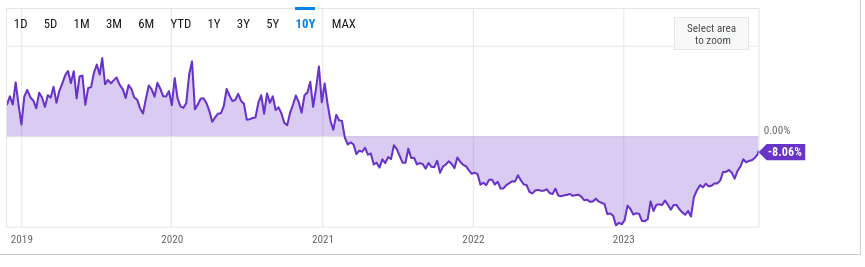

In line with market information from YCharts on Nov. 24, the Grayscale Bitcoin Belief (GBTC) low cost price has narrowed to eight.06%.

The “low cost” refers back to the state of affairs the place the Grayscale Bitcoin Belief (GBTC) shares are buying and selling at a value decrease than their underlying web asset worth (NAV).

GBTC started buying and selling at a reduction in early 2021, someday after Grayscale halted GBTC redemptions. As buying and selling continued, the asset low cost reached its lowest level at 48% in late 2022. The low cost progressively started to slim in early 2023, culminating within the present 8% low cost. An 8% low cost has not been seen since mid-2021.

Earlier than March 2021, GBTC was buying and selling above its web asset worth, often called a premium. Nevertheless, in response to a separate report from consultants, it’s unlikely that the fund will commerce at a premium once more. One skilled even advised that if Grayscale’s plan to transform GBTC into an ETF is realized, any current premium will seemingly vanish.

Investor optimism could also be narrowing low cost

Latest developments have seemingly contributed to the newest change in worth and the fund’s bigger development towards a 0% value distinction.

Over time, the final optimism about Grayscale’s proposal to transition GBTC right into a spot Bitcoin ETF appears to have contributed to the narrowing of the low cost. The corporate received a court docket case in June that compelled the U.S. Securities and Alternate Fee (SEC) to evaluation its spot ETF software. Reviews from October indicated that the SEC wouldn’t attraction the ruling.

Extra not too long ago, in late November, Grayscale stated that it had entered talks with the SEC round its proposal. It additionally submitted an up to date submitting to the SEC. Moreover, Ark Make investments — one other firm that’s in search of its personal spot Bitcoin ETF — bought about $10 million of GBTC shares beginning in late October. These gross sales might have affected the worth of GBTC instantly or influenced different buying and selling exercise.

The publish Grayscale Bitcoin Belief’s low cost narrows to eight% amid rising ETF optimism appeared first on StarCrypto.