- Bullish MIOTA value prediction ranges from $0.1500 to $0.300

- Evaluation means that the MIOTA value may attain above $0.2979 quickly.

- The MIOTA bearish market value prediction for 2023 is $0.1539

IOTA is a venture that helps the web of issues (IoT) and can also be a medium of change. IOTA is multi-chain and is current in its explorer in addition to in Binance Good Chain.

IOTA traders are bullish on the token because it has had a return on funding (ROI) of over 508 occasions previously 6 years. The crypto bubble in December 2017 led to the surge within the value of MIOTA to its current all-time excessive (ATH) value of $5.69. Ever since then, it has been unable to interrupt the resistance degree even within the crypto bubble of 2021. No matter the current crypto winter, MIOTA traders are assured that the way forward for MIOTA is bullish.

In case you are concerned about the way forward for IOTA (MIOTA) and would need to know the worth evaluation and value prediction of MIOTA for 2023, 2024, 2025, 2026, as much as 2030, preserve studying this Coin Version article.

IOTA (MIOTA) Market Overview

HTTP Request Failed… Error: file_get_contents(https://api.coingecko.com/api/v3/cash/iota): Didn’t open stream: HTTP request failed! HTTP/1.1 429 Too Many Requests

What’s IOTA (MIOTA)?

IOTA is a inexperienced, decentralized, and open-source digital infrastructure. It’s constructed on the IOTA Tangle, an open, feeless, and extremely scalable distributed ledger protocol, designed to assist

frictionless knowledge and worth switch. IOTA is designed to be probably the most dependable distributed ledger know-how (DLT) for Web3 purposes and digital economies.

The phrase iota refers back to the Greek letter Iota and its up to date definition, that means a minuscule quantity of one thing. The identify was chosen by the IOTA Basis based mostly on the belief that the Web of Issues will encompass billions of tiny transactions and exchanges per day. Though tiny transactions should not the one factor that the Tangle can facilitate, the flexibility to scale from tiny machine sensors to the biggest networks of civic structure is a distinguishing characteristic of the IOTA ledger.

Iota can also be the identify of the native forex on this protocol, distinguishable from the identify of the protocol by its lowercase formatting. One iota is the smallest unit of forex out there for buy. A finite variety of roughly 2.7 quadrillion iotas exist.

You’ll be able to consider one iota as being just like the smallest out there unit of Bitcoin (BTC), one satoshi. All the iotas in circulation have been created by the very first transaction on the Tangle, referred to as the “genesis transaction.” IOTA is non-inflationary by design, that means that its worth can’t be diluted by exponentially rising the variety of tokens to be able to, for instance, reward miners or stakers for his or her providers.

Analysts’ View on IOTA(MIOTA)

Blockbytes, a crypto information publication platform shared a video titled “How does #Shimmer profit the #IOTA Ecosystem?” $SMR is the native token of the Shimmer community, the official incentivized staging community of the IOTA distributed ledger know-how.

IOTA (MIOTA)Present Market Standing

MIOTA has a circulating provide of two,779,530,283 MIOTA cash, whereas its most provide is 2,779,530,283 MIOTA cash, in line with CoinMarketCap. On the time of writing, MIOTA is buying and selling at $0.2009 representing 24 hours lower of 0.99%. The buying and selling quantity of MIOTA previously 24 hours is $9,419,731 which represents a 7.73% lower.

Some high cryptocurrency exchanges for buying and selling MIOTA are Binance, OKX, Bitrue, Bybit, and Bitget

Now that you recognize MIOTA and its present market standing, we will focus on the worth evaluation of MOTA for 2023.

IOTA (MIOTA) Worth Evaluation 2023

Presently, IOTA (MIOTA) ranks 73 on CoinMarketCap. Will MIOTA’s most up-to-date enhancements, additions, and modifications assist its value go up? First, let’s concentrate on the charts on this article’s MIOTA value forecast.

IOTA (MIOTA) Worth Evaluation – Bollinger Bands

The Bollinger bands are a kind of value envelope developed by John Bollinger. It provides a variety with an higher and decrease restrict for the worth to fluctuate. The Bollinger bands work on the precept of ordinary deviation and interval (time).

