- Bullish LINA worth prediction ranges from $0.03585 – $0.04312.

- LINA worth may additionally attain $0.07 this 2023.

- LINA’s bearish market worth prediction for 2023 is $0.007550.

The communities’ curiosity in decentralization continues to rise and numerous initiatives construct based mostly on hopes to satisfy these calls for. One such undertaking Linear Finance, a non-custodial, cross-chain suitable, delta-one asset protocol, goals to democratize customers’ entry to varied investible belongings as a part of their long-term DeFi imaginative and prescient.

Furthermore, Linear claims that as a DeFi protocol with ‘deep aggregated liquidity’ and the platform’s peer-to-peer contracts enable customers to mint artificial belongings aka Liquids. Other than offering customers entry to varied belongings with enhanced options, Linear Finance additionally hopes to develop into a dependable gateway with the adoption of cryptocurrency.

Earlier than we dive additional into the native token of Linear Finance LINA’s worth evaluation and forecast for the years 2023, 2024, 2025, 2026, till 2050, let’s first perceive Linear Finance.

Linear Finance (LINA) Market Overview

| 🪙 Identify | Linear |

| 💱 Image | lina |

| 🏅 Rank | #242 |

| 💲 Worth | $0.02107447 |

| 📊 Worth Change (1h) | 3.95759 % |

| 📊 Worth Change (24h) | -1.06729 % |

| 📊 Worth Change (7d) | 92.64628 % |

| 💵 Market Cap | $112824682 |

| 📈 All Time Excessive | $0.298899 |

| 📉 All Time Low | $0.00471791 |

| 💸 Circulating Provide | 5344128102.18 lina |

| 💰 Whole Provide | 10000000000 lina |

What’s Linear Finance (LINA)?

As talked about above, Linear Finance is a non-custodial, cross-chain suitable, DeFi protocol permitting customers to mint artificial belongings aka Liquids. Linear additionally permits to construct and handle their very own spots or portfolio exposures. Linear, with its cross-chain options, permits artificial belongings constructed on different EVM-compatible chains.

Furthermore, the spine of Linear’s protocol consists of a collateralized debt pool, the place the digital and real-world belongings are utilized as collateral. When customers present collateralized belongings to the debt pool are in a position to mint Linear USD (lUSD), which can be utilized to buy artificial belongings from the platform’s native alternate.

The native token of Linear Finance, LINA, consists of governance and utility features. The LINA token adopts an inflationary mannequin with the purpose of enhancing the incentives obtainable to lively platform members. Customers may be earned once they take part within the numerous actions of the community. A number of the ways in which customers can earn LINA as rewards are by Professional-rata Alternate Price, Inflationary Rewards, Yield Farming Marketing campaign, Pledge Ratio, and the Linear Pool.

Other than numerous options, LINA additionally consists of merchandise like Linear Buildr, Linear Alternate, Linear Vault, and Linear Swap to offer completely different options. Lastly, Linear hopes to offer a platform the place asset administration is “simple, low-cost, and, clear.” Linear’s long-term targets additionally embrace remodeling it right into a DAO, which is able to enable customers to participate within the decision-making course of.

Linear Finance (LINA) Present Market Standing

LINA is ranked within the 196 place based mostly on its market capitalization, in response to CoinMarketCap. The present circulating provide of LINAcoin is at 5,344,128,102 LINA, whereas its whole provide is 10,000,000,000.

Furthermore, LINA is priced at $0.02079, experiencing a 90.63% rise in seven days. With a market cap of $111,011,422, LINA can also be experiencing a 9.85% spike in 24 hours. It was noticed that LINA’s demand continues to be rising because the buying and selling quantity, valued at $395,464,920, skilled a surge of 54.27% in at some point.

A number of the crypto exchanges for buying and selling LINA are presently Binance, KuCoin, Bithumb, MEXC, and BitGet. Nevertheless, merchants ought to word that over time LINA might be obtainable throughout many different high crypto exchanges.

Now, let’s dive additional and talk about the value evaluation of LINA for 2023.

Linear Finance (LINA) Worth Evaluation 2023

Will LINA’s most up-to-date enhancements, additions, and modifications assist the value of cryptocurrencies rise? Furthermore, would the adjustments within the blockchain business have an effect on LINA’s sentiment over time? Learn extra to seek out out about LINA’s 2023 worth evaluation.

