- LTC decreased by 12.80% within the final 30 days in distinction to the earlier pre-halving efficiency.

- If the 50 EMA flips the 20 EMA, then LTC may fall beneath $90 until shopping for strain will increase.

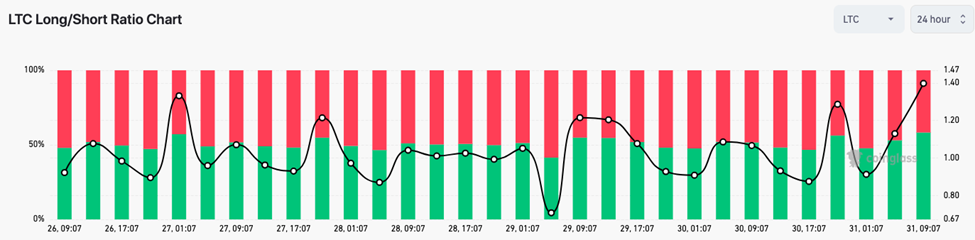

- Lengthy positions outweighed shorts, suggesting a bullish sentiment within the aftermath of the halving.

As Litecoin (LTC), approaches its third halving occasion, discussions have risen on whether or not historical past will repeat itself when it comes to worth efficiency. For context, the halving occurs each 4 years, and it’s a course of the place miners get rewards for validating transactions.

Traditionally, LTC goes on a pre-halving rally earlier than the value falls a number of days after the occasion. In response to CoinMarketCap, this was the case previous to the August 5 2019 halving. Round this era, LTC grew from $88 round July to commerce above $120 on the halving day.

LTC Is Not In Tune with Historical past

Nonetheless, as one of many pioneering cryptocurrencies, LTC has not had the identical transfer this cycle. As talked about above, previous halvings have been related to important worth rallies. However there are compelling elements suggesting that this time is likely to be totally different.

As an illustration, the coin worth was $93.29 — a 12.80% lower within the final 30 days. On the time of writing, LTC didn’t present any robust signal of crossing the $100 psychological degree.

Forward of the occasion, the coin’s market construction pushed towards a blended sign as a substitute of a bullish or bearish bias. This deduction was due to the Exponential Shifting Common (EMA) stance on the each day LTC/USD chart.

On July 30, the 20 EMA (blue) crossed the 50 EMA (yellow). Normally, this can be a bullish sign and was strengthened by a robust purchase candle to $109.08. Nonetheless, bullish dominance didn’t final lengthy, prompting an array of promote strain that drove LTC to $93.36.

Merchants Imagine In a BreakOut

Moreover, the 50 EMA had closed in on the 20 EMA. If the 50 EMA finally flips the 20 EMA, then LTC may lose maintain on the $90 area.

In the meantime, the Chaikin Cash Movement (CMF) was 0.04. Because the CMF was above zero, it implies energy available in the market. However the indicator would wish extra shopping for strain to verify a breakout within the upward route.

Because it stands, the declining quantity and the consolidating momentum revealed that an upward spike could possibly be unlikely.

Regardless of the indicators displayed by the technical indicators, merchants appeared bullish on the LTC worth motion. In response to Coinglass, the LTC 24-hour lengthy/brief ratio had elevated to 1.39.

An extended/brief ratio exceeding 1 suggests the next prevalence of lengthy positions. Conversely, if the indicator is beneath one, then it signifies that brief positions had been increased. So, LTC open positions within the derivatives market counsel a constructive sentiment

In conclusion, there’s a excessive probability that LTC fails to rise above $100 earlier than the halving. However contemplating merchants’ place, the coin may rally a number of weeks after the occasion offered sellers don’t stamp their dominance over patrons.

Disclaimer: The views, opinions, and knowledge shared on this worth prediction are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates won’t be accountable for direct or oblique harm or loss.