- Bullish GMX (GMX) value prediction ranges from $67.7823 to 72.758.

- GMX value may additionally attain $100 quickly.

- GMX’s bearish market value prediction for 2023 is $39.760.

The idea of decentralization has grown as customers understand its significance as time passes. GMX permits customers entry to decentralization options by way of its spot and perpetual trade. Furthermore, GMX permits buying and selling with BTC, ETH, and varied different prime cryptocurrencies instantly from the consumer’s pockets.

GMX consists of two tokens that assist in empowering their ecosystem. GMX is the utility and governance token of the platform. In the meantime, GLP is a liquidity supplier token. GMX additionally holds varied different advantages for the holders.

If you wish to find out about GMX’s value evaluation and forecast for 2023, 2024, 2025, 2026, 2027, 2028 till 205, learn this Coin Version value prediction article.

GMX (GMX) Market Overview

| 🪙 Title | GMX |

| 💱 Image | gmx |

| 🏅 Rank | #90 |

| 💲 Value | $47.45 |

| 📊 Value Change (1h) | -0.53394 % |

| 📊 Value Change (24h) | 6.63087 % |

| 📊 Value Change (7d) | -8.52932 % |

| 💵 Market Cap | $417221236 |

| 📈 All Time Excessive | $91.07 |

| 📉 All Time Low | $11.53 |

| 💸 Circulating Provide | 8791606.14102 gmx |

| 💰 Whole Provide | 8791606.14102 gmx |

What’s GMX (GMX)?

GMX is a decentralized spot and perpetual trade that permits customers to commerce Bitcoin (BTC), Ethereum (ETH), and different main cryptocurrencies straight from their cryptocurrency wallets. The GMX consumer might execute spot swaps and commerce perpetual futures with as much as 50x leverage, simply as on a centralized trade. Not like a centralized trade, they protect custody of their belongings through the use of a cryptocurrency pockets.

The GMX token serves as each a utility and a governance token, and token holders might put it to use to vote on concepts that can assist form the trade’s future.

Token holders who stake their GMX obtain three extra prizes that the system employs to reward customers. To start, GMX stakeholders obtain 30% of all acquired protocol charges. These prices are paid in ETH or AVAX and are collected through market making, swap charges, and leverage buying and selling.

The stakers additionally obtain escrowed GMX (esGMX) tokens. These esGMX tokens might be staked or invested in trade for rewards, and the tokens are transformed again into GMX over 12 months when a consumer stakes GMX. esGMX emissions are a sort of locked staking that stops customers from promoting their GMX straight away.

Final however not least, stakers accumulate Multiplier Factors that improve their yield and reward long-term buyers with out inflicting token inflation. These two incentives encourage loyalty to GMX and advance decentralized platform possession.

By an easy swap interface that resembles typical buying and selling platforms, GMX permits merchants to open leveraged positions. Moreover, as a result of GMX is self-custodial and trustless, anyone might commerce cryptocurrencies instantly from their personal pockets.

Its twin trade mannequin helps each spot swaps and leveraged buying and selling of perpetual swaps. Because of the excessive asset utilization of the GLP pool, which permits consumer deposits to create extra yield as an alternative of sitting dormant, this could improve capital effectivity.

On GMX, buying and selling positions could also be entered and exited with out affecting costs. With this strategy, merchants can acquire higher entry costs than on some order book-based exchanges with slippage. As well as, GMX smooths out value variations utilizing a mixture of Chainlink Oracles and different value feeds, which helps defend holdings in opposition to wicks that trigger transient liquidation of positions.

Analyst’s View on GMX

A crypto analyst on Twitter tweeted that GMX is likely one of the mid-cap cash buyers would possibly need to spend money on. He even talked about that 30% of the funding portfolio may very well be invested in GMX.

Furthermore, a crypto investor with over 350K followers on Twitter, Girl of Crypto, tweeted that she is now making some huge cash by investing in GMX though each mainstream coin is crashing for the time being. We will observe that she is a powerful believer in GMX.

One other tweet from the founding father of Altcryptotalk buying and selling group states that if buyers are holding GMX proper now and after holding GMX for 2 years, there could also be a chance that they could develop into a billionaire.

GMX Present Market Standing

With 8,790,974.38 GMX in circulation, GMX is buying and selling at $47.59 on the time of writing, primarily based on CoinMarketCap. GMX has a 24-hour buying and selling quantity of $23,700,617. Furthermore, the value of GMX elevated by 8.36% throughout the earlier 24 hours.

