Grayscale’s victory towards the U.S. Safety and Exchanges Fee (SEC) triggered over $90 million in liquidations through the previous 4 hours, considerably impacting merchants betting on the additional decline of the market.

In accordance with knowledge from Coinglass, quick merchants accounted for 88% of the $97.63 million liquidations recorded available in the market over the previous 4 hours as Bitcoin (BTC) and Ethereum (ETH) spiked by greater than 5%, respectively.

Bitcoin and ETH cumulatively noticed greater than $60 million of the liquidations, whereas merchants with positions in belongings corresponding to BNB, XRP, Bitcoin Money, Solana, and others recorded thousands and thousands in losses.

That is the best liquidation degree because the market flash crashed on Aug. 17. The crypto trade is at present present process one among its lowest volatility durations, with BTC and ETH not seeing important value motion.

In the meantime, when the liquidation timeframe is prolonged to the previous 24 hours, the losses quantity to $123.52 million.

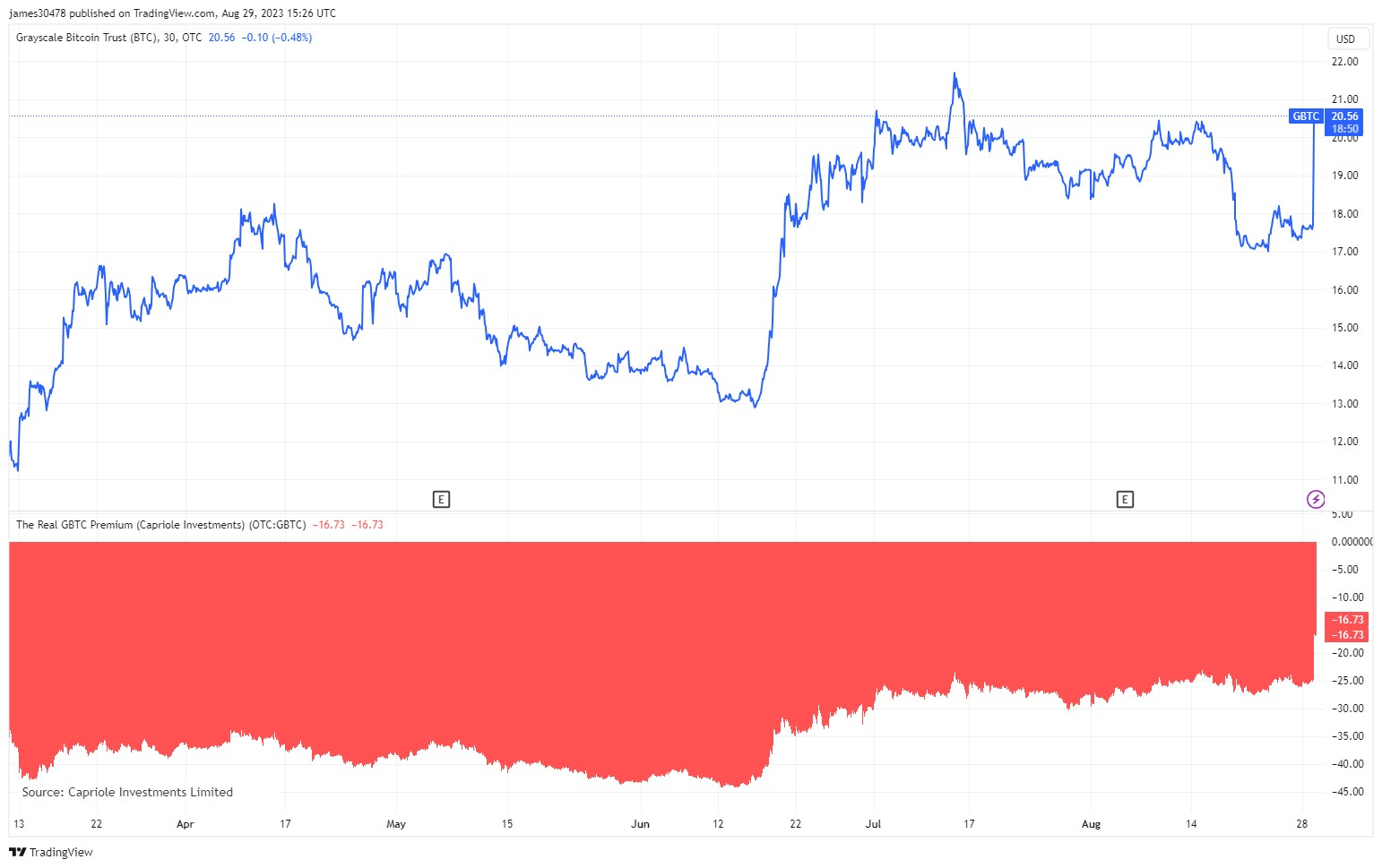

GBTC low cost narrows

In the meantime, Grayscale’s Bitcoin Belief (GBTC) reacted positively to information of its mother or father firm’s victory, quickly compressing to 18%, its lowest degree within the final 2 years.

The GBTC low cost peaked at nearly 50% final 12 months and has largely stayed round 40% this 12 months. Nevertheless, the metric started to considerably decline following BlackRock’s utility for a spot BTC ETF earlier than dropping beneath 20% for the primary time since early 2022.

Earlier at present, the US Courtroom of Appeals for the District of Columbia Circuit handed Grayscale a big win by overturning the SEC’s earlier order. This ruling marks a pivotal second in Grayscale’s lawsuit relating to changing its Bitcoin Belief right into a spot Bitcoin ETF.

The crypto funding agency has persistently maintained that the monetary regulator acted “arbitrarily and capriciously” in rejecting spot Bitcoin ETF functions whereas highlighting the SEC’s “unfair discrimination” towards spot Bitcoin ETF issuers.

The put up Grayscale victory towards SEC sparks $90M in market liquidations, slims GBTC low cost appeared first on StarCrypto.