- GRASS token surged 28.46% this week, signaling robust bullish momentum forward.

- Key help at $0.87 and resistance at $1.05 information potential worth actions.

- Regardless of quantity drop, open curiosity surged 57.85%, indicating dealer engagement.

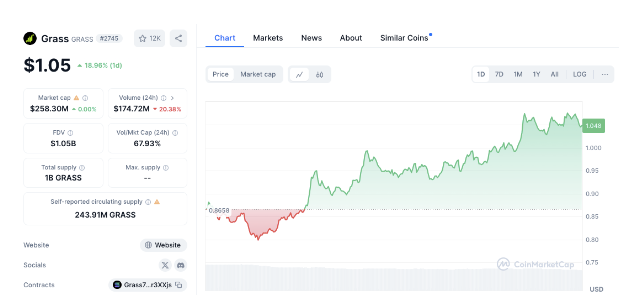

The GRASS token has attracted investor consideration with a formidable surge of 28.46% this week. The value has climbed from roughly $0.87 to $1.05, demonstrating important bullish momentum.

Over the past day alone, the token has jumped 21.35%, indicating robust market curiosity. As buyers analyze the present worth traits, many are asking whether or not this rally can proceed within the coming days.

The present help degree for GRASS is round $0.87. This level was a latest low earlier than the token’s upward trajectory started. If the worth falls, this degree will probably be a necessary barrier the place consumers could re-enter the market.

As well as, a notable resistance degree has fashioned at roughly $1.05. Right here, the worth motion appears to be slowing down, suggesting that sellers could also be stepping in. A breakout above this resistance may result in additional upward momentum for the token.

If GRASS strikes convincingly previous the $1.05 mark, the subsequent goal will seemingly be $1.10. This degree is critical as a result of it aligns with psychological buying and selling thresholds. Nevertheless, if the token falls, the $0.95 degree could act as robust help, offering help for the continued uptrend.

Analyzing Derivatives Knowledge

As per Coinglass information, regardless of the spectacular worth enhance, the derivatives market has proven blended indicators. Whole buying and selling quantity has dropped 24.01% to $301.79 million.

Nevertheless, this decline has occurred alongside a notable surge in open curiosity, which has skyrocketed 57.85% to $43.32 million. This enhance means that merchants have gotten extra engaged, making bets on future worth actions.

When it comes to lengthy/brief ratios, Binance’s GRASS/USDT accounts have a ratio of 1.0247. In the meantime, OKX’s GRASS ratio is at 0.6. liquidations reveals fascinating traits throughout totally different timeframes. Over 24 hours, liquidations have totaled $839.76K. Of this quantity, $306.55K has been from lengthy positions, whereas $533.21K has been from shorts.

Associated: Why Excessive Preliminary Token Circulation Is the Way forward for Tokenomics

Associated: Crypto Roundup: Memecoin Mania, Ethereum Accumulation, Bitcoin’s Surge

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t liable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.