- Bullish Idex (IDEX) value prediction ranges from $0.03678 to $0.291

- Evaluation means that the IDEX value may attain above $0.3

- The IDEX bearish market value prediction for 2023 is $0.036

What’s Idex (IDEX)?

Idex claims to be the primary layer-3 derivatives alternate. It makes use of a hybrid mannequin that mixes the standard order guide and an Automated Market Maker (AMM).

As such, it blends the efficiency and options of a conventional order guide mannequin with the safety and liquidity of an AMM. Moreover, Idex takes an revolutionary strategy to decentralized exchanges by combining an off-chain buying and selling engine with an on-chain commerce settlement. Customers profit from that in a number of methods.

To execute trades, Idex makes use of an off-chain buying and selling engine that matches the efficiency of centralized exchanges and ensures sequencing. Trades are processed in an off-chain order guide. Solely when a commerce is matched and executed, the transaction is settled on-chain.

In doing so, customers profit from not having to pay further community prices for putting and canceling orders. Moreover, placements are processed in actual time, enabling extra superior buying and selling and market-making methods like stop-loss, post-only, and fill-or-kill.

IDEX Present Market Standing

The utmost provide of Idex (IDEX) is unknown, whereas its circulating provide is 673,858,614 IDEX cash, based on CoinMarketCap. On the time of writing, IDEX is buying and selling at $0.0885 representing 24 hours lower of 14.180%. The buying and selling quantity of IDEX previously 24 hours is $247,204,847 which represents a 123.59% enhance.

Some prime cryptocurrency exchanges for buying and selling Idex (IDEX) are Binance, Coinbase, Huobi World, Gate.io, Uniswap v2, and Kraken.

Now that you already know what IDEX is and its present market standing, we will talk about the worth evaluation of Idex (IDEX) for 2023.

IDEX Worth Evaluation 2023

Will the IDEX blockchain’s most up-to-date enhancements, additions, and modifications assist its value rise? Furthermore, will the modifications within the cost and crypto trade have an effect on IDEX’s sentiment over time? Learn extra to search out out about IDEX’s 2023 value evaluation.

Idex Worth Evaluation – Bollinger Bands

The Bollinger bands are a sort of value envelope developed by John Bollinger. It provides a spread with an higher and decrease restrict for the worth to fluctuate. The Bollinger bands work on the precept of normal deviation and interval (time).

The higher band as proven within the chart is calculated by including two instances the usual deviation to the Easy Shifting Common whereas the decrease band is calculated by subtracting two instances the usual deviation from the Easy Shifting Common.

When this setup is utilized in a cryptocurrency chart, we might count on the worth of the cryptocurrency to abide throughout the higher and decrease bounds of the Bollinger bands 95% of the time.

The above thesis is derived from an Empirical legislation also called the three-sigma rule or the 68-95-99.7 which states that the majority noticed knowledge for a traditional distribution (regular scattering of knowledge) will fall inside three customary deviations.

As such for an information set that follows a traditional distribution, 68% of knowledge will fall inside 1 customary deviation of the imply, whereas 95% of knowledge for the conventional distribution will fall inside 2 customary deviations of the imply and 99.7% of knowledge will fall inside 3 customary deviations of the imply.

Therefore, because the Bollinger bands are calculated utilizing two customary deviations, we might count on IDEX to abide throughout the Bollinger bands 95% of the time. (i.e at any time when the cryptocurrency touched the higher band, the possibilities of it coming down are 95%.). This idea applies vice-versa as effectively.

Furthermore, the sections highlighted by purple rectangles present how the bands broaden and contract. When the bands widen, we might count on extra volatility, and when the bands contract, it denotes much less volatility. At the moment, the bands are opening up after being in a closed place.

This might point out that there’s going to be extra volatility for IDEX sooner or later. Furthermore, IDEX is forming candlesticks above the higher band. This reveals that IDEX is extraordinarily overbought and the market might right the worth. As such, IDEX might retrace and reduce in worth and fall again between the higher and decrease bands. Merchants seeking to brief ought to maintain a watchful eye.

