from Gradual Ventures, Haun Ventures, Screw Capital, Chapter One, and quite a few angel buyers.

Cost gateway supplier FLUUS acquired $600,000 in pre-seed funding. FHS Capital, Encryptus.io, and several other angel buyers backed the spherical.

Open-source crypto pockets OneKey raised an undisclosed quantity in an prolonged Sequence A spherical led by IOSG Ventures.

Self-custodial, multi-signature pockets Den raised $2.8 million in a seed spherical. Among the many individuals are IDEO Colab Ventures, Gnosis, Portal Ventures, Not Boring Capital, Balaji Srinivasan, Seed Membership Ventures, Lemniscap, Spice Capital, 3SE Holdings, Eberg Capital, Human Capital, and Volt Capital.

TipLink, a light-weight pockets enabling easy digital asset switch, raised $6 million in a seed spherical led by Sequoia Capital and Multicoin Capital. Large Mind Ventures, Circle Ventures, Uneven, Karatage, Solana Ventures, Monke Ventures, Paxos, and well-known angel buyers backed the spherical.

Blocto raised an undisclosed quantity in a Sequence A spherical led by Mark Cuban and 500 World.

Funding Business Developments

Bit.Retailer, a social cryptocurrency funding platform, acquired fairness funding from Alchemy Pay, which acquired a 15% stake within the startup. The funds will probably be used to boost Bit.Retailer’s technical group, in addition to for analysis and growth and product optimization.

Authentification Business Developments

TheRollNumber raised $165,000 in a pre-seed spherical led by Inflection Level Ventures. The startup develops a market that gives background verification. TheRollNumber will use the funds to strengthen its expertise stack and enhance the platform.

Advertising Business Developments

Buyer loyalty platform Cub3 acquired $6.5 million in a Sequence A spherical led by Bitkraft and Material Ventures. Among the many different individuals are CMT Digital, Geometry Labs, and Purple Beard Ventures. The startup gives infrastructure for manufacturers to reward customers in tokens.

ManesLab, a model group targeted on web3 tradition and the creator financial system, raised $1.8 million in a seed spherical led by YZB Funding. The startup plans to incubate new web3 native IP and blockchain purposes.

Sesame Labs, which gives decentralized options to web3 advertising, raised $4.5 million in a seed spherical led by Enterprise Capital and Patron. The startup goals to allow people and decentralized purposes to interact with the “decentralized world” in belief.

Administration Business Developments

Decentralized account administration protocol Intu raised $2 million in a pre-seed spherical led by CoinFund. Metaweb Ventures, Fantom Basis, Kitefin, Orrick, and several other angel buyers participated within the spherical. The startup launched its beta model at ETHDenver Buidl week on February 24.

Knowledge Business Developments

Gosleep, an Arbitrum-based HealthFi-focused web3 life-style app, raised an undisclosed quantity in a spherical led by Foresight Ventures. Amber Group, SevenX Ventures, KuCoin Ventures, and Gate.io backed the spherical.

Privateness-preserving decentralized database Polybase raised $2 million in a pre-seed spherical led by sixth Man Ventures. Among the many different individuals are Protocol Labs, Alumni Ventures, Orange DAO, NGC Ventures, and CMT Digital. The startup plans to launch within the upcoming weeks.

Web3 observability platform Sentio acquired $6.4 million in a seed spherical led by Lightspeed Enterprise Companions. Hashkey Capital, Essence VC, Canonical Crypto, and GSR Ventures are among the many backers. The funds will probably be used for group growth and for the working of the prevailing infrastructure.

Superchain Community raised $4 million in a mixed seed and pre-seed. The seed spherical was led by Blockchain Capital, whereas pre-seed funding noticed participation from Maven 11, KR1, Tokonomy, and Fansara.

Knowledge analytics startup Blockfenders acquired $1.5 million in a pre-seed spherical. Among the many individuals are Blume Ventures, Collectively Fund, Veda VC, Behind Genius Ventures, World Devc, Higher Capital, Eximius Ventures, Arka Enterprise Labs, FortyTwo, GSF Fund, Pointone, and Upsparks. The corporate will use the funds to extend its presence in numerous industries and develop its group.

Common blockchain search engine developer Elementus raised $10 million in an prolonged collection A spherical led by ParaFi Capital.

Port3 Community, which gives social information for web3 use circumstances, raised $3 million in a seed spherical led by KuCoin Ventures. Among the many different buyers are Block Infinity, Soar Crypto, Cogitent, SNZ, and Momentum6.

