Key Takeaways

- Crypto volatility has picked up within the final two weeks

- A optimistic court docket ruling concerning the conversion of Grayscale’s Bitcoin belief into an ETF propelled markets final week

- Features have since been given up as SEC pushed out evaluation date for ETF filings

After an extended interval of calm, the crypto markets have lastly proven indicators of life within the final couple of weeks. First, the worth of Bitcoin fell from $29,000 to $26,000 two weeks in the past, together with a 7% dip in ten minutes, as markets recalibrated to extra hawkish rate of interest expectations.

Final week, the worth rose again as much as $27,000, buoyed by a seemingly optimistic ruling within the courts. A federal court docket dominated final Tuesday that the SEC was incorrect to reject an utility from Grayscale Investments to transform its belief into an ETF, the choose saying the regulator did not “provide any clarification” following its ruling.

Whereas this doesn’t assure the eventual conversion of the belief into an ETF, it’s nonetheless an enormous win for each Grayscale and merchants who had been betting on a optimistic final result, with a agency suggestion to the SEC that it ought to evaluate its choice to reject.

Beforehand, the SEC rejected Grayscale’s utility on grounds that the merchandise weren’t “designed to forestall fraudulent and manipulative acts and practices.” Grayscale subsequently sued.

Nevertheless, the increase to markets ended up being short-term, for causes once more associated to the SEC. The regulating physique delayed its choice on all ETF purposes, together with these filed by Blackrock and Constancy, to October. Quickly, Bitcoin was again down at $26,000.

The week sums up the 12 months thus far for Bitcoin, an asset that has been tossed about by developments within the regulatory sphere all 12 months.

Nevertheless, assessing the worth of GBTC, and evaluating it to Bitcoin, does present that the market feels extra regulatory readability is on the best way – and doubtlessly in a optimistic means. Within the subsequent chart, we’ve plotted the efficiency of GBTC in opposition to Bitcoin because the latter’s all-time excessive in November 2021.

All through the bear market, in addition to the rebound in 2023, Grayscale traders have suffered worse than counterparts who invested in Bitcoin immediately. However in latest months, the low cost has been declining, with the court docket ruling pushing a considerable convergence final week.

If we plot the identical two belongings once more however as an alternative of going again to Bitcoin’s all-time excessive in This fall of 2021, we take a look at returns because the begin of the 12 months, it’s GBTC that outperforms.

The soar in mid-June stands out, which coincides with the submitting of a number of spot Bitcoin ETFs, led by Blackrock. This led the market to maneuver in the direction of the belief that conversion of Grayscale’s belief into an ETF is extra probably – one thing which has develop into extra actual once more following the ruling final week in opposition to the SEC, and therefore triggered even additional outperformance by GBTC.

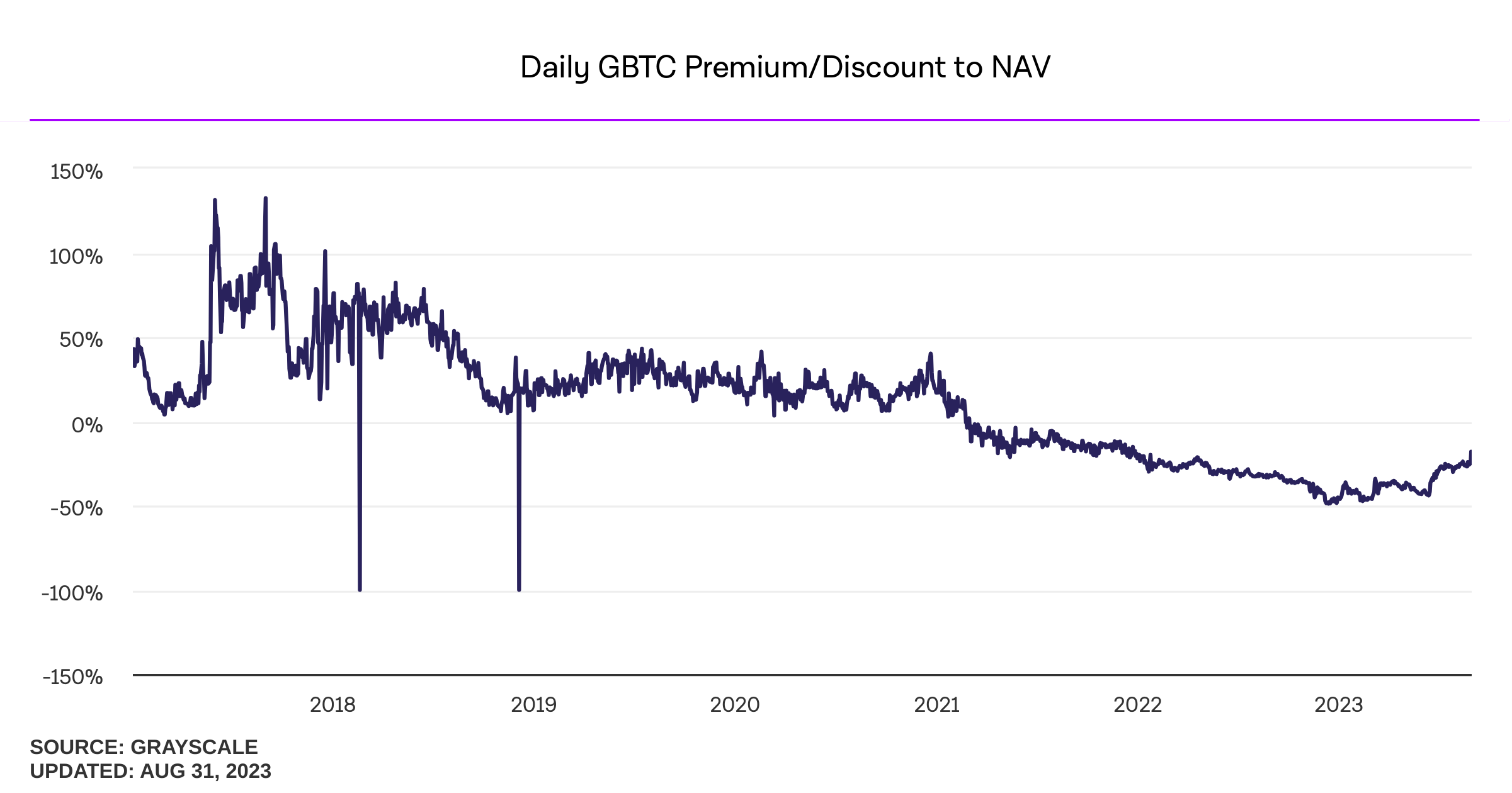

Following the ruling final week, the low cost of GBTC to its web asset worth has narrowed to 19%, the bottom since 2021.

In fact, the conversion of GBTC to an ETF feels inevitable, the court docket ruling summising what most across the market would imagine ought to occur at some stage.

JP Morgan agrees, and in addition speculated positively about what the ruling means for different ETF filings, with its analysts scripting this week that “[The delay] probably factors to approval of a number of spot bitcoin ETF purposes without delay fairly than granting a first-mover benefit to any single applicant.”

The market doesn’t lie, and with the low cost on GBTC right down to 19%, it represents substantial progress. Nevertheless, 19% continues to be an unlimited chasm, highlighting that there stays a strategy to go earlier than all that is resolved.