The higher band as proven within the chart is calculated by including two occasions the usual deviation to the Easy Shifting Common whereas the decrease band is calculated by subtracting two occasions the usual deviation from the Easy Shifting Common. When the bands widen, it reveals there’s going to be extra volatility and after they contract, there may be much less volatility.

When Bollinger bands are utilized in a cryptocurrency chart, we may count on the worth of the cryptocurrency to reside inside the higher and decrease bounds of the Bollinger bands 95% of the time. The above thesis is derived from an Empirical regulation.

The sections highlighted by pink rectangles within the chart above present how the bands increase and contract. When the bands widen, we may count on extra volatility, and when the bands contract, it denotes much less volatility.

The inexperienced rectangles present how MIOTA retraced after touching the higher band (overbought) and decrease band (oversold). Moreover, the blue rectangle reveals how MIOTA examined, and broke the higher bands on quite a few events after receiving assist on the Easy Shifting Common (SMA).

Presently, the Bollinger Bands have began to increase, we may count on the growth of the Bollinger bands to proceed. The above thesis may very well be proved by the Bollinger Band Width (BBW) Indicator used on the backside of the chart.

When contemplating the inexperienced line on the indicator, we may see that it’s heading upwards. The indicator at present reveals a price of 0.21. Nevertheless, for the reason that line is titled upwards we may count on bands to widen additional till it reaches 0.24 on the indicator the place the bands widening bands began squeezing.

Furthermore, after we contemplate the MIOTA’s habits inside the bands, we may see that it has at present retraced after touching the higher band. We may count on MIOTA to seek out assist on the Easy Shifting Common. Nonetheless, the above assertion may very well be negated if the bands proceed to widen. It’s because the SMA can be damaged by the extraordinary volatility available in the market.

The probabilities of MIOTA reaching the decrease band reasonably than discovering assist on the SMA appears to be fairly excessive. As such, consumers want to attend for MIOTA to hit the decrease band earlier than getting into the market. MIOTA roughly took about 18-20 days to achieve the decrease band after rebounding off the higher band.

As such, it could take across the identical timeframe for MIOTA to achieve the decrease Bollinger band. Moreover, MIOTA additionally has the tendency to fall alongside the decrease band after reaching the decrease band. Subsequently, merchants might have to contemplate these and take precautions.

IOTA (MIOTA) Worth Evaluation – Relative Energy Index

The Relative Energy Index is an indicator that’s used to seek out out whether or not the worth of a safety is overvalued or undervalued. As per its identify, RSI indicators assist decide how the safety is doing at current, relative to its earlier value.

Furthermore, it has a sign line which is a Easy Shifting Common (SMA) that acts as a yardstick or reference to the RSI line. Therefore, at any time when the RSI line is above the SMA, it’s thought of bullish; if it’s beneath the SMA, it’s bearish.

Presently, MIOTA is bullish because the RSI is above the Sign line. Furthermore, the RSI is at present at 60.88 and it’s heading towards the overbought area. As such, we may count on the token to rise additional and attain the overbought area. Furthermore, in contrast to the bearish divergence proven on the chart, each, MIOTA and the RSI are shifting in the identical course. Therefore, the above thesis may very well be justified.

The Stochastic RSI at 79.37 has simply entered the conventional zone after being within the oversold territory. Moreover, it’s heading in direction of the oversold area, as such, we may count on the costs to rise additional for MIOTA.

Moreover, the RSI Assist and Resistance (RSI S&R) indicator reveals the Crossover Overbought, Crossunder Overbought, Crossover Oversold, and Crossunder Oversold area for a given RSI worth.

As per the RSI S&R indicator, MIOTA is within the bull zone. If the RSI is above the Sign line and retains shifting up in unison with the worth of MIOTA, then MIOTA may attain the Crossover Overbought Zone at $0.2475.

Contrastingly, within the occasion that the RSI divergence when MIOTA rises and falls beneath the Sign, the furthest that MIOTA may attain is 0.2348 (Crossunder Overbought area).