Notably, the Bollinger Band behaves very intently with the Keltner channel. As an example, if you happen to had been to make use of each the Bollinger bands and Keltner channel indicators for a cryptocurrency, you’d see that nearly more often than not each indicators overlap.

Nevertheless, the one distinction between with Bollinger band and the Keltner channel is that the Bollinger bands use Customary Deviation whereas the Keltner channel makes use of Common True Vary for calculating its bands that are the highest and backside limits.

Idex Worth Evaluation – Relative Energy Index

The Relative Energy Index is an indicator that’s used to search out out whether or not the worth of a safety is overvalued or undervalued. As per its title, RSI indicators assist decide how the safety is doing at current, relative to its earlier value.

Furthermore, it has a sign line which is a Easy Shifting Common (SMA) that acts as a yardstick or reference to the RSI line. Therefore, at any time when the RSI line is above the SMA it’s thought of bullish and if it’s under the SMA then it’s bearish.

When contemplating the primary inexperienced rectangle from the left of the chart under we are able to see that the RSI line (purple) is under the Sign line (yellow). As such, IDEX is bearish or dropping worth. Due to this fact it’s reaching decrease lows as proven within the chart.

The second inexperienced rectangle reveals that the RSI is above the sign. Therefore, IDEX is bullish as it’s making larger highs.

At the moment, the RSI of IDEX is within the overbought area with a worth of 81.50 which is above the Sign line. Nevertheless, the RSI continues to be wanting into the overbought area, therefore, we might count on the costs of IDEX to extend and reside within the overbought.

To infer whether or not a cryptocurrency is bearish or bullish, the RSI compares the positive factors of the securities in opposition to the losses it made previously. This ratio of positive factors in opposition to the losses is then deducted from the 100.

If the reply is the same as or lower than 30, then we name that the worth of the safety is within the oversold area.

Because of this many are promoting the safety out there, and as such the safety is undervalued. Furthermore, as per the Provide-demand curve principle, the worth is meant to drop when there is a rise in provide.

If the reply is the same as or better than 70 then the safety is overbought as many are shopping for. Since many need to purchase the safety the demand will increase which intuitively will increase the costs.

Moreover, the RSI could possibly be used to find out how robust a development is. As an example, when a cryptocurrency is bullish or reaching larger highs, then the RSI line additionally ought to be making larger highs in unison.

As an example, if the RSI is making decrease highs when the cryptocurrency is making larger highs, then we might say that though the token/coin is on a bullish development it’s dropping worth. As such, there could possibly be a development reversal sooner or later.

Nevertheless, the RSI might additionally give false alarms for breakouts. Though we might count on, the costs to retrace if it goes to the oversold or overbought area, the costs can also keep within the oversold or overbought area for an prolonged interval. As such, merchants ought to be cautious of it and let the market saturate earlier than making very important choices.

Idex Worth Evaluation – Shifting Common

The Exponential Shifting averages are fairly much like the straightforward transferring averages (SMA). Nevertheless, the SMA equally distributes down all values whereas the Exponential Shifting Common provides extra weightage to the present costs. Since SMA undermines the weightage of the current value, the EMA is utilized in value actions.

The 200-day MA is taken into account to be the long-term transferring common whereas the 50-day MA is taken into account the short-term transferring common in buying and selling. Based mostly on how these two strains behave, the power of the cryptocurrency or the development might be decided on common.

Specifically, when the short-term transferring common (50-day MA) approaches the long-term transferring common (200-day MA) from under and crosses it, we name it a Golden Cross.

Contrastingly, when the short-term transferring common crosses the long-term transferring common from above then, a dying cross happens.

Normally, when a Golden Cross happens, the costs of the cryptocurrency will shoot up drastically, however when there’s a Loss of life Cross, the costs will crash.

