- Binance’s spot market share rose from 59.4% in January to 61.8% in February.

- The 24-hr buying and selling quantity of Binance exceeded $15B, whereas its closest rival bought $4.1B.

- The change additionally leads the perpetual futures house with the best providing.

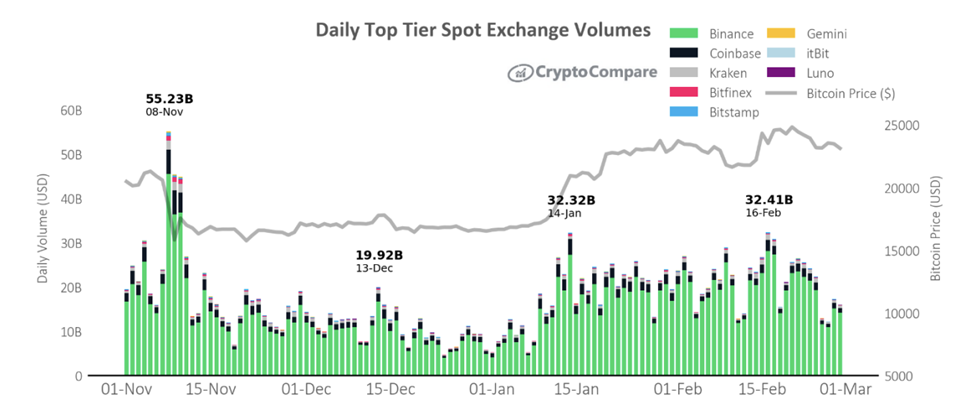

For 4 consecutive months, the Binance crypto change has maintained an higher hand over its opponents relating to the crypto spot market share. Based on a current report from CryptoCompare, a market analysis agency, Binance’s market share rose from 59.4% in January to 61.8% in February.

CryptoCompare additionally famous that Binance’s spot volumes elevated by 13.7% to an all-time excessive of $504 billion regardless of the widespread regulatory frictions and group FUDs in opposition to the change. Moreover, Binance led different top-tier crypto exchanges, reminiscent of Coinbase and Kraken, with an in depth margin within the crypto spot market.

Jacob Joseph, a analysis analyst at CryptoCompare, attributed Binance’s dominance to the huge quantity of liquidity on the change. Joseph added:

Regardless of the current criticism the change has acquired, market contributors proceed to take shelter on Binance beneath the premise that the biggest change is seen as one of many safer buying and selling venues.

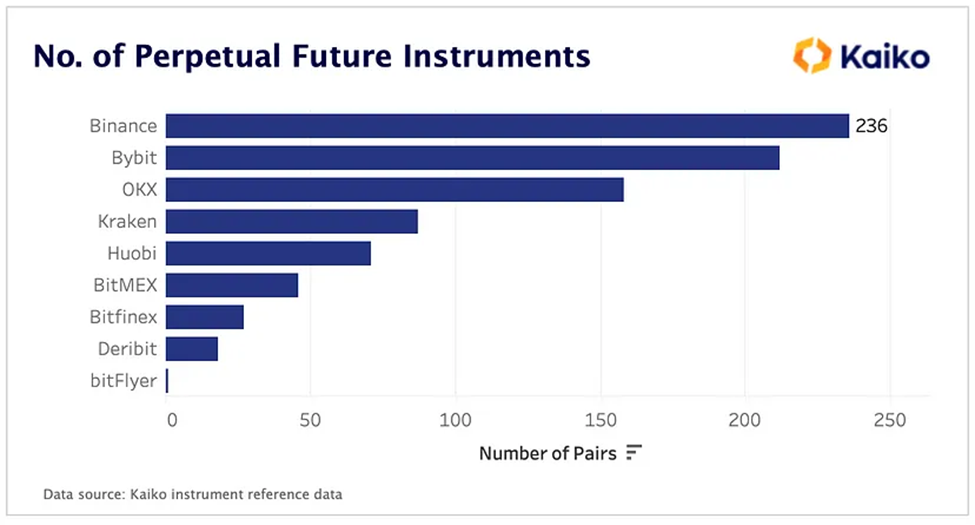

Apparently, Binance additionally dominates the crypto by-product market. Based on a report from an institutional-grade market tracker final month, the Binance change took over from FTX because the market chief within the perpetual futures house, with essentially the most variety of pairs supplied.

The now-defunct FTX change was on the frontier of by-product contracts till its demise final November. Nevertheless, Binance now occupies the place with 236 listed pairs. Whereas Bybit and OKX are inside shut vary of Binance, different exchanges reminiscent of Kraken, Huobi, and BitMex are far behind, providing fewer than 100 perpetual futures devices.

Within the final 24 hours, Binance buying and selling quantity exceeded $15 billion. The change closest to Binance on the rating had solely $4.1 billion in 24-hour buying and selling quantity.