Within the unlikely occasion that MIOTA crashes (with out the correction being thought of) when the RSI is above the Sign, then could search assist at $0.1792 (Crossover Oversold) earlier than it really begins to rise over. Nonetheless, from its earlier habits, we haven’t seen MIOTA being supported on the Crossover Oversold.

As such above talked about state of affairs is kind of redundant. Therefore, we may count on the RSI to fall beneath the Sign and MIOTA to crash and search Assist at $0.1750 (Crossunder Oversold). As such merchants could need to contemplate having their entry level, cease loss, and take earnings on the acceptable locations.

IOTA (MIOTA) Worth Evaluation – Shifting Common

The Exponential Shifting averages are fairly just like the straightforward shifting averages (SMA). Nevertheless, the SMA equally distributes down all values whereas the Exponential Shifting Common provides extra weightage to the present costs. Since SMA undermines the weightage of the current value, the EMA is utilized in value actions.

The 200-day MA is taken into account to be the long-term shifting common whereas the 50-day MA is taken into account the short-term shifting common in buying and selling. Based mostly on how these two strains behave, the power of the cryptocurrency or the development might be decided on common.

Specifically, when the short-term shifting common (50-day MA) approaches the long-term shifting common (200-day MA) from beneath and crosses it, we name it a Golden Cross.

Contrastingly, when the short-term shifting common crosses the long-term shifting common from above then, a demise cross happens.

Normally, when a Golden Cross happens, the costs of the cryptocurrency will shoot up drastically, however when there’s a Dying Cross, the costs will crash.

Every time the worth of cryptocurrency is above the 50-day or 200-day MA, or above each we could say that the token is bullish. Contrastingly, if the token is beneath the 50-day or 200-day, or beneath each, then we may name it bearish (Blue triangle part).

Presently, we may see that MIOTA is searching for assist from the 50-day MA after being rejected on the 200-day MA, which is appearing because the quick resistance. Within the occasion that MIOTA fails to be supported by the 50-day MA, we might even see it fall until it reaches the inexperienced line which is slightly below the $0.1800 degree. Nevertheless, if MIOTA recovers and begins to surge after rebounding off of the 50-day MA, we may count on it to check the 200-day MA as soon as once more.

IOTA (MIOTA) Worth Evaluation – Elder Drive Index

Elder Drive Index is an indicator that was invented by Alexander Elder, who was an entrepreneur. The indicator primarily makes use of two parameters to adjudicate the shopping for and promoting pressure and thereby predicts the market development. Specifically, it depends on value change and quantity. As such the power of the shopping for pressure or promoting pressure relies on both the worth change or the quantity.

Every time the EFI is bigger than zero, or optimistic, lets say that the development is bullish, as there may be extra shopping for stress. Nevertheless, when the EFI is within the damaging zone, lets say that the cryptocurrency is within the damaging zone and the promoting stress is extra.

Furthermore, the Elder Drive is also used to determine development reversals and breakouts. As an illustration when the EFI is making decrease highs whereas the cryptocurrency is making larger highs, then lets say that it is a bearish divergence. Nevertheless, within the occasion that the cryptocurrency is making decrease lows whereas the EFI is making larger lows, then it’s a bullish divergence represented within the chart.

When wanting on the chart above we may see that the Elder Drive Index(EFI) information a damaging worth of 11.482K. Nevertheless, the EFI line appears to be shifting in direction of zero. We may count on it to maneuver above zero. Within the occasion that the EFI crosses zero, we may count on it to achieve 4.606K. Nonetheless, if the worth continues to rise and the quantity can also be wholesome then EFI may attain 10.981K.

Furthermore, the Bear-Bull-Energy indicator additionally reveals a price of 0.0137 and the road is heading extra towards the optimistic area. As such, lets say that the bulls are gaining extra energy, due to this fact, we would see MIOTA surge sooner or later.

