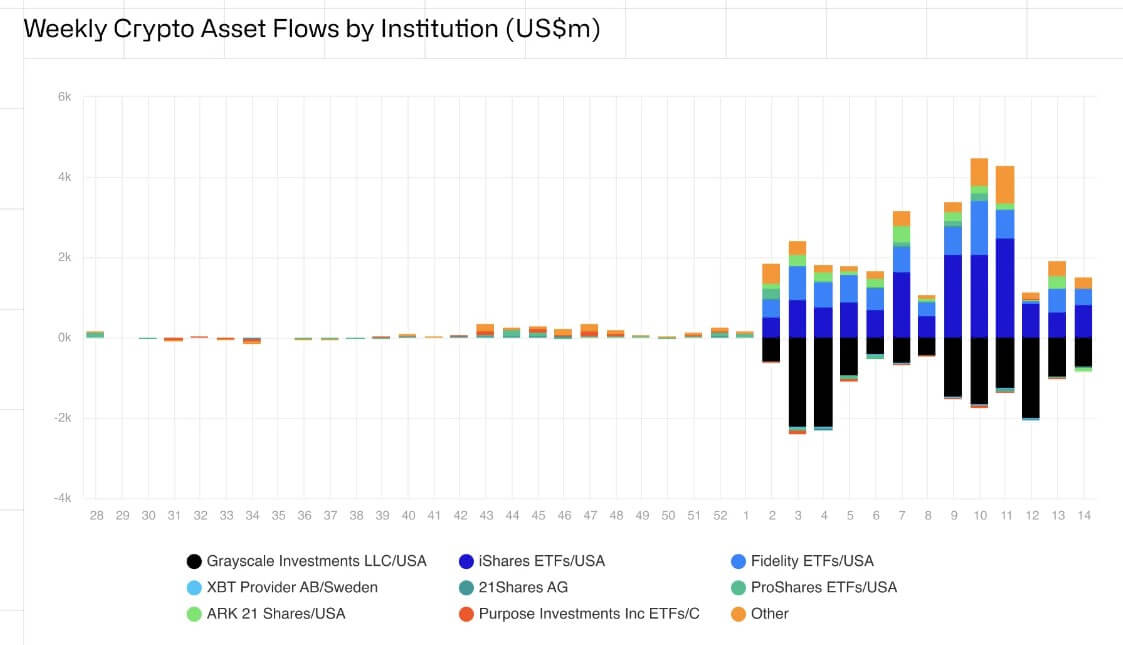

Crypto-related funding merchandise continued their upward trajectory, recording inflows of $646 million throughout the previous week, based on CoinShares‘ weekly report.

This influx brings the full for the yr to an unprecedented $13.8 billion, propelling the full property underneath administration to a staggering $94.47 billion.

Bitcoin ETF hype moderating

Buying and selling quantity for crypto funding merchandise declined final week, dwindling to $17.4 billion from the $43 billion recorded within the first week of March. This means a possible moderation in investor curiosity in Bitcoin exchange-traded funds (ETF) after weeks of consecutive hype.

In the meantime, Bitcoin stays the point of interest for buyers, sustaining its market dominance for the reason that ETF approvals in January. In the course of the previous week, BTC-related merchandise witnessed a considerable constructive web movement of $663 million.

The lion’s share of this influx got here from BlackRock’s iShares, which amassed $811 million, with Constancy FBTC following at $395.83 million. In distinction, Grayscale GBTC recorded $731 million in outflows.

Whereas Bitcoin merchandise flourished, outflows from different digital property precipitated the full web movement to dip to $646 million. Ethereum witnessed its fourth consecutive week of outflows, shedding a further $22.5 million. Consequently, ETH’s year-to-date web flows have dropped to $52 million.

Conversely, choose altcoins demonstrated resilience. Solana, Litecoin, and Filecoin attracted notable inflows of $4 million, $4.4 million, and $1.4 million, respectively.

Furthermore, the present bullish sentiment out there resulted briefly Bitcoin merchandise experiencing their third consecutive week of outflows totaling $9.5 million. This displays a waning conviction amongst bearish buyers, particularly as BTC’s worth jumped by roughly 4% throughout the previous week to over $70,000 as of press time.

Regardless of the “moderating” urge for food for Bitcoin ETFs, america retained its place because the main market, with inflows totaling $648 million. Brazil, Germany, and Hong Kong additionally witnessed substantial inflows of $9.8 million, $9.6 million, and $9 million, respectively.

Conversely, Canada and Switzerland skilled outflows of $27 million and $7.3 million, respectively, underscoring regional variations in market sentiment.

The submit Investor fervor for Bitcoin ETFs cools regardless of $646 million weekly surge in crypto funds appeared first on StarCrypto.