- Bullish LQTY value prediction ranges from $2.539 to $2.857.

- LQTY value may also attain $4 this 2023.

- LQTY’s bearish market value prediction for 2023 is $0.486.

Liquity is a decentralized borrowing protocol that permits customers to attract loans in opposition to Ether tokens used as collateral. Not like different platforms, Liquity presents interest-free liquidity and a low collateral ratio, making it extra environment friendly for debtors. Moreover, Liquity ensures a tough value flooring and a governance-free algorithmic financial coverage that ensures censorship resistance.

If you’re interested by the way forward for Liquity (LQTY) and wish to know the worth evaluation and value prediction of LQTY for 2023, 2024, 2025, 2026, and as much as 2050, preserve studying this Coin Version article.

Liquity (LQTY) Market Overview

HTTP Request Failed… Error: file_get_contents(https://api.coingecko.com/api/v3/cash/liquity): Did not open stream: HTTP request failed! HTTP/1.1 429 Too Many Requests

What’s Liquity (LQTY)?

Liquity is a decentralized borrowing protocol that permits customers to attract loans in opposition to Ether tokens used as collateral. The platform pays out loans utilizing LUSD tokens, a USD-pegged stablecoin that may be redeemed at any time in opposition to the underlying collateral at face worth. Customers want to keep up a minimal collateral ratio of 110%, and their Trove account retains observe of their ETH and LUSD debt.

Liquity makes use of the Stability Pool to keep up the system’s solvency by performing because the liquidity supply to repay debt from liquidated Troves and making certain that the entire LUSD provide stays backed up. Stability suppliers fund the Stability Pool by transferring LUSD, they usually acquire a pro-rata share of the liquidated collateral whereas shedding a pro-rata share of their LUSD deposits over time.

Not like different platforms, Liquity presents interest-free liquidity and a low collateral ratio, making it extra environment friendly for debtors. Moreover, Liquity ensures a tough value flooring and a governance-free algorithmic financial coverage that ensures censorship resistance. The platform incentivizes early adopters and frontends by way of its secondary token, LQTY, which rewards stability suppliers, customers depositing LUSD to the Stability Pool, frontends facilitating these deposits, and liquidity suppliers of the LUSD:ETH Uniswap pool.

Present collateralized debt platforms cost recurring charges for borrowing, which may have an oblique influence on financial provide and be ineffective within the quick time period. Moreover, over-collateralization makes the borrower’s capital inefficient, and collateral auctions and fixed-price selloffs have turned out to be inefficient by design.

Crypto-backed stablecoins are often topic to increased value volatility than conventional currency-backed stablecoins because of the lack of direct arbitrage cycles, they usually depend on a gentle peg mechanism that’s much less efficient. Liquity addresses these points by providing interest-free liquidity, a low collateral ratio, and a tough value flooring, making it a extra environment friendly borrowing platform.

Analysts’ View on Liquity (LQTY)

Traders are going bullish on LQTY that the coin would possibly attain $3 quickly.

A crypto analyst is mentioning LQTY as a gem on this tweet, with the hope that the coin would possibly attain its highest quickly.

Liquity (LQTY) Present Market Standing

Based on CoinMarketCap, Liquity (LQTY) is hovering at $0.8509 on the time of writing, with a complete of 93,370,844 LQTY in circulation. LQTY has a 24-hour buying and selling quantity of $23,898,226, with a 104% improve. And through 24 hours, the worth of LQTY surged by 2.37%.

The most well-liked exchanges to commerce Liquity (LQTY) are Binance, Coinbase, Uniswap, KuCoin and Gemini. Let’s proceed with our LQTY value analysis for 2023.

Liquity (LQTY) Value Evaluation 2023

LQTY ranks 255 on CoinMarketCap’s listing of the largest cryptocurrencies by market capitalization. Will LQTY’s most up-to-date enhancements, additions, and modifications assist its value rise? First, let’s concentrate on the charts on this article’s LQTY value forecast.

