Key Takeaways

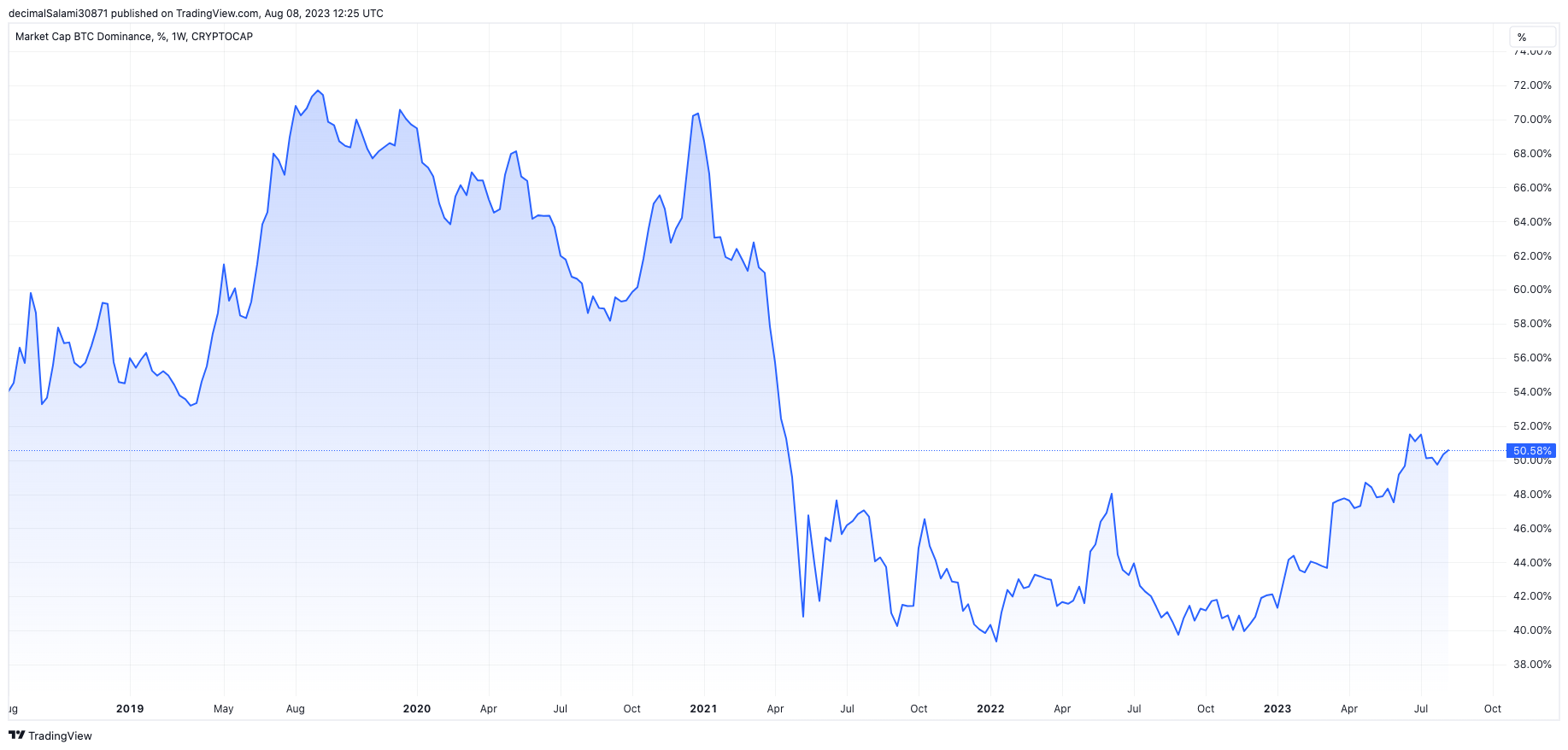

- Bitcoin dominance has risen above 50%, having began the yr at 42%

- Historically, dominance falls whereas market costs are rising within the sector, marking the yr 2023 out as uncommon

- This hammers house how Bitcoin continues to be discovering its ft, and why prudence must be taken when extrapolating previous efficiency to the long run

- Bitcoin was solely launched in 2009 and had minimal liquidity for the primary few years, that means our pattern area of knowledge is just too quick to make assumptions solely based mostly on the previous

Bitcoin dominance, which measures the ratio of the Bitcoin market cap to all the cryptocurrency market cap, has clambered again above 50%. With the interval of relative serenity within the crypto markets lately, it has been rangebound for the final two months, though dipped to 49% final week.

Nonetheless, the dominance of the world’s largest crypto has surged for the reason that begin of this yr, having been within the low 40’s because the e-book was closed on the yr 2022.

