- Bullish HBAR value prediction ranges from $0.055 to $0.1.

- Evaluation means that the HBAR value would possibly attain $0.0990.

- The HBAR bearish market value prediction for 2023 is $0.0375.

Hedera is a blockchain-based challenge for enterprise options and funds. Its native token is HBAR which is utilized in its market for transactions. Hedera was launched between July and August 2018 after an Preliminary Coin Choices (ICO). The ICO value of every HBAR was $0.12.

Hedera traders are bullish on the token because it has a return on funding (ROI) of over 5 instances prior to now 32 months. The crypto bubble of 2021 led to a surge within the value of HBAR and it attained its current all-time excessive (ATH) value of $0.5701 on September 16th, 2021. The latest crypto winter had affected its value, although its traders are bullish on the long run value.

In case you are considering the way forward for Hedera (HBAR) and would wish to know the worth evaluation and value prediction of HBAR for 2023, 2024, 2025, 2026, as much as 2030, preserve studying this Coin Version article.

Hedera (HBAR) Market Overview

| 🪙 Identify | Hedera |

| 💱 Image | hbar |

| 🏅 Rank | #33 |

| 💲 Worth | $0.053341 |

| 📊 Worth Change (1h) | 0.19248 % |

| 📊 Worth Change (24h) | 2.41854 % |

| 📊 Worth Change (7d) | 0.99182 % |

| 💵 Market Cap | $1731068684 |

| 📈 All Time Excessive | $0.569229 |

| 📉 All Time Low | $0.00986111 |

| 💸 Circulating Provide | 32519286394.8 hbar |

| 💰 Whole Provide | 50000000000 hbar |

What’s Hedera (HBAR)?

Hedera (HBAR) publicly launched its mainnet in September 2019 after it had its preliminary coin choices that ended on August 15th, 2018. It was based by Dr. Leemon Baird and Mance Harmon. It’s a third-generation public ledger with 3-5 seconds latency finality. There are over 1.03 million accounts on the Hedera mainnet.

Holders of Hedera blockchain native token HBAR can earn rewards by staking the token to safe the integrity of the platform. HBAR can as nicely be used within the fee of transaction charges, storage recordsdata, and the execution of good contracts on the Hedera blockchain.

The Hedera platform has adopted a singular distributed ledger know-how (DLT) known as Hashgraph consensus which is a proof-of-stake (PoS) community. With this, it will probably obtain the best grade of safety doable. This helps builders to construct on many blockchains. Transactions inside the Hedera mainnet could be accomplished for as little as $0.0001. About 10,000 transactions per second (TPS) could be accomplished on Hedera.

Hedera (HBAR) Present Market Standing

Hedera has a circulating provide of 32,519,286,395 HBAR, whereas its most provide is 50,000,000,000 HBAR in accordance with CoinMarketCap. On the time of writing, HBAR is buying and selling at $0.05408 representing 24 hours lower of 6.04%. The buying and selling quantity of HBAR prior to now 24 hours is $ 71,580,918 which represents a 191.53% improve.

Some prime cryptocurrency exchanges for buying and selling HBAR are Binance, Bittrex, and Huobi World.

Now that you realize HBAR and its present market standing, we will talk about the worth evaluation of HBAR for 2023.

Hedera (HBAR) Worth Evaluation 2023

At the moment, Hedera (HBAR) ranks 32 on CoinMarketCap. Will HBAR’s most up-to-date enhancements, additions, and modifications assist its value go up? First, let’s deal with the charts on this article’s HBAR value forecast.

Hedera (HBAR) Worth Evaluation – Bollinger Bands

The Bollinger bands are a kind of value envelope developed by John Bollinger. It has an Higher band, a Decrease band, and a Easy Transferring Common (SMA). The higher band provides the highest restrict and the decrease band provides the decrease restrict for the worth to fluctuate. The Bollinger bands work on the precept of normal deviation and interval (time).

As such each time the worth of the cryptocurrency reaches the higher or decrease band, the probabilities of it retracing are 95%. When the bands widen, it exhibits there’s going to be extra volatility and after they contract, there may be much less volatility.

The sections highlighted by crimson rectangles within the chart above present how the bands broaden and contract. When the bands widen, we may count on extra volatility, and when the bands contract, it denotes much less volatility. The inexperienced rectangles present how HBAR retraced after repeatedly touching the higher band (overbought).

At the moment, the Bollinger bands are titling upwards and HBAR has crossed the SMA and is now within the higher half of the Bollinger bands. As such, there’s a chance that HBAR may rise towards the higher band and kiss it. In that case, HBAR may attain $0.0563 or extra within the coming days.

