Introduction

Within the ever-changing panorama of cryptocurrencies, the present market presents a singular playground for merchants, particularly in leverage buying and selling utilizing CFDs. This method permits merchants to amplify their potential positive aspects from even the smallest market actions. A working example is Solana (SOL), whose latest value exercise exemplifies the profitable alternatives in leverage buying and selling in such a unstable market.

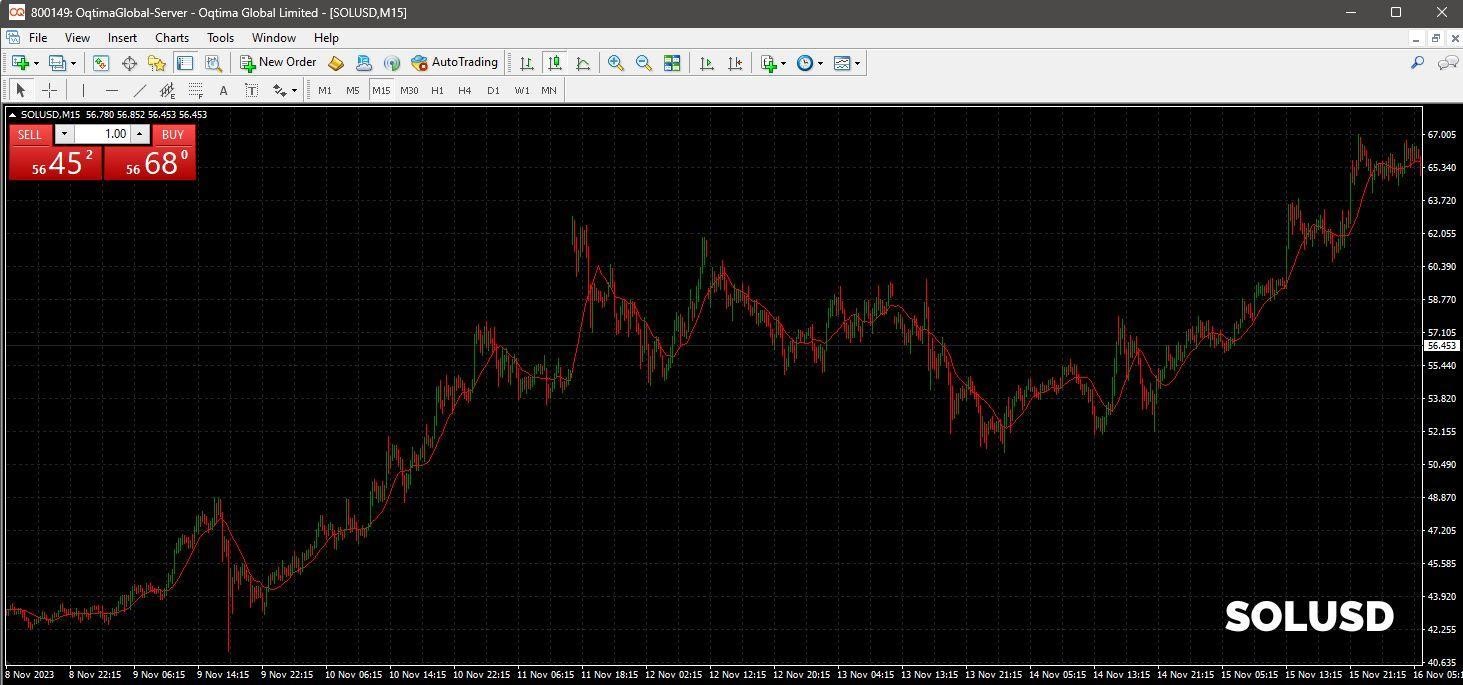

Solana’s Market Resilience

Solana, a outstanding participant within the crypto world, not too long ago demonstrated outstanding resilience previously two weeks within the face of market turbulence. After experiencing a pointy decline to $51.27, SOL managed a formidable restoration, rebounding to $55.31. For leverage merchants, these sorts of value actions are golden alternatives. They provide an opportunity to enter and exit trades at strategic factors, thus maximizing potential returns. Solana’s journey by this era of volatility is a superb instance of how leverage buying and selling might be employed successfully within the crypto market, turning market volatility into a possible benefit.

