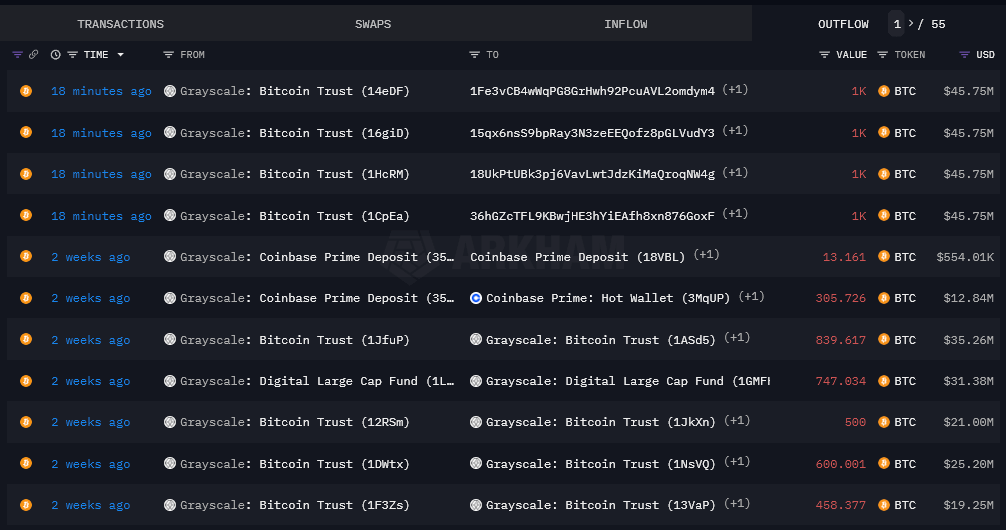

Grayscale has begun shifting Bitcoin out of its belief and sending it to Coinbase as of two p.m. GMT, Jan. 12. A complete of 4,000 BTC (roughly $200M) has been despatched as of press time, with all Bitcoin going to Coinbase Prime, one of many key members within the collection of Bitcoin ETFs launched yesterday.

Coinbase acts because the dealer and buying and selling counterparty for nearly all ETF issuers, together with Grayscale. Thus, it’s probably that this switch signifies outflows from the belief from gross sales yesterday. The final outflows earlier than right this moment had been round 2 weeks once more, the place there have been a number of transactions out and in of the Grayscale Bitcoin wallets.

Whereas the spot Bitcoin ETFs monitor the worth of Bitcoin instantly, they don’t require issuers to purchase and promote Bitcoin stay throughout buying and selling hours. The important thing occasions when Bitcoin is bought or bought regarding the creation and redemption of ETF shares within the Grayscale ETF, for instance, will be summarized as follows:

Creation of Baskets (Shopping for Bitcoin):

- The Approved Individuals place creation orders for Baskets with the Switch Agent by 1:59:59 p.m., New York time, on any enterprise day.

- The Sponsor determines the Whole Basket Internet Asset Worth (NAV) and any Variable Price as quickly as practicable after 4 p.m., New York time.

- The Liquidity Supplier transfers the Whole Basket Quantity (in Bitcoin) to the Belief’s Vault Steadiness on T+1 or T+2, relying on the order placement time.

Redemption of Baskets (Promoting Bitcoin):

- The Approved Individuals place redemption orders with the Switch Agent no later than 1:59:59 p.m., New York time, on every enterprise day.

- The Sponsor determines the Whole Basket NAV and any Variable Price as quickly as practicable after 4 p.m., New York time.

- The Liquidity Supplier delivers the Whole Basket NAV (much less any Variable Price) to the Money Account on T+2 (or T+1 on a case-by-case foundation, as authorized by the Sponsor).

In each eventualities, the essential time for initiating orders is earlier than 2:00 p.m., New York time, on a enterprise day. The precise switch of Bitcoin (both to the Belief’s Vault Steadiness within the case of creations or from the Custodian to the Liquidity Supplier within the case of redemptions) happens on T+1 or T+2, relying on the particular circumstances of the order.

These transactions might doubtlessly have an effect on the spot worth of Bitcoin, particularly if massive orders are positioned. Nonetheless, the precise impression on the spot worth would rely on numerous elements, together with the dimensions of the orders relative to the typical day by day buying and selling quantity of Bitcoin and the market situations on the time of the transactions.

The transfers of Bitcoin from the belief and the timing align with the creation and redemption processes, suggesting that maybe simply $200 million in redemptions was deemed mandatory by Grayscale following the primary day of buying and selling. It is very important notice that that is extremely speculative, however one doable motive for the outflows said above.

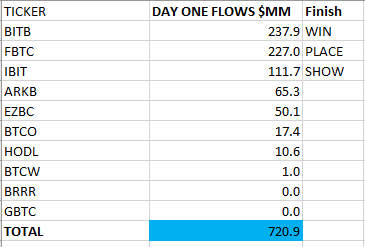

Bitcoin ETF flows.

Moreover, BlackRock’s day-one inflows had been round $112 million, with solely $10 million in seed capital. This means the fund ought to require at the very least $90 million in Bitcoin to match the share purchases.

Bloomberg’s Eric Balchunas shared estimates of round $720 million in inflows into Bitcoin ETFs on day one. Nonetheless, as of the shut of buying and selling, he couldn’t establish how a lot of those flows could also be offset by promoting out of the Grayscale belief, which has the best payment by some margin among the many new spot Bitcoin ETFs. Grayscale costs 1.5% yearly, whereas others are as little as 0.2%, with some providing zero charges for a promotional interval.

As with Grayscale, the above inflows would require the funds to match shares with Bitcoin, however all share creations have to be executed with money. Because of this Bitcoin can’t be used to create shares. If an investor sells shares in a single ETF and buys shares in one other, one fund can not give Bitcoin to a different if outflows go into one other. Money have to be used for creation and redemption per the present SEC rulings.

For any funds utilizing a T+2 settlement, with Monday being a financial institution vacation within the U.S., Bitcoin will not be settled till Tuesday, leaving room for an thrilling weekend of Bitcoin worth motion.