A wave of regulatory stress rippling by the U.S. crypto market has pushed merchants away from Bitcoin (BTC) and Ethereum (ETH) and in the direction of the seeming security of stablecoins.

This shift aligns with the emergence of a burgeoning political motion within the U.S. aiming to impose stringent controls on the crypto and mining sectors. Proponents of the brand new regulation argue that the disruptive nature of cryptocurrencies calls for a tighter regulatory grip to make sure stability and safety within the monetary ecosystem.

Then again, critics specific considerations that heavy-handed regulation might stifle innovation and drive the business offshore. This polarizing debate has created an environment of uncertainty that’s reshaping buying and selling behaviors.

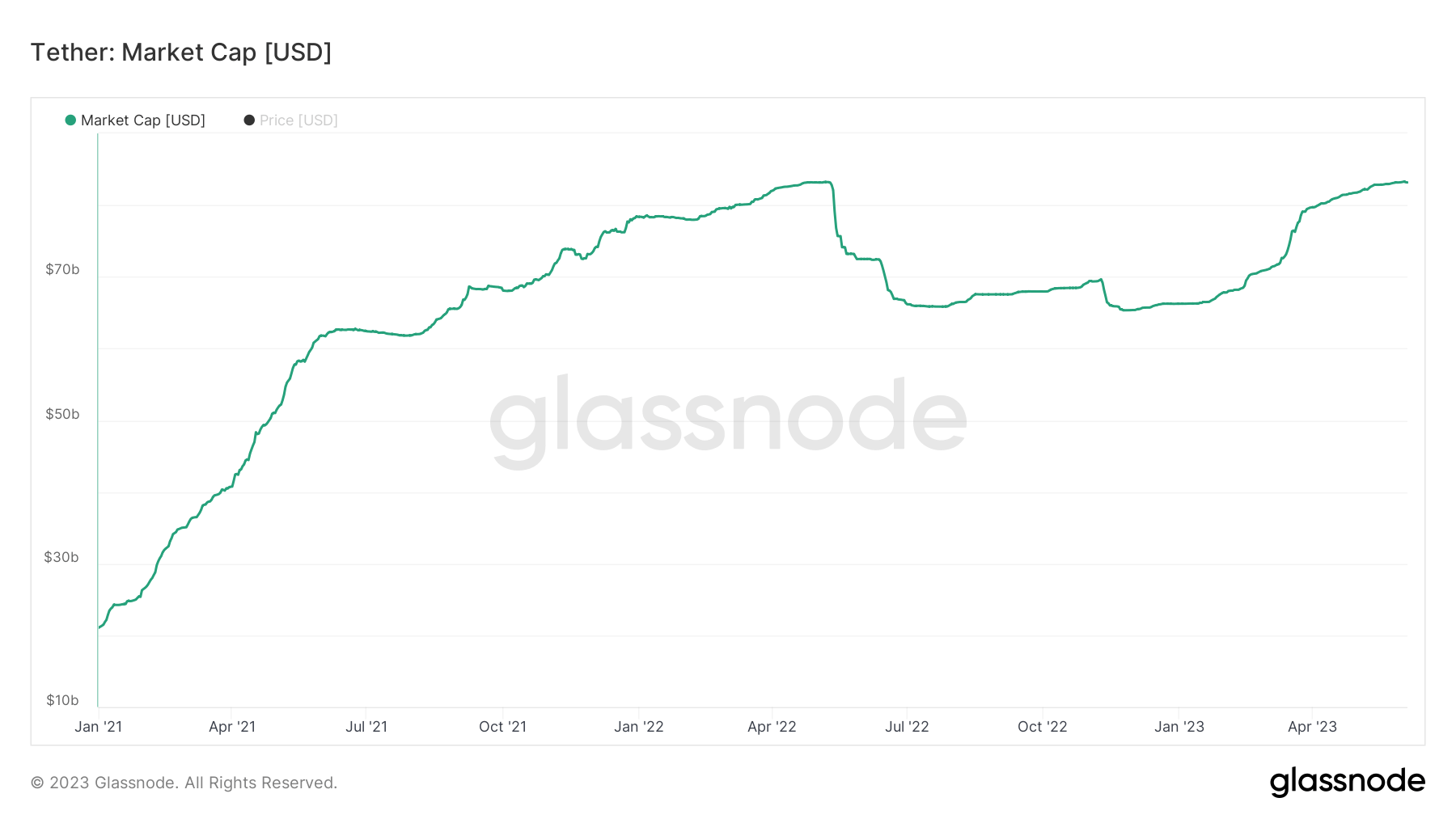

