Monitoring adjustments in liquidity is equally necessary as monitoring adjustments in Bitcoin‘s on-chain information. Every value motion, be it up or down, exerts important strain on liquidity. One strategy to analyze adjustments value swings deliver to the market is to have a look at market depth.

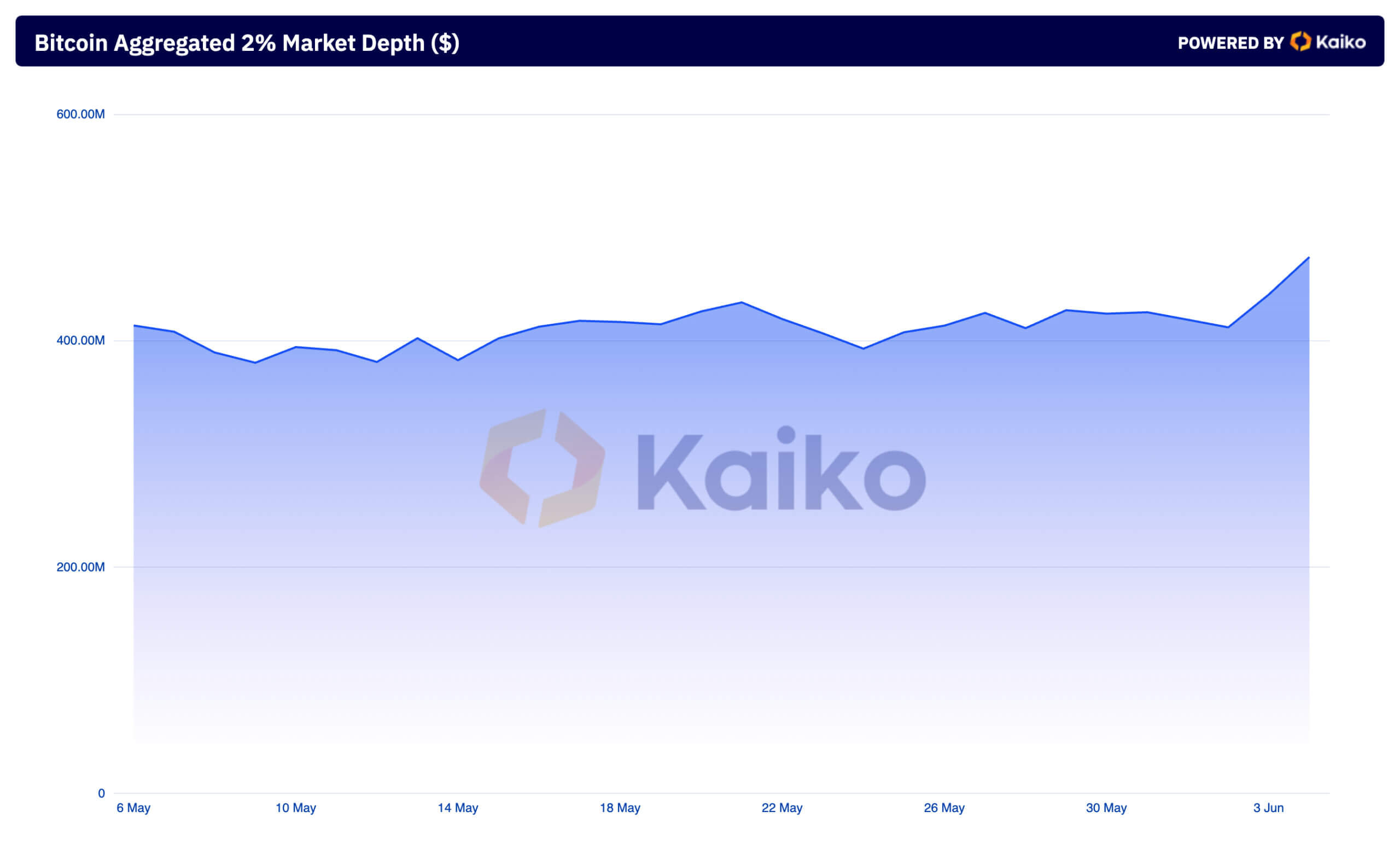

The aggregated 2% market depth and the two% bid vs. ask depth are glorious indicators of market liquidity and sentiment for Bitcoin. The aggregated market depth represents the mixed worth of purchase and promote orders inside a 2% vary of the present value. It gives perception into how a lot BTC might be traded with out inflicting important value actions. On June 2, the aggregated market depth was $411.83 million throughout centralized exchanges tracked by Kaiko. The depth spiked to $473.97 million on June 4, the very best prior to now two months.

