Grayscale’s Bitcoin Belief (GBTC) has turn into a vital instrument within the cryptocurrency world since its launch by Grayscale Investments. As one of many pioneers in offering a bridge between the normal funding panorama and the nascent cryptocurrency area, GBTC permits traders to faucet into the Bitcoin market with out straight shopping for, storing, or managing it. Monitoring GBTC’s worth motion has turn into paramount, particularly for analysts aiming to gauge market sentiment.

Crafted within the mould of a standard funding belief, GBTC’s distinctive proposition lies in its technique of holding Bitcoin. As a substitute of particular person traders grappling with cryptographic keys and wallets, Grayscale centralizes the holding course of, utilizing high-security measures, together with chilly storage mechanisms, to make sure the protection of the belongings.

GBTC shares, representing possession of a fraction of the belief’s underlying Bitcoin, are traded on the OTCQX market. The OTCQX, or the Over-The-Counter QX, is a top-tier, regulated market for shares and securities that don’t commerce on standard, large-scale exchanges. It provides a platform for firms to entry U.S. traders whereas complying with excessive monetary requirements and disclosure practices.

One distinguishing characteristic of GBTC, setting it aside from some ETFs (Change Traded Funds), is its lack of a redemption mechanism. In easy phrases, traders can’t change their GBTC shares straight for Bitcoin. As a substitute, they’ll solely commerce these shares on the open market. This design selection aids in offering extra worth stability, stopping giant traders from abruptly cashing out and considerably affecting the market dynamics.

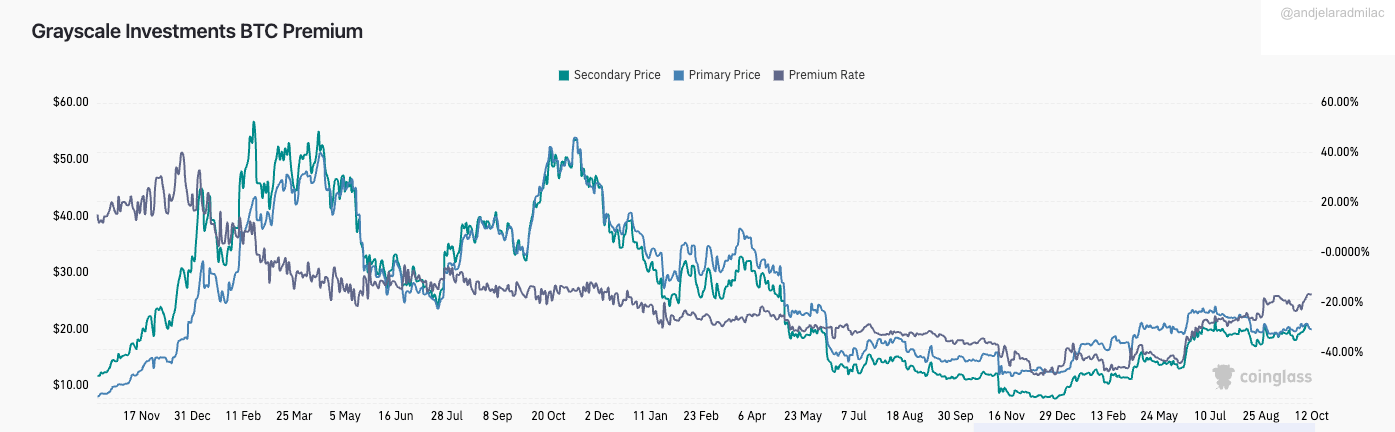

The individuality of GBTC lies in its premium, a time period denoting the distinction between the market worth of GBTC shares and the precise worth of the Bitcoin it holds, generally known as the Web Asset Worth (NAV).

This premium arises because of a number of components. Initially, GBTC was one of many scarce channels for institutional gamers to entry Bitcoin publicity, particularly in restricted jurisdictions. This exclusivity led to GBTC buying and selling at a considerable premium. Furthermore, GBTC’s liquidity and comfort added to its enchantment, driving a wedge between its worth and the precise Bitcoin worth. Nonetheless, this premium isn’t static and may oscillate primarily based on market situations and rework into a reduction.