These regulatory pressures appear to be nudging merchants towards the soundness of stablecoins. That is distinctly noticed within the habits of Tether’s USDT, whose provide reached an all-time excessive of $83.2 billion on June third. Round $17 billion of this determine has been added to Tether’s market cap in 2023 alone.

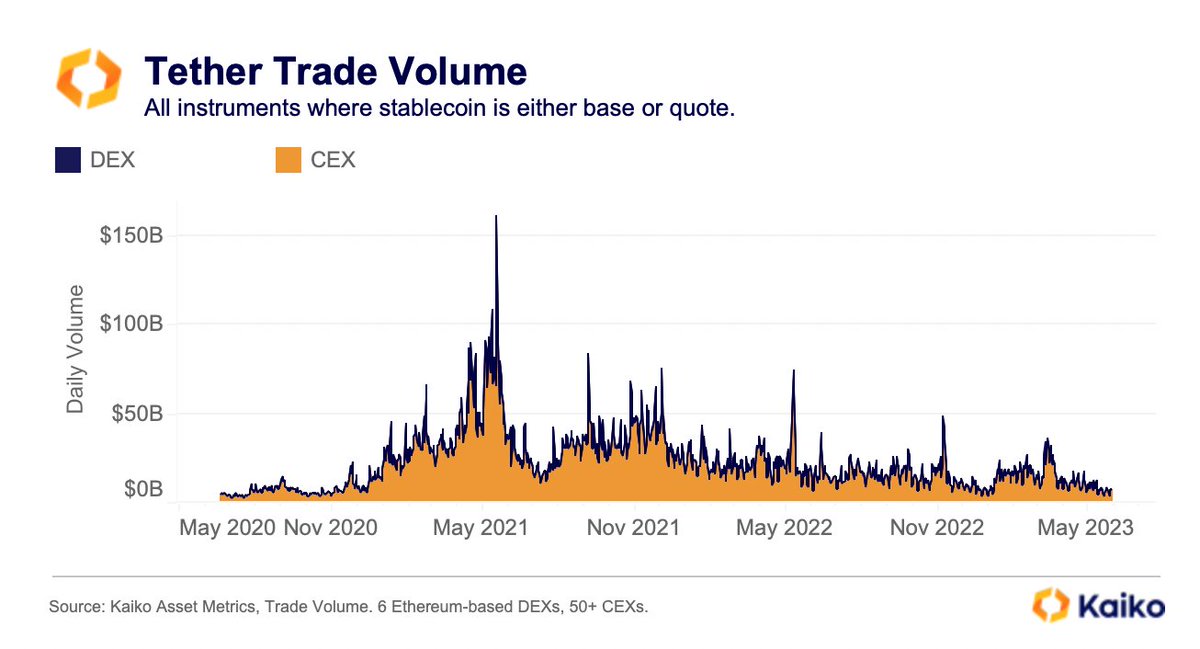

Nonetheless, regardless of Tether’s rising market capitalization, its buying and selling quantity is experiencing a downward development. Knowledge from Kaiko confirmed that on each CEXs and DEXs, each day USDT quantity averaged round $7 billion in Could, reaching multi-year lows. This seeming contradiction signifies that whereas the general provide is rising, energetic buying and selling of the asset is lowering.

