As the first holding space for unconfirmed Bitcoin transactions, the mempool presents important insights into the community’s operational standing.

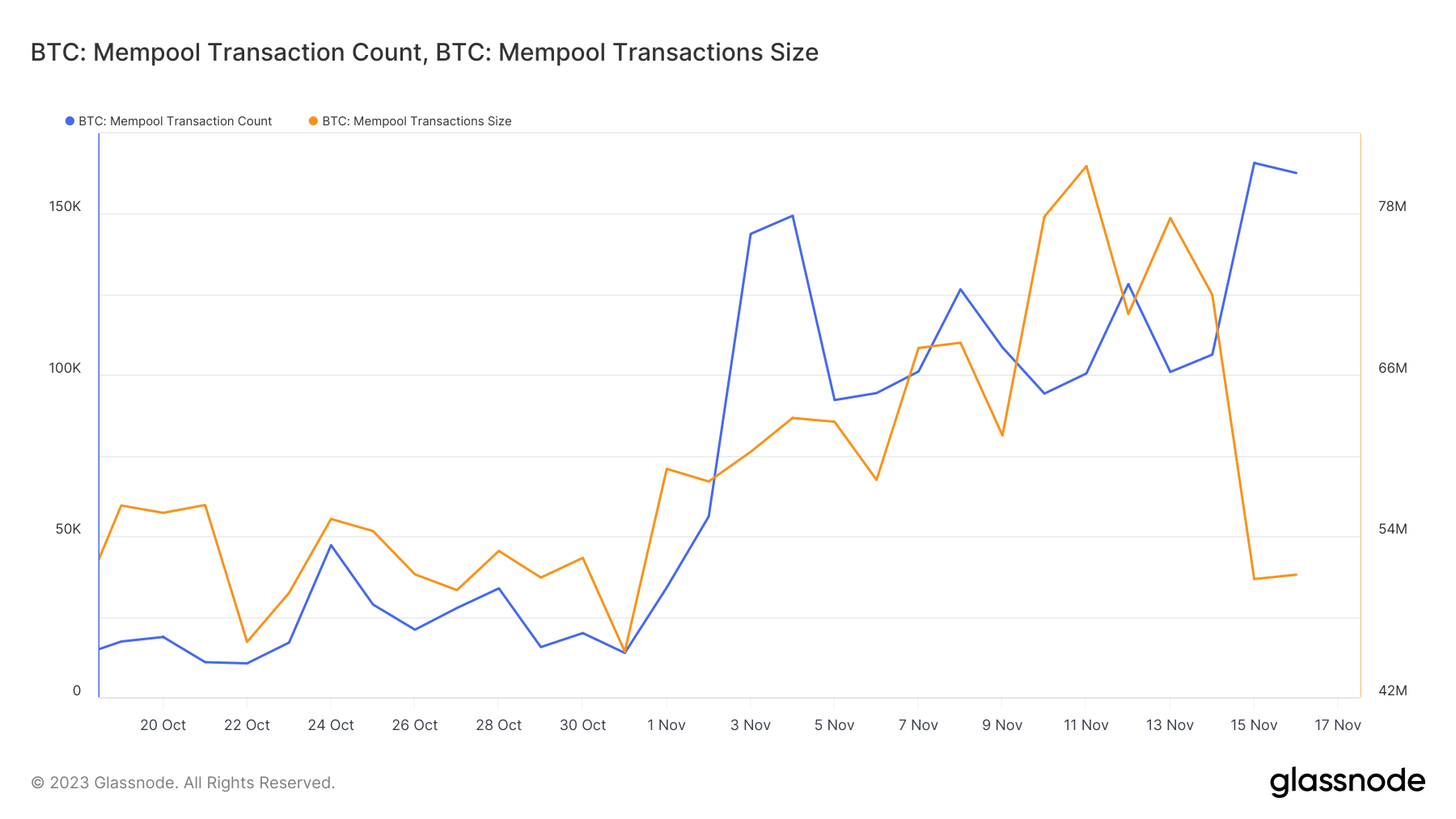

Excessive charges throughout the mempool usually sign elevated community exercise and potential congestion, impacting transaction processing instances and consumer prices. There was a notable enhance in each the variety of transactions and the full measurement of transactions within the Bitcoin mempool all through November.

