Bitget Pockets, a crypto pockets with its native token BWB, is dedicated to offering a complete person expertise that prioritizes each safety and ease of use. On this interview, we communicate with Alvin Kan, Chief Working Officer of Bitget Pockets, to delve into the challenges of Web3 pockets growth and Bitget Pockets’s strategy to overcoming them. He additionally discusses the upcoming Bitget Onchain Layer designed to simplify person interplay with the Web3 world.

- Making an allowance for the present trade panorama, what are probably the most vital includes a pockets ought to have to face the competitors and reply to the person’s wants?

After conducting intensive analysis on person wants, we arrived on the conclusion that there are 4 main issues that drive person engagement with Web3 and crypto: Asset Administration, Asset Discovery, Onchain Buying and selling, and Incomes. Amongst these, On-Chain Buying and selling and Incomes stand out as probably the most vital focal factors. To cater to those wants, Bitget Pockets has invested closely in constructing a complete buying and selling platform that helps immediate and cross-chain swaps over a big selection of blockchains. Bitget Swap, our native swap characteristic on the pockets, is able to aggregating liquidity throughout lots of of various blockchains to current customers with probably the most optimum buying and selling routes obtainable. On the similar time, we’ve additionally cultivated a strong Incomes middle, that gives customers with a myriad of alternatives to earn airdrops and rewards for interacting with featured DApps. To carry much more worth to our customers, we’ve additionally created a local launchpad on our pockets, that can even provide customers early entry to rising tasks, permitting customers to greatest capitalize on their time spent on Web3.

All of those options are engineered particularly to cater to the person wants we’ve recognized, and we consider that is what offers us the required edge to face out from the competitors.

2. Going deeper into safety issues, what are probably the most frequent safety considerations of web3 pockets customers? Are there any considerations which can be but not possible to be addressed?

Web3 wallets are primarily divided into custodial and non-custodial sorts, every differing when it comes to management, comfort, safety, and threat.

Custodial wallets are managed by third events, resembling exchanges or pockets service suppliers, which means customers don’t straight maintain their non-public keys. This setup has a number of benefits: customers don’t have to again up and handle non-public keys themselves, making custodial wallets simpler to make use of. Moreover, these wallets assist restoration by means of identification authentication in case of misplaced entry, resembling forgotten passwords, and provide customer support help.

Nevertheless, custodial wallets include sure dangers. Centralization threat is a serious concern, as third-party platforms might endure from hacks or different points main to personal key leaks and person fund losses. Belief threat is one other issue, requiring customers to belief that the third-party firm won’t misuse or lose their funds. Lastly, regulatory threat is current, as some international locations might impose rules on custodial platforms, doubtlessly freezing or seizing person funds.

However, non-custodial wallets give customers full management and administration of their very own non-public keys, permitting them to securely handle their crypto property. This setup presents a number of benefits: higher privateness and safety, as solely the person can management their property. So long as the non-public key stays safe, the funds are secure.

Nevertheless, non-custodial wallets additionally include dangers. Administration threat is important, as customers want a sure degree of technical data to guard their non-public keys. If a personal key’s misplaced or stolen, the property can’t be recovered. Phishing threat is one other concern; customers might inadvertently expose their non-public keys or authorize transactions to phishing websites, that are prevalent and pose vital challenges. Moreover, the complexity of operations may be daunting for novice customers, doubtlessly resulting in fund losses resulting from operational errors.

Total, no matter whether or not it’s a custodial or non-custodial pockets, non-public key safety is probably the most crucial concern for pockets customers. Customers ought to select the kind of pockets primarily based on their particular wants. Wallets are a elementary core part of blockchain expertise, so there aren’t any unsolvable points relating to asset record-keeping.

3. It’s identified that safety is likely one of the very important preferences of decentralized wallets, whereas user-friendliness is steadily a draw back for them. How do you handle to maintain safety sturdy whereas offering quick & environment friendly UI?