The rise is the largest extended growth in Bitcoin dominance since 2019, when it rose from 53% to 72% in a five-month interval starting that April.

Notably, the rise of Bitcoin’s dominance this time round contrasts with what we have now seen prior to now regard the timing of cycles. Regardless of its excessive volatility when evaluating to different main asset lessons, Bitcoin can typically be considered because the lowest-beta choice inside digital belongings.

Notably, the rise of Bitcoin’s dominance this time round contrasts with what we have now seen prior to now regard the timing of cycles. Regardless of its excessive volatility when evaluating to different main asset lessons, Bitcoin can typically be considered because the lowest-beta choice inside digital belongings.

In earlier cycles, the dominance has therefore tended to fall in bull markets as altcoins outpace Bitcoin’s beneficial properties. The sample has tended to be as follows:

- Bear market

- Bitcoin rises, dominance jumps

- Altcoins rise extra, dominance falls

This time round, the altcoins haven’t fulfilled their finish of the discount.

Crypto market is altering basically

There are a couple of theories which spring to thoughts to clarify these occurences. The primary is that Bitcoin is separating itself from the remainder of the crypto market. Regulation is one issue right here – Bitcoin has confirmed to be extra immune than many different cash within the area, a lot of whom have been weighed down by the crackdown within the US round securities legal guidelines.

The SEC explicitly named many tokens as securities, together with SOL (Solana), MATIC (Polygon) and ADA (Cardano). Whereas Ripple received a landmark case (at the least partially) in opposition to the SEC final month, offering hope for the long run authorized path of those proceedings, the extreme hostility proven by lawmakers within the US has undoubtedly served to dampen token costs. Bitcoin, nonetheless, appears to be in its personal style, focusing on “commodity” standing reasonably than a safety.

Then there may be the elephant within the room: all of the sordid exercise that has taken place within the crypto trade over the previous eighteen months. From the Terra demise spiral to the Celsius scandal to the FTX “deceit”, crypto has taken a beating. This has undoubtedly affected Bitcoin too (as its value chart will so clearly point out), however it’s honest to say that the a part of the crypto area that lies additional out on the danger curve could discover it more durable to regain belief from establishments and trad-fi actors (or to win it to start with, if it by no means had it within the first place).

Many have at all times argued that Bitcoin is separate from the remainder of crypto, a lot in order that the faction who promote this aggressively have been labelled with the moniker “Bitcoin maximalists”. As least so far as regulation goes, it appears lawmakers could also be coming round in the direction of additionally separating out the asset from the remainder of the group.

Bitcoin has suffered immensely within the final yr, nonetheless much less so price-wise than different cash, whereas its community has remained on-line, at all times, with out a hitch. There are a lot of different cryptos who can argue the identical, however whether or not honest or unfair, they could be getting caught up within the reputational crossfire a bit greater than Bitcoin is.

Past these speculative theories, maybe the best lesson of all is to concentrate on how fickle lots of the developments throughout the crypto are. Are we actually shocked that Bitcoin dominance has risen and altcoins haven’t caught up because the optimistic sentiment continues? Why? Due to historical past?

Allow us to remind ourselves that “historical past” pertains to barely a minute right here. Bitcoin was launched in 2009, and didn’t commerce with any type of real liquidity till maybe 2015 (if even). Altcoins have been even later. The pattern measurement which we have now to work with right here is way too small to make any type of concrete conclusions. Evaluate this to the inventory market, or bonds, the place we are able to make all kinds of return and threat assumptions to suit properly into our Black-Litterman fashions or so forth.

Not solely is the pattern measurement small, however the timing is essential, too. Bitcoin was borne out of the embers of one of many biggest crashes in financial historical past, launched two months earlier than the inventory market bottomed in March 2009. Following these tumultuous years, we embarked upon one of many longest bull markets in historical past. Danger belongings went parabolic as generationally-low rates of interest fuelled dizzying beneficial properties.

Subsequently, till final yr, Bitcoin – and crypto – had solely ever skilled a low-interest price, free cash financial system of up-only threat belongings. I’ve spent a whole lot of time having enjoyable with Bitcoin fashions, and my primary takeaway is that, fairly merely, we don’t know.

The world continues to be determining what cryptocurrency is. In the future, we’ll know precisely easy methods to mannequin this factor, identical to pension funds know precisely easy methods to apply Markowitz idea to inventory/bond portfolios. There’ll come a day when an environment friendly frontier portfolio has magic Web cash in it.

However we aren’t there but. Therefore, we are able to actually lean on the previous few years for steerage, however placing an excessive amount of weight into this extremely quick and bespoke interval (which additionally included a once-in-a-lifetime pandemic that noticed the worldwide financial system abruptly lock down) can be misguided.

Perspective is required. And we don’t have a ok viewpoint but to get that perspective.