Binance, Kucoin, Krakenl, OKX, Gate.io, and Bybit are at the moment the preferred cryptocurrency exchanges for GMX buying and selling.

GMX Value Evaluation 2023

Presently, GMX ranks 81 on CoinMarketCap. Will GMX’s most up-to-date enhancements, additions, and modifications assist the value of cryptocurrencies rise? First, let’s concentrate on the charts on this article’s GMX value forecast.

GMX Value Evaluation – Bollinger Bands

The Bollinger Bands is a technical evaluation instrument that’s used to investigate value motion and volatility. Bollinger Bands (BB) makes use of the time interval and the stand deviation of the value. Usually, the default worth of BB’s interval is about at 20. The higher band of the BB is calculated by including 2 instances the usual deviations to the Easy Transferring Common (SMA), whereas the decrease band is calculated by subtracting 2 instances the usual deviation from the SMA. Based mostly on the empirical legislation of ordinary deviation, 95% of the info units will fall inside the two customary deviations of the imply.

GMX’s candlesticks have touched the decrease band, indicating that the altcoin entered the oversold territory. Nevertheless, after touching the band, inexperienced candlesticks have lately shaped indicating that it might quickly climb upwards. Furthermore, the upward motion might be confirmed as there’s a sign {that a} development reversal may occur because the bands proceed to increase. The Bollinger Band Width additionally confirms this speculation that the GMX’s market might expertise excessive volatility because it continues to maneuver upwards.

GMX Value Evaluation – Relative Power Index (RSI)

The Relative Power Index (RSI) is a momentum indicator utilized to search out out the present development of the value motion and decide whether it is within the oversold or overbought area. Merchants usually use this instrument to make choices about when to purchase or promote the tokens. When the RSI is usually valued beneath or at 30, it’s thought-about an oversold area, and a value correction may occur quickly. Furthermore, when the RSI is valued above or at 70, it’s considered the overbought area, and merchants anticipate the value may fall quickly.

The RSI is at the moment valued at 39.67 and remains to be thought-about a weak development by most merchants as it’s valued between 50 and 30. Nevertheless, the RSI indicator additionally confirms that GMX might present a optimistic sentiment because the RSI crossed above the SMA, which may very well be thought-about a bullish development. Furthermore, the RSI continues to be pointed upwards and there’s a excessive chance that it might attain a powerful development valued between 50 and 70 throughout GMX’s bullish development.

GMX Value Evaluation – Transferring Common (MA)

The candlesticks are beneath the 200MA and the 50MA, indicating that GMX is witnessing a downtrend. The 4-Hour GMX/USD additionally exhibits that the newly-formed candles moved upwards and entered the consolidation space indicating that there could also be an uptrend sooner or later. Nevertheless, merchants should be cautious within the consolidation space as earlier value actions recommend that GMX fell after a slight uptrend into the consolidation space.

GMX Value Evaluation – Transferring Common Convergence Divergence (MA)

The Transferring Common Convergence Divergence (MACD) indicator can be utilized to determine potential value traits, momentums, and reversals in markets. MACD will simplify the studying of a shifting common cross simpler. The MACD indicator is calculated by subtracting the long-term EMA (Exponential Transferring Common) indicator from the short-term EMA. Usually, the default values for the MACD are set at 12-day EMA, 26-day EMA, and 9-day EMA. Furthermore, MACD is taken into account a lagging indicator because it can’t present commerce indicators with none previous value information. MACD performs an vital function as it could possibly verify the traits and determine potential reversals.

Though the candlestick was going through a gradual decline over the previous few days, the MACD indicator exhibits that there a optimistic momentum might occur quickly for GMX. The MACD line met the sign line on the crossroad indicating {that a} bullish crossover might happen quickly. The bullish crossover would act as a sign that GMX might expertise an uptrend within the quick time period interval. If the bullish crossover takes place and the GMX uptrend begins, then, the candlesticks may escape from the Help area.