“The corporate’s in-house algorithm refines and standardizes person information, segmenting person profiles in keeping with choice, worth & authenticity,”

explains the corporate in a press launch.

Messaging Business Developments

Cities, a gaggle chat protocol and app constructed by Right here Not There Labs, raised $25.5 million in a Sequence A spherical led by Andreessen Horowitz. The startup allows customers to construct digital city squares.

Decentralized immediate messenger Sending Labs raised $12.5 million in a seed spherical led by Insignia Enterprise Companions, Signum Capital, and MindWorks Capital. The opposite individuals are K3 Ventures, UpHonest Capital, LingFeng Innovation Fund, and Aipollo Funding. The startup plans to make use of the funds to speed up its integration with different Layer 1s and Layer 2s.

Web3 communication platform Salsa raised $2 million in a pre-seed spherical. Among the many buyers are IDEO Colab Ventures, Inflection, Superscrypt, and famous angel buyers.

Sumi Community, a web3 platform that gives wallet-to-wallet communication, raised $3 million in a seed spherical led by Scythe. Fuse, D1 Ventures, DFG, and TRGC additionally participated within the spherical. The startup plans to make use of the funds to develop decentralized communication and storage options.

Safety Business Developments

Kekkai, a web3 pockets safety supplier, raised $371,350 in a pre-seed spherical led by Skyland Ventures.

Blockchain cybersecurity platform Ironblocks raised $7 million in a seed spherical led by Disruptive AI and Collider Ventures. Among the many different individuals are ParaFi, Samsung Subsequent, Quantstamp, and famous angel buyers. The corporate will use the funds to develop the group and speed up growth.

Software program and {hardware} wallets safety resolution supplier Webacy raised $4 million in a seed spherical led by VC agency gmjp. Gary Vaynerchuk, AJ Vaynerchuk, Mozilla Ventures, Soma Capital, CEAS Investments, DG Daiwa Ventures, Dreamers, Quantstamp, and Miraise backed the spherical.

“To welcome the subsequent billion customers to Web3, we’ll want a secure surroundings that enables everybody to transact and personal property with the facility to guard themselves,”

mentioned the corporate in a press release.

Notable Traders

Argentinian financial institution Banco Bilbao Vizcaya Argentaria, French BNP Paribas, British Normal Chartered, Canadian Imperial Financial institution of Commerce, Brazilian Itaú Unibanco, British Nationwide Westminster Financial institution, Nationwide Australia Financial institution, Sumitomo Mitsui Banking Company, and Swiss UBS invested $45 million in Carbonplace.

Silicon Valley-based enterprise capital agency Andreessen Horowitz led the Sequence A spherical of Right here Not There Labs’ group chat protocol Cities. The startup acquired $25.5 million from the famous enterprise fund. In February, a16z additionally led the prolonged seed spherical of Azra Video games, which acquired $10 million, and the seed spherical of Stelo Labs, which raised $6 million. As well as, Andreessen Horowitz participated within the $13.8 million token buy of Yield Guild Video games, which was led by DWF Labs.

DWF Labs additionally invested $25 million within the web3 ecosystem Bedlex. DWF Labs is a market maker and a multi-stage web3 funding agency with workplaces in Switzerland, UAE, Singapore, Hong Kong, South Korea, and the British Virgin Islands. The fund has beforehand invested in Blockchain Soccer, Kingdomverse, NFTY Finance, and different web3 startups. On a aspect observe, DWF Labs makes a part of the monetary providers firm Digital Wave Finance.

Amazon Alexa Fund led the prolonged Sequence A spherical of digital collectibles and vinyl toys creator Superplastic. Total, the corporate acquired $20 million from Alexa Fund, Google Ventures, Galaxy Digital, Kering, Sony Japan, and Animoca Manufacturers.

Amazon Alexa Fund focuses on such areas as Synthetic Intelligence and machine studying, schooling, enterprise collaboration, fintech and commerce, gaming, leisure and social, {hardware}, well being and wellness, mobility, property tech, robotics and frontier tech, good house, and voice growth instruments.

Palo Alto-based Accel led the seed spherical of the India-based Kratos Studio, which raised a complete of $20 million. Prosus Ventures, Nexus Enterprise Companions, Courtside Ventures, and Nazara Applied sciences backed the spherical. The enterprise capital agency has beforehand invested in Spotify, Fb, Etsy, DropBox, and different famous firms.

Learn extra associated matters: