- Loom Community’s meteoric rise and abrupt fall have left traders questioning its future in a risky market.

- Speculations about trade manipulations and a large provide sale forged a shadow over LOOM’s prospects.

- Technical indicators present excessive volatility and oversold circumstances, suggesting potential for each restoration and additional declines.

After years of dormancy, Loom Community made headlines with an over 7x surge. This rise introduced it above its 2021 excessive, even amidst a tumultuous market. Nonetheless, its surprising ascent was short-lived.

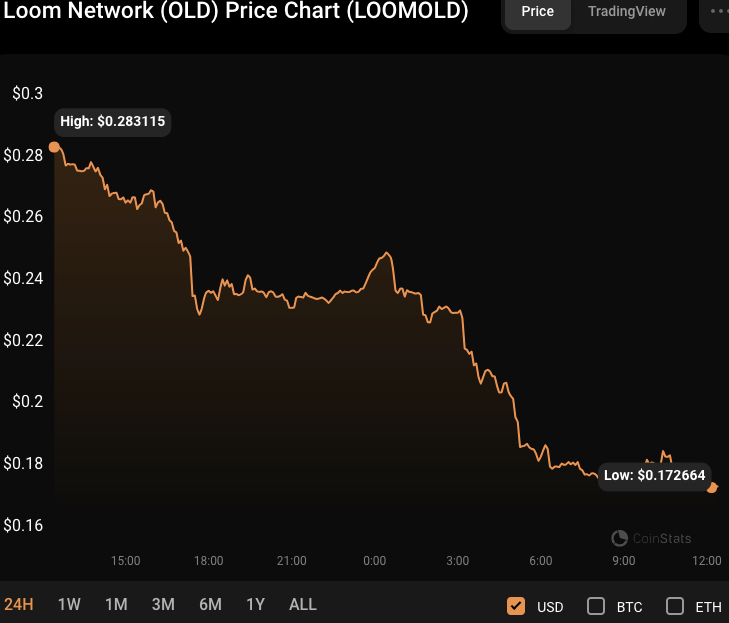

Simply because the broader market started to point out inexperienced shoots, Loom’s worth plummeted. Since October 15, it has nosedived from $0.48 to $0.1686 at press time, recording a 39.43% decline throughout the final 24 hours.

If bearish momentum breaches the $0.1728 help, the subsequent stage to observe for is round $0.15. This sudden drop in worth has left traders involved concerning the prospects of Loom Community and whether or not it could regain its earlier highs.

Through the downturn, LOOM’s market capitalization decreased by 37.20% to $214,550,482, whereas its 24-hour buying and selling quantity decreased by 5.98% to $503,699,018, respectively. The numerous lower in market capitalization and buying and selling quantity additional provides to the uncertainty surrounding Loom Community’s future efficiency.

Speculations Amid LOOM’s Nosedive

A number of analysts have joined the dialog about Loom’s fast descent. 0x_Lens, a preferred voice on X (previously Twitter), hints at “next-level manipulation by exchanges.” Considerably, he believes the venture is “lifeless,” given its low market cap.

Equally, one other dealer expresses bearish sentiments. He advises on shorting Loom. Moreover this, he feedback on a typical PCSN situation with most unfavourable funding. He additionally highlights that somebody possessing 50% of Loom’s provide initiated a sale.

Therefore, issues over Loom’s distribution have intensified. A current revelation by blockchain analytics agency Lookonchain states {that a} pockets holding 47.5% of LOOM’s provide has began promoting. Consequently, speculations are rife that this pockets belongs to the crypto trade Upbit. Apparently, this aligns with 0x_Lens’s perception about trade manipulations.

Moreover, Santiment factors out a regarding development. Developer exercise round Loom Community has dwindled dramatically over time. Such important inactivity means that the pump might not have a robust basis.

LOOM/USD Technical Evaluation

Bulging Bollinger bands on the LOOMUSD 4-hour value chart, with the higher hand at $0.44751206 and the decrease bar at $0.15265124, recommend that the value of LOOM/USD is experiencing excessive volatility. The wide selection between the higher and decrease bands signifies a big potential for value motion in both path.

The worth motion growing into crimson candlesticks on the decrease band signifies that there’s promoting stress out there. A transfer beneath the decrease band may sign an additional decline within the value of LOOM/USD, with a $0.15 help stage being examined.

The Relative Power Index (RSI) ranking of 30.79 additionally means that the LOOM/USD pair is at present oversold. This RIS stage may result in a short-term bounce in value as consumers might step in to reap the benefits of the decrease costs. Nonetheless, there’s room for additional draw back potential if promoting stress continues to dominate the market.

In conclusion, Loom Community’s current nosedive raises questions on its future amidst distribution issues and declining developer exercise. Volatility stays excessive, however the potential for a bounce exists.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be liable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.