The launch of the spot Bitcoin ETFs within the U.S. marked a watershed second within the crypto business. Whereas the affect it may have on the worldwide Bitcoin market, like legitimizing it as an asset class or creating extra demand, has been analyzed at size, few have centered on its results on different regulated funding merchandise like futures.

As a spot Bitcoin ETF gives a extra direct funding street to cryptocurrencies, it’s necessary to look at the way it influences the Bitcoin futures market. The connection between these two funding autos reveals investor sentiment and market traits, and the affect regulation has on crypto buying and selling.

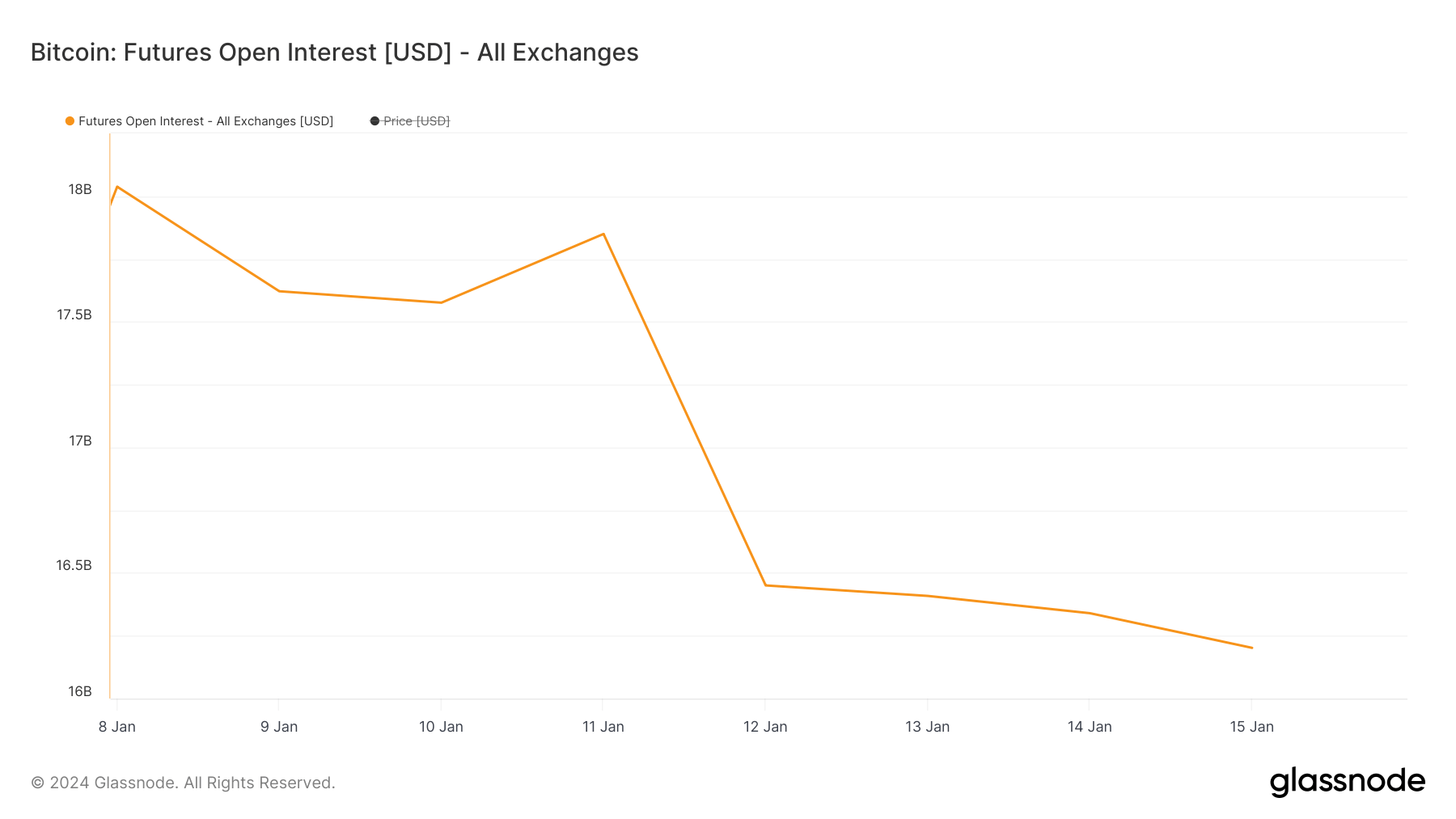

From Jan. 9 to Jan. 15, there was a noticeable decline within the whole open curiosity throughout all exchanges, reducing from $17.621 billion to $16.201 billion. This 8.05% drop suggests a discount within the variety of open futures contracts, hinting at both a diminished curiosity in futures buying and selling or a potential reallocation of investments to different autos, such because the spot ETFs, which started buying and selling on Jan. 11.

Most exchanges providing futures and different derivatives noticed comparable drops in open curiosity. Nevertheless, CME stands as an outlier, the change that suffered probably the most vital lower in open curiosity and buying and selling quantity.