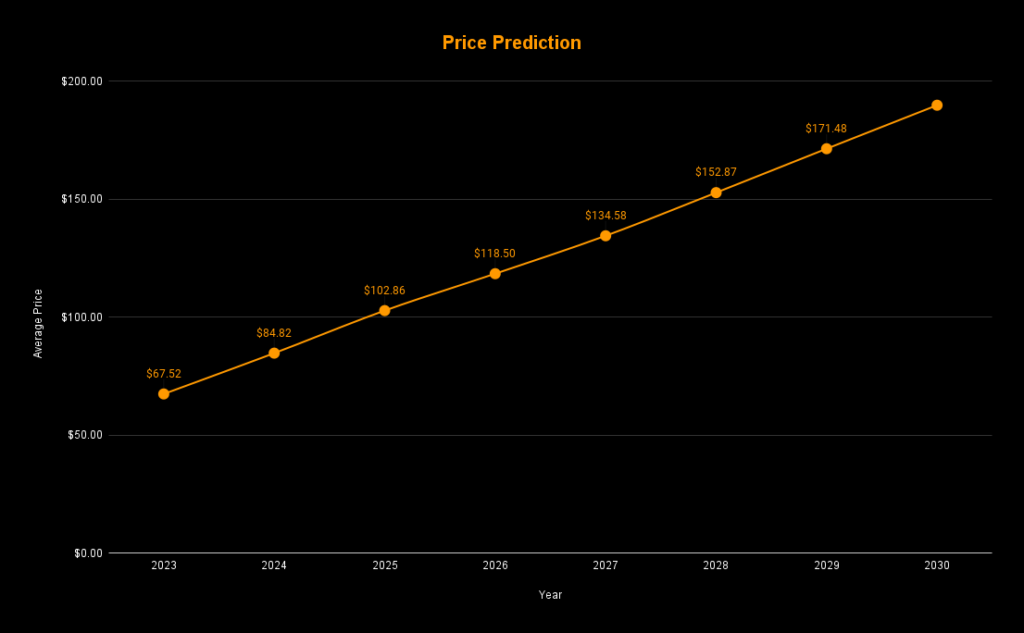

GMX Value Prediction 2023-2030 Overview

| Yr | Minimal Value | Common Value | Most Value |

| 2023 | $43.695 | $67.520 | $80.750 |

| 2024 | $78.089 | $84.820 | $92.720 |

| 2025 | $93.259 | $102.860 | $107.890 |

| 2026 | $108.892 | $118.499 | $123.535 |

| 2027 | $124.968 | $134.575 | $139.611 |

| 2028 | $143.259 | $152.866 | $157.902 |

| 2029 | $161.869 | $171.476 | $176.512 |

| 2030 | $180.309 | $189.916 | $194.952 |

| 2040 | $195 | $250 | $310 |

| 2050 | $476 | $530 | $580 |

GMX Value Prediction 2023

GMX is at the moment buying and selling between the Weak Resistance and the Help area. The candlesticks deflected from the Help area after going through a gradual fall over time. Furthermore, the MACD line might kind a bullish crossover if it crosses above the sign line. After forming new inexperienced candlesticks, GMX is experiencing a really sturdy energy in its development because the ADX is valued at 39.24. Merchants ought to watch for the affirmation earlier than getting into the commerce such because the bullish crossover and the ADX’s steady affirmation of development energy.

In the meantime, the value prediction of GMX for 2023 stays to be bullish and is predicted to succeed in past the extent of $67.7823 The bearish value prediction vary for GMX is between $37.812 to $39.760. Nevertheless, if GMX experiences excessive bullish sentiment, then it might attain the $90 stage.

| Bullish Value Prediction | Bearish Value Prediction |

| $67.7823 – 72.758 | $37.812 – $39.760 |

GMX Value Prediction 2023 – Resistance and Help Ranges

The candlesticks lately bounced away from the Help stage after going through a downfall. If GMX experiences a bullish interval, it has the potential to succeed in its excessive bullish space on the $67 stage. GMX has the potential to succeed in resistance stage 2 on the $90 stage if it continues to expertise an especially bullish interval. Furthermore, when GMX passes by way of every Resistance, every stage may develop into a brand new Help stage.

| Month | Minimal Value | Common Value | Most Value |

| July 2023 | 43.695 | 55.720 | 63.743 |

| August 2023 | 54.469 | 67.520 | 72.541 |

| September 2023 | 69.099 | 70.120 | 76.180 |

| October 2023 | 72.897 | 74.920 | 77.943 |

| November 2023 | 74.875 | 75.900 | 79.921 |

| December 2023 | 75.570 | 76.690 | 80.750 |

GMX Value Prediction 2024

GMX (GMX) value can rise to unimaginable heights, peaking at $92.66. It’s possible provided that the market continues its upward path and GMX breaks by way of the previous psychological resistance ranges.

