Grayscale Investments‘ flagship product, Grayscale Bitcoin Belief (GBTC), serves as an important bridge between the normal monetary world and the comparatively new realm of cryptocurrencies. GBTC affords buyers publicity to Bitcoin with out the necessity for direct possession, successfully bypassing challenges like storage, safety, and regulatory issues. By buying shares of GBTC, buyers can achieve publicity to Bitcoin’s worth actions by a car that trades on conventional markets.

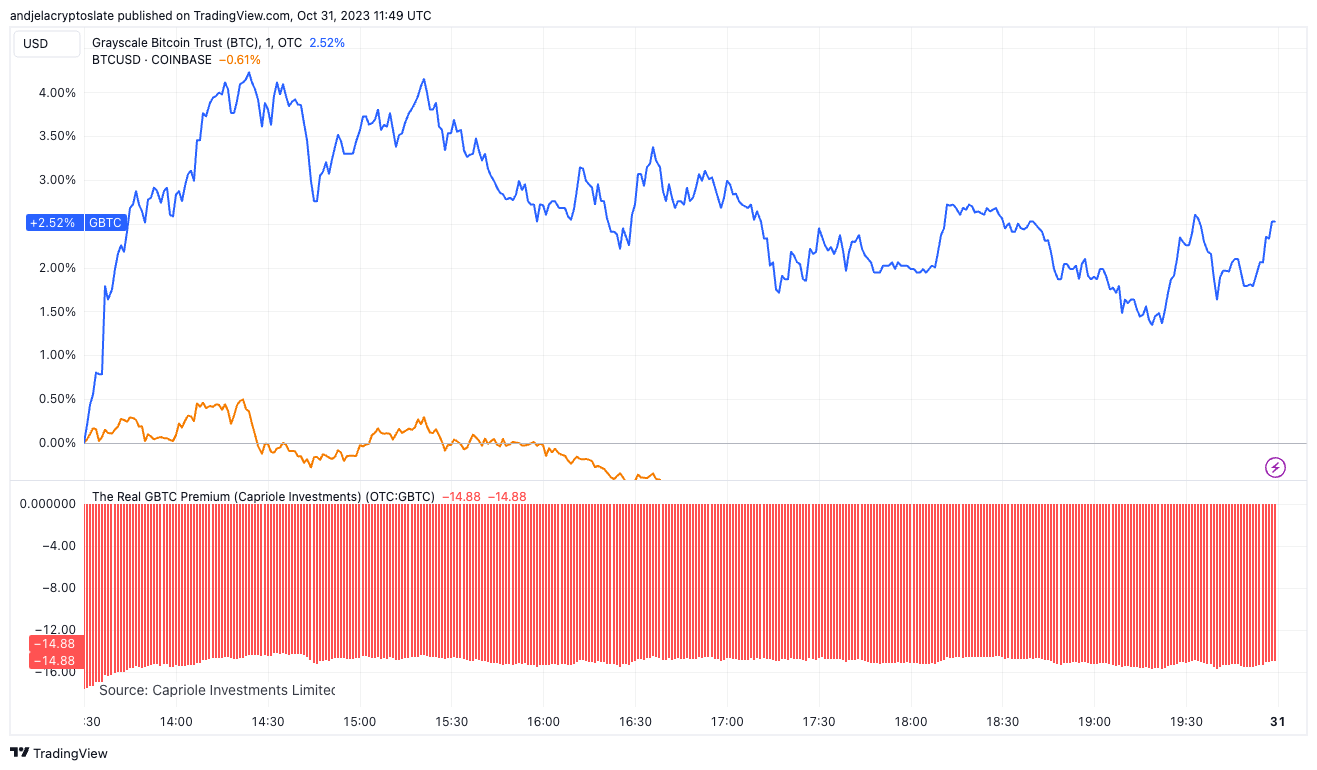

A putting remark from latest knowledge is the divergence between GBTC’s every day efficiency and that of Bitcoin (BTC). On Oct. 30, whereas GBTC elevated by 2.52%, Bitcoin noticed a decline of 0.61%. Such a divergence raises questions on market dynamics and investor sentiment. Does this imply the normal market’s urge for food for Bitcoin publicity, as seen by GBTC, is stronger than the direct cryptocurrency market?

The information appears to counsel so, particularly after we broaden our lens to longer timeframes.