When contemplating the larger image for Hedera, we may see that earlier than the final BTC halving occur, in 2019 there was consolidation. And even in the course of the 12 months of BTC halving HBAR was consolidating. Since 2023 is simply earlier than the BTC halving which is scheduled for 2024, we may even see HBAR consolidate sooner or later. This consolidation may lengthen till the start of 2025.

Furthermore, the Bollinger bandwidth (BBW) indicator on the backside of the chart signifies that the BBW is fluctuating near the place it was in 2019 and 2020. The Multi Bollinger Band Tremendous Development Indicator exhibits a inexperienced patch shifting sideways adopted by a crimson patch. This identical sample may very well be noticed presently as nicely. Therefore, this too dietary supplements HBAR is reciprocating its habits again in 2019.

Hedera (HBAR) Worth Evaluation – Relative Energy Index

The Relative Energy Index is an indicator that’s used to search out out whether or not the worth of a safety is overvalued or undervalued. As per its identify, RSI indicators assist decide how the safety is doing at current, relative to its earlier value.

As such, the indicator has a sign line which is a Easy Transferring Common (SMA) that acts as a yardstick or reference to the RSI line. Therefore, each time the RSI line is above the SMA, it’s thought-about bullish; if it’s under the SMA, it’s bearish.

At the moment, the RSI reads a price of 54.66 and the RSI line is simply popping above the Sign line. As such this might imply that the costs of HBAR might begin rising within the quick time period. Furthermore, the formation of an inverted bullish hammer would possibly point out that HBAR may improve in

the long run. As such, the RSI may additionally rise with the rise in HBAR costs.

The longer timeframe exhibits that there may very well be consolidation because the RSI is positioned parallel to the horizontal axis and it might proceed to maintain shifting in that course. At the moment, the RSI reads a price of 48.57 and the RSI is simply above the Sign. Because the RSI is neither overbought nor oversold, the pattern may very well be thought-about as robust.

Hedera (HBAR) Worth Evaluation – Transferring Common

The Exponential Transferring averages are fairly just like the easy shifting averages (SMA). Nevertheless, the SMA equally distributes down all values whereas the Exponential Transferring Common provides extra weightage to the present costs. Since SMA undermines the weightage of the current value, the EMA is utilized in value actions.

The 200-day EMA is taken into account to be the long-term shifting common whereas the 50-day EMA is taken into account the short-term shifting common in buying and selling. Primarily based on how these two traces behave, the energy of the cryptocurrency or the pattern could be decided on common.

At the moment, each the EMAs are shifting horizontally, as such, there’s a chance that HBAR may transfer horizontally within the coming days. Particularly, HBAR has been rebounding on the 50-day EMA and has been testing the 200-day EMA above it recently. As such, we may count on HBAR to check the 200-day EMA as soon as once more. If it breaks above the 200-day EMA HBAR may take a look at the $0.0780.

