- An analyst opined that market individuals ought to DCA into altcoins lengthy earlier than the Bitcoin halving.

- Bitcoin and Ethereum’s dominance stays flat, indicating a doable season for altcoins to thrive.

- Utilizing the CMF, the LINK/USD chart confirmed that accumulation has begun.

Within the crypto market, timing performs an important function in figuring out funding outcomes and asset efficiency. For a lot of cycles, the time issue has been instrumental in figuring out altcoins’ development whereas figuring out the season to build up these property.

With latest shifts within the cryptocurrency panorama and the continuing volatility of main gamers like Bitcoin (BTC) and Ethereum (ETH), traders are naturally inquisitive about whether or not the present juncture presents a chance to amass a portfolio of altcoins.

Apparently, crypto analyst Michaël van de Poppe weighed in on the matter whereas referring to the value efficiency of a number of altcoins. In keeping with Poppe, various altcoins have misplaced between 90 to 99% of their worth since they fell from their All-Time Excessive (ATH).

Nonetheless, Poppe, who can also be the founding father of MN Buying and selling, opined that the drawdown will not be the one issue to find out if shopping for altcoins proper now is a good choice. As a substitute, he centered on the basics, historic efficiency, and market sentiment.

Bitcoin Dominance to Pave the Approach

Poppe defined that on-line searches for altcoins have decreased considerably. However a take a look at the Bitcoin halving historical past means that altcoins hit their bottoms ten months earlier than the occasion. In earlier cycles, Bitcoin additionally misplaced its dominance and made means for the altcoin season throughout this era.

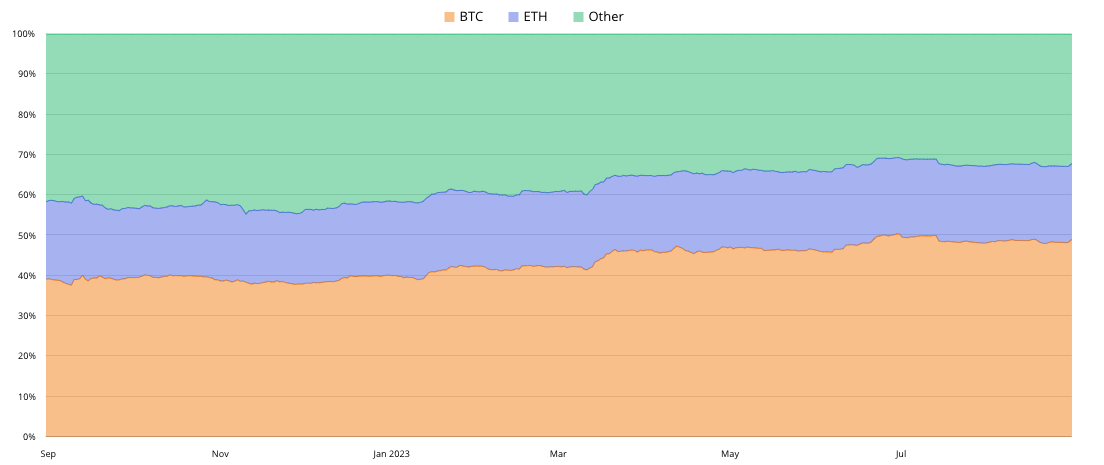

Oftentimes, when the altcoin season is about to start, Bitcoin dominance shrinks, paving the way in which for ETH and different altcoins to thrive. Nonetheless, in response to BTCTools, Bitcoin has maintained its dominance over Ethereum with a 48.27% to 18.87% distinction.

Moreover, it’s often a good suggestion to carry BTC or ETH when the dominance will increase. Additionally, when the dominance decreases, it presents a chance to build up altcoins. On the time of writing, the dominance flatlined. Thus, providing a comparatively good alternative to purchase altcoins at their doable bottoms.

Other than the dominance chart, Poppe talked about that the progress made with altcoin tasks needs to be a sign for accumulation. He used examples resembling the rise in DeFi and NFT exercise as grounds to take altcoin accumulation significantly.

LINK With the Excessive Probabilities

Like earlier instances, the analyst didn’t fail to say Chainlink (LINK) as a significant altcoin to build up. In keeping with Poppe, Chainlink’s growth of its Cross Chain Interoperability Protocol (CCIP) places it on the forefront of different altcoins.

For context, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is a cross-chain communication protocol that gives good contract builders with the flexibility to transmit information and tokens throughout blockchain networks in a trust-minimized method.

In the meantime, LINK’s value at press time was $6.06—a 2.96% improve within the final 24 hours. From the LINK/USD 4-hour chart, the token confronted rejection at $6.24 after a sudden surge from $5.88. Nonetheless, the lower in LINK value appears to not have affected accumulation.

As of this writing, the Chaikin Cash Circulation (CMF) was 0.04. As a basis of accumulation and distribution, the CMF indicated that LINK was in bullish territory as a result of elevated shopping for stress.

If the CMF continues to extend, then there’s a risk that LINK’s value improve and the goal could also be between $6.30 and $6.50.

In conclusion, Michaël van de Poppe famous that the present market situation presents an opportunity for individuals to build up altcoin utilizing the Greenback Value Averaging (DCA) technique. Whether or not following the recommendation or not will repay, time will inform.

Disclaimer: The views, opinions, and knowledge shared on this value prediction are printed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates won’t be answerable for direct or oblique harm or loss