From late October to mid-November 2023, the variety of transactions swelled from 13,778 to 165,829, whereas the full transaction measurement escalated from 45.3 million to 81.5 million digital bytes, finally reducing to 50 million. This correlation signifies heightened community utilization and congestion, resulting in longer wait instances for transaction confirmations.

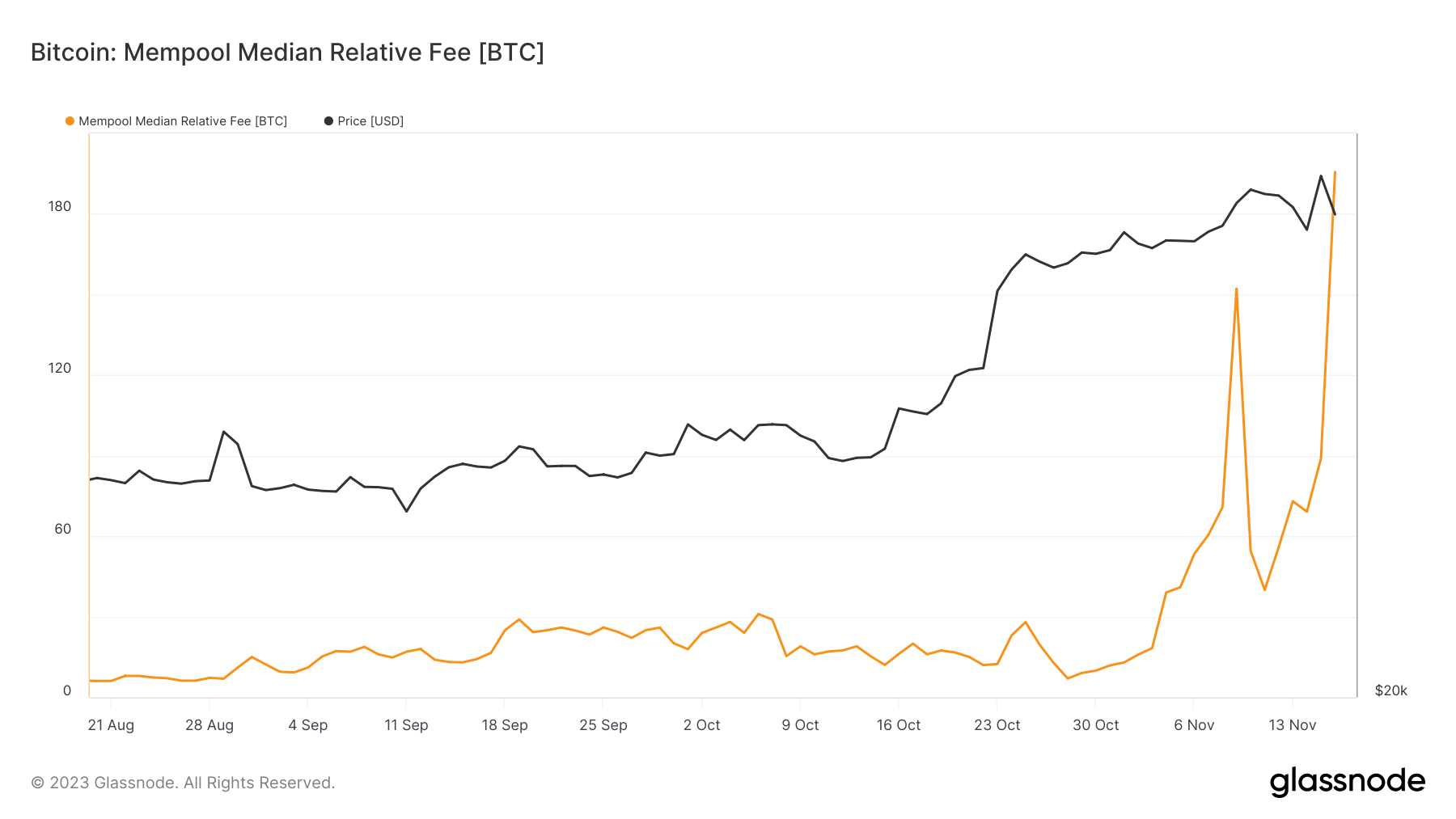

One other uptick was noticed within the median and common transaction charges throughout the mempool. The common charge jumped from 14.85 BTC to 207.6 BTC, and the median charge elevated from 11.8 BTC to 195.6 BTC over the identical interval. These figures replicate the rising value burden on Bitcoin customers, particularly throughout peak exercise durations.

