Regardless of the volatility Bitcoin skilled in 2023, the prolonged sideways motion between February and July has proved to be fertile floor for accumulation. Onchain evaluation confirmed that short-term holders (STHs) and long-term holders (LTHs) had steadily collected all through the previous quarter, indicating a robust perception within the asset’s long-term worth.

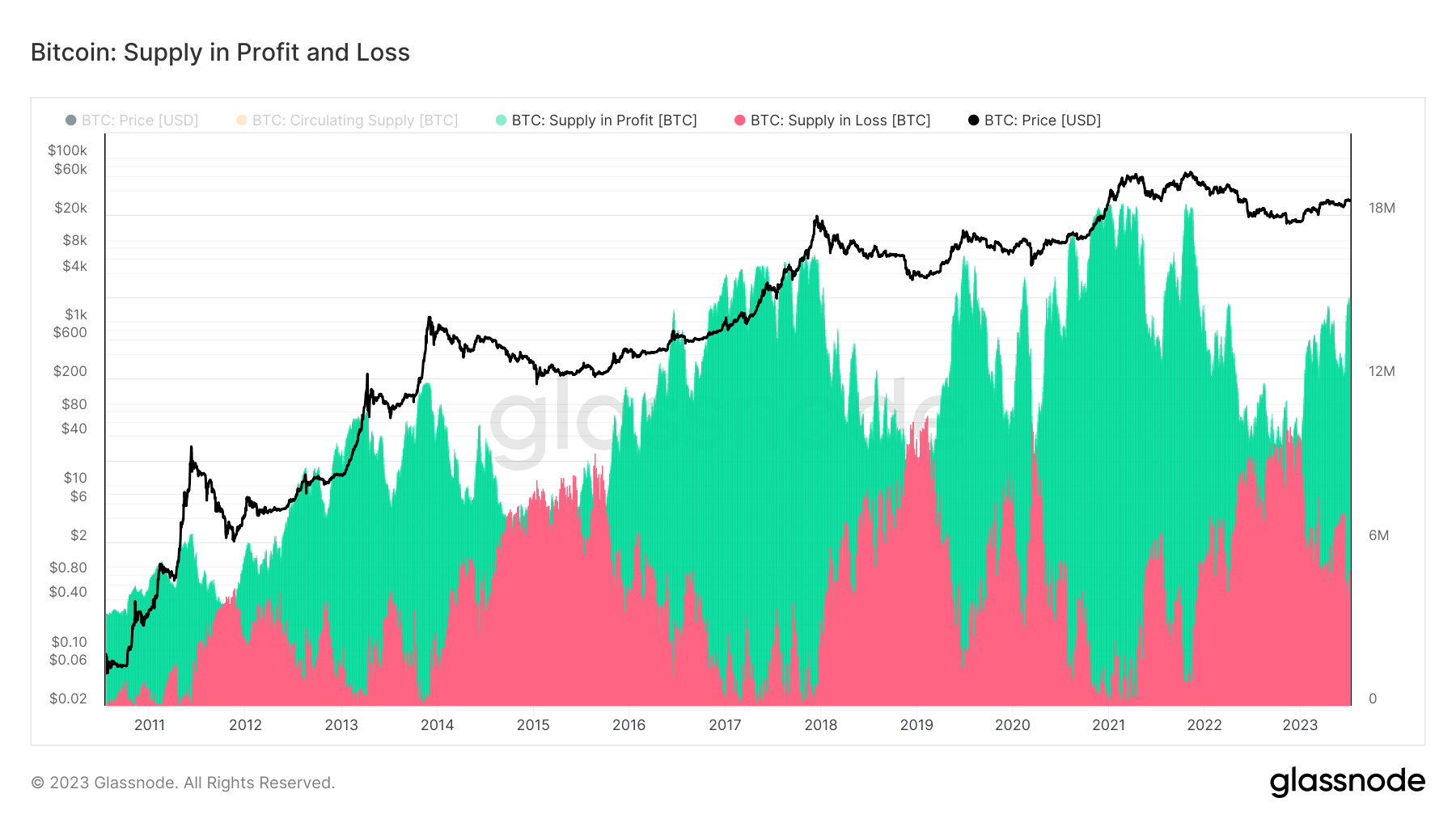

Measuring Bitcoin’s provide in revenue and loss is a necessary a part of analyzing the market. These metrics present worthwhile insights into market sentiment and investor habits — the next provide in revenue signifies that traders are holding onto their belongings, anticipating additional value appreciation. Conversely, the next provide in loss might sign potential sell-offs.