| Month | Minimal Value | Common Value | Most Value |

| January 2024 | 78.089 | 78.110 | 78.133 |

| February 2024 | 79.927 | 79.940 | 79.969 |

| March 2024 | 81.765 | 81.790 | 81.850 |

| April 2024 | 83.498 | 83.510 | 83.533 |

| Might 2024 | 84.799 | 84.820 | 84.841 |

| June 2024 | 85.697 | 85.720 | 85.780 |

| July 2024 | 87.665 | 87.690 | 87.713 |

| August 2024 | 88.439 | 88.490 | 88.511 |

| September 2024 | 90.069 | 90.090 | 90.150 |

| October 2024 | 90.867 | 90.890 | 90.913 |

| November 2024 | 91.845 | 91.870 | 91.891 |

| December 2024 | 92.540 | 92.660 | 92.720 |

GMX Value Prediction 2025

GMX costs would possibly develop to $107.830 throughout the subsequent three years. That is solely possible if the market continues its upward path and if GMX breaks by way of the previous psychological resistance ranges.

| Month | Minimal Value | Common Value | Most Value |

| January 2025 | 93.259 | 93.280 | 93.303 |

| February 2025 | 95.097 | 95.110 | 95.139 |

| March 2025 | 96.935 | 96.960 | 97.020 |

| April 2025 | 98.668 | 98.680 | 98.703 |

| Might 2025 | 99.969 | 99.990 | 100.011 |

| June 2025 | 100.867 | 100.890 | 100.950 |

| July 2025 | 102.835 | 102.860 | 102.883 |

| August 2025 | 103.609 | 103.660 | 103.681 |

| September 2025 | 105.239 | 105.260 | 105.320 |

| October 2025 | 106.037 | 106.060 | 106.083 |

| November 2025 | 107.015 | 107.040 | 107.061 |

| December 2025 | 107.710 | 107.830 | 107.890 |

GMX Value Prediction 2026

GMX costs would possibly develop to $123.475 throughout the subsequent 4 years. The expansion will proceed after that reasonable, however no vital drops are forecast.

| Month | Minimal Value | Common Value | Most Value |

| January 2026 | 108.892 | 108.913 | 108.936 |

| February 2026 | 110.736 | 110.749 | 110.778 |

| March 2026 | 112.574 | 112.599 | 112.659 |

| April 2026 | 114.307 | 114.319 | 114.342 |

| Might 2026 | 115.608 | 115.629 | 115.650 |

| June 2026 | 116.506 | 116.529 | 116.589 |

| July 2026 | 118.474 | 118.499 | 118.522 |

| August 2026 | 119.248 | 119.299 | 119.320 |

| September 2026 | 120.878 | 120.899 | 120.959 |

| October 2026 | 121.676 | 121.699 | 121.722 |

| November 2026 | 122.658 | 122.683 | 122.704 |

| December 2026 | 123.355 | 123.475 | 123.535 |

GMX Value Prediction 2027

Traders anticipate a bullish run in 2027 as a result of halving of Bitcoin. GMX costs would possibly soar to $139.551 within the subsequent 5 years. Moreover, hitting this stage could also be simple for GMX as different mediums, corresponding to short-term and long-term value goals for buy or promote orders, could also be found.

| Month | Minimal Value | Common Value | Most Value |

| January 2027 | 124.968 | 124.989 | 125.012 |

| February 2027 | 126.812 | 126.825 | 126.854 |

| March 2027 | 128.650 | 128.675 | 128.735 |

| April 2027 | 130.383 | 130.395 | 130.418 |

| Might 2027 | 131.684 | 131.705 | 131.726 |

| June 2027 | 132.582 | 132.605 | 132.665 |

| July 2027 | 134.550 | 134.575 | 134.598 |

| August 2027 | 135.324 | 135.375 | 135.396 |

| September 2027 | 136.954 | 136.975 | 137.035 |

| October 2027 | 137.752 | 137.775 | 137.798 |

| November 2027 | 138.734 | 138.759 | 138.780 |

| December 2027 | 139.431 | 139.551 | 139.611 |

GMX Value Prediction 2028

In 2028, Bitcoin halving will happen. Therefore, the consolidating market in 2027 may very well be adopted by a bullish run. Notably, the market may attain increased values. Within the subsequent 5 years, GMX costs may rise to $158. Based on the forecast, GMX has a powerful likelihood of reaching the earlier ATH.

