In finance, ‘good cash’ sometimes refers to institutional or skilled buyers presumed to own better market information and sources. Nonetheless, an intriguing sample emerges when inspecting the highest holders throughout main DeFi platforms.

starcrypto analyzed the highest 5 wallets (excluding funds and exchanges) and the highest 5 fund wallets from main DeFi platforms listed on the on-chain knowledge web site Cherry Choose. Platforms included Uniswap, Aave, Curve, Balancer, and 1inch.

Threat Tolerance and Diversification.

The info exhibits that single wallets linked to establishments typically have decrease balances than particular person wallets. This might point out a number of issues.

Firstly, institutional buyers could also be diversifying their portfolios to mitigate danger. Conventional monetary knowledge advocates diversification as a hedge towards volatility, and it appears this precept could also be carrying over into the growing world of DeFi. That is supported by funds having a number of wallets tagged. Secondly, the decrease balances might counsel that establishments are nonetheless cautiously exploring DeFi, doubtlessly skeptical of its long-term prospects or operational dangers.

Right here, ‘good cash’ seems to be exercising warning by not placing all their eggs in a single basket or limiting their publicity to the DeFi area altogether.

For instance, the typical steadiness in Aave for wallets is roughly $11.46 million, whereas funds maintain a median of simply $528,635. This stark distinction might indicate that institutional buyers are diversifying their dangers or are maybe nonetheless testing the waters within the DeFi area.

Elevated losses from funds.

Regardless of these decrease balances, funds exhibit greater realized and unrealized losses. Uniswap’s common realized loss for funds is round $470,000, in comparison with the colossal common lack of $68.6 million for particular person wallets.

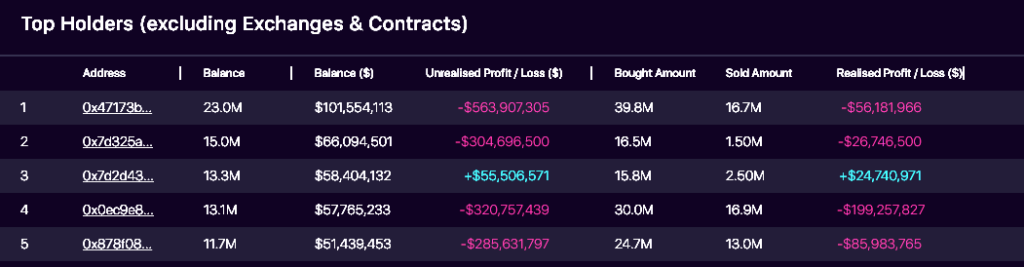

Staggeringly, the highest UNI pockets has over $500 million in unrealized losses, with all however one of many high 5 seeing nine-figure unrealized losses. Analyzing the highest pockets, it seems to be a pockets linked to the protocol itself, because it obtained 39.7 million UNI in March 2021, valued at round $1.1 billion.

At Uniswap’s peak simply two months later, it was value round $1.68 billion.

Immediately, the pockets is valued at $101 million after sending round 16 million UNI out of the pockets over the previous 36 months, promoting solely as soon as for a revenue.

The divergence might counsel that whereas institutional buyers are extra cautious with their capital, they’re extra accepting of short-term losses, probably as a part of a long-term funding technique.

A altering of the guard.

Each particular person wallets and institutional funds present a robust inclination towards Uniswap. With a median steadiness of $66.9 million for wallets and $104,821 for funds, it’s evident that Uniswap stays a cornerstone in retail and institutional DeFi portfolios.

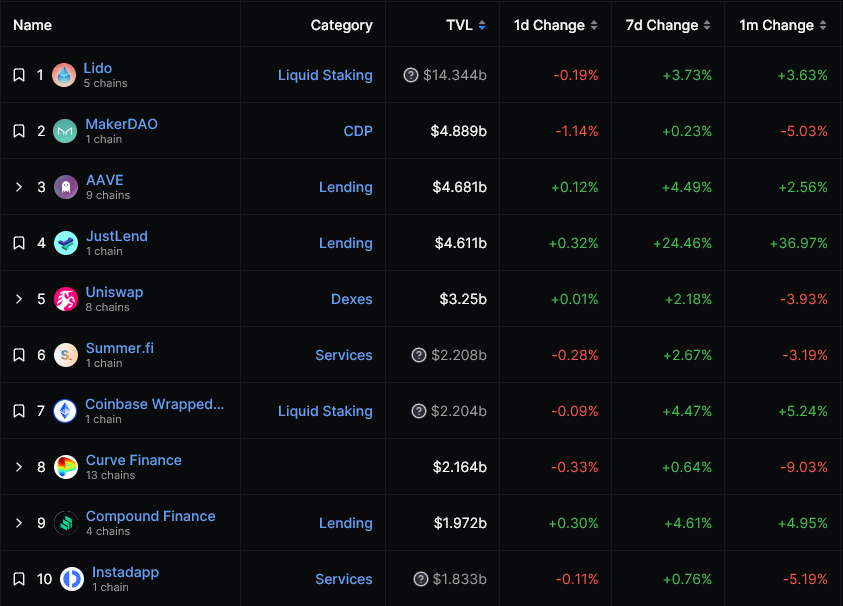

Whereas platforms like JustLend are making strides with a TVL of $4.611 billion, knowledge exhibits that ‘good cash’ continues to be primarily invested in legacy platforms, with Lido, Maker, Aave, and Uniswap all remaining within the high 5 DeFi platforms by TVL.

But, the highest 10, as tracked by DefiLlama, is now lacking a number of legacy DeFi gamers, equivalent to Balancer, PancakeSwap, SushiSwap, and Yearn Finance. As an alternative, newer protocols equivalent to JustLend, Summer time.fi, and Instadapp have taken their spots.

Profitability and Effectivity

One would possibly anticipate ‘good cash’ to flock towards platforms with greater revenues and charges. Nonetheless, this isn’t essentially the case. For instance, whereas Uniswap has cumulative charges of $3.254 billion, it has not prevented ‘good cash’ from incurring common realized losses of over $470,000.

Trying forward, knowledge from DeFiLlama reveals thrilling developments in TVL modifications over time. Platforms like JustLend have seen a 24.46% improve in TVL in simply 7 days.

Whereas our dataset doesn’t present a direct correlation, it begs the query: Is ‘good cash’ agile sufficient to capitalize on these speedy shifts?