- VP Kamala Harris overpowers Donald Trump in betting odds on the presidential election.

- Although Bitcoin dipped to a each day low yesterday, it recovered just lately, marking practically a 3% surge.

- Peter Schiff hints at a attainable inflation if Kamala Harris wins the presidential election.

Bitcoin skilled a pointy drop after the U.S. presidential candidates’ debate and a shift within the betting markets. As VP Kamala Harris’ odds on Polymarket climbed to 56%, surpassing Donald Trump’s 48%, Bitcoin dropped to a each day low of $55,591. Economist Peter Schiff, commenting on Harris’ rising odds, predicted an impending inflation ought to she be elected.

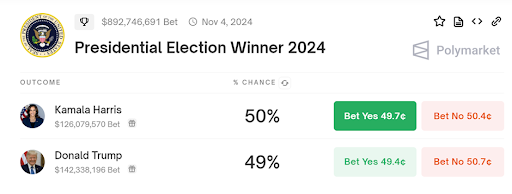

In accordance with the most recent information from Polymarket, Kamala Harris stays the main candidate within the presidential race, even with minor fluctuations. Her odds dropped to 50%, whereas Trump’s odds rose to 49%.

Schiff recommended Harris might introduce authorities funding initiatives, implying the potential of debt restoration underneath her management. Nevertheless, he warned of inflationary pressures. Altcoins like Dogecoin noticed important losses as Harris gained floor within the betting markets, whereas the Japanese yen strengthened to 140.70 per U.S. greenback.

As of press time, Bitcoin is buying and selling at $58,069, marking a notable rally from the current low. Over the past 24 hours, the cryptocurrency has skilled a hike of two.94%, with a 1.94% enhance during the last week. Although Dogecoin marked a plummet of over 4% yesterday, it has recovered and surged by 2.75% over 24 hours.

Consultants Weigh In on the Election

There are blended views on how the election may have an effect on the crypto market. Trump, who has overtly expressed help for cryptocurrency and labeled himself the ‘crypto president,’ affords hope for a possible market revival.

Learn additionally: Harris Skips Crypto Regulation as Trump Leads Polymarket with 52%

Whereas Harris has not clearly outlined her stance on crypto, some worry she might align with the anti-crypto motion. Nevertheless, others stay hopeful, believing her presidency may spark a bullish pattern. The crypto group awaits the ultimate consequence of the 2024 U.S. presidential election this November.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t answerable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.