At any time when the worth of cryptocurrency is above the 50-day or 200-day MA, or above each we might say that the coin is bullish (purple rectangle). Contrastingly, if the token is under the 50-day or 200-day, or under each, then we might name it bearish (Inexperienced triangle part).

After briefly rebounding on the 200-day MA, IDEX ricocheted off of the 50-day MA which is

above the 200-day MA. Thereafter IDEX has risen virtually exponentially.

As highlighted by the circles, we might see that IDEX examined the 50-day MA on quite a few events however wasn’t capable of break above it. Nevertheless, the daybreak of 2023 introduced some momentum to IDEX. This helped the token break the 50-day MA and thereafter check and break the 200-day MA.

At the moment, each Shifting Averages are dealing with upwards, this might have been the results of the exponential enhance within the latest previous.

Idex Worth Evaluation – Fee of Change (ROC)

The Fee of Change Indicator is a momentum oscillator, that measures the change of the present value in opposition to the previous value a couple of variety of durations in the past, in share. So long as the worth is rising ROC will probably be constructive. However, the ROC indicator will attain the unfavorable zone when the costs scale back. Growing values in both course, constructive or unfavorable, point out rising momentum and transferring again towards zero signifies diminishing momentum.

Furthermore, the equation for ROC is as follows: ROC = [(Today’s Closing Price – Closing Price n periods ago) / Closing Price n periods ago] x 100.

In contrast to the RSI, ROC has no set overbought or oversold areas, it fairly relies on a dealer’s discretion. Merchants usually have a tendency to search out the areas within the constructive and unfavorable zones the place the development modifications have occurred in regularity. Based mostly on this they may mark their bounds for overbought and oversold areas.

ROC may be used as a divergence indicator that indicators a doable upcoming development change. Divergence happens when the worth of a inventory or asset strikes in a single course whereas its ROC strikes in the other way.

For instance, if a inventory’s value is rising over a time period and registering larger highs whereas the ROC is progressively transferring decrease, or making decrease highs, then the ROC is indicating bearish divergence from value, which indicators a doable development change to the draw back. The identical idea applies if the worth is transferring down and ROC is transferring larger.

When contemplating the chart we might that though the IDEX was making larger highs, the ROC indicator was making decrease highs, therefore the development modified. Furthermore, IDEX’s excessive overbought areas are marked as overbought areas 1 and a pair of, prime locations the place development reversals occurred in regularity. Equally, the oversold areas too are marked based mostly on development reversal.

At the moment, because the ROC signifies IDEX is at 67.89, this can be very overbought, therefore, there might presumably be a development reversal.