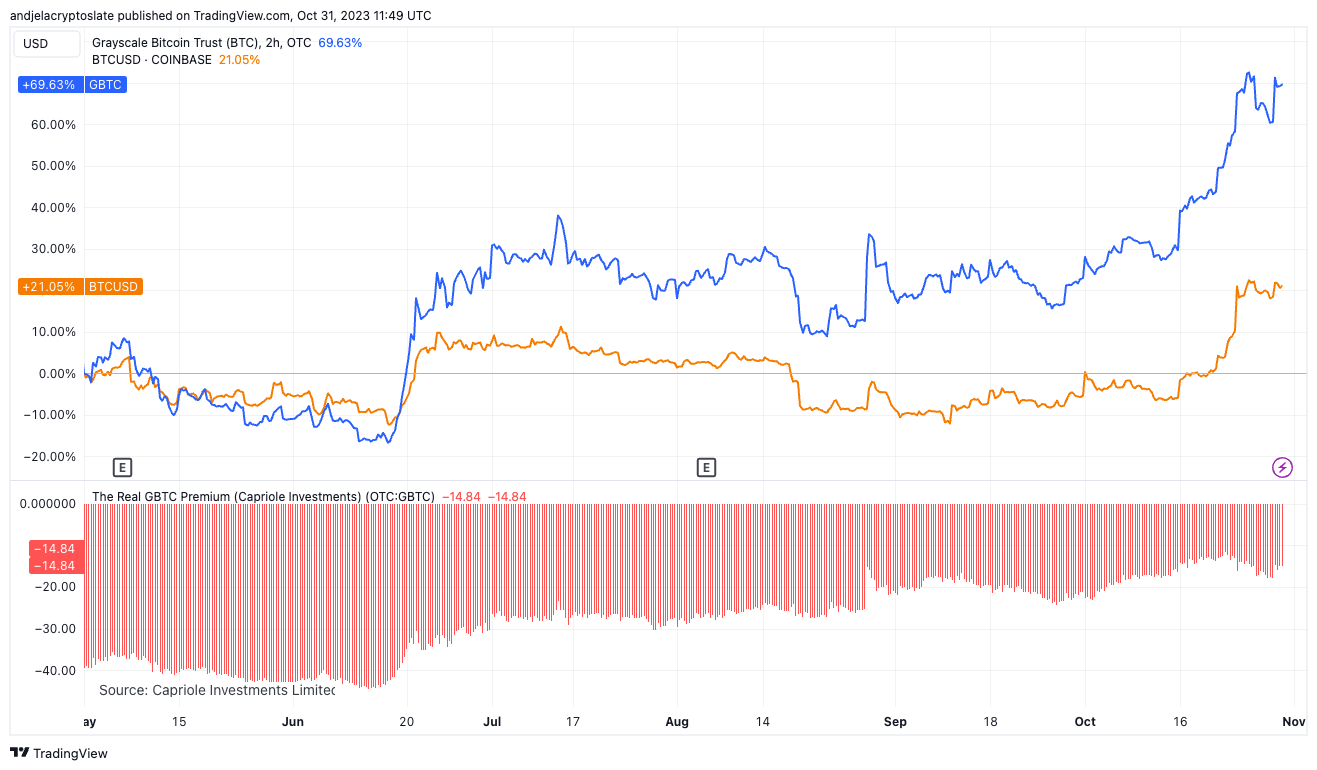

Over the previous month, GBTC rose by 31.7% in comparison with Bitcoin’s 20.6%. The development continues over three and 6 months, with GBTC rising by 39.1% and 69.6%, respectively, considerably outpacing BTC’s development of 17.3% and 21.1%. 12 months-to-date, it grew a whopping 222.9%, doubling Bitcoin’s commendable rise of 106.9%.

| 1D | 1M | 3M | 6M | YTD | |

|---|---|---|---|---|---|

| GBTC | +2.52% | +31.7% | +39.1% | +69.6% | +222.9% |

| BTC | -0.61% | +20.6% | +17.3% | +21.1% | +106.9% |

| GBTC Premium | -14.88 | -14.87 | -14.86 | -14.84 | -14.98 |

Nevertheless, whereas these numbers paint a rosy image of GBTC’s efficiency, the persistent detrimental premium affords a extra nuanced narrative. Regardless of its stronger returns, it constantly trades at a reduction to the precise worth of the Bitcoin it holds. This low cost, hovering round -14.88 to -14.98 throughout the board, signifies that the market values the precise Bitcoin greater than the GBTC shares representing it. Such a secure detrimental premium, even within the face of GBTC’s outperformance, may very well be a manifestation of assorted issues. Buyers could be cautious of the asset attributable to its price construction, potential liquidity points, or the shortcoming to redeem shares for precise Bitcoin. The consistency of this low cost additionally means that the market sentiment relating to these issues has remained unchanged.

The broader implications of this secure low cost are manifold. It would point out a latent demand for a extra direct publicity mechanism to Bitcoin, which a U.S. Bitcoin ETF might satiate. The introduction of such an ETF would permit institutional buyers to achieve publicity to Bitcoin in a way extra aligned with the precise cryptocurrency, doubtlessly providing extra liquidity and the power to redeem shares for precise Bitcoin. A Bitcoin ETF would additionally seemingly have a extra aggressive price construction. With the rising curiosity in Grayscale’s Bitcoin Belief, the launch of a Bitcoin ETF within the U.S. might see a large inflow of institutional cash into the crypto house, additional legitimizing the asset class and doubtlessly main to cost appreciation.

Whereas GBTC has constantly demonstrated sturdy efficiency, outpacing Bitcoin over varied timeframes, the persistent low cost to the underlying asset can’t be ignored. It serves as a bellwether of market sentiment, indicating attainable issues or a need for extra direct publicity mechanisms.

The publish Grayscale’s GBTC paradox: Efficiency at a reduction appeared first on StarCrypto.