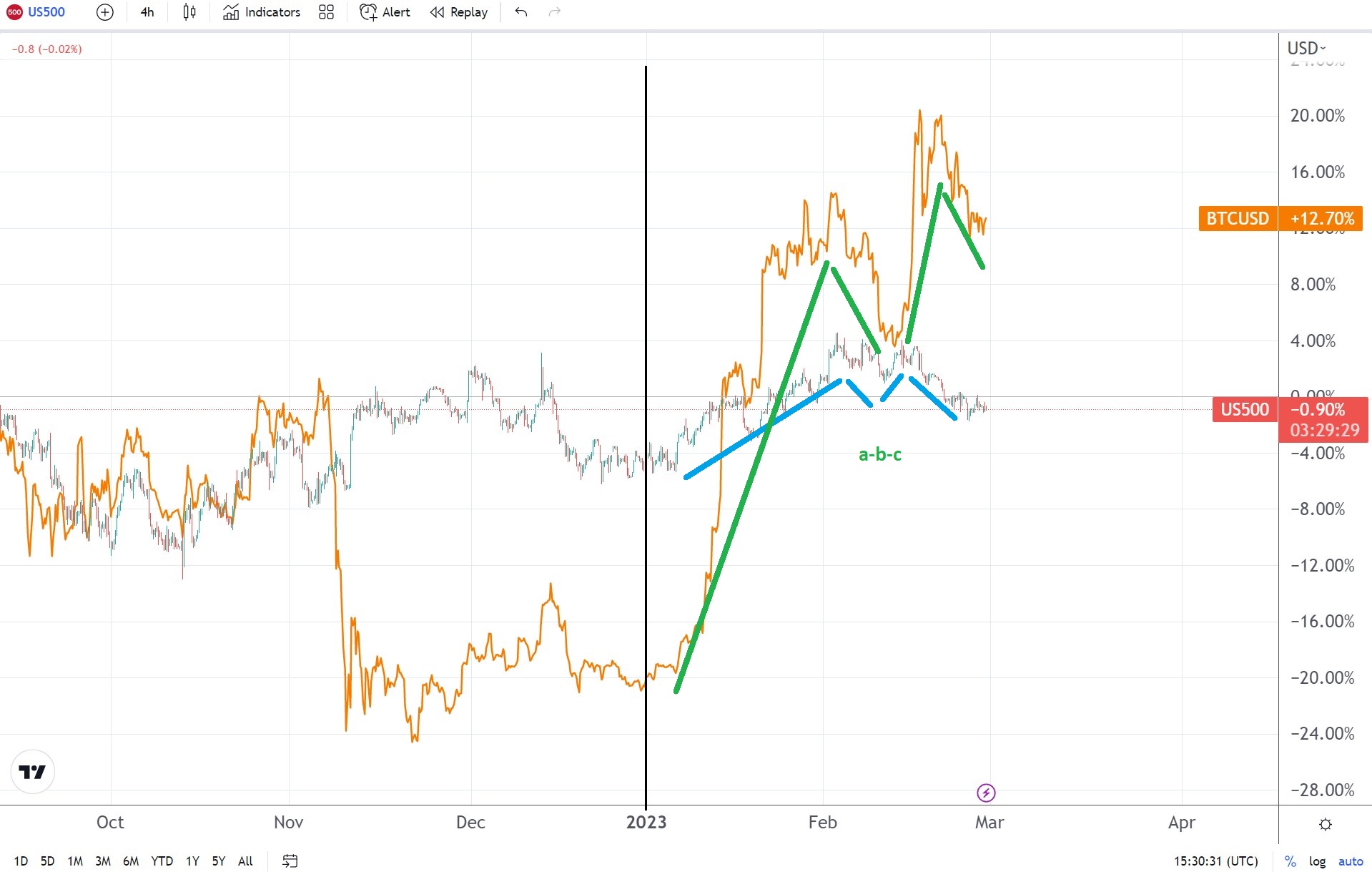

- Bitcoin and the S&P 500 transfer in a direct correlation

- The current corrections seem like an Elliott Waves a-b-c

- If shares make a brand new excessive for the yr, Bitcoin will observe

US shares rallied in 2023, and so did Bitcoin. One could ask what market is main, and the reply is the inventory market.

The S&P 500 index seems to have made a double prime this month, but when the correlation with Bitcoin holds, then the double prime can be invalidated by shares making a brand new excessive.

Thus far, the 4,150 space proved to be resistance, however it would possibly simply be that the market types an ascending triangle. If we have a look at how Bitcoin reacted to the S&P 500 rally, the current correction is simply a part of an a-b-c construction, acquainted to these utilizing the Elliott Waves concept to commerce monetary markets.

S&P500 chart by TradingView

Flat patterns level to extra upside

A flat sample is a corrective wave labeled as an a-b-c. Elliott merchants use letters to rely corrective buildings.

Solely on this case, the flat sample has two corrective waves of a decrease diploma (i.e., waves a and b), and one impulsive (i.e., the c-wave).

In different phrases, it signifies that the following wave of the identical diploma will absolutely retrace the inventory market’s decline from this yr’s highs. Given the direct correlation between the S&P 500 and Bitcoin, it signifies that Bitcoin will do the identical and make a brand new excessive for the yr.

To reply this text’s query, Bitcoin would observe the shares lead if the S&P 500 bounces from the present lows.