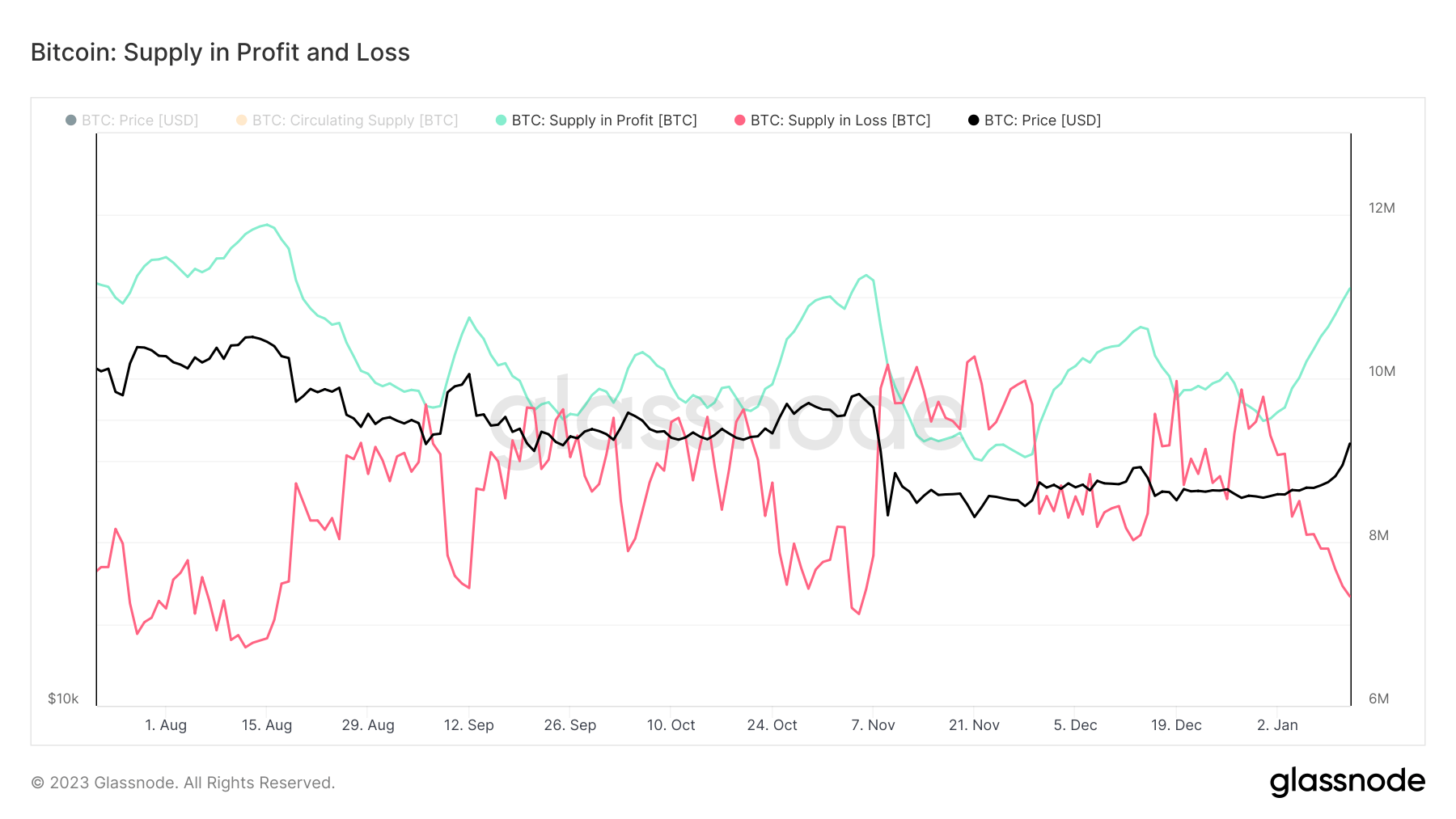

Between September and December 2022, throughout a interval of serious value volatility, the provides in revenue and loss converged a number of occasions, reflecting the market’s uncertainty.