Linear Finance (LINA) Worth Evaluation – Bollinger Bands

The Bollinger Bands is a technical evaluation software that’s used to research worth motion and volatility. Bollinger Bands (BB) makes use of the time interval and the stand deviation of the value. Usually, the default worth of BB’s interval is about at 20. The higher band of the BB is calculated by including 2 occasions the usual deviations to the Easy Transferring Common (SMA), whereas the decrease band is calculated by subtracting 2 occasions the usual deviation from the SMA. Based mostly on the empirical regulation of normal deviation, 95% of the information units will fall throughout the two normal deviations of the imply.

Trying on the chars, LINA is experiencing a excessive risky market which is likely one of the main components for its sudden surge. Excessive volatility out there sentiment led to a change within the development because the bands expanded. Every time the bands expanded and the market was risky, the Bollinger Band Width shot upwards. Furthermore, the same signal was noticed lately which confirmed excessive volatility because the Bollinger Band Width continues to maneuver upwards. If LINA continues to expertise excessive volatility, then, it might get better again to its earlier place earlier than the autumn.

Linear Finance (LINA) Worth Evaluation – Relative Power Index (RSI)

The Relative Power Index (RSI) is a momentum indicator utilized to seek out out the present development of the value motion and decide whether it is within the oversold or overbought area. Merchants usually use this software to make choices about when to purchase or promote the tokens. When the RSI is usually valued under or at 30, it’s thought-about an oversold area, and a worth correction might occur quickly. Furthermore, when the RSI is valued above or at 70, it’s considered the overbought area, and merchants count on the value might fall quickly.

Presently, the RSI is valued at 85.54, which is taken into account the overbought area as it’s valued above 70. Furthermore, there’s a chance that the RSI might stay within the overbought area for a while earlier than it faces a fall. The Relative Risky Index is above the sign line after making a bullish crossover. If the RVGI falls under the sign line and the RSI begins pointing downward, then, LINA’s fall might occur quickly. In the end, merchants want to attend for a sign from each the RSI and the RVGI earlier than the altcoins’ sentiment.

Linear Finance (LINA) Worth Evaluation – Transferring Common Convergence Divergence (MACD)

The Transferring Common Convergence Divergence (MACD) indicator can be utilized to establish potential worth traits, momentums, and reversals in markets. MACD will simplify the studying of a transferring common cross simpler. The MACD indicator is calculated by subtracting the long-term EMA (Exponential Transferring Common) indicator from the short-term EMA. Usually, the default values for the MACD are set at 12-day EMA, 26-day EMA, and 9-day EMA. Furthermore, MACD is taken into account a lagging indicator because it can not present commerce indicators with none previous worth information. MACD performs an vital position as it might probably verify the traits and establish potential reversals.

The MACD line is presently above the sign line, indicating that LINA is experiencing an enormous surge within the short-term interval. After a bullish crossover, when the MACD line went above the SMA, LINA has been experiencing an uptrend. Furthermore, the hole between the MACD line and the SMA continues to widen and it will take a while earlier than a bearish crossover is fashioned. When the MACD line crosses under the SMA, then, LINA might expertise a bearish sentiment within the quick time period.

Linear Finance (LINA) Worth Evaluation – Transferring Common

Trying on the charts, a golden cross was fashioned because the 50MA crossed above the 200MA. After the golden cross was fashioned, the candlesticks was buying and selling above the transferring common indicator, which is taken into account because the bullish development. Furthermore, as quickly because the candlesticks entered the consolidation space, LINA skilled an enormous surge, which led the altcoin above the MA indicators. Presently, the 200MA can also be appearing as a Assist area as candlesticks usually touched this area.

