The U.S. Securities and Change’s (SEC) lawsuit towards Binance wiped off over $200 million inside one hour from crypto merchants who held positions available on the market.

Following the information, StarCrypto’s knowledge confirmed that the overall market cap of digital belongings declined 2.87% to $1.12 trillion.

Practically $300M within the final 24 hours

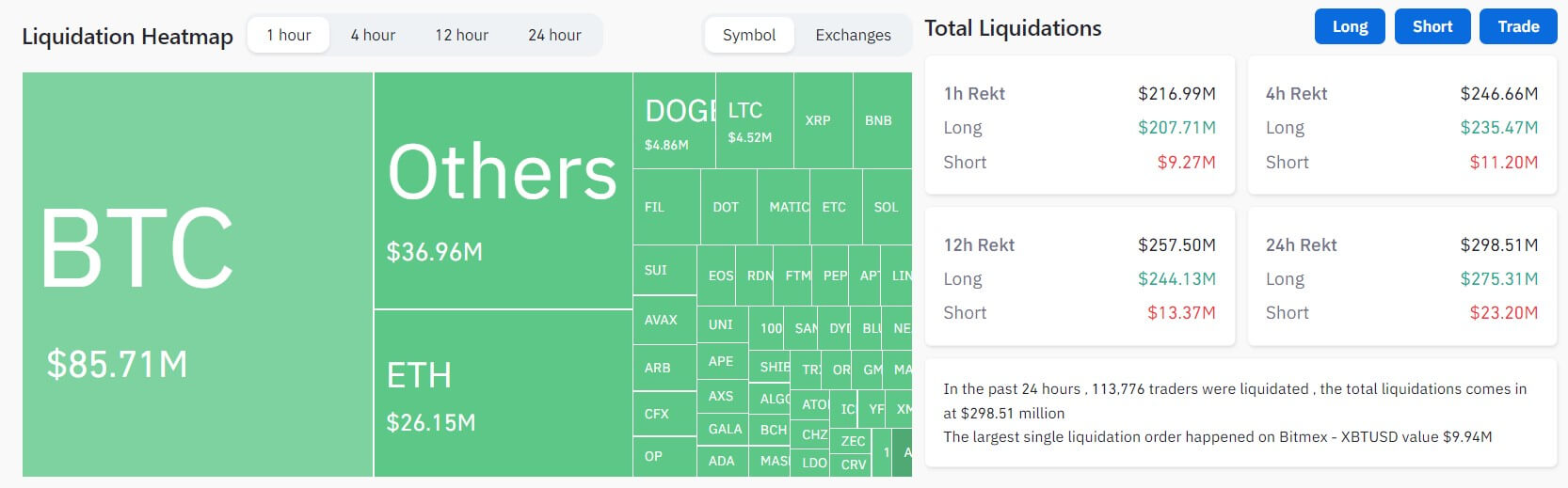

The crypto market noticed $298.51 million liquidated up to now 24 hours, with greater than 110,000 merchants affected.

Information from Coinglass confirmed that lengthy merchants misplaced $275.31 million, with Bitcoin and Ethereum accounting for $130.46 million of those losses.

In the meantime, quick merchants skilled $23.2 million in liquidations. The highest two digital belongings had been accountable for round 49.5% of those losses.

Different belongings equivalent to BNB, Chainlink, XRP, Litecoin, and Solana skilled lower than $2 million in liquidations, respectively.

Throughout exchanges, many of the liquidations occurred on OKX, Binance, and ByBit. These three exchanges accounted for 75% of the general liquidations, with 92% being lengthy positions. Different exchanges like Huobi, Deribit, and Bitmex additionally recorded a sizeable quantity of the overall liquidations.

Probably the most important liquidation occurred on Bitmex – XBTUSD, valued at $9.94 million.

Purple market

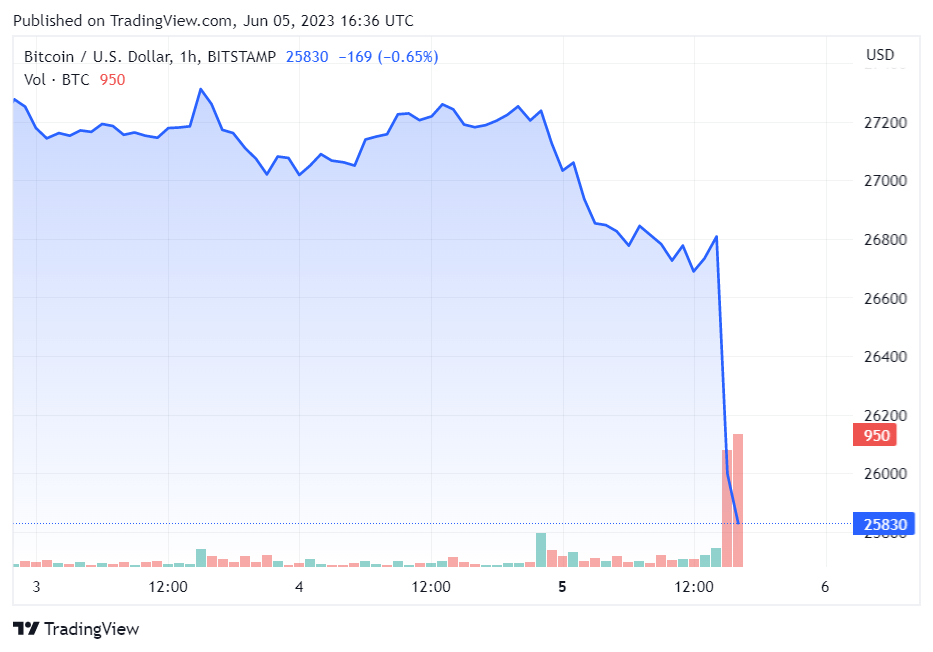

Bitcoin dipped from over $27,000 to under $26,000 inside one hour and was buying and selling at $25,859 as of 16:36 UTC

The worth of Bitcoin is down total by nearly 5% over the previous 24 hours.

Binance-related BNB noticed the best loss, plunging by practically 10% to $281, whereas Ethereum (ETH) fell 3%. Different high digital belongings like XRP, Cardano (ADA), Dogecoin (DOGE), and others additionally reported important losses through the reporting interval.

The put up Liquidations surpass $200M in 1 hour after SEC’s Binance lawsuit appeared first on StarCrypto.