- Kraken is main the best way in ETH staking cancellations.

- Twitter customers blame the Huobi ETH staked withdrawal surge on the handover between new and present homeowners.

- The Shanghai replace (Shapella) for Ethereum is already dwell.

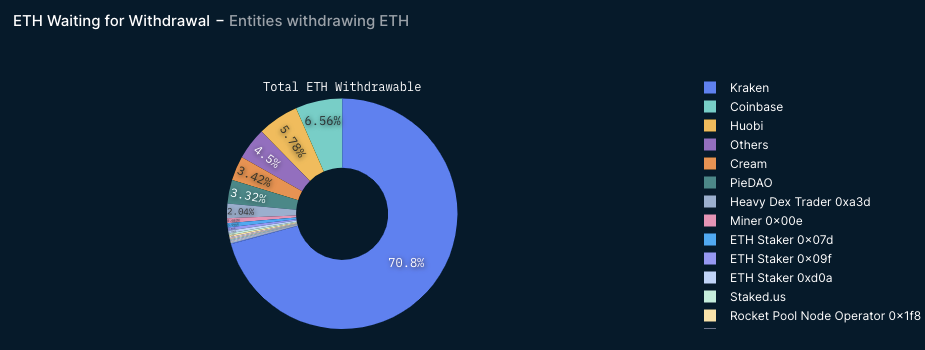

In line with a current evaluation by Nansen, Kraken is main the best way within the quantity of staked ETH ready for withdrawal. As per the report, Kraken, the US-based cryptocurrency change, topped the checklist with 70.8% of the full ETH ready for withdrawal.

The report additionally revealed a number of different in style change platforms ready to cancel their ETH staking. These included Coinbase, which had 6.56% of complete withdrawable ETH, and Huobi, a Seychelles-based cryptocurrency change with 5.78%. Alternatively, “Others” was fourth on the checklist with a share of 4.5% of the full withdrawable ETH, whereas Cream, an open supply and blockchain agnostic protocol, had 3.42% at press time.

Nonetheless, cryptocurrency proponents on Twitter declare that the handover of latest and previous shareholders is responsible for the present spike in ETH-staked withdrawals on Huobi. One person claimed that Li Lin, the creator of Huobi, was pressured to carry out a handover as soon as the withdrawal was opened, which necessitated withdrawing some ETH from the change and depositing it again. This process might have produced extra withdrawals and deposits than typical, which could have led to the platform’s current spike in ETH withdrawals.

This comes amid the Shanghai (Shapella) Improve, which mixes modifications to Ethereum’s execution layer (Shanghai improve), consensus layer (Capella improve), and the Engine API. The Shanghai replace for Ethereum, which is already dwell, will full the transformation of Ethereum to a “proof of stake” blockchain, which makes use of over 99% much less power than the “proof of labor” blockchain that runs the Bitcoin community.