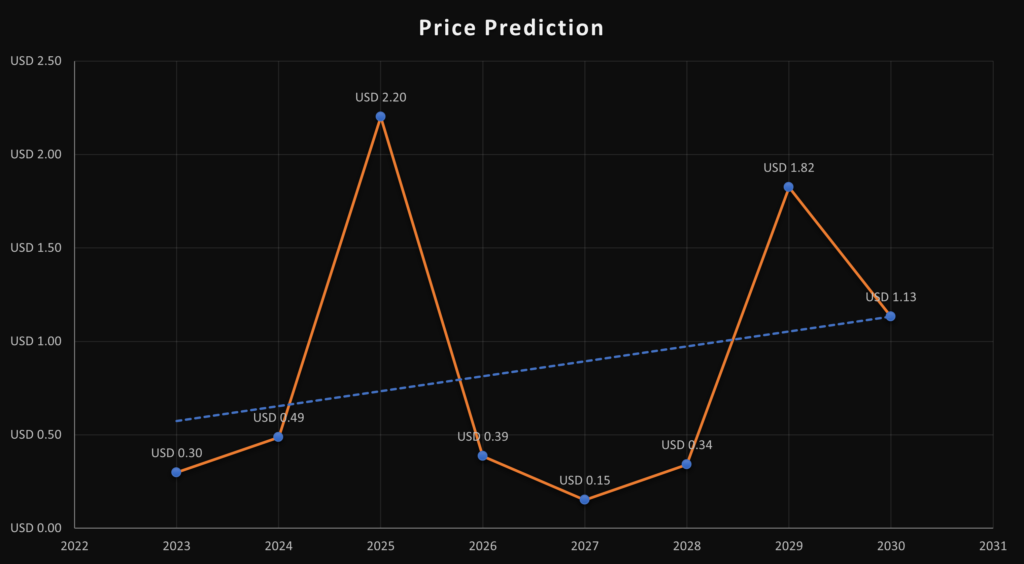

IOTA (MIOTA) Worth Prediction 2023-2030 Overview

| 12 months | Minimal Worth | Common Worth | Most Worth |

| 2023 | $0.2875 | $0.2979 | $0.3100 |

| 2024 | $0.3824 | $0.4870 | $0.5014 |

| 2025 | $1.9278 | $2.2013 | $2.4500 |

| 2026 | $0.2912 | $0.3858 | $0.4250 |

| 2027 | $0.1025 | $0.1514 | $0.2001 |

| 2028 | $0.3125 | $0.3409 | $0.3950 |

| 2029 | $1.5284 | $1.8246 | $2.0021 |

| 2030 | $0.9154 | $1.1324 | $1.2501 |

| 2040 | $1.2100 | $1.4602 | $1.9251 |

| 2050 | $1.0012 | $1.6792 | $1.8920 |

IOTA (MIOTA) Worth Prediction 2023

When contemplating the habits of IOTA it has been fluctuating in a falling wedge. We may count on MIOTA to proceed fluctuating inside the wedge. Within the occasion that MIOTA continues to remain inside the wedge, we may count on it to make decrease highs and decrease lows. Though it’s tough to time the MIOTA’s breakout from the falling wedge, we may count on it to interrupt out from the wedge as soon as it touches Assist at $0.1539.

The above thesis may very well be supported by the MIOTA’s historic habits of being catapulted from Assist 1 to larger than Resistance 3 at $0.2979. Nevertheless, on its approach up, MIOTA may expertise some friction at Resistance 1 and Resistance 2.

Since MIOTA has an opportunity of breaking out from the wedge when it reaches Assist 1, consumers could need to wait till MIOTA breaks out of the wedge earlier than getting into the market. They could need to contemplate having their entry level simply above the breakout and the take revenue may very well be based mostly on their discretion. Nevertheless, the cease loss may very well be round Assist 1 to present some slack for MIOTA to recuperate.

Within the occasion that MIOTA doesn’t adjust to the higher and decrease development strains of the wedge, we may count on it to achieve Resistance 1 at $0.2290 from the place it’s as of now. With extra momentum from the bulls, MIOTA may break by means of Resistance 1 and attain Resistance 2.