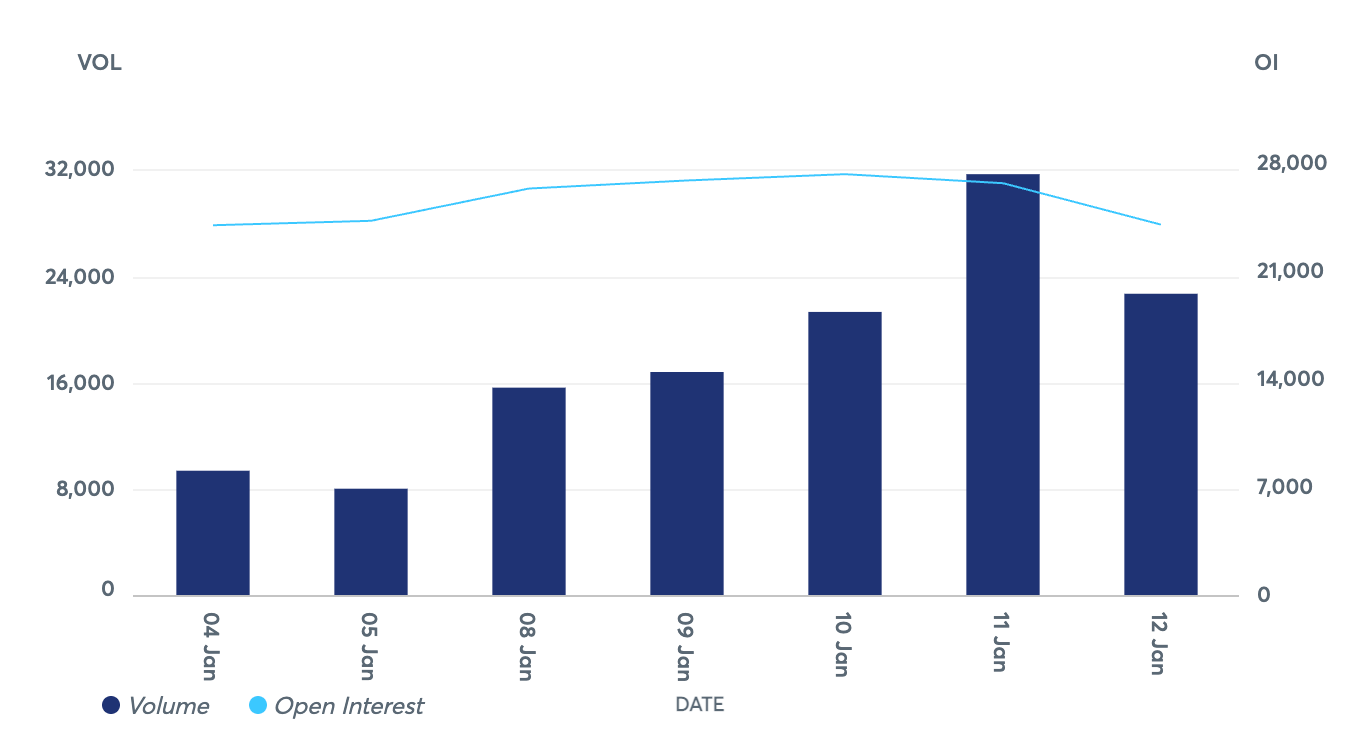

Starting at 26,846 BTC on Jan. 9, open curiosity on CME Bitcoin futures elevated barely to 27,252 BTC on Jan. 10, a modest enhance of 1.51%, earlier than getting into a decline. By Jan. 12, the open curiosity had fallen to 23,992 BTC, marking a major discount of 10.64% from its highest level on Jan. 10.

This lower in open curiosity, notably notable between Jan. 11 and Jan. 12, coincides with a substantial drop in Bitcoin’s worth throughout the first day of spot Bitcoin ETF buying and selling. This implies a correlation between the declining market confidence in Bitcoin’s future worth and the lowered curiosity in futures contracts.

The buying and selling quantity of CME Bitcoin futures confirmed much more volatility. After an preliminary quantity of 16,821 BTC on Jan. 9, it peaked on Jan. 11 with 31,681 BTC, a considerable enhance of 88.33%. Nevertheless, this peak was short-lived; following the sharp decline in Bitcoin’s worth, the futures buying and selling quantity fell to 22,699 BTC by Jan. 12, a lower of 28.34% from the day past’s peak.

Bitcoin additionally exhibited vital volatility final week. Beginning at $46,088 on Jan.9, the value fluctuated barely earlier than experiencing its most vital drop between Jan. 11 and Jan. 12, falling from $46,393 to $42,897, a lower of seven.54%.

The notable drop in open curiosity and quantity on CME reveals the potential the spot Bitcoin ETF has to affect established markets like Bitcoin futures or GBTC.

