- Lawyer Invoice Morgan says the decide’s choice on the Daubert movement centered on professional proof for XRP’s secondary market buying and selling.

- The relisting of XRP on exchanges will depend on addressing whether or not it’s inherently categorised as a safety.

- Ripple might search settlement from the SEC to exclude secondary gross sales explicitly within the Last Judgment.

In a latest tweet, lawyer Invoice Morgan says that within the Daubert movement choice, Choose Analisa Torres supplied a transparent stance on the precise matter she should resolve. The choice revolved round permitting or disallowing professional proof pertaining to XRP’s secondary market buying and selling, quite than XRP itself.

Morgan shares that he’s hopeful that the decide will deal with the essential query of whether or not XRP qualifies as a safety, in continuation to his final Twitter thread on Could 29.

Within the thread, he highlighted the continuing dialogue concerning whether or not or how the “secondary market gross sales” of XRP will probably be addressed within the Ripple case. This side holds significance as a result of the relisting of XRP on exchanges largely will depend on whether or not the elemental query of whether or not XRP is inherently categorised as safety is satisfactorily addressed. Addressing this significant difficulty is essential to instilling confidence within the potential relisting of XRP on exchanges.

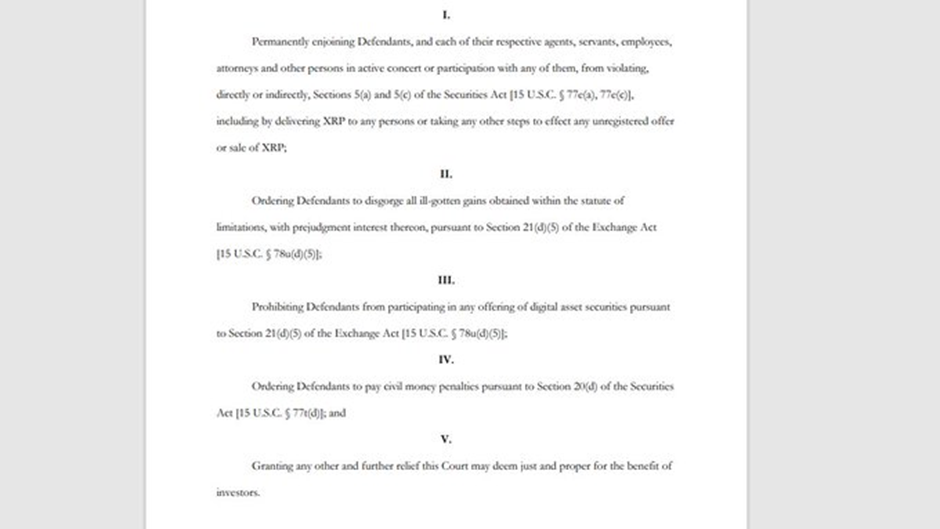

Regardless of the presence of language within the SEC’s lawsuit that means XRP itself is taken into account a safety, Morgan notes that the requests made by the SEC to the Court docket don’t search to confer such a standing on the asset.

In line with Morgan, a number of situations might deal with the difficulty of secondary gross sales within the Ripple case. Firstly, Ripple might search settlement from the SEC to exclude secondary gross sales explicitly within the Last Judgment, following the profitable strategy taken by KIK Interactive.

Secondly, the lawyer mentions that the Choose would possibly take into account considerations raised by numerous events, together with XRP holders represented by lawyer Deaton, concerning secondary gross sales. Given the LBRY case precedent, the place secondary gross sales have been addressed to some extent, an identical strategy could also be doable within the Ripple case.

Furthermore, if Ripple loses the case, through the “penalties” stage when drafting a disgorgement order, the Choose could also be compelled to deal with secondary gross sales. Ripple might argue that solely direct purchasers from Ripple ought to obtain their funding again, as established within the SEC vs. Wang case. Failing to take action would lead to diluted disgorgement quantities for particular person purchasers on account of important secondary gross sales.

Finally, such a ruling would implicitly deal with the difficulty of secondary gross sales and guarantee a good distribution of disgorged funds, as per Morgan.