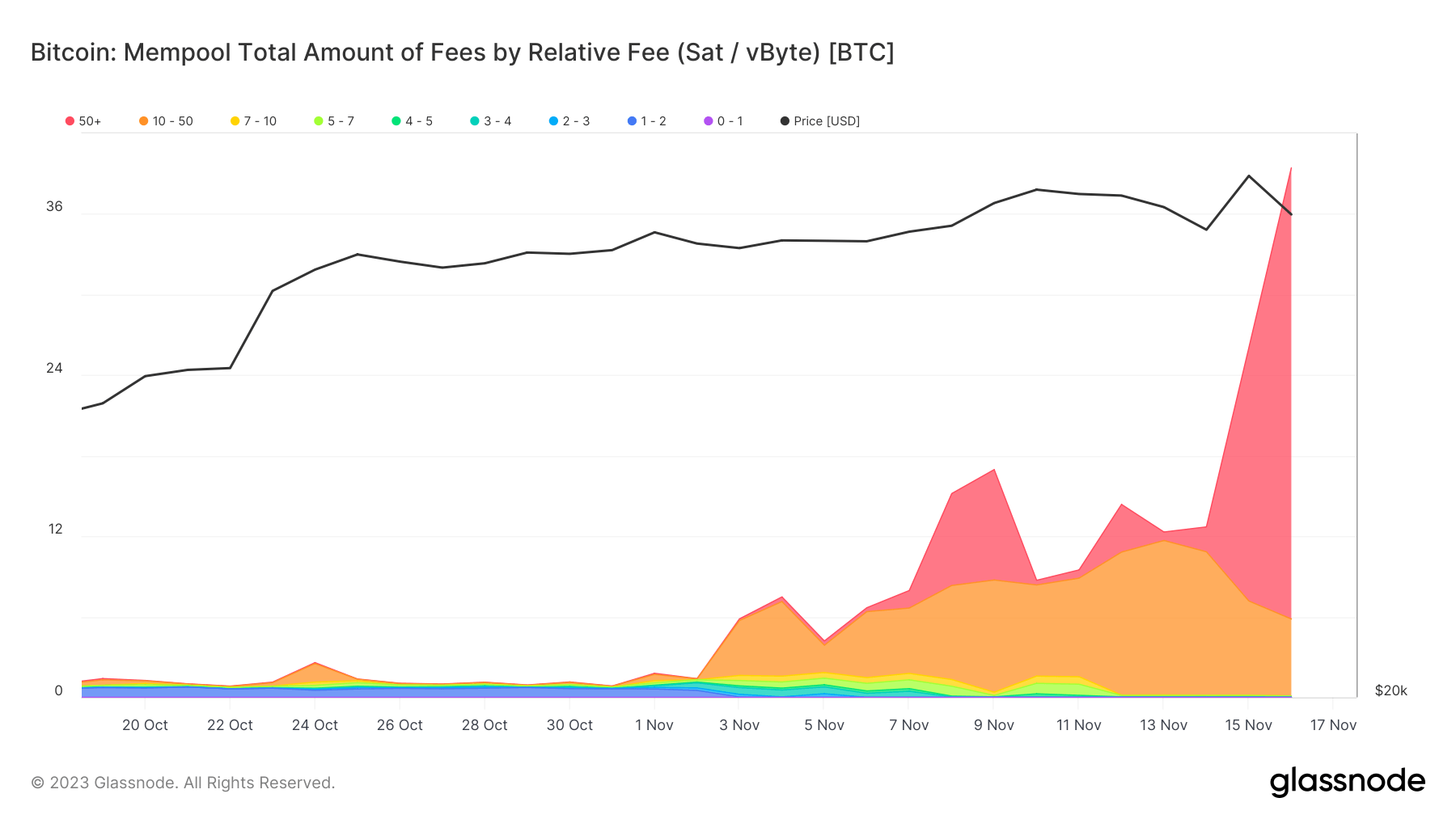

Diving deeper, Glassnode information reveals vital insights into the full quantity of charges throughout totally different relative charge cohorts, measured in Satoshis per digital byte (Sat/vByte). The distribution of charges throughout numerous brackets like 10-50 and 5-7 Sat/vByte point out a variety of transactions, from small-scale transfers to high-value exchanges.

Significantly noteworthy is the presence of transactions within the 50+ bracket, exhibiting that some customers have been prepared to pay premium charges for sooner processing, a testomony to the urgency or significance of those transactions.