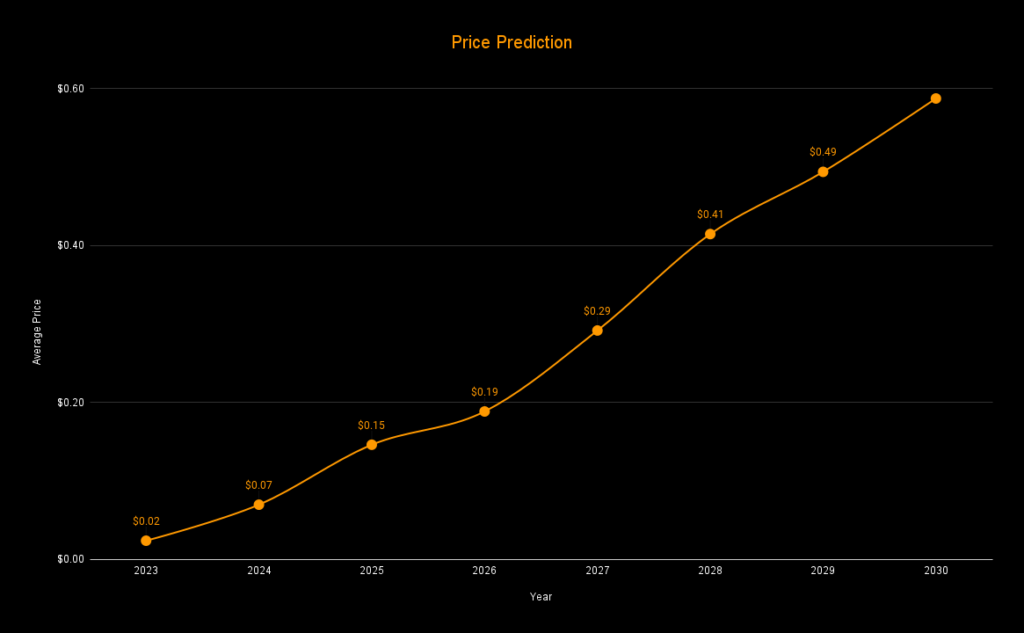

Linear Finance (LINA) Worth Prediction 2023 – 2030 Overview

| 12 months | Minimal Worth | Common Worth | Most Worth |

| 2023 | $0.005809 | 0.02351 | $0.07543 |

| 2024 | $0.04701 | $0.0694 | $0.1511 |

| 2025 | $0.9317 | $0.1458 | $0.2085 |

| 2026 | $0.1196 | $0.1882 | $0.2593 |

| 2027 | $0.2271 | $0.2914 | $0.3786 |

| 2028 | $0.3314 | $0.4143 | $0.4608 |

| 2029 | $0.4005 | $0.4936 | $0.5747 |

| 2030 | $0.4513 | $0.5871 | $0.6388 |

| 2040 | $1.3100 | $1.3729 | $1.4602 |

| 2050 | $2.4117 | $2.4965 | $2.6705 |

Linear Finance (LINA) Worth Prediction 2023

Presently, LINA is experiencing an enormous surge, because the candlesticks fashioned new upward-pointing inexperienced candlesticks. The MACD line can also be above the sign line, which is taken into account a bullish affirmation for the short-term. The MACD indicator additionally highlights that inexperienced bars might proceed to kind because the hole between the MACD line and the sign line continues to widen. The ADX is presently valued at 34.43, indicating that the development’s power is basically robust. The MACD line and the ADX is pointed upwards indicating that costs might proceed to maneuver in an uptrend sentiment.

In the meantime, the value prediction of LINA for 2023 stays to be bullish and is anticipated to succeed in past the extent of $0.3585. The bearish worth prediction vary for LINA is between $0.005809 to $0.007550. Nevertheless, if LINA experiences excessive bullish sentiment, then it will attain the $0.07 degree.

| Bullish Worth Prediction | Bearish Worth Prediction |

| $0.03585 – $0.04312 | $0.005809 – $0.007550 |

Linear Finance (LINA) Worth Prediction – Resistance and Assist Ranges

LINA’s candlesticks is buying and selling between the Resistance 1 and Assist. If LINA continues to maneuver in its present upward motion, then, it might attain the Resistance 1 at $0.03585. If it experiences an excessive bullish sentiment, then, the candlesticks might attain the Resistance 2. In the meantime, if LINA experiences a bearish sentiment, it might fall again to the Assist area.

Linear Finance (LINA) Worth Prediction 2024

Merchants are trying ahead to this yr because it might be a historic second for cryptocurrencies, because the Bitcoin halving is anticipated to occur in 2024. More often than not, every time BTC rises, merchants have noticed the same surge within the altcoins. LINA is also affected by Bitcoin halving and will commerce past the value of $0.1 by the tip of 2024.

Linear Finance (LINA) Worth Prediction 2025

LINA might nonetheless expertise the after-effects of the Bitcoin halving and is anticipated to commerce above its 2024 worth. Many commerce analysts speculate that BTC halving might create a huge effect on the crypto market. Furthermore, much like many altcoins, LINA will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that LINA would commerce past the $0.2 degree.