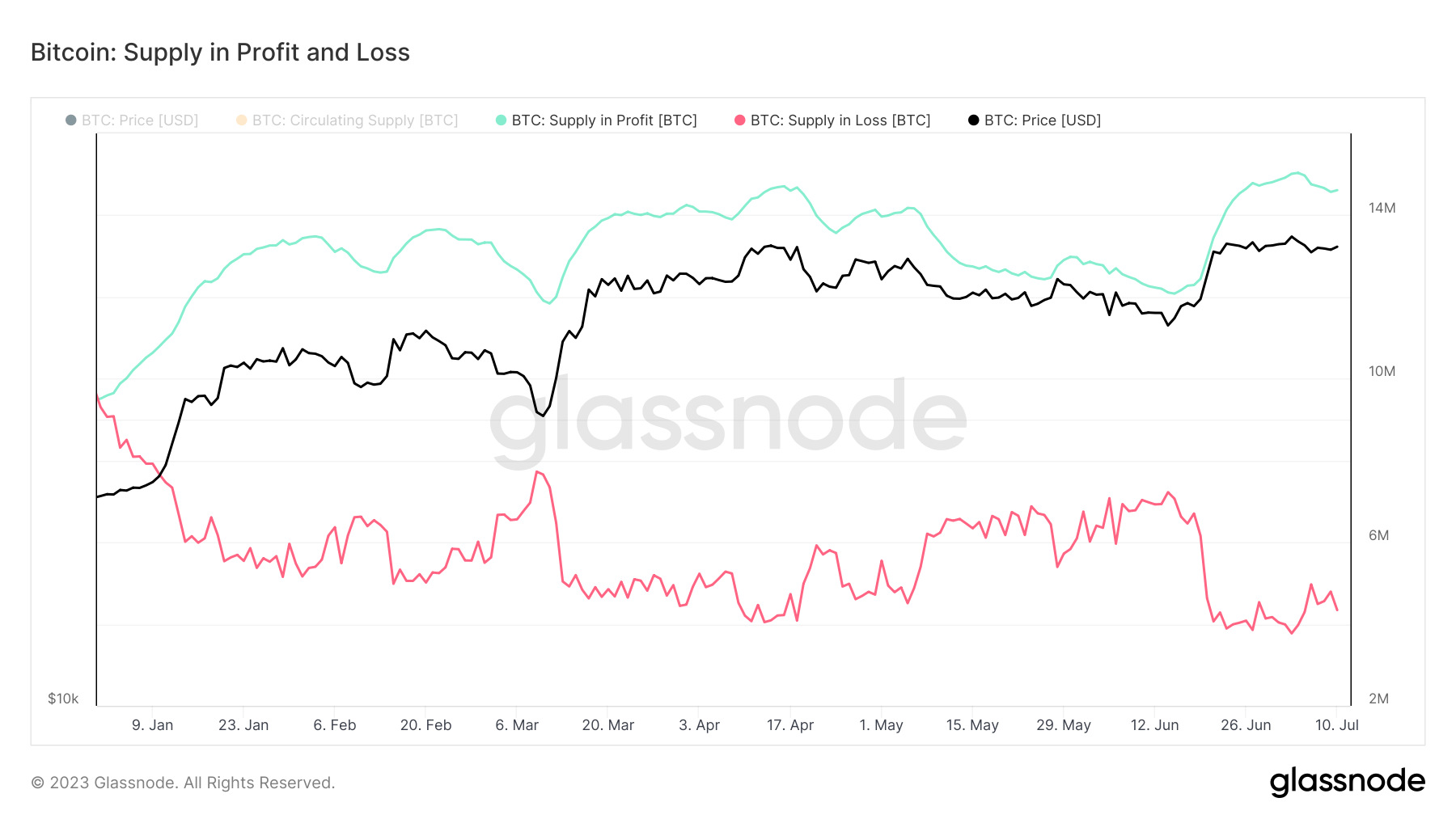

Nevertheless, the panorama has shifted for the reason that starting of 2023. The provides in revenue and loss have diverged, with the portion of the provision in revenue rising by over 53%. In keeping with information from Glassnode, 14.61 million BTC is at the moment in revenue, whereas 4.34 million BTC is in loss.

As of July 11, 75% of the provision is in revenue, leaving solely 25% in loss. This important equilibrium is harking back to the eventualities witnessed in the course of the mid-points of the 2016 and 2019 market cycles. Glassnode information additional revealed that fifty% of Bitcoin’s buying and selling days had seen the next Revenue-to-Loss steadiness and 50% a decrease one.

The present accumulation part and the ensuing 75% of Bitcoin’s circulating provide being in revenue is a promising signal for the cryptocurrency. If historic patterns proceed, this might be the mid-point in Bitcoin’s present market cycle, suggesting {that a} backside has been reached and the market is at the moment gearing up for a rally.

Nevertheless, it’s essential to contemplate that whereas historic patterns present helpful context, they could not at all times predict future actions. As we speak’s Bitcoin market is influenced greater than ever by a bunch of macro components, similar to regulatory developments and broader financial circumstances.

The put up Heavy accumulation places 75% of Bitcoin’s circulating provide in revenue appeared first on StarCrypto.