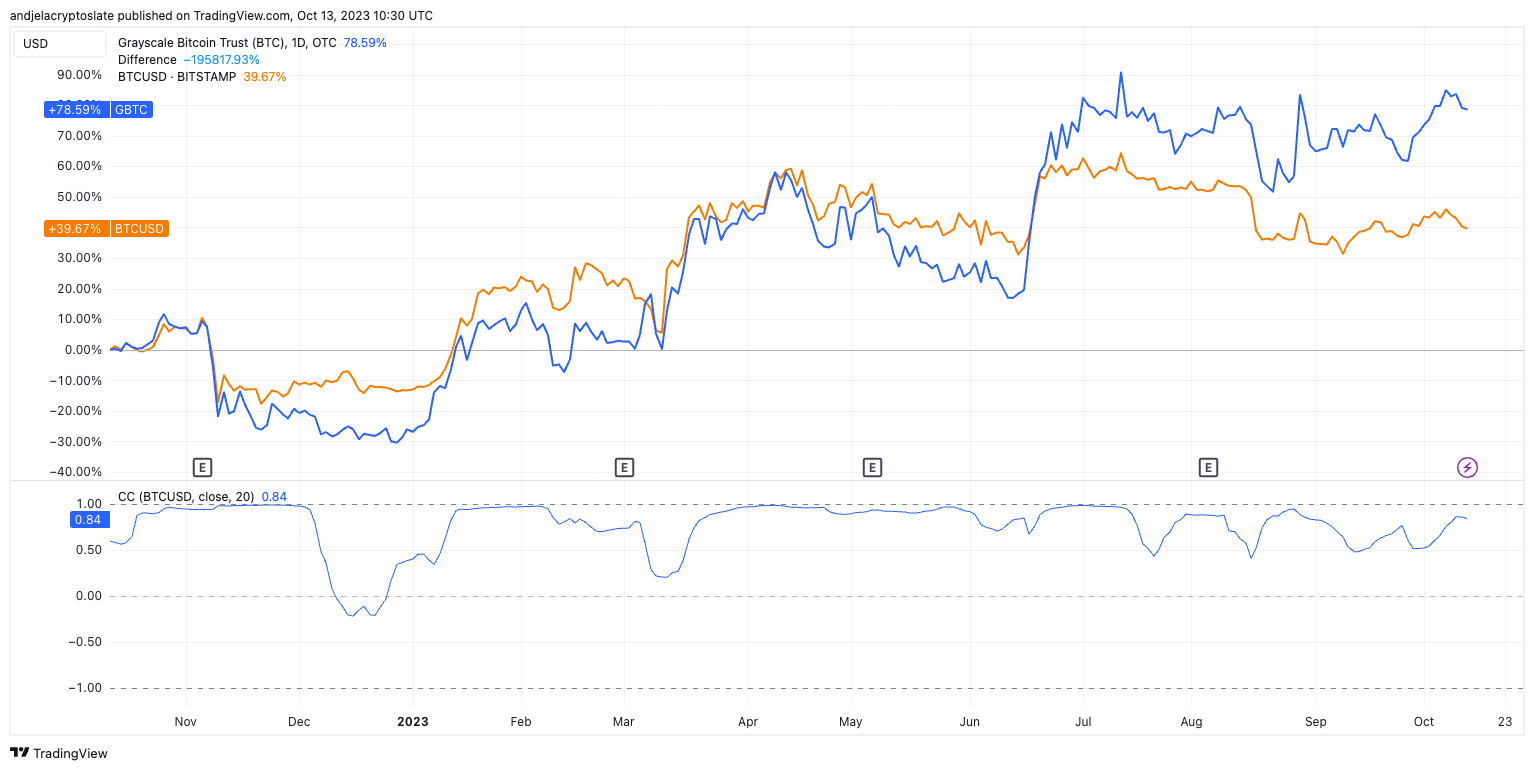

Traditionally, GBTC has proven a excessive diploma of correlation with Bitcoin (BTC). That is anticipated because the main asset underlying GBTC is Bitcoin. As BTC costs transfer, the worth of the Bitcoin held by the belief additionally shifts, influencing GBTC’s NAV. Nonetheless, the market worth of GBTC, affected by provide and demand dynamics for its shares, can deviate from this NAV, resulting in the talked about premium or low cost.

If laws round cryptocurrency funding autos change, it might have an effect on GBTC’s attractiveness to traders, main to cost actions impartial of Bitcoin’s worth. As extra cryptocurrency funding autos emerge, particularly these providing options GBTC doesn’t (like redemption options), it might scale back demand for GBTC, affecting its correlation with BTC.

One such looming regulatory choice is the potential approval of a Grayscale spot Bitcoin ETF. The market is abuzz with hypothesis, with many believing that Grayscale could be the frontrunner in securing this approval. This transformation would handle the longstanding premium/low cost challenge and function a monumental step in integrating cryptocurrencies into mainstream finance.

The potential advantages are manifold. An ETF construction would streamline the buying and selling course of, presumably bringing in a contemporary inflow of institutional cash. Furthermore, it could additional solidify Bitcoin’s place as a authentic and acknowledged asset class.

Nonetheless, a Grayscale Bitcoin ETF might additionally introduce heightened volatility, particularly throughout its preliminary days, because the market adjusts to the brand new dynamics. And whereas the GBTC premium has traditionally been a bellwether for market sentiment, an ETF conversion may dilute this indicator’s efficiency.

The publish Grayscale’s GBTC: Understanding its premium and market influence appeared first on StarCrypto.