Linear Finance (LINA) Worth Prediction 2026

It’s anticipated that after a protracted interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, LINA might tumble into its assist area of $0.21. Furthermore, when LINA stays within the oversold area, there might be a worth correction quickly. LINA, by the tip of 2026, might be buying and selling past the $0.25 resistance degree after experiencing the value correction.

Linear Finance (LINA) Worth Prediction 2027

Naturally, merchants count on a bullish market sentiment after the crypto business was affected negatively by the bears’ claw. LINA is anticipated to rise after its slumber within the bear season. Furthermore, LINA might even break extra resistance ranges because it continues to get better from the bearish run. Subsequently, LINA is anticipated to commerce at $0.37 by the tip of 2027.

Linear Finance (LINA) Worth Prediction 2028

As soon as once more, the crypto neighborhood is trying ahead to this yr as there might be a Bitcoin halving. Alike many altcoins, LINA will proceed to kind new larger highs and is anticipated to maneuver in an upward trajectory. Therefore, LINA could be buying and selling at $0.46 after experiencing an enormous surge by the tip of 2028.

Linear Finance (LINA) Worth Prediction 2029

2029 is anticipated to be one other bull run because of the aftermath of the BTC halving. Nevertheless, merchants speculate that the crypto market would step by step develop into steady by this yr. In tandem with the steady market sentiment and the slight worth surge anticipated after the aftermath, LINA might be buying and selling at $0.57 by the tip of 2029.

Linear Finance (LINA) Worth Prediction 2030

After witnessing a bullish run out there, LINA and plenty of altcoins would present indicators of consolidation and would possibly commerce sideways for a while whereas experiencing minor spikes. Subsequently, by the tip of 2030, LINA might be buying and selling at $0.63.

Linear Finance (LINA) Worth Prediction 2040

The long-term forecast for LINA signifies that this altcoin might attain a brand new all-time excessive(ATH). This may be one of many key moments as HODLERS might count on to promote a few of their tokens on the ATH level. Nevertheless, LINA might face a slight fall earlier than beginning its upward journey as soon as once more. It’s anticipated that the value of LINA might attain $1.46 by 2040.

| Minimal Worth | Common Worth | Most Worth |

| $1.31 | $1.37 | $1.46 |

Linear Finance (LINA) Worth Prediction 2050

The neighborhood believes that there might be widespread adoption of cryptocurrencies, which might preserve gradual bullish positive factors. By the tip of 2050, if the bullish momentum is maintained, LINA might surpass the resistance degree of $2.67.

| Minimal Worth | Common Worth | Most Worth |

| $2.41 | $2.49 | $2.67 |

Conclusion

To summarize, if buyers proceed to indicate curiosity in LINA and add these tokens to their portfolio, then, it might proceed to stand up. LINA’s bullish worth prediction reveals that it might go past the $0.07 degree. Furthermore, LINA might surpass the $2.67 degree by the tip of 2050.

FAQ

Linear Finance is a non-custodial, cross-chain suitable, DeFi protocol permitting customers to mint artificial belongings aka Liquids. Linear additionally permits to construct and handle their very own spots or portfolio exposures. Linear, with its cross-chain options, permits artificial belongings constructed on different EVM-compatible chains.

LINA has numerous advantages and utilities, which improve its worth. Furthermore, LINA might proceed to develop into one of many tokens below the watch listing as they purpose to offer a wealth flexibility for customers.

The utmost provide of LINA is 10,000,000,000.

Linear FInance was co-founded by Drey Ng and Kevin Tai.

LINA may be saved in a chilly pockets, sizzling pockets, or alternate pockets.

LINA is anticipated to succeed in $0.04 in 2023.

LINA is anticipated to succeed in $0.1 in 2024.

LINA is anticipated to succeed in $0.2 in 2025.

LINA is anticipated to succeed in $0.25 in 2026.

LINA is anticipated to succeed in $0.25 in 2027.

LINA is anticipated to succeed in $0.46 in 2028.

LINA is anticipated to succeed in $0.57 in 2029.

LINA is anticipated to succeed in $0.63 in 2030.

LINA is anticipated to succeed in $1.46 in 2040.

LINA is anticipated to succeed in $2.67 in 2050.

Disclaimer: The views and opinions, in addition to all the knowledge shared on this worth prediction, are printed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates is not going to be held responsible for any direct or oblique injury or loss.