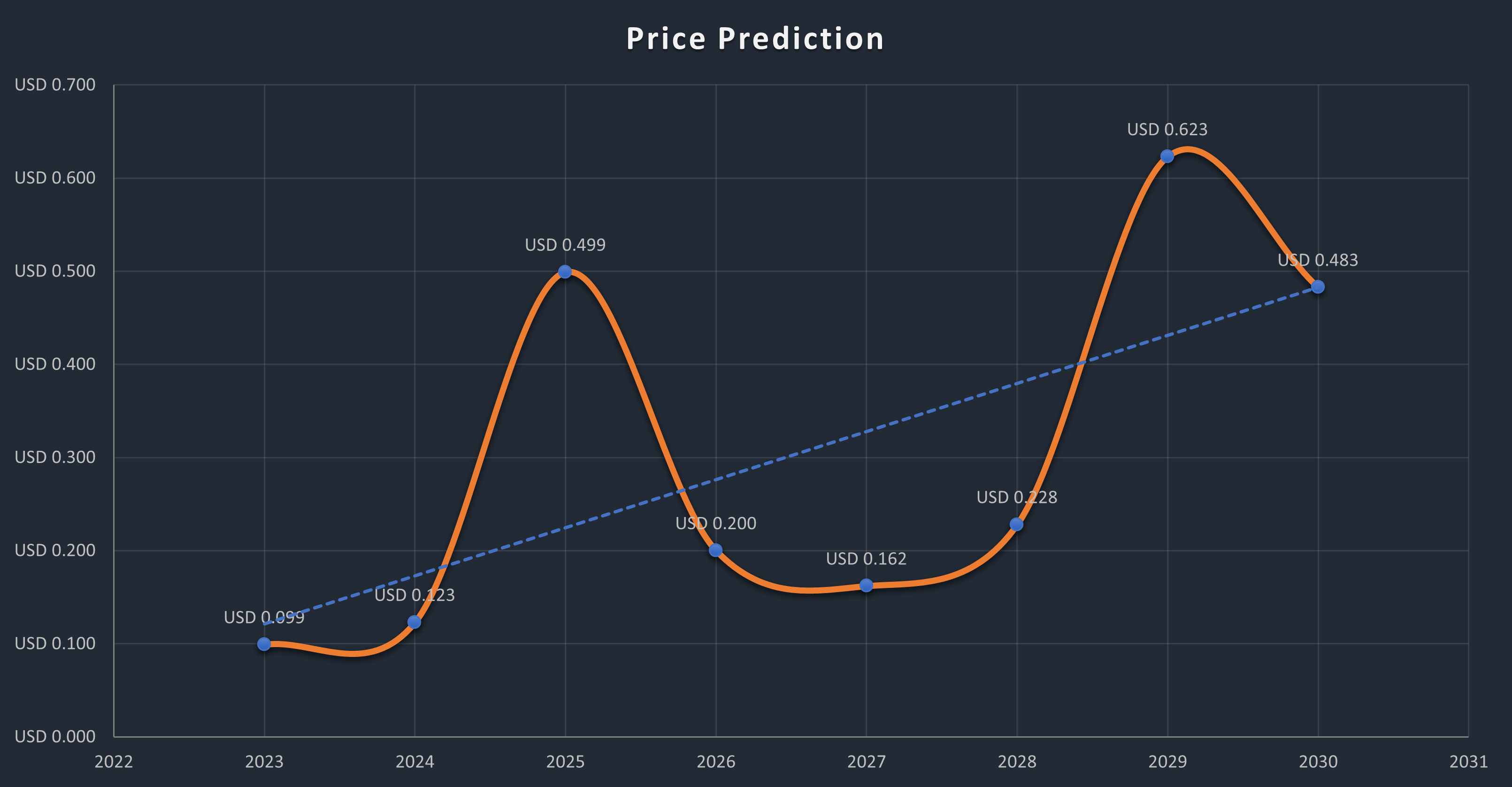

Hedera (HBAR) Worth Prediction 2023-2030 Overview

| Yr | Minimal Worth | Common Worth | Most Worth |

| 2023 | $0.080 | $0.099 | $0.100 |

| 2024 | $0.110 | $0.123 | $0.130 |

| 2025 | $0.200 | $0.499 | $0.6 |

| 2026 | $0.1950 | $0.200 | $0.25 |

| 2027 | $0.150 | $0.162 | $0.180 |

| 2028 | $0.200 | $0.228 | $0.250 |

| 2029 | $0.5 | $0.623 | $0.750 |

| 2030 | $0.350 | $0.483 | $0.650 |

| 2040 | $0.800 | $0.960 | $1.100 |

| 2050 | $1.200 | $1.408 | $1.800 |

Hedera (HBAR) Worth Prediction 2023

The above chart exhibits how Hedera has been declining inside a falling wedge after its rise originally of 2023. It made decrease lows and decrease highs contained in the falling wedge. Nevertheless, after HBAR broke out of the falling wedge there wasn’t a right away spike for HBAR.

Nonetheless, it appears to be progressively rising. As such, we might HBAR rise in direction of the Resistance 3 stage ($0.0990) and break above. Nevertheless, HBAR can be met with promoting strain at Resistance 1 ($0.0670) and Resistance 2 ($0.0778). To interrupt these resistance ranges, we may anticipate HBAR to consolidate close to these areas.

As such the climb to Resistance 3 could also be extended. It could take the identical period it took to kind the falling wedge, for HBAR to achieve the above Resistance 3. Therefore, we may anticipate HBAR to achieve the above-said stage by the top of 2023.

Within the occasion, HBAR loses momentum and the bears take over the market, then we may even see HBAR in search of help at Assist 1 ($0.0440). If Assist 1 is damaged then Assist 2 $0.0377 will be the solely choice that Hedera may rely on.

When wanting on the greater image for HBAR, we may see that it fashioned the double-top sample. After breaking out of this sample, HBAR is fluctuating between Assist 0 ($0.0320) and Resistance 0($0.0875). As such, we may count on HBAR to check Resistance 0 shortly. Nevertheless, if HBAR breaks Resistance 0 it should take a look at Resistance 1 at ($0.2585). If Resistance 1 is damaged, then it may head over to Resistance 2 at $0.3307 and perhaps even increased.

Hedera (HBAR) Worth Prediction – Resistance and Assist Ranges

Contemplating the above chart we may see that HBAR rose above the 1:1 Gann line throughout early 2023 and it reached the utmost value of $0.0990 in February 2023. After reaching its most value HBAR crashed to 0.618 fib retracement stage for help.

After HBAR discovered help it began to rise alongside the two:1 Gann line for a while however misplaced momentum and began to slip down alongside the three:1 Gann line. At the moment, after efficiently breaking the three:1 Gann line HBAR is rising alongside the 8:1 Gann line. So long as the 8:1 Gann line helps HBAR, it might proceed to rise.