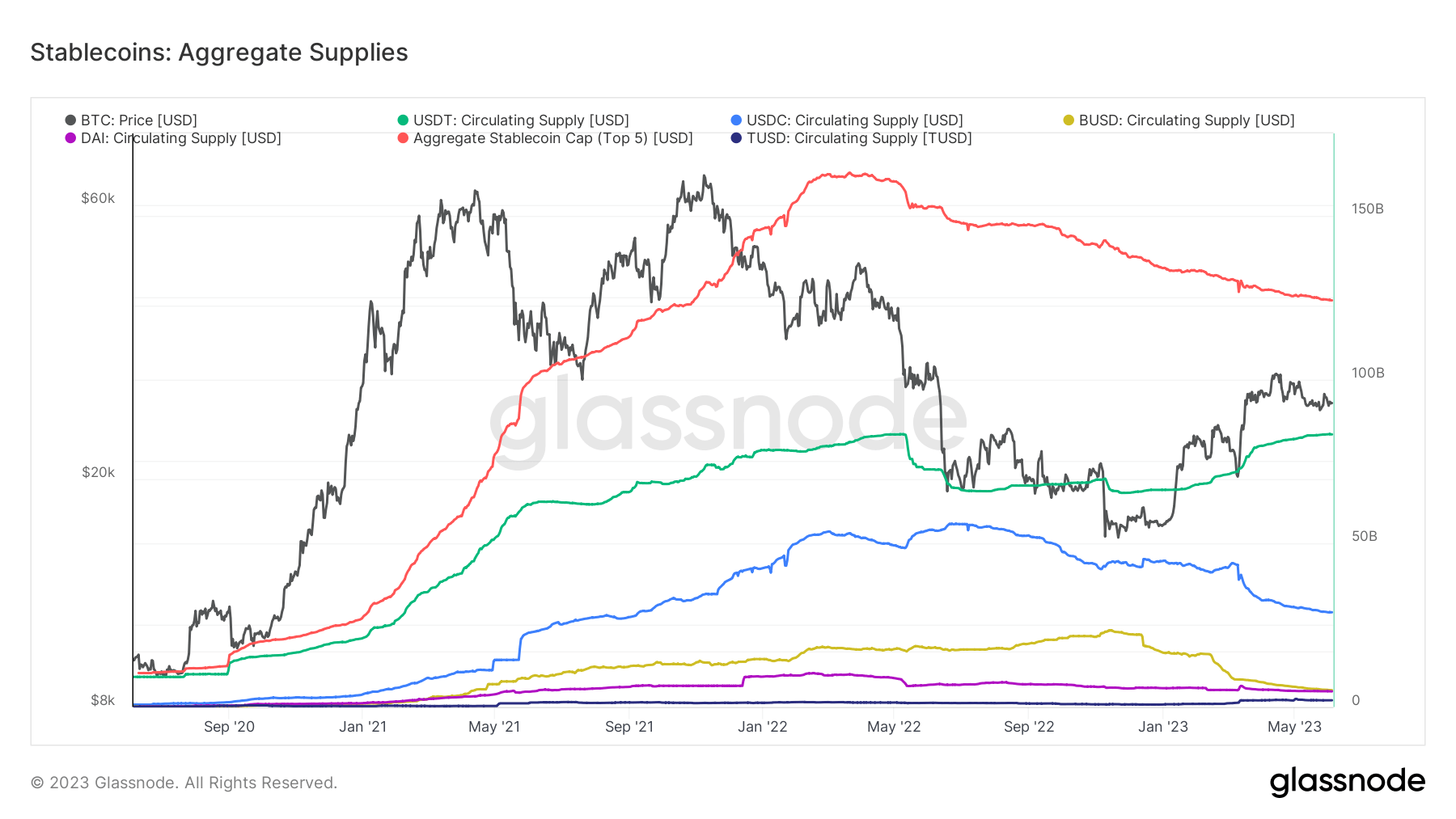

Conversely, different vital gamers within the stablecoin market, USDC, and BUSD, witnessed their provide drop to multi-year lows.