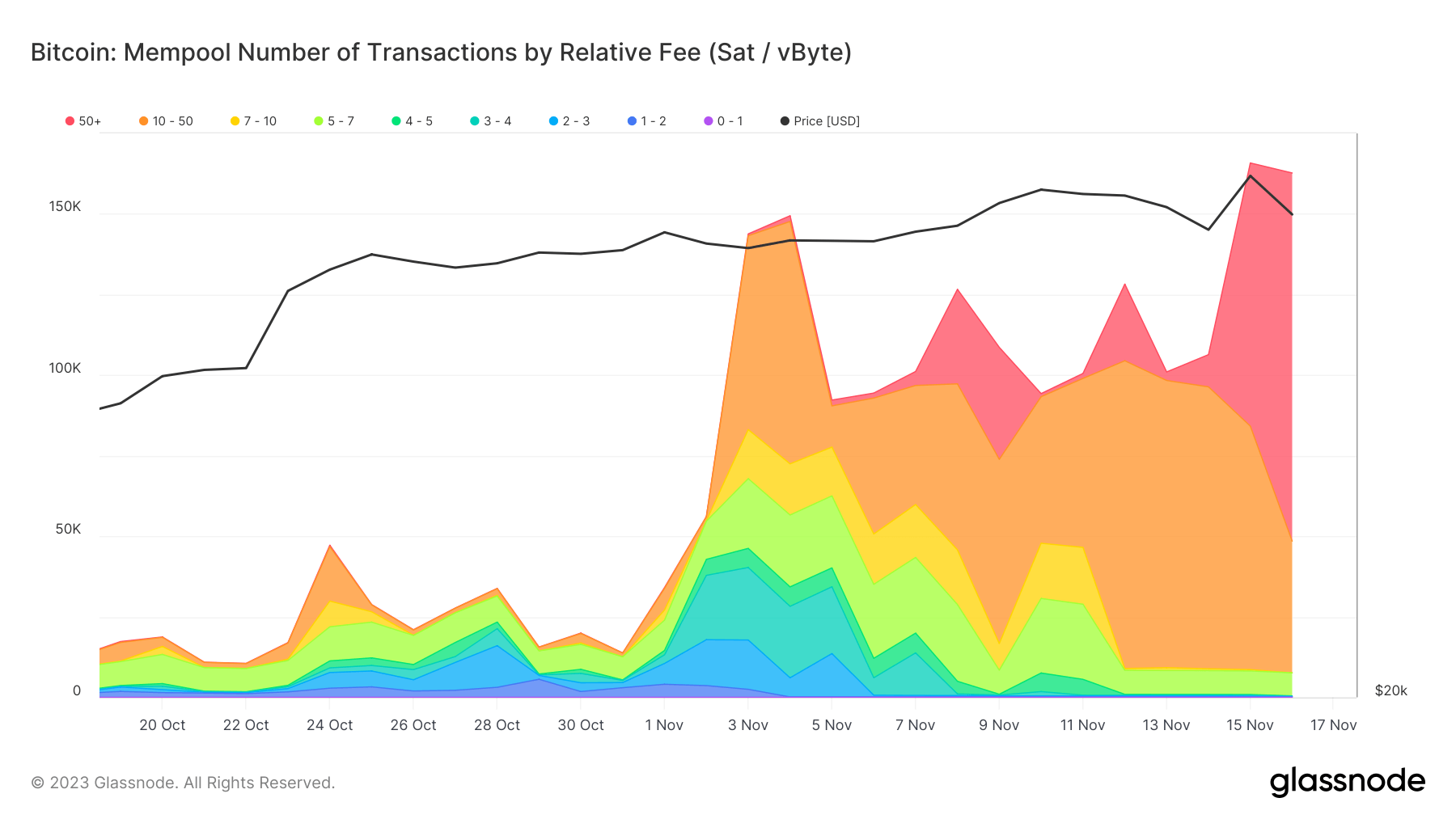

Parallel to this, every charge bracket’s whole variety of transactions paints an image of consumer conduct underneath various community circumstances. The focus of transactions in decrease charge brackets suggests a desire for value effectivity. In distinction, the less, high-fee transactions suggest a willingness amongst a smaller group of customers to prioritize velocity over value.