Liquity (LQTY) Value Evaluation – Bollinger Bands

The Bollinger Bands is a technical evaluation instrument that’s used to investigate value motion and volatility. Bollinger Bands (BB) makes use of the time interval and the stand deviation of the worth. Usually, the default worth of BB’s interval is ready at 20. The higher band of the BB is calculated by including 2 instances the usual deviations to the Easy Shifting Common (SMA), whereas the decrease band is calculated by subtracting 2 instances the usual deviation from the SMA. Primarily based on the empirical legislation of normal deviation, 95% of the information units will fall throughout the two commonplace deviations of the imply.

The candlesticks are at the moment buying and selling close to the highest half of the Bollinger Bands after buying and selling within the backside half of the indicator. LQTY was dealing with many falls over the long-term interval. The surge that LQTY is experiencing might be an indication of restoration. The Bollinger bands might proceed to stay secure for a while, nevertheless, any indicators of bands increasing might be seen by way of the BBW.

Liquity (LQTY) Value Evaluation – Relative Power Index (RSI)

The Relative Power Index (RSI) is a momentum indicator utilized to seek out out the present development of the worth motion and decide whether it is within the oversold or overbought area. Merchants typically use this instrument to make selections about when to purchase or promote the tokens. When the RSI is usually valued under or at 30, it’s thought of an oversold area, and a value correction might occur quickly. Furthermore, when the RSI is valued above or at 70, it’s thought to be the overbought area, and merchants count on the worth might fall quickly.

The RSI is at the moment valued at 63.44 and shifting nearer to the SMA after hitting the oversold area. There’s a excessive probability that the RSI might cross the SMA and fall under it. This might sign that LQTY might face a bearish development. Nevertheless, if the RSI indicators a bullish divergence, then, the candlesticks might begin climbing as soon as once more.

Liquity (LQTY) Value Evaluation – Shifting Common Convergence Divergence (MACD)

The Shifting Common Convergence Divergence (MACD) indicator can be utilized to establish potential value traits, momentums, and reversals in markets. MACD will make the studying of a shifting common cross simpler. The MACD indicator is calculated by subtracting the long-term EMA (Exponential Shifting Common) indicator from the short-term EMA. Usually, the default values for the MACD are set at 12-day EMA, 26-day EMA, and 9-day EMA. Furthermore, MACD is taken into account a lagging indicator because it can’t present commerce indicators with none previous value knowledge.

After a subsequent fall, inexperienced bars began to type on the MACD confirming LQTY’s bullish sentiment. The MACD fashioned a double prime because it initially did after experiencing a surge twice. Nevertheless, at the moment, the inexperienced bars on the MACD is at the moment decreasing, which might be an indication that the bullish development might be decreasing. Furthermore, the MACD line is pointed downwards which might be an indication that it might fall down for a while.