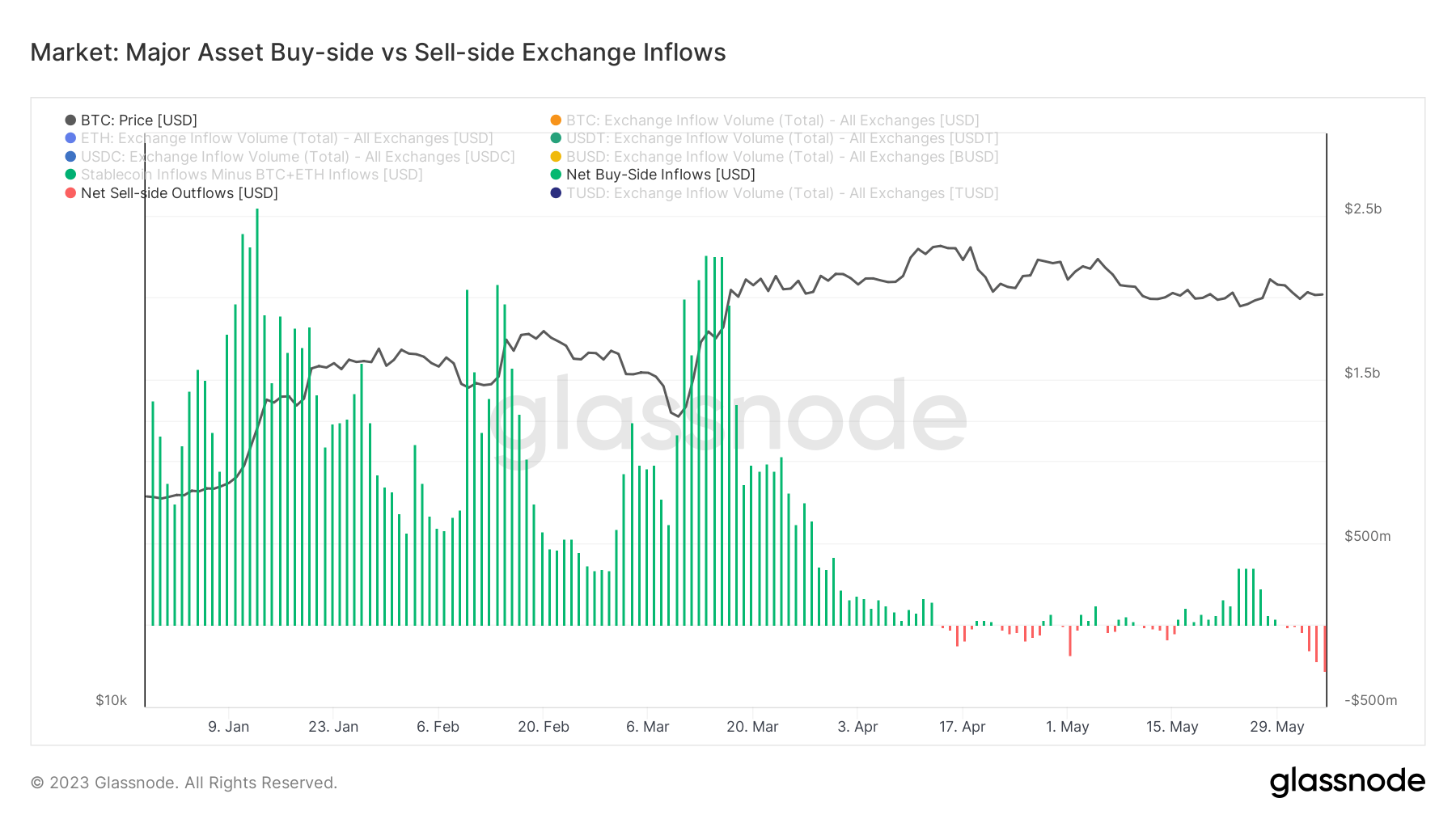

Analyzing alternate inflows reveals an thrilling development. Since April, demand for stablecoins on exchanges has weakened, with BTC and ETH inflows compensating for this. Regardless of the sustained influx, the 2 cryptocurrencies have been primarily buying and selling sideways or experiencing hostile value motion, indicating that almost all inflows are probably sell-side.

Stablecoins, being non-interest bearing and exempt from capital positive factors taxes, provide a sure attract to merchants. Their nature doesn’t generate the taxable occasions integral to buying and selling BTC or ETH, which is especially enticing to U.S. merchants beginning to really feel the squeeze of elevated regulatory scrutiny and potential enforcement actions.

The publish Merchants flip to stablecoins as regulatory stress within the US ramps up appeared first on StarCrypto.