- A crypto Twitter consumer tweeted yesterday that Huobi’s BTC collateral is getting dangerously low.

- The publish additionally warned {that a} financial institution run could also be on the playing cards if Huobi doesn’t improve its reserves quickly.

- At press time, BTC was buying and selling at $30,351.14 after a 24-hour lack of 1.35%.

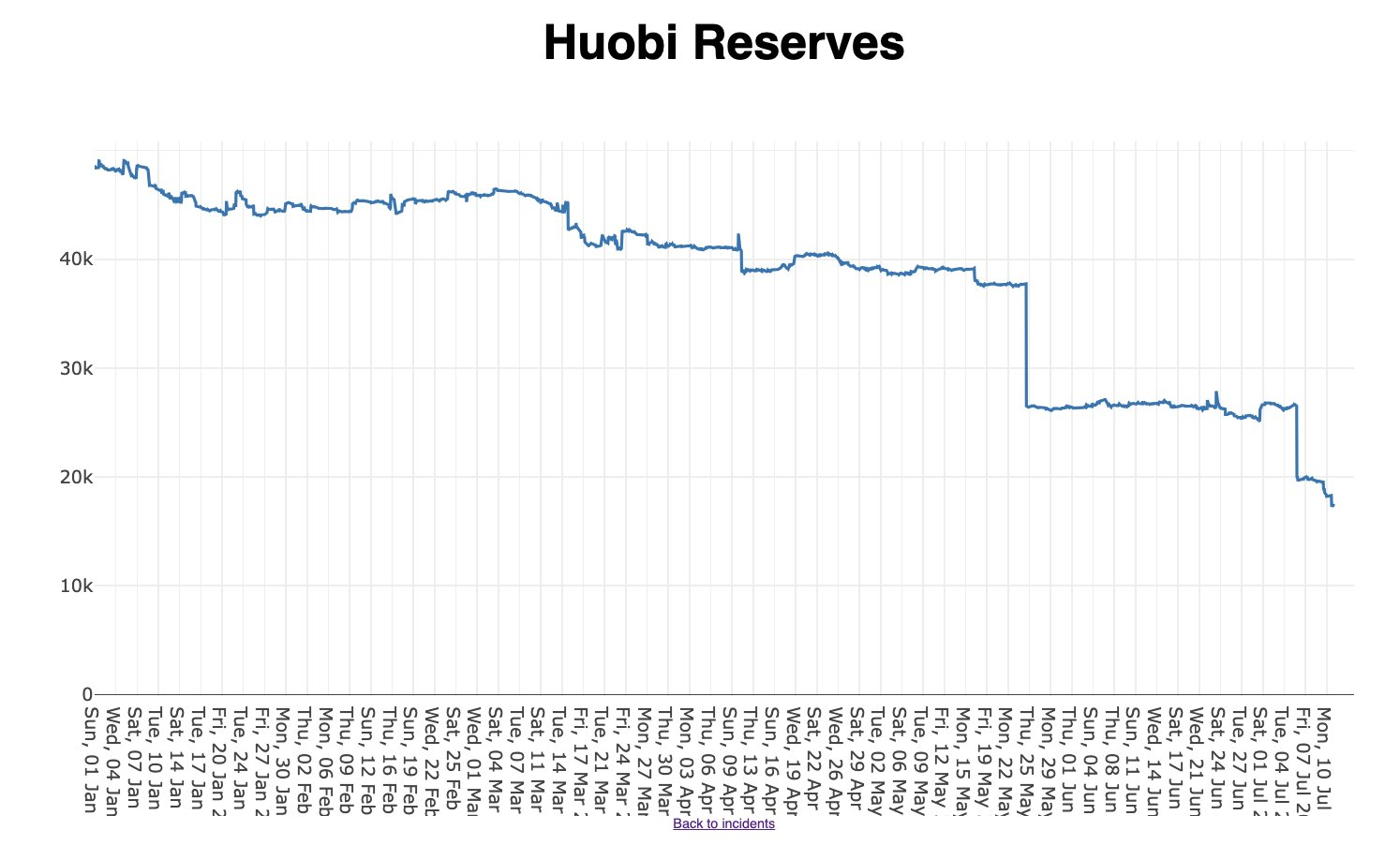

Analyst Willy Woo revealed in a tweet yesterday that Huobi’s Bitcoin (BTC) collateral is “beginning to look dangerously low.” Moreover, he warned that the trade could also be susceptible to a financial institution run quickly.

Within the publish, Woo revealed that the trade’s reserves have been in a decline over the previous few weeks. Firstly of the 12 months, Huobi’s reserves stood at greater than $40K. Since then, nevertheless, the overall has dropped beneath $20K.

In associated information, the BTC’s value stood at $30,351.14 at press time in accordance with CoinMarketCap. This was after it had dropped roughly 1.35% over the previous 24 hours. This damaging each day efficiency dragged the market chief’s weekly efficiency into the pink as properly. In consequence, the crypto was down 0.89% over the previous 7 days.

The 24-hour loss meant that the crypto was additionally buying and selling nearer to its each day low of $30,228, whereas its 24-hour excessive stood at $30,959.97. Along with weakening towards the Greenback, BTC was additionally outperformed by Ethereum (ETH) over the previous 24 hours. At press time, BTC was down 0.08% towards the biggest altcoin by market cap.

From a technical perspective, BTC was buying and selling beneath the 9-day EMA line at press time. If it doesn’t shut immediately’s each day candle above the technical indicator, then it could be susceptible to dropping to the 20-day EMA line at round $30K within the subsequent 48 hours. Continued promote strain might even lead to BTC dropping to the essential assist at $29,550 within the coming week.

Nevertheless, if BTC is ready to shut the following 2 each day candles above $30,400 then it could look to retest the most important resistance stage at $31,060 in the following couple of days. If the main crypto is ready to flip this key resistance into assist, then it could have a transparent path to climb to $32K.

Disclaimer: The views and opinions, in addition to all the data shared on this value evaluation, are printed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates won’t be held chargeable for any direct or oblique harm or loss.