Bitcoin has maintained a decent buying and selling vary between $28,000 and $30,000 since April 2023, a protracted sideways motion that has been a rarity out there. One of many causes for this squeezed worth vary, particularly after BTC dropped under $30,000, is worth assist created by short-term holders.

Quick-term holders are entities which have held Bitcoin for a comparatively temporary interval, usually lower than 155 days. Their conduct is essential in analyzing Bitcoin’s efficiency as they usually react extra shortly to market adjustments, thereby influencing worth actions.

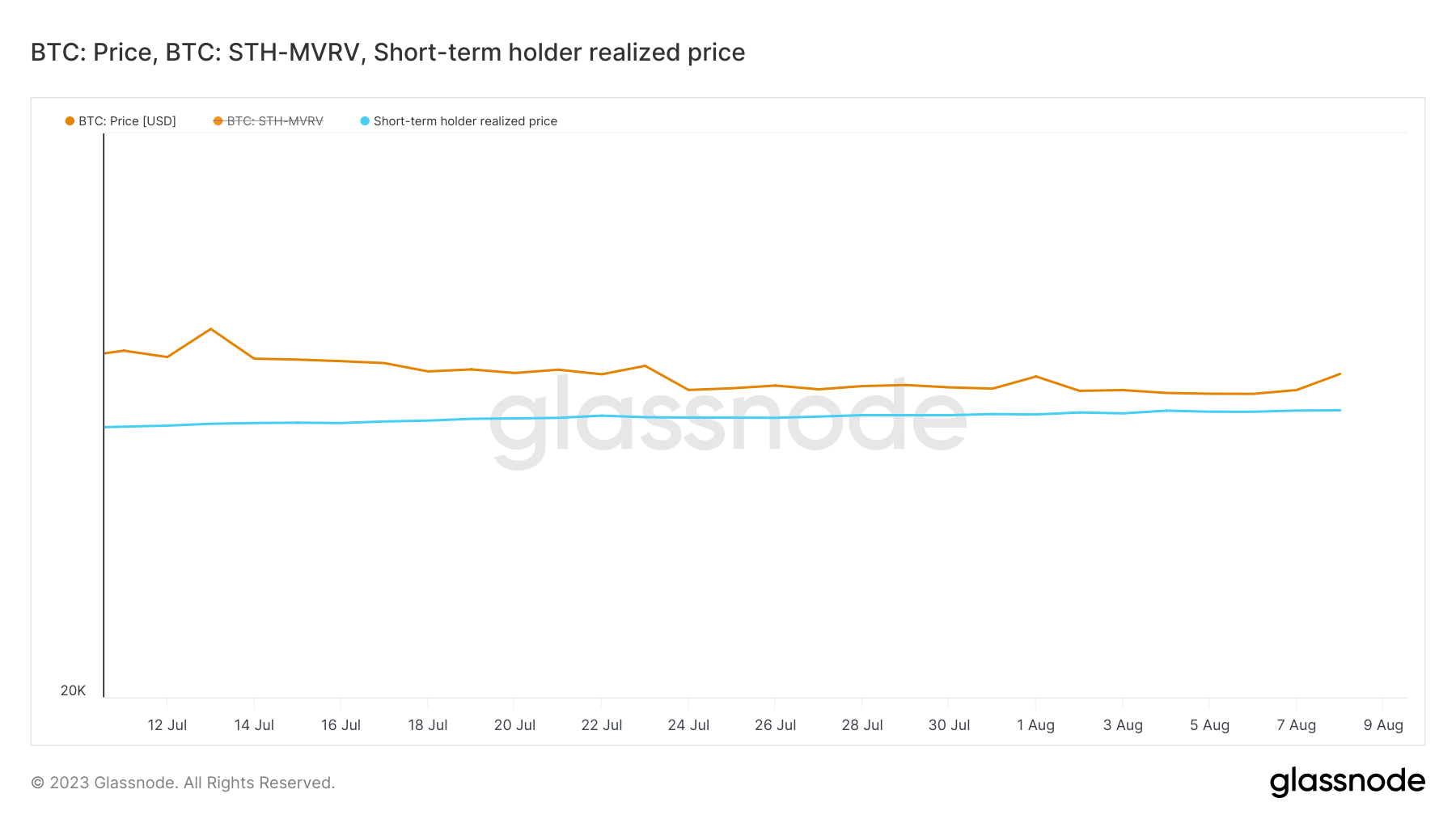

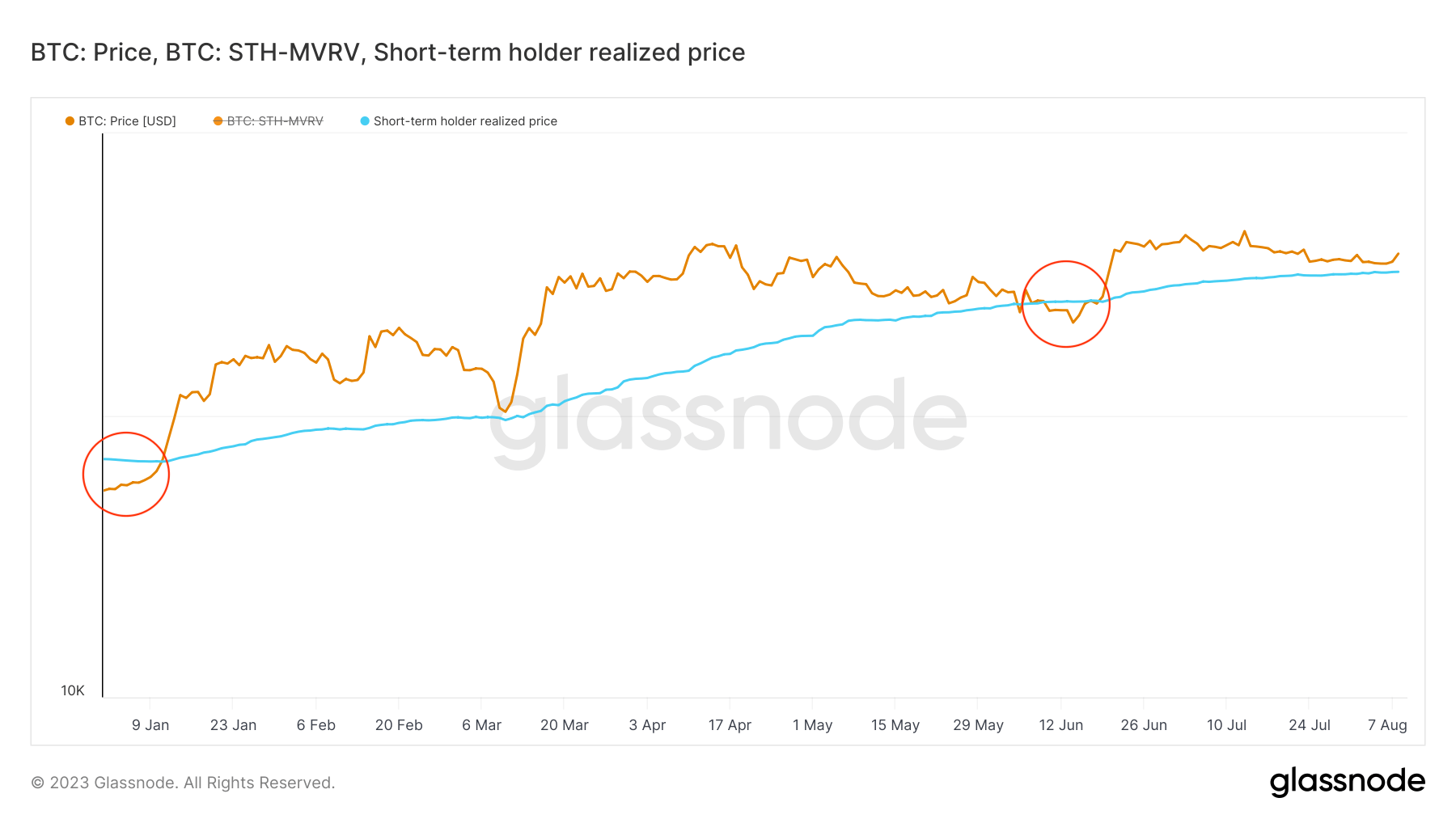

Knowledge from Glassnode confirmed that Bitcoin’s worth has traded above the realized worth for short-term holders since June 19. The realized worth is a metric that calculates the common worth at which all Bitcoins have been final transacted. It represents the common price of Bitcoin for all customers at any time limit, offering a way of the market’s price foundation.

As of Aug. 8, the on-chain price foundation for short-term holders is $28,462. Which means the entire addresses on the Bitcoin community which have acquired their cash previously 155 days have purchased them at a mean worth of $28,462.

Because the starting of the 12 months, Bitcoin’s worth traded under the short-term holder realized worth solely twice — from Jan. 1 to Jan. 11 and from June 9 to June 19. These temporary dips under the realized worth underscore the resilience of Bitcoin’s assist stage.