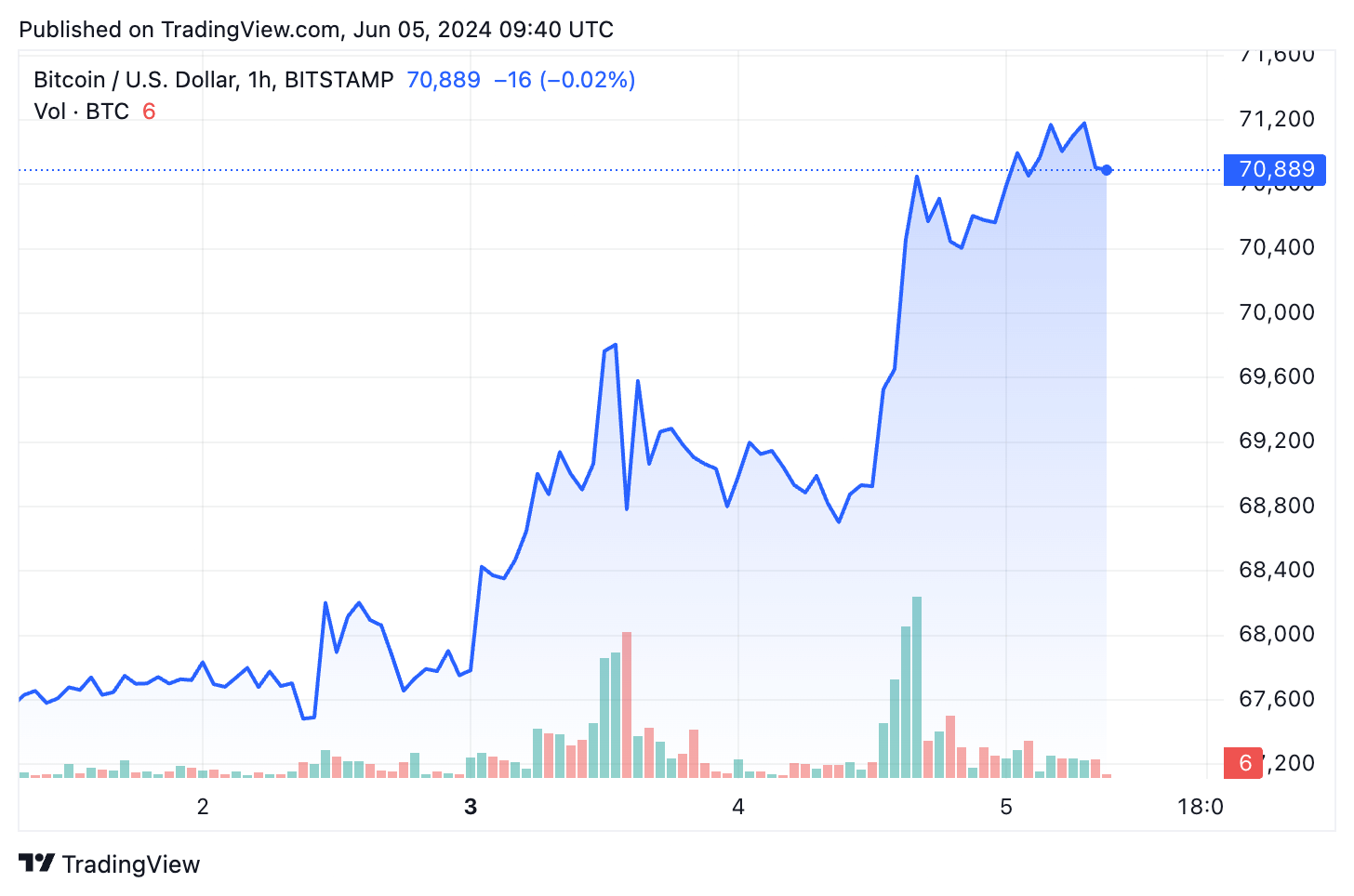

The spike in market depth adopted Bitcoin’s value enhance from $67,750 to $70,600. Whereas this won’t be a big share enhance, $70,000 is an particularly necessary psychological milestone. This spike turns into much more important when accounting for the truth that BTC spent weeks within the mid $60,000 vary.