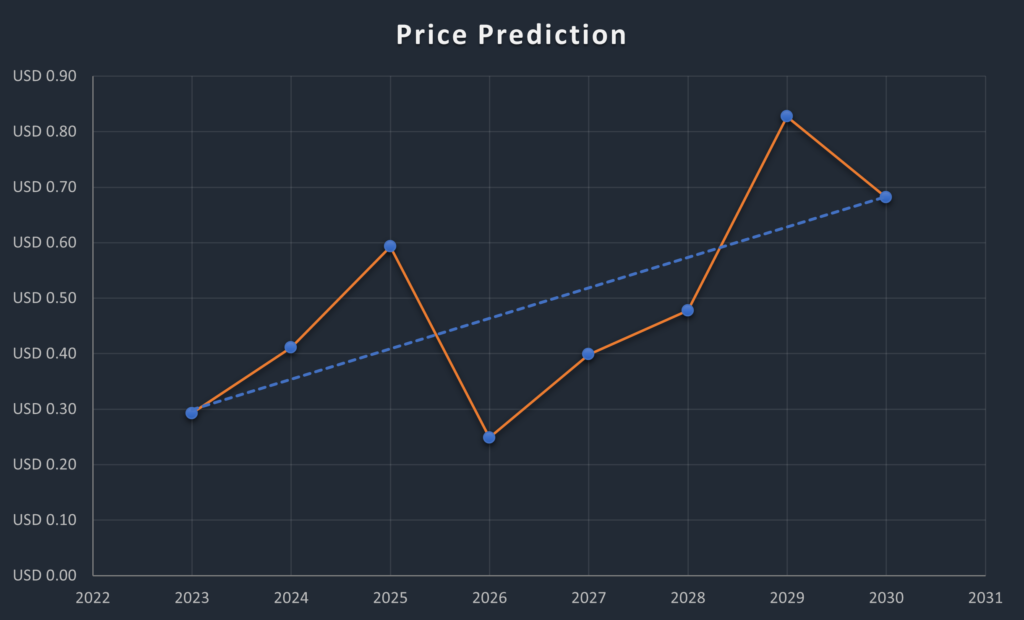

Idex Worth Prediction 2023-2030 Overview

| 12 months | Minimal Worth | Common Worth | Most Worth |

| 2023 | $0.2812 | $0.2923 | $0.3012 |

| 2024 | $0.3890 | $0.4112 | $0.4512 |

| 2025 | $0.5866 | $0.5928 | $0.6125 |

| 2026 | $0.2311 | $0.2484 | $0.2516 |

| 2027 | $0.3922 | $0.4015 | $0.4116 |

| 2028 | $0.4355 | $0.4777 | $0.6825 |

| 2029 | $0.7122 | $0.8273 | $0.9220 |

| 2030 | $0.6715 | $0.6802 | $0.7015 |

| 2040 | $1.1259 | $1.2315 | $1.5923 |

| 2050 | $1.6258 | $1.7800 | $1.9825 |

Idex Worth Prediction 2023

When contemplating the chart above we might see that IDEX shaped the Adam and Eve sample. At the moment, as IDEX has damaged above the resistance line, we might count on it to retest the road by the guide. Furthermore, IDEX has touched the higher Bollinger band, therefore, we might count on the costs to retrace. Throughout this retracement section, we might count on IDEX to check the Resistance line at $0.085.

After retesting the Resistance line, IDEX might surge to Resistance 2 at $0.291 as proven by the yellow trajectory line. Nevertheless, there additionally lies the likelihood that IDEX might rebound on the Resistance line and check Resistance 1 at $0.205.

Nevertheless, through the section of retesting the resistance line, if the bears take over, then IDEX might look to land on Assist 1 at $0.0603. Based mostly on previous habits, Assist 1 might not be capable to maintain up IDEX. If that is so IDEX might fall to Assist 2 at $0.036.

Idex Worth Prediction – Resistance and Assist Ranges

The above chart reveals how IDEX descended from Resistance 4 to its current residing zone. Though IDEX was falling fairly abruptly in October 2021, we might see that it had some consolidation between Resistance 1 and Resistance 3. Nevertheless, the bulls weren’t capable of management the bears for too lengthy.

The start of 2022 caused one other wave of collapse that made IDEX fall under Resistance 1 and attain out for help from Assist 1. Since June 2022, IDEX has been rebounding on Assist 1. In comparison with the earlier years, there appear to be only a few vertical actions for IDEX.

Idex Worth Prediction 2024

There will probably be Bitcoin halving in 2024, and therefore we must always count on a constructive development out there as a result of consumer sentiments and the search by traders to build up extra of the coin. For the reason that Bitcoin development impacts the course of commerce of different cryptocurrencies, we might count on Idex to commerce at a value not under $0.4112 by the tip of 2024.

Idex Worth Prediction 2025

Idex should still expertise the after-effects of the Bitcoin halving and is anticipated to commerce above its 2024 value. Many commerce analysts speculate that BTC halving might create a big impact on the crypto market. Furthermore, much like many altcoins, Idex will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that Idex would commerce past the $0.5928 stage.

Idex Worth Prediction 2026

It’s anticipated that after an extended interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, Idex might tumble into its help areas. Throughout this era of value correction, Idex might lose momentum and be just a little under its 2025 value. As such it could possibly be buying and selling at $0.2484 by 2026.

