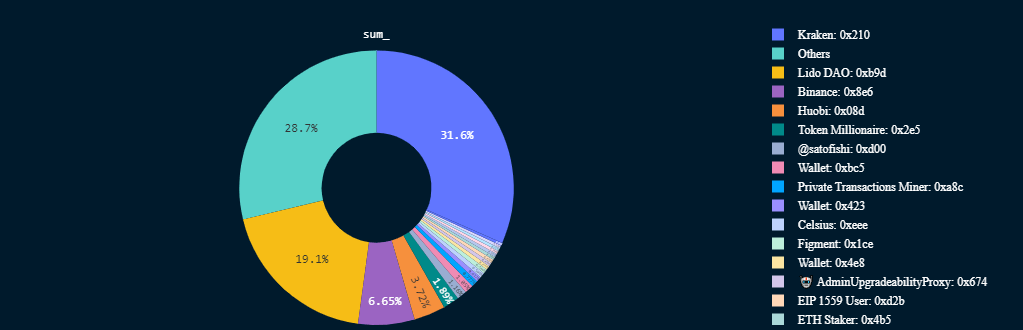

Kraken is main the second wave of full-staked Ethereum (ETH) withdrawals, based on Nansen’s dashboard.

Nansen’s information journalist Martin Lee mentioned the U.S.-based crypto alternate has withdrawn over 330,000 ETH. Lee added that “one other 175,000 in ETH left, which is basically principal withdrawals.”

Since withdrawals have been enabled, Kraken has led the desk of entities withdrawing property from the beacon chain. The alternate’s excessive withdrawal fee is influenced by the regulatory stress from the U.S. Securities and Trade Fee (SEC). The alternate paid a $30 million tremendous for failing to register its staking companies with the regulator.

Regardless of its withdrawals, Kraken continues to be one of many largest depositors on the Beacon Chain. The alternate nonetheless has round 935,488 ETH staked as of press time.

Different entities withdrawing staked ETH

Asides from Kraken, Lido DAO is liable for most withdrawals. The liquid staking platform accounts for 25% of all withdrawals processed, based on Nansen’s dashboard.

Lido is adopted by Binance — which has withdrawn 91,190 staked ETH, equating to six.65% of withdrawn ETH. Different centralized entities like bankrupt lender Celsius and centralized alternate Huobi are additionally among the many prime addresses which have withdrawn their staked tokens.

In the meantime, the highest three entities awaiting withdrawals are exchanges — Binance, Coinbase, and Kraken. The corporations need to withdraw over 60% of the 1.37 million ETH ready for withdrawal.

Deposits outpace withdrawals

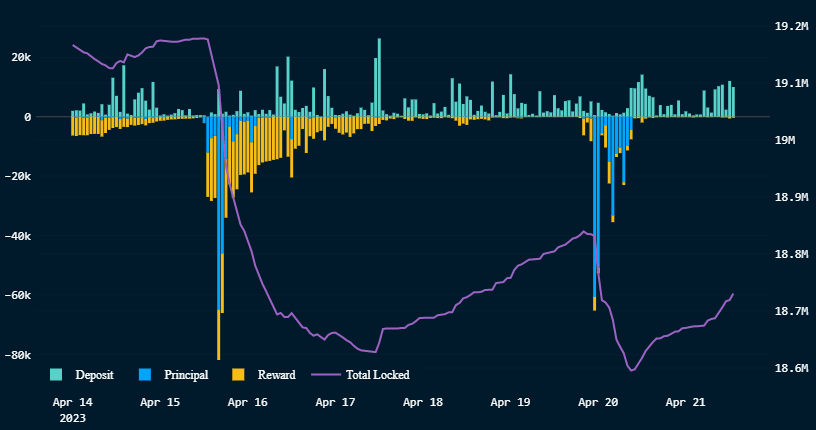

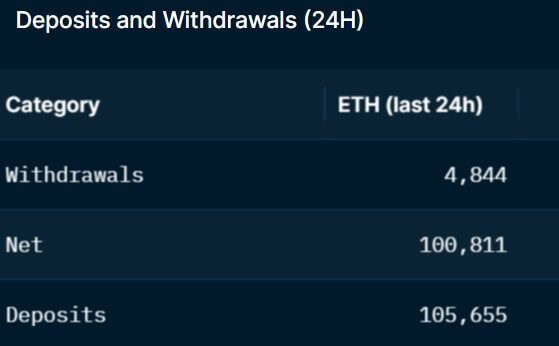

Staked Ethereum deposits have been outpacing withdrawals for the previous few days, based on the Nansen dashboard.

In line with the dashboard, over 100,000 ETH was deposited within the final 24 hours — whereas lower than 5,000 ETH have been withdrawn throughout the identical interval.

The put up Kraken withdraws 330k ETH amid regulatory stress – deposits outpace withdrawals in staking race appeared first on starcrypto.