Crypto asset supervisor Grayscale has questioned the U.S. Securities and Trade Fee’s resolution to approve a leveraged Bitcoin (BTC) exchange-traded fund (ETF) in a July 10 letter.

The agency’s Bitcoin Belief (GBTC) additionally narrowed to its lowest level since Could 2022, in line with ycharts information,

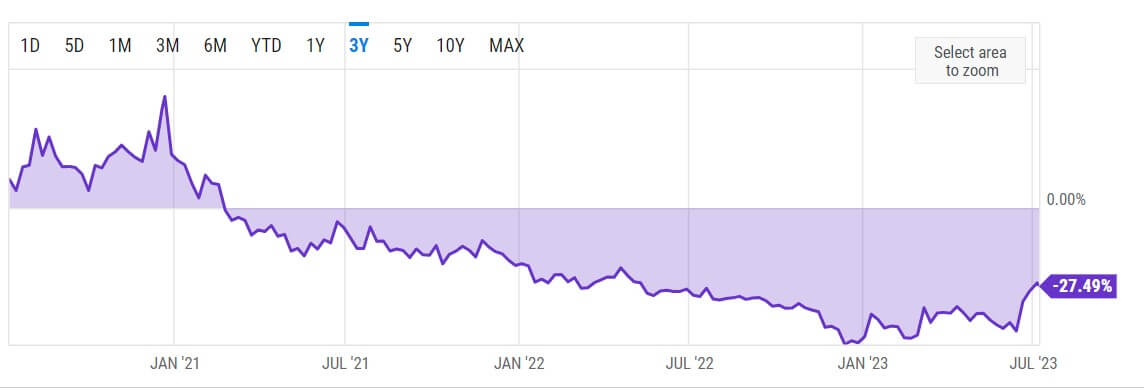

GBTC low cost narrows

GBTC’s low cost to its internet asset worth (NAV) narrowed to 27.49%, and its shares had been buying and selling close to $20, in line with ycharts information.

In the course of the previous few weeks, GBTC’s low cost has more and more narrowed, and the worth of its shares has outperformed that of Bitcoin. For context, whereas GBTC shares have risen by almost 43% through the previous month, BTC’s worth gained solely 17% throughout the identical timeframe, in line with StarCrypto’s information.

Market observers have attributed GBTC’s improved efficiency to BlackRock’s software for a Bitcoin spot ETF. For the reason that asset supervisor utilized for a spot BTC ETF on June 15, different conventional monetary establishments, together with Constancy and others, have utilized for the same ETF.

Grayscale questions SEC over BTC leverage ETF

On July 10, Grayscale criticized the U.S. monetary regulator’s resolution to approve a leveraged BTC ETF—an funding fund that goals to generate amplified returns through the use of monetary derivatives and debt—arguing that the SEC’s actions show it’s appearing arbitrarily.

The agency wrote:

“The 2x levered bitcoin futures ETF employs leverage with the aim of doubling the efficiency of the S&P CME Bitcoin Futures Day by day Roll Index every day. This exposes buyers to a fair riskier funding product than conventional bitcoin futures exchange-traded merchandise.”

Grayscale identified that the thrill generated by this leveraged BTC ETF exhibits that “investors are looking forward to BTC publicity with the protections of the ETF wrapper.”

The agency added that the SEC had no good cause to disclaim the approval of spot merchandise whereas approving leveraged futures merchandise.

Final yr, the SEC rejected Grayscale’s plan to transform its Bitcoin Belief into an ETF, forcing the agency to file a lawsuit towards the SEC, arguing {that a} spot ETF was not completely different from a futures ETF—which the SEC had beforehand permitted.

The publish Grayscale challenges SEC’s resolution on leveraged Bitcoin ETF as GBTC low cost narrows appeared first on StarCrypto.