IOTA (MIOTA) Worth Prediction – Resistance and Assist Ranges

When contemplating the chart above we may see that the MIOTA was descending alongside the 1:8 Gann line from Might 2018- September 2018. Thereafter, over the past quarter of 2018, the token slides alongside the 1:4 Gann line earlier than discovering assist on the 4:1 Gann line.

The Gann 4:1 line assist MIOTA from mid-December 2018 to mid of 2019 (July). However for the reason that bears have been getting stronger, the 4:1 Gann line couldn’t maintain the worth of MIOTA from falling additional. As such, MIOTA reached out for assist from the 8:1 Gann line until November 2019.

From November 2019 to early 2021, MIOTA was buying and selling beneath the 8:1 Gann line, at occasions testing and breaking. Nevertheless, the daybreak of 2021 introduced rejuvenated the bull and drove the costs of MIOTA larger.

When contemplating the MIOTA’s motion since 2021 we may see that it was bullish because it was buying and selling above the 1:1 Gann line (thick purple strains). From early January 2021 to Might 2021 MIOTA was buying and selling above the 1:2 Gann line for more often than not. Nevertheless, come mid of Might, MIOTA misplaced momentum and succumbed to the bear’s stress. This made MIOTA crash beneath the 1:1 Gann line.

After this crash, MIOTA began recovering by rising alongside the two:1 Gann line at occasions rebounding off of three:1 and 4: 1 Gann strains. Nevertheless, MIOTA’s rise was delivered to a stall by the intersection of each 2:1 Gann strains. Thereafter, MIOTA was restricted to descending alongside the two:1 Gann line coming from above. Though at occasions MIOTA broke this line, it wasn’t in a position to maintain above it.

Curiously, since Might 2022, we will see MIOTA fluctuating horizontally. Its diagonal motion has ceased to exist.

When contemplating MIOTA’s motion from Might 2022 to the current, we may be aware quite a lot of motion patterns. From Might to the start of August 2022, we may see that MIOTA was fluctuating beneath the 1:1 Gann line. However, since mid-August, we may see that the bulls gained momentum as MIOTA made the 1:1 Gann line its assist, the place it may slide alongside downwards.

MIOTA slides downwards till late December 2022 earlier than the daybreak of 2023 noticed extra MIOTA take a look at the two:1 Gann line. Specifically, the rise of MIOTA in its early levels was exponential, nevertheless, following that MIOTA rose alongside the 0.5 Fib Arc. Nevertheless, being obstructed by the two:1 Gann line. MIOTA fell to the following arc (0.618) for assist however was denied.

As such MIOTA reciprocated its habits of rising alongside the surface of Fib 0.618 arc however was as soon as once more hindered by the two;1 Gann line. Presently, as MIOTA is within Fib 0.786 arc, we would see it rising alongside that arc, because it has crossed the two:1 Gann line which was an obstruction previously. Nevertheless, there may be additionally the potential for MIOTA falling and reaching for assist from the Fib 1 arc.

However earlier than that, we might even see MIOTA rising on the surface of the Fib 0.786 arc. As such merchants could need to contemplate this earlier than making selections.

IOTA (MIOTA) Worth Prediction 2024

There shall be Bitcoin halving in 2024, and therefore we should always count on a optimistic development available in the market resulting from consumer sentiments and the search by traders to build up extra of the coin. Nevertheless, the yr of BTC halving didn’t yield the utmost MIOTA based mostly on the earlier halving. Therefore, we may count on MIOTA to commerce at a value not beneath $0.49 by the top of 2024.

IOTA (MIOTA) Worth Prediction 2025

MIOTA could expertise the after-effects of the Bitcoin halving and is predicted to commerce a lot larger than its 2024 value. Many commerce analysts speculate that BTC halving may create a huge effect on the crypto market. Furthermore, just like many altcoins, MIOTA will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that MIOTA would commerce past the $2.20 degree.

IOTA (MIOTA) Worth Prediction 2026

It’s anticipated that after an extended interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, MIOTA may tumble into its assist areas. Throughout this era of value correction, MIOTA may lose momentum and be approach beneath its 2025 value. As such it may very well be buying and selling at $0.39 by 2026.