Idex Worth Prediction 2027

Naturally, merchants count on a bullish market sentiment after the crypto trade was affected negatively by the bears’ claw. Furthermore, the build-up to the subsequent Bitcoin halving in 2028 might evoke pleasure in merchants. As such we might count on Idex to commerce at round $0.4015 by the tip of 2027.

Idex Worth Prediction 2028

Because the crypto neighborhood’s hope will probably be re-ignited wanting ahead to Bitcoin halving like many altcoins, Idex will proceed to kind new larger highs and is anticipated to maneuver in an upward trajectory. Therefore, Idex could be buying and selling at $0.4777 after experiencing an enormous surge by the tip of 2028.

Idex Worth Prediction 2029

2029 is anticipated to be one other bull run because of the aftermath of the BTC halving. Nevertheless, merchants speculate that the crypto market would step by step change into steady by this yr. In tandem with the steady market sentiment and the slight value surge anticipated after the aftermath, Idex could possibly be buying and selling at $0.8273 by the tip of 2029.

Idex Worth Prediction 2030

After witnessing a bullish run out there, Idex and plenty of altcoins would present indicators of consolidation and may commerce sideways and transfer downwards for a while whereas experiencing minor spikes. Due to this fact, by the tip of 2030, Idex could possibly be buying and selling at $0.6802.

Idex Worth Prediction 2040

The long-term forecast for Idex signifies that this altcoin might attain a brand new all-time excessive(ATH). This could be one of many key moments as HODLERS might count on to promote a few of their tokens on the ATH level.

Nevertheless, Idex might face a slight fall earlier than beginning its upward journey as soon as once more. It’s anticipated that the common value of Idex might attain $1.2315 by 2040.

Idex Worth Prediction 2050

The neighborhood believes that there will probably be widespread adoption of cryptocurrencies, which might preserve gradual bullish positive factors. By the tip of 2050, if the bullish momentum is maintained, DOT might surpass the resistance stage of $1.7800

Conclusion

As mentioned above, the worth of Idex might even attain above $0.2923 if traders have determined that the cryptocurrency is an efficient funding, together with mainstream cryptocurrencies.

FAQ

Idex claims to be the primary layer-3 derivatives alternate. It makes use of a hybrid mannequin that mixes the standard order guide and an Automated Market Maker.

IDEX might be traded on many exchanges like different digital property within the crypto world. Binance, Coinbase, Kraken, and Uniswap V2 are at present the preferred cryptocurrency exchanges for buying and selling Idex.

IDEX has a risk of surpassing its current all-time excessive (ATH) value of $0.9745 in 2021. Nevertheless, because of the constructive sentiments of its traders, this could possibly be reached by the tip of 2040.

IDEX is likely one of the few cryptocurrencies that has retained its bullish momentum previously seven days. If this momentum is maintained, IDEX may attain $0.3 quickly after its breaks the Resistance 1 stage.

IDEX has been some of the appropriate investments within the crypto area. It has been rising exponentially, therefore, merchants could also be allured to spend money on IDEX.

IDEX has a gift all-time low value of $0.008559.

Idex was launched by CEO and co-founder Alex Wearn and his brother and COO Phil Wearn.

Idex most provide is unavailable.

Idex was launched in 2017.

Idex might be saved in a chilly pockets, sizzling pockets, or alternate pockets.

IDEX is anticipated to achieve $ 0.4112 by 2024.

IDEXis anticipated to achieve $0.5928 by 2025.

IDEX is anticipated to achieve $0.2484 by 2026.

IDEX is anticipated to achieve $0.4015 by 2027.

IDEX is anticipated to achieve $0.4777 by 2028.

IDEX is anticipated to achieve $0.8273 by 2029.

IDEX is anticipated to achieve $0.6802 by 2030.

IDEX is anticipated to achieve $1.2315 by 2040.

IDEX is anticipated to achieve $1.7800 by 2050.

Disclaimer: The views and opinions, in addition to all the data shared on this value prediction, are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates is not going to be held accountable for any direct or oblique harm or loss.