For many decentralized platforms, user-friendliness typically comes at the price of safety. Nevertheless, there are nonetheless sure methods that wallets can make use of to take care of a stability of each. On the safety design aspect, having Multi-Issue Authentication helps to make sure that even when one safety layer is compromised, extra safety parameters will nonetheless exist to guard person property. Moreover, having {hardware} pockets compatibility and biometric authentication (resembling fingerprint or facial recognition) can even assist present a strong safety framework with out compromising on user-friendliness.

One other key space can be person training, as we consider that customers additionally play a key position in making certain the safety of their property. At Bitget Pockets, we often produce high-quality tutorials and academic items to maintain our customers knowledgeable on the newest safety developments and options, along with a complete assist middle.

Below the hood, having environment friendly coding practices and writing optimized codes can make sure that the pockets runs easily and rapidly, enhancing the general person expertise. Leveraging caching and preloading strategies can even assist to enhance response speeds and cut back loading instances.

At Bitget Pockets, we additionally conduct common safety audits with main safety companies within the trade, and we additionally construct our most important core codes in open-source, permitting the group to evaluate and contribute to our general defenses. These are some examples of constructing a strong safety framework with out compromising on person expertise.

4. How is the pockets exercise after the BTC halving occasion? Do you see a variety of deposits and withdrawals or are the wallets dormant?

On April 20, 2024, BTC accomplished its fourth halving. Within the month for the reason that halving:

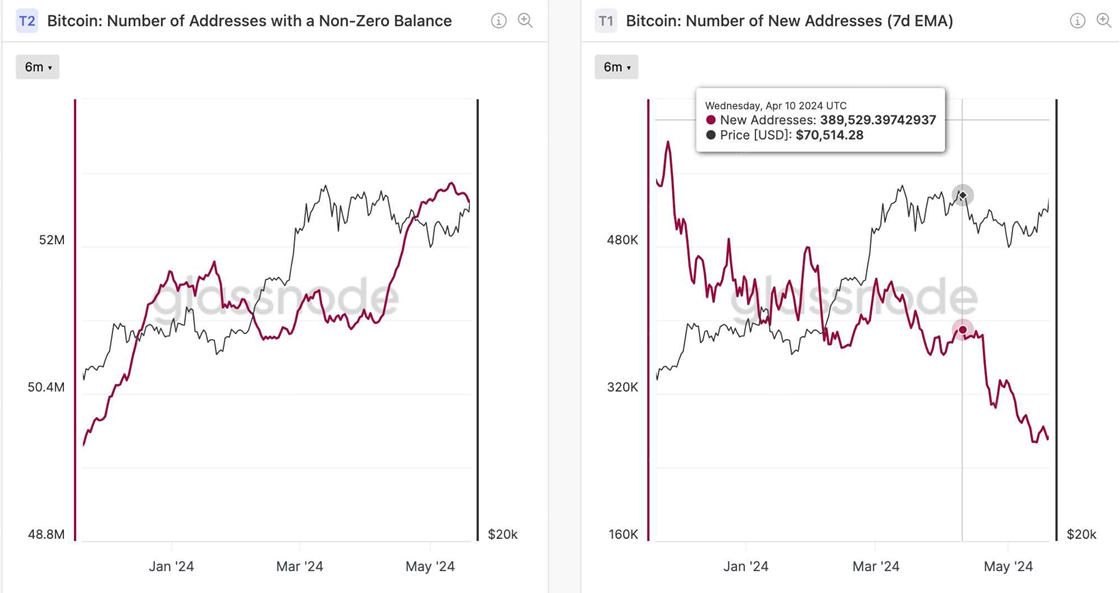

4.1 The variety of lively addresses on the BTC community first elevated after which decreased. This can be associated to numerous on-chain actions such because the launch, minting, and hypothesis of tokens.