Hedera (HBAR) Worth Prediction 2024

There can be Bitcoin halving in 2024, and therefore we must always count on a constructive pattern out there because of consumer sentiments and the search by traders to build up extra of the coin. Nevertheless, the 12 months of BTC halving didn’t yield the utmost HBAR primarily based on the earlier halving. Therefore, we may count on HBAR to commerce at a value not under 0.123 by the top of 2024.

Hedera (HBAR) Worth Prediction 2025

HBAR might expertise the after-effects of the Bitcoin halving and is anticipated to commerce a lot increased than its 2024 value. Many commerce analysts speculate that BTC halving may create a huge effect on the crypto market. Furthermore, just like many altcoins, HBAR will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that HBAR would commerce past the $0.499 stage.

Hedera (HBAR) Worth Prediction 2026

It’s anticipated that after a protracted interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, HBAR may tumble into its help areas. Throughout this era of value correction, HBAR may lose momentum and be manner under its 2025 value. As such it may very well be buying and selling at $0.2 by 2026.

Hedera (HBAR) Worth Prediction 2027

Naturally, merchants count on a bullish market sentiment after the crypto business was affected negatively by the bears’ claw. Furthermore, the build-up to the following Bitcoin halving in 2028 may evoke pleasure in merchants. Nevertheless, there’ll be a dip in value earlier than the thrill can be reciprocated in HBAR. As such we may count on HBAR to commerce slightly below its 2026 worth at round $0.162 by the top of 2027.

Hedera (HBAR) Worth Prediction 2028

Because the crypto group’s hope can be re-ignited wanting ahead to Bitcoin halving like many altcoins, HBAR might reciprocate its previous habits in the course of the BTC halving. Therefore, HBAR could be buying and selling at $0.228 after experiencing a substantial surge by the top of 2028.

Hedera (HBAR) Worth Prediction 2029

2029 is anticipated to be one other bull run because of the aftermath of the BTC halving. Nevertheless, merchants speculate that the crypto market would progressively turn out to be steady by this 12 months. In tandem with the steady market sentiment, HBAR may very well be buying and selling at $0.623 by the top of 2029.

Hedera (HBAR) Worth Prediction 2030

After witnessing a bullish run out there, HBAR and lots of altcoins would present indicators of consolidation and would possibly commerce sideways and transfer downwards for a while whereas experiencing minor spikes. Subsequently, by the top of 2030, HBAR may very well be buying and selling at $0.483.

Hedera (HBAR) Worth Prediction 2040

The long-term forecast for HBAR signifies that this altcoin may attain a brand new all-time excessive(ATH). This is able to be one of many key moments as HODLERS might count on to promote a few of their tokens on the ATH level.

If they begin promoting then HBAR may fall in worth. It’s anticipated that the typical value of HBAR may attain $0.960 by 2040.

Hedera (HBAR) Worth Prediction 2050

The group believes that there can be widespread adoption of cryptocurrencies, which may keep gradual bullish features. By the top of 2050, if the bullish momentum is maintained, HBAR may hit $1.480.

Conclusion

If traders proceed exhibiting their curiosity in HBAR and add these tokens to their portfolio, it may proceed to rise. HBAR’s bullish value prediction exhibits that it may attain the $0.01 stage.

FAQ

HBAR is the native token of the Hedera ecosystem.

Like different cryptocurrencies, Hedera (HBAR) could be traded in cryptocurrency exchanges like Binance, Huobi World, Kucoin, Bittrex, Crypto.com, and others.

HBAR is without doubt one of the few cryptocurrencies that has gained worth prior to now seven days. If AR spikes it may rise to $16.

HBAR has been probably the most appropriate investments within the crypto house. It’s extremely unstable, as such, it has fairly a margin when its value fluctuates. Therefore, merchants could also be allured to spend money on HBAR. It’s funding within the quick time period and in the long run as nicely.

Hedera (HBAR) has a low chance of surpassing its current all-time excessive (ATH) value of $0.5701 in 2022.

It was launched in 2018.

HBAR is anticipated to achieve $0.099 by 2023.

HBAR is anticipated to achieve $0.123 by 2024.

HBAR is anticipated to achieve $0.499 by 2025.

HBAR is anticipated to achieve $0.2 by 2026.

HBAR is anticipated to achieve $0.162 by 2027.

HBAR is anticipated to achieve $0.228 by 2028.

HBAR is anticipated to achieve $0.623 by 2029.

HBAR is anticipated to achieve $0.483 by 2030.

HBAR is anticipated to achieve $0.960 by 2040.

HBAR is anticipated to achieve $1.408 by 2050.

Disclaimer: The views and opinions, in addition to all the knowledge shared on this value prediction, are revealed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates won’t be held chargeable for any direct or oblique harm or loss.