- USDT peg destabilization might have been triggered by manipulation, in response to Kaiko.

- Promoting exercise started days earlier than USDT dipped to $0.995.

- Binance’s USDT-USDC pair witnessed substantial USDT promoting.

Kaiko, a cryptocurrency information supplier, has uncovered insights into the current volatility surrounding Tether (USDT), the world’s largest stablecoin. The corporate’s evaluation means that the destabilization of USDT’s peg to the US greenback might have been triggered by manipulation previous a big doc launch, which make clear the agency’s banking relationships and business paper publicity.

A number of days earlier than USDT skilled a dip to as little as $0.995 on centralized and decentralized exchanges, a wave of promoting exercise commenced. In response to Kaiko, sure holders might have superior information of the upcoming doc launch.

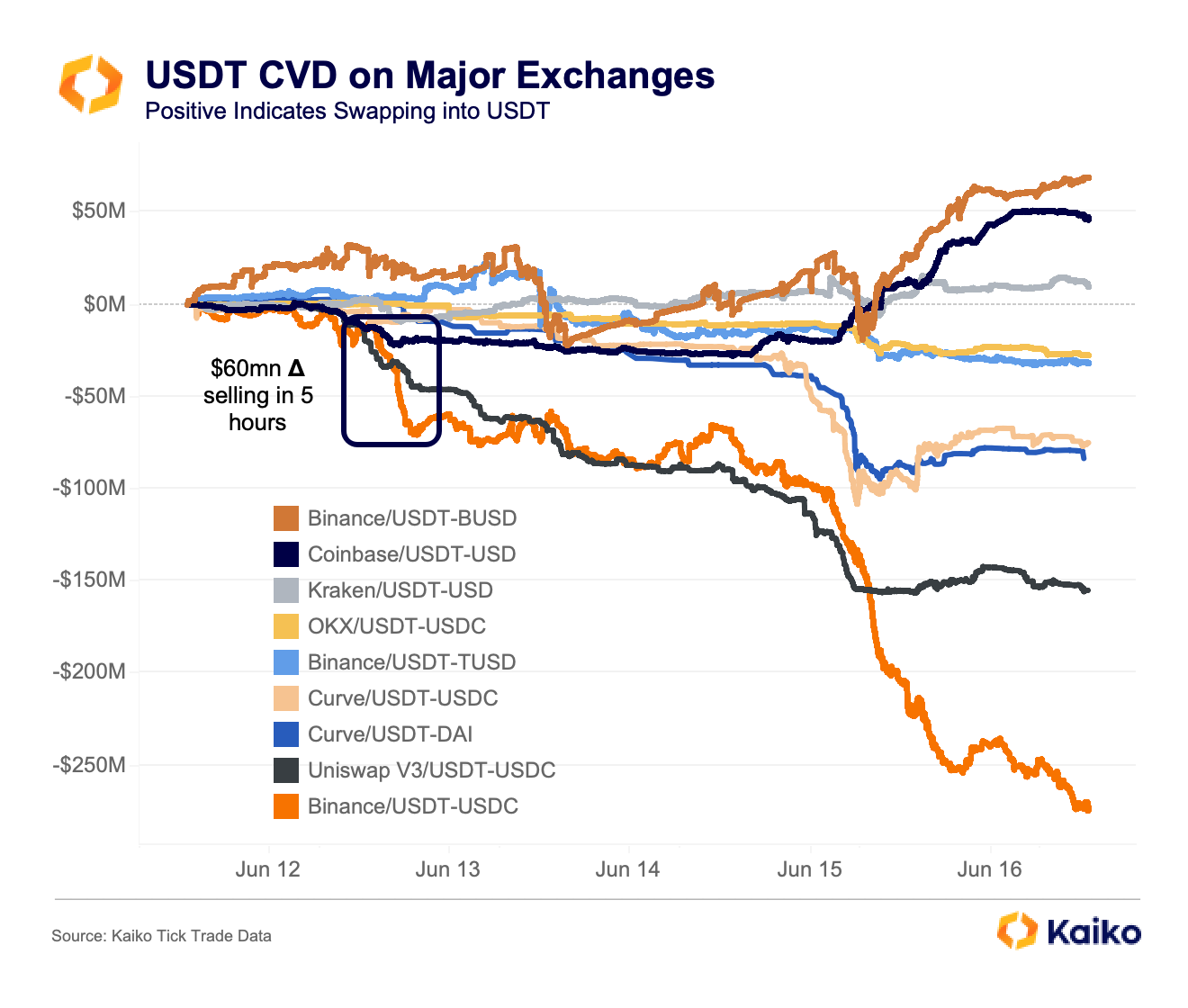

One metric that gives beneficial insights into the market dynamics is the Cumulative Quantity Delta (CVD) indicator, which depicts shopping for and promoting traits for particular buying and selling pairs. On this context, constructive CVD values point out a desire for swapping into USDT, whereas unfavourable values signify the promoting of USDT.

Binance’s USDT-USDC pair demonstrated the most important USDT promoting exercise, recording a unfavourable CVD of $250 million from Monday to Friday. Following intently behind was Uniswap V3, which registered a unfavourable CVD of $150 million.

Conversely, Coinbase and Kraken’s USDT-USD markets exhibited constructive CVD values, indicating merchants’ willingness to trade fiat foreign money for a barely discounted USDT. Moreover, Binance’s USDT-BUSD pair displayed a constructive CVD, suggesting merchants’ inclination to grab a possibility to unload BUSD.

The evaluation additional revealed that Curve, the first decentralized market for stablecoin swaps, witnessed vital promoting strain on USDT throughout the pool, primarily involving DAI and USDC. This buying and selling pair exhibited a unfavourable CVD of $150 million, emphasizing the magnitude of the promoting exercise throughout the decentralized ecosystem.

Apparently, amid the de-pegging occasion, the most important order recorded amounted to roughly $12 million value of USDC swapped for USDT. This transaction signifies that some astute merchants sought to capitalize on the worth discrepancy between the 2 stablecoins, aiming to revenue from the prevailing market circumstances.