Distinguished digital asset supervisor Grayscale will slash its administration charges to 1.5% from 2% for its proposed spot Bitcoin exchange-traded fund (ETF), based on an up to date S3 submitting submitted to the U.S. Securities and Change Fee on Jan. 8. The asset supervisor stated the charges are payable within the prime cryptocurrency.

The submitting additional revealed that the asset supervisor added Jane Avenue, Virtu Americas, Macquarie Capital, and ABN AMRO Clearing as licensed members (APs) for its proposed ETF. It additionally named Jane Avenue, Virtu Circulate Merchants, and Flowdesk liquidity suppliers for the ETF.

Excessive charges

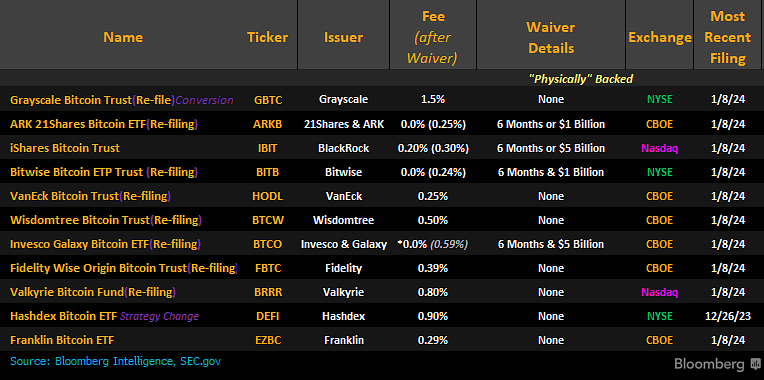

Regardless of Grayscale’s payment lower, the agency’s price stays notably greater than the proposed charges by ETF issuers like BlackRock and others, who’ve principally charged beneath 1%.

Ark and 21 Shares lowered its charges to 0.25% from 0.8% earlier in the present day whereas waiving its charges for the primary six months or $1 billion. One other asset supervisor, VanEck, additionally plans to cost 0.25%.

In distinction, BlackRock has outlined a payment construction beginning at 0.2% for the preliminary 12 months and $5 billion of its ETF, which can improve to 0.3% later. Bitwise opted for a 0% cost through the first six months, adopted by a 0.24% payment thereafter.

Others, like Wisdomtree, Invesco Galaxy, Constancy, Valkyrie, Hashdex, and Franklin Templeton, cost between 0.39% and 0.9%, respectively.

Grayscale stands out amongst ETF candidates by strategically focusing on the transformation of its Bitcoin Belief right into a spot ETF. This distinctive method positions Grayscale favorably towards opponents as a consequence of its substantial current holdings of BTC. The agency holds almost 620,000 items of BTC, value nearly $27 billion.

Ryan Selkis, Messari founder and CEO, additional defined why the agency may be sustaining a excessive payment, mentioning that:

“The brand new ETF issuers are racing to the underside on charges the place each BILLION {dollars} in AUM results in $3-5 MILLION in annual income. Grayscale’s head begin means beginning ARR [annual recurring revenue] of $420 million.”

Eric Balchunas, Bloomberg’s ETF analyst, additionally famous that decreasing Grayscale’s charges would possibly kill their margins.