- Mantle introduced Ondo Finance’s $USDY token as a companion for RWAs.

- Ondo is main the RWA house with a 50% share of the tokenized safety market.

- Mantle anticipates utilizing $USDY as collateral in lending protocols and “money leg” in AMMs.

Earlier right now, the Mantle Community revealed a weblog asserting Ondo Finance’s USD Yield, $USDY as a showcase companion for Actual World Property (RWA). On Twitter, Mantle celebrated unlocking consumer entry to U.S. Treasury yield immediately by way of their Mantle wallets.

In line with Mantle, RWAs provide the “biggest potential to convey important advantages for customers.” Therefore, serves as a “incredible selection” for the Mantle Showcase, enabling seamless consumer expertise accompanied by investor protections. Moreover, Mantle Chief Alchemist Jordi Alexander shared:

$USDY really is a sport changer for the world of DeFi. For the primary time ever, customers will be capable to entry U.S. Treasury yield straight from the faucet and immediately into their pockets, with the same ease of entry as stablecoins like USDT and USDC.

Furthermore, Mantle’s announcement famous that secured by a mix of U.S. Treasuries and financial institution deposits, $USDY tokeholders obtain a yield, at the moment standing at 5% APY, which is backed by the premium property. Concurrently, Mantle emphasised their efforts to guard buyers and their capital. After analyzing the chapter remoteness course of in place, the weblog confirmed that “$USDY’s investor protections are the very best that exists in tokenized RWAs.”

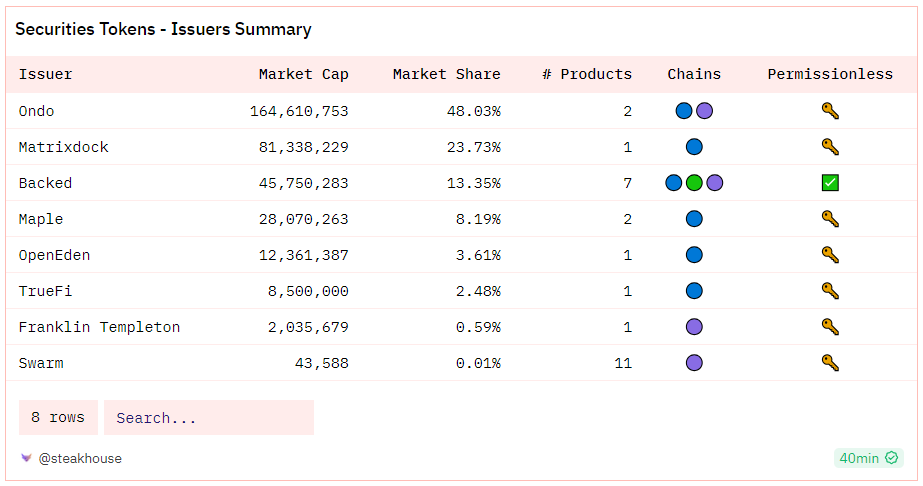

Mantle additionally acknowledged that Mantle customers don’t have to modify to Ondo’s platform to accumulate or commerce $USDY as it’s a tokenized bearer instrument with reference to authorized construction. Moreover, Ondo is already a frontrunner within the RWA panorama, holding a 50% market share in tokenized securities, as per information from Dune Analytics.

Mantle additionally mentioned plans to make use of $USDY as collateral for derivatives and lending protocols, in addition to a “money leg” in an AMM. $USDY will stay pegged to $1, producing new token items to pay curiosity, thus, simplifying the token for cost use.

Lastly, the Founder & CEO of Ondo, Nathan Allman expressed his enthusiasm for the partnership and recommended Mantle’s technique of offering strong assist for a fastidiously chosen portfolio of top-tier protocols and merchandise, aiming to create an built-in on-chain ecosystem.