- The analyst inspired contributors to purchase the Bitcoin and altcoin dip.

- BTC’s dominance dropped, suggesting a possible altcoin rally.

- Bitcoin would possibly hold buying and selling sideways as bulls and bears keep on the sidelines.

Crypto analyst Michaël van de Poppe posted that the broader altcoin correction could possibly be a chance to load up on the dips. van de Poppe stated this in a submit on January 24.

Based on him, the damaging sentiment at the moment skilled out there shouldn’t be seen as an indication of dropping religion. As an alternative, he opined that it could possibly be one of the best time to build up earlier than the following rally.

The analyst additionally talked about Bitcoin (BTC) in one other submit. Based on him, BTC was within the remaining part of its correction as a result of volatility has been lowering.

He, nonetheless, talked about that the coin worth might nonetheless drop as little as $36,000 however famous {that a} rally might occur earlier than the halving.

On January 24, Coin Version reported how one other analyst famous that BTC may not hit $46,000 till after the halving.

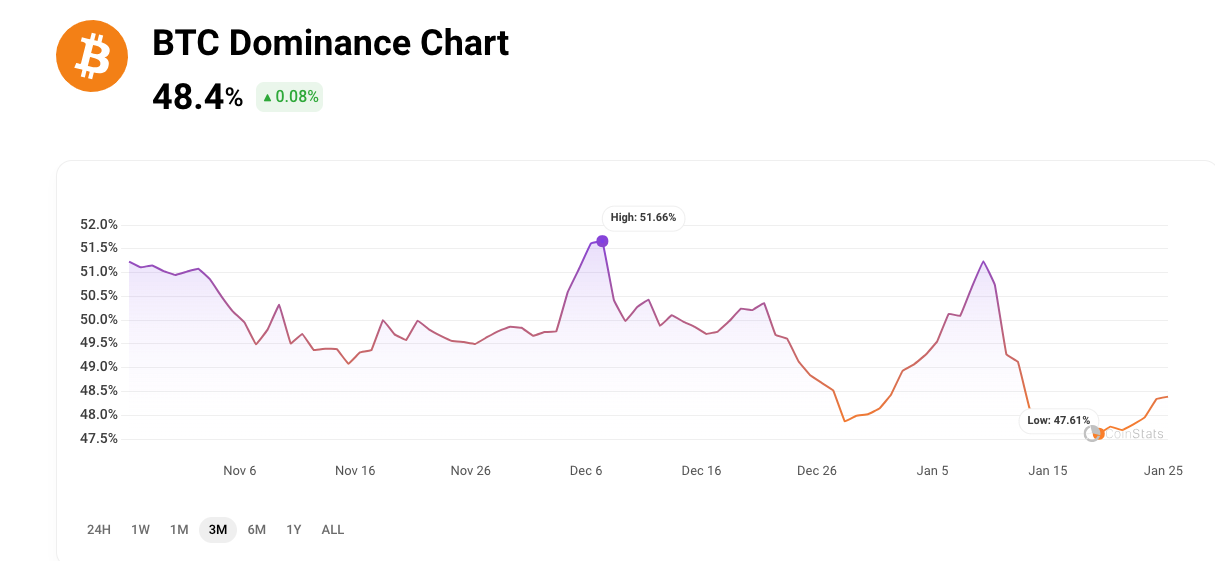

Just lately, Bitcoin, alongside many high altcoins, has shredded a good portion of its worth. At press time, BTC’s worth was $40,020. A take a look at the Bitcoin dominance chart confirmed that it was 48.4%, information from CoinStats confirmed.

The Bitcoin dominance chart is a key metric that signifies the power of Bitcoin in comparison with the remainder of the cryptocurrency market. When Bitcoin’s dominance is excessive, it implies that Bitcoin is outperforming different altcoins by way of market capitalization.

Nevertheless, a decrease dominance means that altcoins could possibly be in line to outperform the coin. The worth was one of many lowest BTC has seen previously three months.

If it rises increased than this, then BTC’s worth would possibly improve. Nevertheless, an extra fall than this might end result within the rotation of liquidity into altcoins, and push the costs increased.

For now, BTC would possibly hold hovering round $39,000 and $40,000. This was in line with the indication proven on the 4-hour chart.

At press time, the Accumulation/Distribution (A/D) indicator has stalled. A scenario like this means that almost all market gamers are onlookers with bulls and bears hoping for a greater time to indicate power.

Nevertheless, the RSI confirmed that bulls might need a greater likelihood of influencing the worth. As of this writing, the RSI was 45.88, suggesting that gentle shopping for momentum had come into the market.

Ought to extra consumers return, BTC might rise to $42,000. Nevertheless, a dearth of bulls might trigger the worth to crash additional whereas permitting altcoins to rally.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t chargeable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.