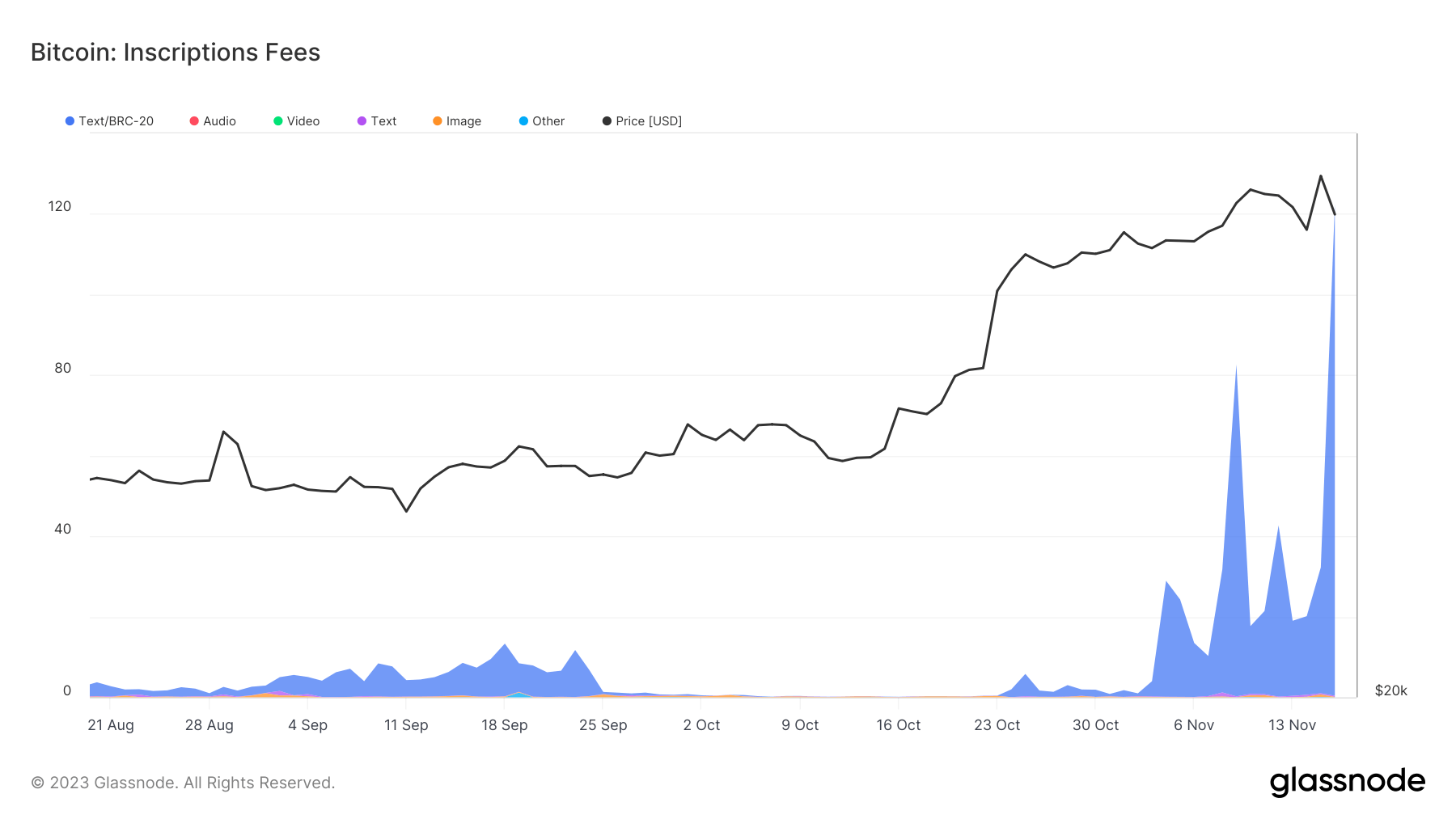

Inscription charges have grown considerably because the starting of November – from 0.8 BTC to 122.4 BTC. This enhance, in tandem with the overall hike in transaction charges, signifies a rising monetary burden on customers partaking in these particular transaction varieties.

The market implications of those developments are profound. For one, the surge in inscription charges emerges as a major driver of the general charge enhance. This phenomenon factors to a rising demand for particular transaction varieties. Moreover, the escalation in charges and mempool congestion might deter potential customers, push present customers to hunt options, or forego utilizing the community solely, doubtlessly affecting Bitcoin’s market place.

The put up Mempool overload results in skyrocketing Bitcoin transaction prices appeared first on StarCrypto.