In a bullish indicator for the broader cryptocurrency market, six stablecoins have technically led trade losses over the previous 7 days, with the biggest decline at 0.12%, underscoring the general energy of the market.

The market stays strong, with stablecoins’ excessive commerce volumes highlighting their basic function within the crypto ecosystem, holding their peg inside a spread of 0.15%. After the stablecoins, the subsequent asset on the record is Loom Community (LOOM), which recorded a 2.69% achieve prior to now week.

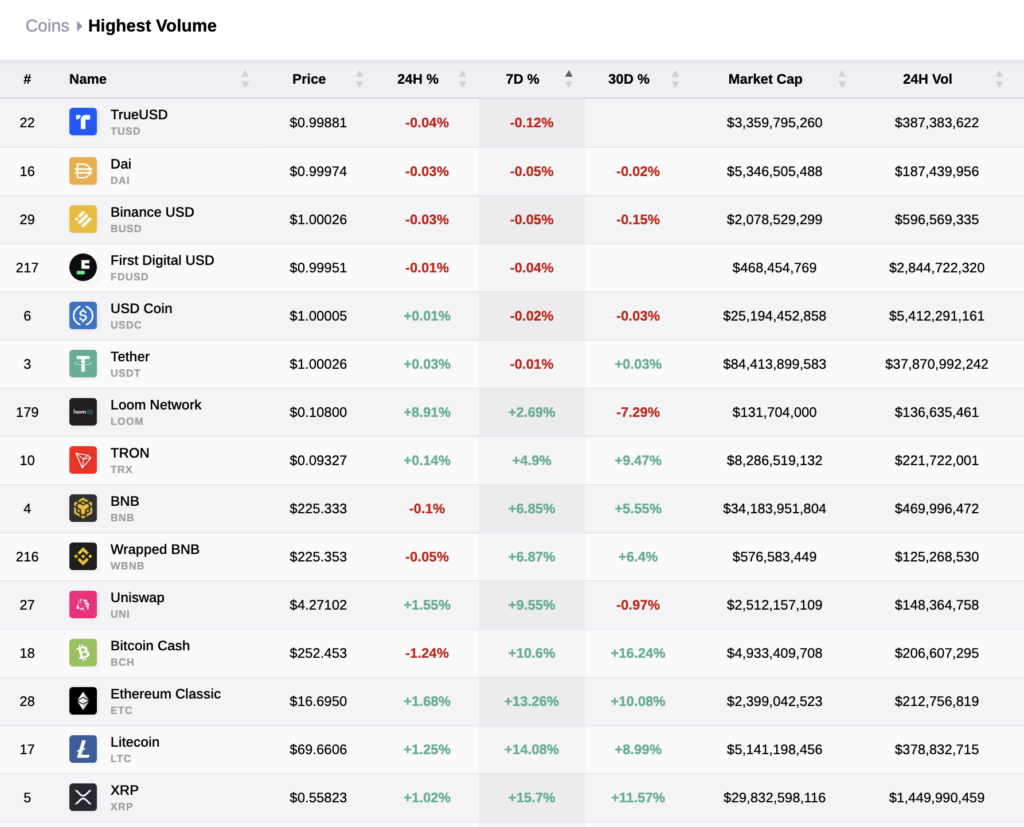

Solely property with buying and selling volumes above $125 million have been included within the desk to research the actions of property with excessive liquidity. Tether recorded the best buying and selling quantity of the previous 24 hours at $37,870,992,242, whereas the bottom quantity throughout the knowledge set was Wrapped BNB at $125,268,530.

In response to starcrypto knowledge, TrueUSD (TUSD), Dai (DAI), Binance USD (BUSD), First Digital USD (FDUSD), USD Coin (USDC), and Tether (USDT) secured the highest 6 spots when it comes to 7-day losses when viewing the best traded tokens of the previous week. This comes when the market shows a bullish sentiment, marked by a marked uptick in Bitcoin (BTC) and Ethereum (ETH).

Over the previous week, TrueUSD posted a 0.12% decline, whereas Dai skilled a 0.05% dip. Equally, Binance USD, First Digital USD, and USD Coin noticed a 0.05%, 0.04%, and 0.02% lower, respectively. Tether, at present main the pack when it comes to buying and selling quantity, noticed a minute 0.01% decline.

The significance of stablecoins within the digital asset economic system can’t be overstated. Their stability pegged to conventional fiat currencies, makes them the popular selection for merchants in search of to mitigate volatility dangers inherent within the cryptocurrency market. These digital property present an environment friendly medium of alternate, a sturdy unit of account, and a sensible retailer of worth, contributing to their excessive buying and selling volumes.

In the meantime, Bitcoin and Ethereum, the second and third main digital property by quantity, posted strong positive factors over the identical interval. Bitcoin rose by 20.07%, at present buying and selling at $34,214, whereas Ethereum noticed a rise of 17.67%, with its worth climbing to $1,826.95 as of press time.

Whereas the positive factors within the main digital property recommend a bullish market, the lower in stablecoin values over the previous week signifies a shift in investor sentiment. As stablecoins’ quantity surges, merchants use these digital property as a launchpad, on the brink of enterprise into extra unstable cryptocurrencies amid an optimistic market outlook.

But, these market actions must be seen of their broader context. Undoubtedly, the crypto market stays unstable and topic to fast change. Nevertheless, the excessive buying and selling quantity of stablecoins and the latest upswing in Bitcoin and Ethereum supply a promising glimpse into the current market dynamics.

As we proceed to observe these tendencies, it’s price noting that such nuances in market conduct spotlight the intricate dynamics of the crypto trade. When stablecoins