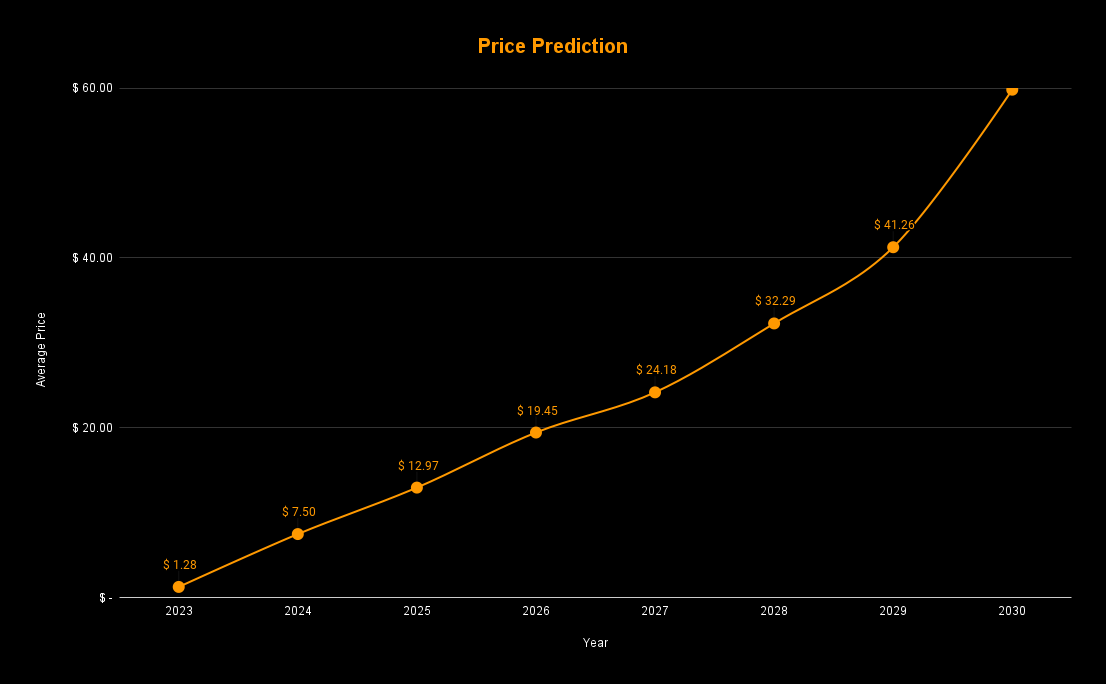

Liquity (LQTY) Value Prediction 2023-2030 Overview

| 12 months | Minimal Value | Common Value | Most Value |

| 2023 | $0.486 | $1.28 | $2.85 |

| 2024 | $6.9 | $7.50 | $8.37 |

| 2025 | $10.48 | $12.97 | $14.54 |

| 2026 | $17.37 | $19.45 | $21.73 |

| 2027 | $22.57 | $24.18 | $26.72 |

| 2028 | $25.17 | $32.29 | $36.28 |

| 2029 | $35.88 | $41.26 | $45.90 |

| 2030 | $55.01 | $59.80 | $63.94 |

| 2040 | $131.11 | $138.58 | $140.38 |

| 2050 | $316.89 | $329.56 | $330.29 |

Liquity (LQTY) Value Prediction 2023

Trying on the charts, the candlesticks earlier had been buying and selling close to the $0.777 degree which is the vital zone for LQTY. Earlier, an analogous sentiment was noticed when the altcoin confronted a fall and fell to the primary degree. Nevertheless, the candlesticks rose up and jumped to the second degree. An analogous development could also be anticipated because it follows an analogous commerce sample. If this speculation tends to be correct, there could also be a excessive probability that the candlesticks will commerce within the second degree.

In the meantime, the forecast for LQTY stays to be bullish and is predicted to achieve past the extent of $2.539. The bearish value prediction for LQTY ranges from $ 0.486 to $0.359. Nevertheless, on the off probability, that LQTY experiences an especially bullish sentiment once more, there’s a excessive risk that it commerce past the extent of $4.49.

| Bullish Value Prediction | Bearish Value Prediction |

| $2.539 – $2.857 | $0.359 – $0.486 |

Liquity (LQTY) Value Prediction 2023 – Resistance and Assist

The candlesticks are at the moment near the help of the chart. Furthermore, it’s clear that LQTY additionally confronted a subsequent drop from Resistance 2 this 12 months. If LQTY experiences a bullish interval as soon as once more, it has the potential to achieve its excessive bullish space on the $4 degree. LQTY has the potential to achieve resistance degree 3 if it continues to expertise a bullish interval. When LQTY passes by way of every Resistance, every degree might change into a brand new Assist degree.

Liquity (LQTY) Value Prediction 2024

The cryptocurrency market is understood to repeat historical past, and most cryptocurrencies observe the Bitcoin development. With 2024 because the 12 months of the Bitcoin halving, there will probably be many sentiments towards the market, which is all the time bullish. We will count on the worth of Liquity (LQTY) to react positively to the information and commerce at round $8.3 by the top of 2024.

Liquity (LQTY) Value Prediction 2025

The impact of any Bitcoin correction is skilled within the following 12 months from latest historical past. If LQTY ends in 2024 for $10 or extra, we will count on the worth of LQTY to develop in 2025. This might make LQTY commerce at $14.5 or extra in 2025, contemplating traders will probably be bullish.

Liquity (LQTY) Value Prediction 2026

With the rise in cryptocurrency adoption within the mainstream, we will count on a doable market reversal in 2026 to have little influence on the latest features within the value of LQTY. Therefore, Liquity might finish in 2026 at round $21.7 or extra.

