- Maker (MKR) and THORChain (RUNE) costs rose sharply as Bitcoin retested $27k.

- MKR may spike in the direction of $2k whereas RUNE eyes buy-side liquidity above $2.01

The cryptocurrency market flipped greater on Thursday, with positive aspects for Bitcoin (BTC) and most altcoins sending the whole market cap up by 3.1% as on the time of writing. BTC traded above $27k once more, benefiting from general positivity in danger asset markets.

With shares additionally edging greater following a retreat for yields and oil, two notable performers in crypto had been Maker (MKR) and THORChain (RUNE).

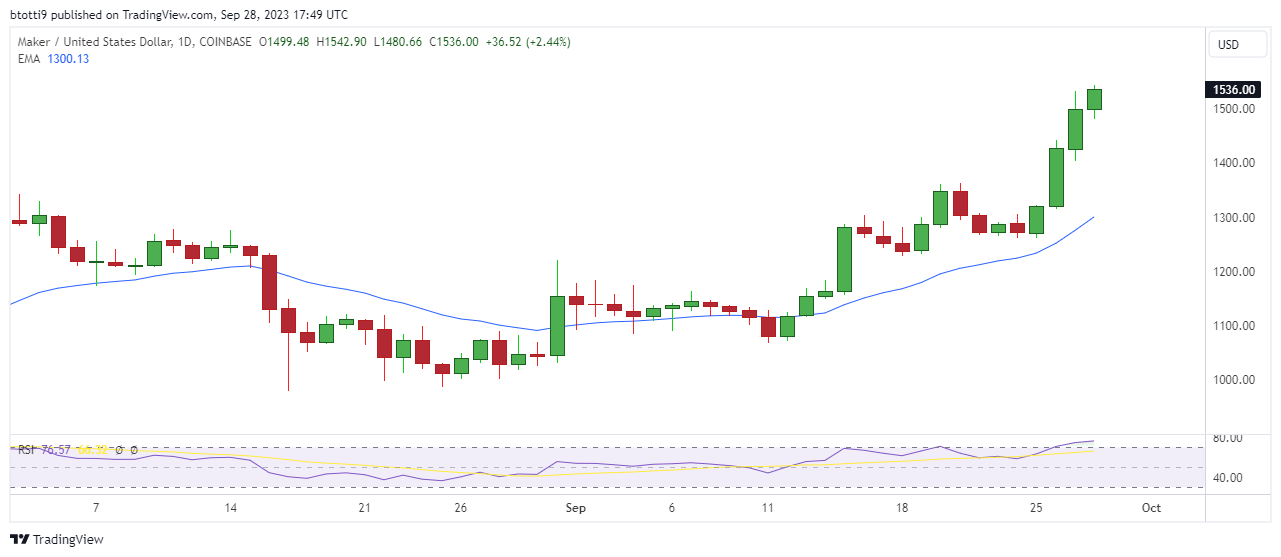

Maker value breaks to highest stage since Might 2022

Maker (MKR) broke greater following this week’s spectacular positive aspects, buying and selling to intraday highs of $1,542.90 on Coinbase. Bulls had been on the lookout for a fourth consecutive inexperienced candle on the each day chart, with 24-hour positive aspects of 6% and weekly uptick of 16%. MKR value has jumped practically 48% previously 30 days.

Amid the positive aspects is a surge in on-chain exercise, notably in lively handle rely that stood at a 10-week excessive as of Thursday. Curiosity in MKR may see bulls search out $2,000 – particularly if the general market image helps additional upside momentum.

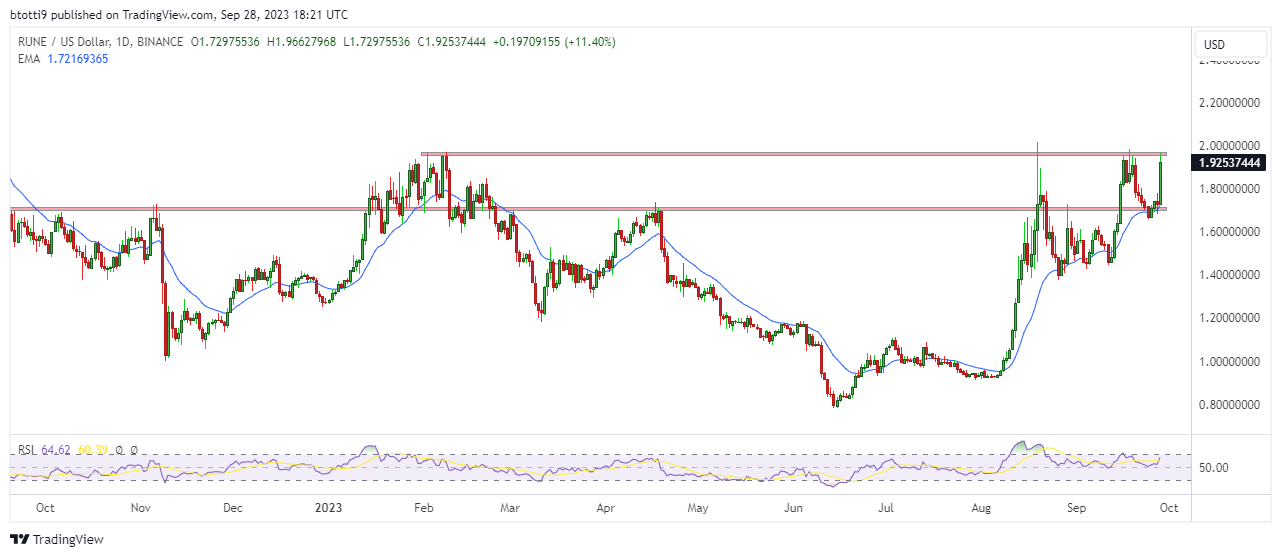

THORChain (RUNE) eyes breakout above $2

THORChain (RUNE) value is one in every of outperformers right now, with the altcoin’s worth breaking past $1.9 as shopping for stress mounted.

RUNE obtained rejected at $1.98 on September 18, ultimately slipping to lows of $1.65. As we speak’s positive aspects sees the cryptocurrency pierce the resistance round $1.74, with the 20-day EMA performing as help close to $1.72.

For RUNE, there could possibly be an urgency amongst patrons if value breaks above $2.01. If the anticipated buy-side liquidity performs out, we may see RUNE/USD eye $3.

Nonetheless, whereas bulls would possibly eye a contemporary break to $3.00, they face powerful resistance at this week’s provide wall that’s a part of a horizontal hurdle that additionally thwarted patrons in February. A pullback is subsequently probably given potential revenue taking, wherein case the first help could possibly be within the area of $1.72 to $1.66.