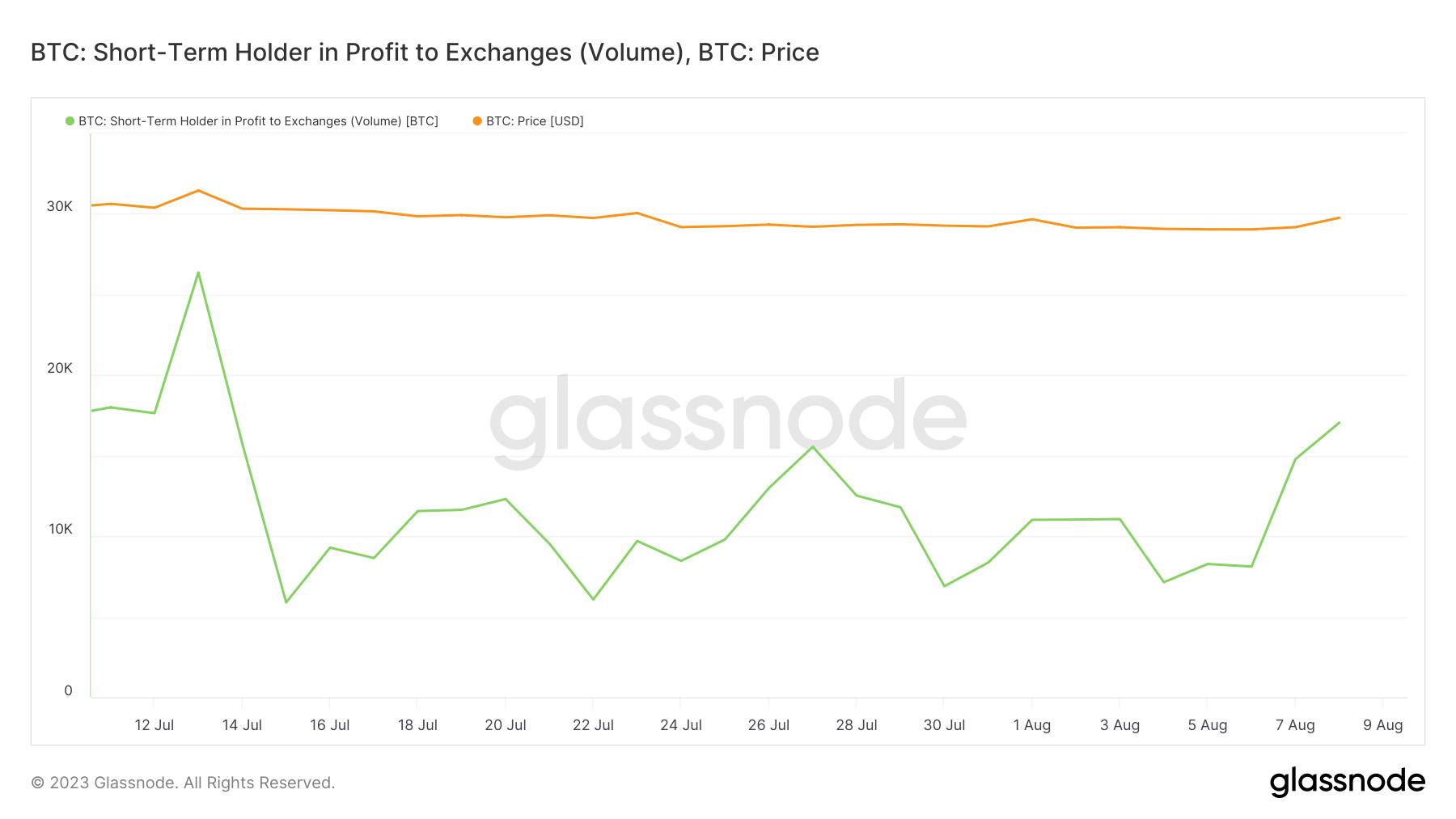

The heightened promote strain from short-term holders, evident from their elevated exercise on exchanges, can be a possible contributing issue to Bitcoin’s sustained sideways motion. There was a notable enhance within the quantity of BTC short-term holders in revenue who’ve despatched their holdings to exchanges in August.

A rise in Bitcoin transfers to exchanges signifies a readiness to promote, which might create a provide glut, holding the worth from transferring upward.

The conduct of short-term holders has created a stable assist stage for Bitcoin’s worth, but it surely additionally contributes to the present sideways motion. The steadiness between shopping for at a mean worth and the readiness to promote has created a singular market situation the place Bitcoin’s worth has been secure but constrained.

The submit How short-term holders hold Bitcoin worth secure however constrained appeared first on StarCrypto.