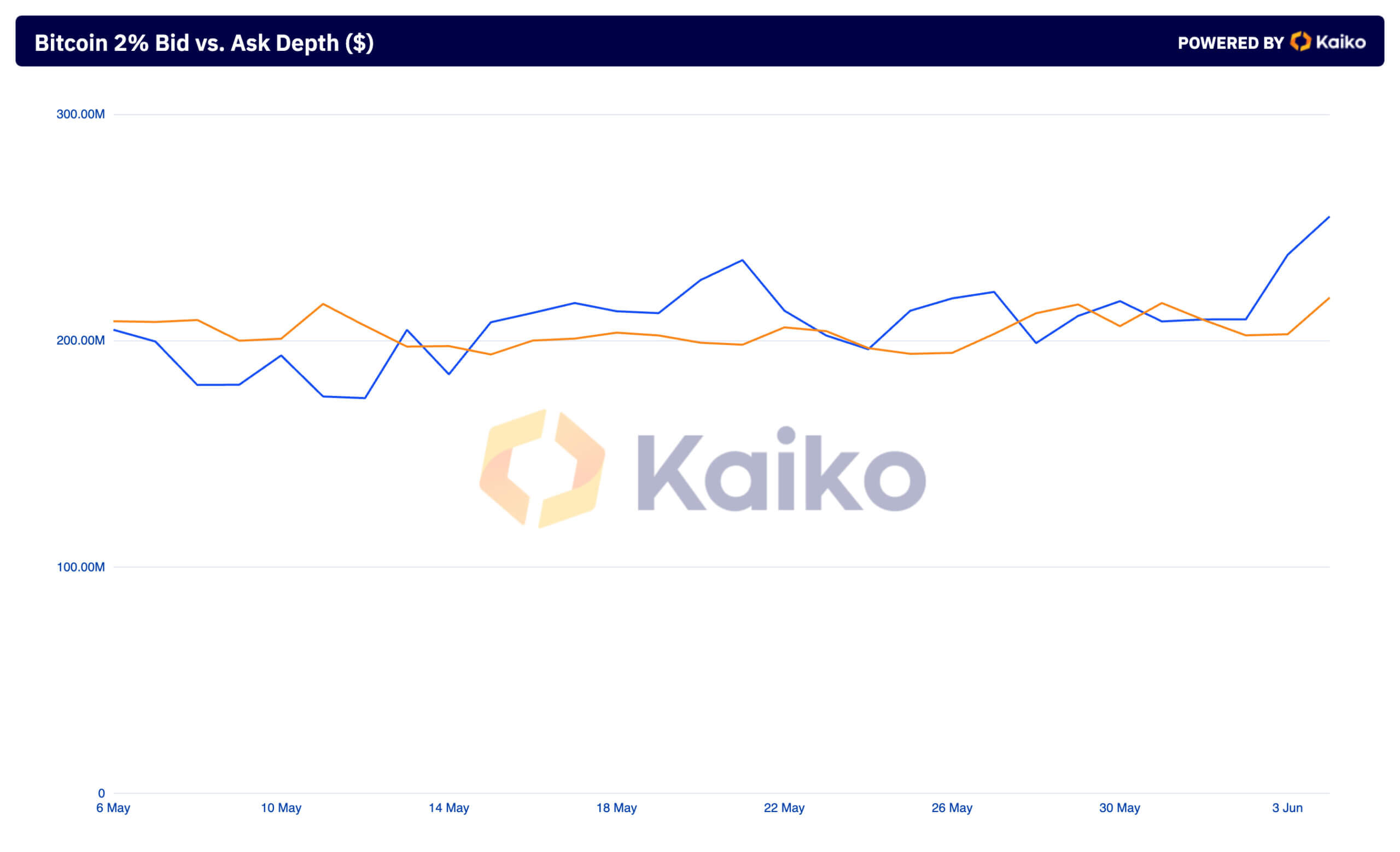

The bid vs. ask depth exhibits the worth of purchase and promote orders throughout the identical 2%. This unfold additionally noticed a notable enhance over the previous couple of days. On June 2, there have been $202.40 million in bids and $209.44 million in asks. This aligns with earlier StarCrypto evaluation, which discovered the market virtually equally break up between shopping for and promoting.

By June 4, the bids had elevated to $219.06 million, and the asks had risen sharply to $254.91 million, ensuing within the largest unfold between asks and bids since early April. This enhance in each market depth and bid vs. ask depth exhibits heightened market exercise.

The rise in aggregated market depth means that the market can deal with bigger trades with much less affect on value. This can be a clear signal of larger liquidity available in the market. This increased liquidity means merchants can execute substantial transactions with out inflicting important value fluctuations, contributing to general market stability. The simultaneous enhance in bid and ask depth displays the elevated exercise and confidence amongst merchants. Extra purchase and promote orders throughout the 2% vary present that merchants are extra actively collaborating available in the market.

The bigger enhance in ask depth in comparison with bid depth implies that sellers are setting increased costs, anticipating continued value good points. This sentiment is supported by the substantial rise in bid depth, indicating sturdy demand for Bitcoin at increased value ranges. As extra consumers enter the market, keen to buy at these elevated costs, the market’s upward momentum is strengthened. The elevated liquidity, coupled with increased bid and ask values, paints an image of a strong buying and selling atmosphere the place massive trades might be executed with minimal affect on the value.

A good portion of this exercise resulted from spot Bitcoin ETFs. Farside information confirmed that spot Bitcoin ETFs noticed $886.6 million in inflows on June 4, making it the second-largest day of inflows since launch. StarCrypto reported that this was the most important influx ever for a day when no US ETF recorded an outflow, together with GBTC. The bigger unfold between asks and bids means that sellers anticipate continued value will increase, setting increased costs accordingly. The elevated liquidity helps value stability, making the market extra engaging to institutional traders and enormous merchants. The rising institutional curiosity, evidenced by the rise in ETF inflows, cements the demand for Bitcoin, contributing to the potential for sustained value good points within the coming months.

The publish Market depth reveals Bitcoin’s underlying power at $70k appeared first on StarCrypto.