Throughout the first two days of buying and selling, spot Bitcoin ETFs noticed $1.4 billion in inflows. These two days noticed extraordinarily excessive buying and selling exercise, totaling roughly 500,000 merchants and amassing round $3.6 billion in quantity. Amidst this inflow, the Grayscale Bitcoin Belief (GBTC) encountered notable outflows, amounting to $579 million. When these outflows are factored in, the web inflows for all spot Bitcoin ETFs are $819 million. Nevertheless, these figures won’t replicate the precise quantity and inflows on Jan. 11 and Jan. 12, as some transactions are nonetheless pending remaining accounting settlement.

Some analysts speculate that the outflows from GBTC may react to the approval of the spot Bitcoin ETF, as Grayscale’s 1.50% price is being weighed in opposition to less expensive alternate options like BlackRock’s ETF, which expenses a 0.25% price. In such a short while, the quantity of outflows may point out a rising sensitivity amongst traders to ETF price buildings.

This sensitivity to value may be one of the vital elements influencing Bitcoin futures. Spot ETFs might provide a less expensive method of investing in Bitcoin, as futures contracts typically contain premium prices and rollover bills. For bigger institutional traders, these prices may be vital over time, particularly given the extremely aggressive charges among the many 11 listed ETFs.

For conventional traders or establishments, an ETF represents a well-known construction akin to investing in shares or different commodities, making it a extra enticing choice than futures contracts. If the shift towards the spot Bitcoin ETF continues, it should present a rising desire for less complicated, extra direct funding strategies in Bitcoin. It could point out that traders are looking for methods to include Bitcoin into their portfolios in a way that aligns extra intently with conventional funding practices.

The submit How ETFs affected BTC futures buying and selling within the U.S. appeared first on StarCrypto.