The Significance of Macro Evaluation in CFD Buying and selling

In leverage buying and selling, significantly within the crypto area, understanding macroeconomic components is important. The case of Solana, considerably impacted by FTX’s strategic selections relating to their SOL liquidity, underscores the significance of macro evaluation. Merchants who’re well-versed in these broader financial, monetary, and political developments can anticipate potential market actions. This perception is especially worthwhile in leverage buying and selling, the place the flexibility to foretell market traits can drastically affect buying and selling success. Thus, macro evaluation not solely enhances technical evaluation however is a important part in a dealer’s decision-making course of, particularly when buying and selling on margin.

Technical Evaluation in Leverage Buying and selling

Technical evaluation is an indispensable device in leverage buying and selling, particularly in unstable markets like cryptocurrency. Specializing in Solana, we see how analyzing value resistance, help ranges, and different chart patterns is important. As an example, when SOL dipped to $51.27, it shaped a big help stage.

A dealer noticing a rebound from this stage may infer a robust shopping for curiosity at this value, which is essential for making leverage trades. Equally, Solana’s earlier peak at $63.80 might act as a resistance stage. Leverage merchants can use these insights to find out their entry and exit factors, optimizing their possibilities for greater returns.

Moreover, recognizing chart patterns, reminiscent of bullish or bearish traits, may give further alerts to merchants. In essence, technical evaluation helps merchants perceive not simply market traits but additionally the psychology behind market actions, which is crucial in leverage buying and selling.

OQtima: A Platform for Leveraged Crypto Buying and selling

Our present decide for the sort of operation can be OQtima, an modern CFD dealer established in 2021 that stands out within the realm of crypto buying and selling. It serves a large spectrum of merchants, from seasoned professionals to novices, offering a versatile and user-friendly platform for leverage buying and selling. Whereas OQtima presents a excessive leverage of as much as 1:500 for many merchandise, it strategically limits the utmost leverage on cryptocurrencies to twenty:1. This method balances the necessity to defend merchants’ property towards the inherent volatility of the crypto market whereas nonetheless providing them leverage alternatives.

Within the case of Solana, a dealer utilizing OQtima’s platform may have utilized this leverage to amplify their potential income.

Suppose a dealer decides to take a place in Solana (SOL) utilizing OQtima’s platform. The dealer has $500 to speculate and chooses to make use of the utmost leverage of 20:1 accessible for cryptocurrencies. Right here’s the way it works:

Preliminary funding: The dealer begins with $500.

Leveraged place: With 20:1 leverage, the dealer’s shopping for energy is elevated to $10,000 ($500 * 20).

Entry level: The dealer buys SOL at $51.27.

Exit level: The dealer sells SOL at $55.31.

Worth motion: The value of SOL strikes from $51.27 to $55.31, a $4.04 improve per SOL.

Unleveraged revenue: With out leverage, a $500 funding would purchase roughly 9.75 SOL ($500 / $51.27). The revenue can be 9.75 SOL * $4.04 = $39.39.

Leveraged revenue: With leverage, the dealer should purchase roughly 195 SOL ($10,000 / $51.27). The revenue is now 195 SOL * $4.04 = $787.80.

This instance demonstrates how leverage can considerably amplify income. The dealer’s preliminary $500, with assistance from leverage, permits for a a lot bigger place and a correspondingly greater revenue from the identical value motion. Nevertheless, whereas leverage can amplify income in buying and selling, it’s equally essential to acknowledge the added danger it introduces. Efficient danger administration is important to leveraging methods, particularly in unstable markets like cryptocurrencies.

Merchants ought to at all times think about using instruments like stop-loss orders to restrict potential losses. A stop-loss order robotically closes a buying and selling place as soon as it reaches a predefined loss threshold, serving to to guard the dealer’s capital from vital market swings. Moreover, merchants ought to solely make investments funds they will afford to lose and repeatedly monitor their positions. Understanding and managing these dangers is essential for sustainable and accountable leverage buying and selling.

Furthermore, OQtima’s adaptability extends to its cost choices. The platform accepts deposits in a wide range of cryptocurrencies, making it extremely accessible for crypto fanatics. OQtima adheres to the regulatory requirements set by the Cyprus Securities and Alternate Fee (CySEC) and the Monetary Providers Authority of the Seychelles. The platform’s flexibility, adherence to rules, and aggressive buying and selling circumstances like low spreads and environment friendly execution occasions place it as a great selection for merchants aiming to capitalize on the dynamic and unstable crypto market.

Conclusion

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be liable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.