Ethereum (ETH) gasoline charges jumped to a 10-month excessive — prompted by a surge in meme coin mania.

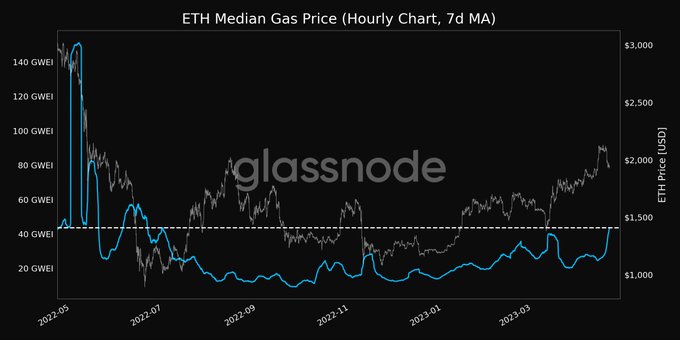

Per Glassnode, the median Ethereum gasoline worth over a seven-day shifting common (7DMA) reached 43.641 gwei — a worth final seen on June 30, 2022.

Gwei is a denomination of ETH — with 1,000,000,000 gwei equaling 1 ETH, or 1 gwei equaling 0.000000001 ETH.

Over the previous 12 months, the median gasoline worth over a 7DMA peaked at 150 gwei in Could 2022 however dropped sharply by July 2022. It then step by step stabilized across the 20 gwei mark going into September 2022, when the Merge rolled out.

Ethereum gasoline charges

The price of utilizing Ethereum has been a degree of rivalry because the “DeFi Summer season” of 2020 — when the common gasoline worth reached as excessive as 700 gwei.

This era noticed community exercise surge as yield protocols, reminiscent of Curve, Compound, and Yearn, started taking off — triggering mania from the demand to farm unreal features.

Ethereum’s structure is such that top gasoline charges come about when community visitors and the demand for transaction verification is excessive.

Whereas some assumed the Merge and the change to Proof-of-Stake (PoS) consensus would sort out this drawback, it was confirmed that gasoline charges stay primarily pushed by the demand for blocks and the community’s capability to fulfill that demand — not the consensus mechanism used.

Not too long ago, Ethereum community exercise has skyrocketed with a wave of newly launched meme cash — a few of which netted early traders features within the hundreds of %.

Meme cash are again

PEPE is one such meme coin, which has risen to turn into the sixth largest by market cap at $89.1 million in a number of days.

PEPE reached a neighborhood high of $0.000000391704 on April 20 and has been trending downwards since.

The success of PEPE has spurred social media chatter on which meme coin is subsequent to spike. For instance, a tweet from @liquiditygoblin mentioned meme season is again — tagging “$PEPE, $WOJAK, $COPE.”

The put up Meme season blamed for bounce in Ethereum (ETH) gasoline charges appeared first on starcrypto.