4.2 The variety of non-zero stability addresses on the BTC community additionally elevated, whereas the variety of new each day addresses on the BTC community decreased. Each metrics observe cyclical developments and don’t appear to have undergone vital modifications across the halving interval, indicating that the halving might not have impacted these indicators.

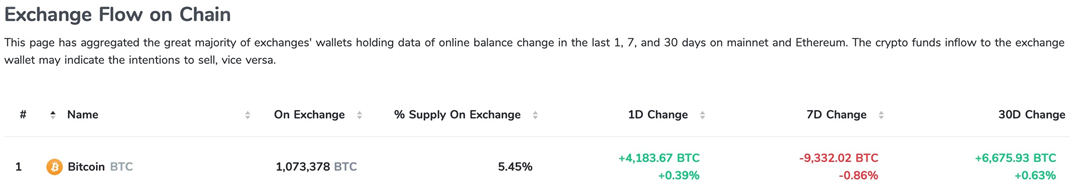

4.3 Analyzing the online influx/outflow of BTC from the chain to CEXs:

- Within the month following the halving, there was a internet influx of 6.6k BTC to CEXs.

- Previously seven days, there was a internet outflow of 9k BTC from CEXs.

- This corresponds to the value decline and volatility of BTC over the previous month and its latest enhance within the final seven days.

4.4 a broader timeline: It’s evident from the information that since 2018, the variety of traders prepared to promote BTC has been reducing. Many long-term holders have stopped promoting their tokens, persevering with to be bullish and accumulate BTC.

5. There’s been loads of information about BWB. What’s it precisely, and what are your goals for it? What’s the token’s worth for customers?

Because the official platform token for Bitget Pockets, BWB not solely brings with it a number of significant use instances to customers but additionally symbolizes a big milestone in Bitget Pockets’s growth development. For starters, BWB token holders can count on to take pleasure in perks resembling group governance, staking, the fee of gasoline charges on a number of chains, entry to Bitget Pockets’s Launchpad and Bitget’s platform occasions, and extra.

Moreover, BWB can also be obtainable for subscription on our launchpad. 1,000,000 BWB, or 0.1% of the overall provide, will likely be provided throughout the BWB Launchpad subscription occasion. Subscriptions will likely be divided into whitelist and public rounds, with eligibility for the latter being obtainable to customers who’ve accomplished at the least one Bitget Swap transaction up to now three months. Every BWB token is obtainable at a subscription worth of $0.1, distributed on a first-come, first-served foundation.

6. Are you able to share the roadmap’s teaser? What options focused at smoothing UI are deliberate?

Our roadmap for the longer term lies within the creation of the Bitget Onchain Layer – an intermediate layer that abstracts away complexities for customers to work together with the Web3 world. This will likely be our key initiative to supply a superbly seamless UI to facilitate mass onboarding. To realize this purpose, we now have launched the mixing of Modular Characteristic DApps (MFDs) as a part of the Bitget Onchain Layer. These specialised DApps can operate each as standalone DApps in addition to native options built-in straight into Bitget Pockets. The primary goal of those MFDs is to function native gateways for customers exploring a large breadth of Web3 DeFi companies, proper from the comfort of their Bitget Pockets app, having fun with distinctive benefits resembling heightened safety, enhanced liquidity, and an unmatched person expertise.

Co-building has at all times been a core tenet for us at Bitget Pockets, and we’re extending this to the Bitget Onchain Layer as effectively. We now have established a $10 million BWB Ecosystem Fund to incubate and put money into rising tasks constructing on the Bitget Onchain Layer that may span a variety of DeFi sub-sectors, together with Telegram Tot, Pre-Market, and the On-Chain Derivatives Market.By working with trade builders to create efficient and purposeful MFDs, we envision the Bitget Onchain Layer to not solely be our subsequent massive step in revolutionizing the general person expertise for our customers but additionally the blueprint of Web3 innovation for your complete Bitget ecosystem.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be answerable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.