Liquity (LQTY) Value Prediction 2027

Probably the most bearish market is adopted by market consolidation within the subsequent 12 months. If the 12 months 2026 seems to be bearish for LQTY, we might count on the market to stabilize in 2027 and even commerce increased. Therefore, it’s doable to see LQTY commerce at round $26.7 in 2027.

Liquity (LQTY) Value Prediction 2028

Liquity will seemingly commerce above its 2025 value prediction of $120 in 2028 because of the Bitcoin halving. With the highly effective sentiment of traders to purchase extra cryptocurrencies, a purchase stress might be seen available in the market, which can make LQTY commerce at round $36 in 2028.

Liquity (LQTY) Value Prediction 2029

Probably the most influence of a bullish sentiment ensuing from Bitcoin halving is principally skilled within the coming 12 months. We will count on the worth of LQTY to interrupt extra psychological resistance and commerce round $45 by the top of 2029. Additionally, LQTY is extremely prone to break its all-time excessive worth.

Liquity (LQTY) Value Prediction 2030

The influence of cryptocurrency adoption might stabilize the market by 2030, sustaining the bullish features of the earlier years. Therefore, we will count on the worth of LQTY to commerce above $63 by the top of 2030. Additionally, LQTY is extremely prone to break its all-time excessive worth.

Liquity (LQTY) Value Prediction 2040

LQTY is predicted to surpass extra psychological resistance ranges and commerce round $140 by the top of 2040, doubtlessly even surpassing its all-time excessive worth.

Liquity (LQTY) Value Prediction 2050

By the 12 months 2050, the widespread adoption of cryptocurrencies is predicted to stabilize the market and preserve the earlier bullish features. In consequence, we will anticipate LQTY to commerce above the $330 mark in direction of the top of 2050.

Conclusion

To summarize, if traders proceed to point out curiosity in LQTY and add these tokens to their portfolio, then, it might proceed to stand up. LQTY’s bullish value prediction reveals that it might move past the $2 degree in 2023. Furthermore, LQTY might surpass the $330 degree by the top of 2050.

FAQ

Liquity is a decentralized borrowing protocol that permits customers to attract loans in opposition to Ether tokens used as collateral. The platform pays out loans utilizing LUSD tokens, a USD-pegged stablecoin that may be redeemed at any time in opposition to the underlying collateral at face worth. Customers want to keep up a minimal collateral ratio of 110%, and their Trove account retains observe of their ETH and LUSD debt.

LQTY could be traded on many exchanges like different digital property within the crypto world. Binance, Coinbase, Uniswap, and Gemini are at the moment the most well-liked cryptocurrency exchanges for buying and selling LQTY.

Since LQTY gives traders with a number of alternatives to revenue from their crypto holdings, it appears to be a superb funding in 2023. Notably, LQTY has a excessive risk of surpassing its present ATH in 2023.

LQTY is likely one of the few energetic crypto property that proceed to rise in worth. So long as this bullish development continues, LQTY would possibly break by way of $6 and attain as excessive as $10. After all, if the present market favoring crypto continues, it is going to seemingly occur.

LQTY is predicted to proceed its upward development as one of many fastest-rising cryptocurrencies. We might also conclude that LQTY is a wonderful cryptocurrency to take a position on this 12 months, given its latest partnerships and collaborations which have improved its adoption.

The bottom LQTY value is $0.533, attained on November 13, 2022, in keeping with CoinMarketCap.

LQTY was launched on April 5, 2021.

LQTY was based by Robert Lauko.

The utmost provide of LQTY is 100,000,000 LQTY.

LQTY could be saved in a chilly pockets, scorching pockets, or change pockets.

LQTY value is predicted to achieve $2 by 2023.

LQTY value is predicted to achieve $8.3 by 2024.

LQTY value is predicted to achieve $14 by 2025.

LQTY value is predicted to achieve $21 by 2026.

LQTY value is predicted to achieve $26 by 2027.

LQTY value is predicted to achieve $36 by 2028.

LQTY value is predicted to achieve $45 by 2029.

LQTY value is predicted to achieve $63 by 2030.

LQTY value is predicted to achieve $140 by 2040.

LQTY value is predicted to achieve $330 by 2050.

Disclaimer: The views and opinions, in addition to all the data shared on this value prediction, are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates is not going to be held accountable for any direct or oblique harm or loss.