IOTA (MIOTA) Worth Prediction 2027

Naturally, merchants count on a bullish market sentiment after the crypto business was affected negatively by the bears’ claw. Furthermore, the build-up to the following Bitcoin halving in 2028 may evoke pleasure in merchants. Nevertheless, there shall be a dip earlier than MIOTA really surges, as such we may count on MIOTA to commerce at round $0.15 by the top of 2027.

IOTA (MIOTA) Worth Prediction 2028

Because the crypto group’s hope shall be re-ignited wanting ahead to Bitcoin halving like many altcoins, MIOTA could reciprocate its previous habits throughout the BTC halving. Therefore, MIOTA can be buying and selling at $0.34 after experiencing a substantial surge by the top of 2028.

IOTA (MIOTA) Worth Prediction 2029

2029 is predicted to be one other bull run as a result of aftermath of the BTC halving. Nevertheless, merchants speculate that the crypto market would steadily develop into steady by this yr. In tandem with the steady market sentiment, MIOTA may very well be buying and selling at $1.82 by the top of 2029.

IOTA (MIOTA) Worth Prediction 2030

After witnessing a bullish run available in the market, MIOTA and plenty of altcoins would present indicators of consolidation and may commerce sideways and transfer downwards for a while whereas experiencing minor spikes. Subsequently, by the top of 2030, MIOTA may very well be buying and selling at $1.13

IOTA (MIOTA) Worth Prediction 2040

The long-term forecast for MIOTA signifies that this altcoin may attain a brand new all-time excessive(ATH). This is able to be one of many key moments as HODLERS could count on to promote a few of their tokens on the ATH level.

If they begin promoting then MIOTA may fall in worth. It’s anticipated that the common value of MIOTA may attain $1.46 by 2040.

IOTA (MIOTA) Worth Prediction 2050

The group believes that there shall be widespread adoption of cryptocurrencies, which may keep gradual bullish good points. By the top of 2050, if the bullish momentum is maintained, MIOTA may hit $1.68

Conclusion

If traders proceed exhibiting their curiosity in MIOTA and add these tokens to their portfolios, it may proceed to rise. MIOTA’s bullish value prediction reveals that it may attain the $0.30 degree.

FAQ

IOTA is a inexperienced, decentralized, and open-source digital infrastructure.

MIOTA tokens might be traded on many exchanges like Binance, OKX, Bitrue, Bitget, and Bybit.

MIOTA has a chance of surpassing its current all-time excessive (ATH) value of $5.69 in 2017.

MIOTA is among the few cryptocurrencies that has proven resilience. If MIOTA continues its exponential rise then, it’d attain $0.30 quickly after it breaks the Resistance 1 and a couple of ranges.

MIOTA has been one of the crucial appropriate investments within the crypto house. It’s extremely unstable, as such, it has fairly a margin when its value fluctuates. Therefore, merchants could also be allured to spend money on MIOTA. It’s a very good funding within the quick time period and in the long run as nicely.

The current all-time low value of MIOTA is $0.0796.

The utmost provide of IOTA is 2,779,530,283 MIOTA cash.

MIOTA might be saved in a chilly pockets, scorching pockets, or change pockets.

MIOTA has 4 co-founders and they’re Sergey Ivancheglo, Serguei Popov, David Sønstebø, and Dominik Schiener.

It was launched in July 2016.

MIOTA is predicted to achieve $0.2979 by 2023.

MIOTA is predicted to achieve $0.4870 by 2024.

MIOTA is predicted to achieve $2.2013 by 2025.

MIOTA is predicted to achieve $20.3858 by 2026.

MIOTA is predicted to achieve $0.1514 by 2027.

MIOTA is predicted to achieve $0.3409 by 2028.

MIOTA is predicted to achieve $1.8246 by 2029.

MIOTA is predicted to achieve $1.1324 by 2030.

MIOTA is predicted to achieve $1.4602 by 2040.

MIOTA is predicted to achieve $1.6792 by 2050.

Disclaimer: The views and opinions, in addition to all the knowledge shared on this value prediction, are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates won’t be held responsible for any direct or oblique injury or loss.