Gold, traditionally considered as a retailer of worth and a hedge towards financial turbulence, is usually the benchmark asset towards which many others are gauged. Within the crypto age, Bitcoin (BTC) and Ethereum (ETH) have emerged as contenders to gold’s throne, not as direct replacements however as fashionable alternate options representing a brand new breed of digital belongings.

Evaluating their efficiency towards gold supplies insights into market sentiment, the evolving panorama of funding, and the potential dangers and rewards related to each conventional and digital belongings. In 2023, the trajectories of Bitcoin, Ethereum, and gold had been notably distinct.

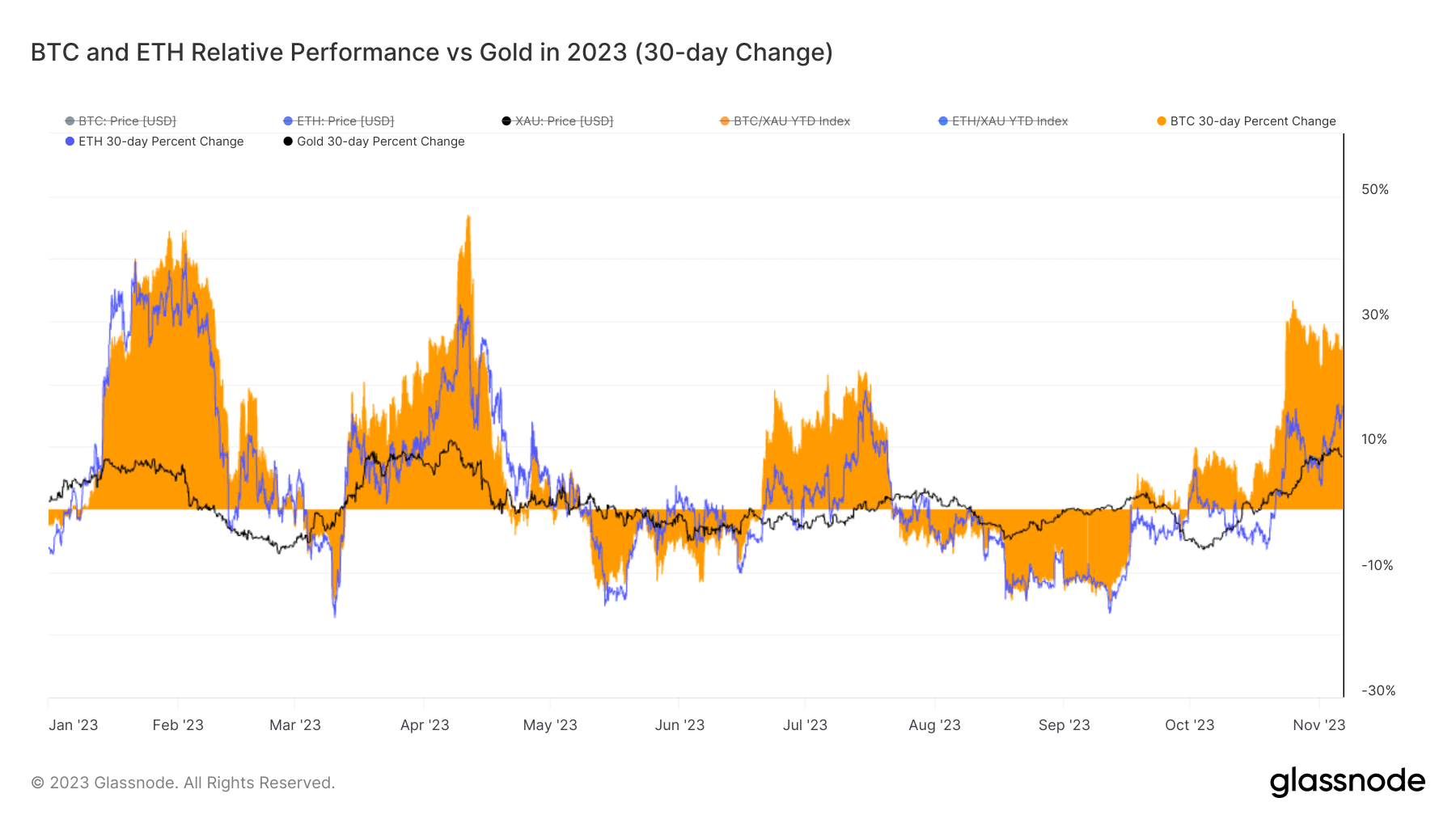

Bitcoin confirmed its risky nature all year long. On common, BTC grew by 6.90% month-to-month. In April, it reached a exceptional peak efficiency of 46.99%, however the winds shifted in June, pushing it to a dip of 14.99%. Ethereum adopted the same sample, albeit with barely subdued fluctuations. Ethereum’s month-to-month common ascent was 3.70%. Its peak was in Could, touching 40.82%, however by July, it confronted a decline of 17.34%.

Contrasting sharply with the 2 main cryptocurrencies, gold moved with extra predictability. Throughout 2023, its common month-to-month worth adjustment was a modest 0.87%. March witnessed its highest surge, hitting 11.04%, whereas September noticed a dip of seven.09%.

Reflecting on the whole yr, Bitcoin’s assertive presence within the crypto market was plain. By November, it surged 111.76%. Ethereum, whereas not mirroring Bitcoin’s meteoric rise, nonetheless recorded a year-to-date development of 58.72%. Gold, ever the regular performer, elevated by 8.84% for the reason that starting of the yr.

These dynamics underscore a number of pivotal market narratives. Firstly, the pronounced volatility in cryptocurrencies underscores each their potential for vital returns and their susceptibility to sharp declines. This dual-edged nature of digital belongings is a testomony to their nascent stage within the monetary ecosystem, influenced by elements starting from regulatory developments to technological developments.

Gold’s modest but regular efficiency reinforces its popularity as a stabilizing asset, one much less inclined to the speedy market actions typically related to cryptocurrencies. It stays a well-liked alternative for traders in search of a hedge towards broader market uncertainties, whilst its returns are overshadowed by the extra aggressive development trajectories of digital belongings.

The publish Gold stays secure whereas volatility rocks Bitcoin and Ethereum’s 2023 appeared first on starcrypto.