| Month | Minimal Value | Common Value | Most Value |

| January 2028 | 143.259 | 143.280 | 143.303 |

| February 2028 | 145.103 | 145.116 | 145.145 |

| March 2028 | 146.941 | 146.966 | 147.026 |

| April 2028 | 148.674 | 148.686 | 148.709 |

| Might 2028 | 149.975 | 149.996 | 150.017 |

| June 2028 | 150.873 | 150.896 | 150.956 |

| July 2028 | 152.841 | 152.866 | 152.889 |

| August 2028 | 153.615 | 153.666 | 153.687 |

| September 2028 | 155.245 | 155.266 | 155.326 |

| October 2028 | 156.043 | 156.066 | 156.089 |

| November 2028 | 157.025 | 157.050 | 157.071 |

| December 2028 | 157.722 | 157.842 | 157.902 |

GMX Value Prediction 2029

By 2029, there may very well be a lot stability within the value of most cryptocurrencies that had stayed for over a decade. This is because of implementing classes discovered to make sure their buyers retain the challenge’s confidence. Within the subsequent six years, GMX costs may rise to $176.45. Based on the forecast, GMX has a powerful likelihood of reaching the earlier ATH.

| Month | Minimal Value | Common Value | Most Value |

| January 2029 | 161.869 | 161.890 | 161.913 |

| February 2029 | 163.713 | 163.726 | 163.755 |

| March 2029 | 165.551 | 165.576 | 165.636 |

| April 2029 | 167.284 | 167.296 | 167.319 |

| Might 2029 | 168.585 | 168.606 | 168.627 |

| June 2029 | 169.483 | 169.506 | 169.566 |

| July 2029 | 171.451 | 171.476 | 171.499 |

| August 2029 | 172.225 | 172.276 | 172.297 |

| September 2029 | 173.855 | 173.876 | 173.936 |

| October 2029 | 174.653 | 174.676 | 174.699 |

| November 2029 | 175.635 | 175.660 | 175.681 |

| December 2029 | 176.332 | 176.452 | 176.512 |

GMX Value Prediction 2030

The cryptocurrency market skilled excessive stability as a result of holding actions of early buyers in order to not lose future positive aspects within the value of their belongings. In 2030, GMX costs may rise to $195.

| Month | Minimal Value | Common Value | Most Value |

| January 2030 | 180.309 | 180.330 | 180.353 |

| February 2030 | 182.153 | 182.166 | 182.195 |

| March 2030 | 183.991 | 184.016 | 184.076 |

| April 2030 | 185.724 | 185.736 | 185.759 |

| Might 2030 | 187.025 | 187.046 | 187.067 |

| June 2030 | 187.923 | 187.946 | 188.006 |

| July 2030 | 189.891 | 189.916 | 189.939 |

| August 2030 | 190.665 | 190.716 | 190.737 |

| September 2030 | 192.295 | 192.316 | 192.376 |

| October 2030 | 193.093 | 193.116 | 193.139 |

| November 2030 | 194.075 | 194.100 | 194.121 |

| December 2030 | 194.772 | 194.892 | 194.952 |

GMX Value Prediction 2040

Based on our long-term GMX value estimate, GMX costs may attain a brand new all-time excessive this yr. If the present progress price continues, we may anticipate a mean value of $250 by 2040. If the market turns bullish, the value of GMX may go up past what we predicted for 2040.

| Minimal Value | Common Value | Most Value |

| $195 | $250 | $310 |

GMX Value Prediction 2050

Based on our GMX forecast, the common value of GMX in 2050 is perhaps above $530. If extra buyers are drawn to GMX between these years, the value of GMX in 2050 may very well be far increased than our projection.

| Minimal Value | Common Value | Most Value |

| $476 | $530 | $580 |

Conclusion

To summarize, if buyers proceed to point out curiosity in GMX and add these tokens to their portfolio, then, it may proceed to stand up. GMX’s bullish value prediction exhibits that it may go past the $67.7823 stage in 2023. Furthermore, GMX may surpass the $580 stage by the tip of 2050.

FAQ

The GMX token serves as each a utility and a governance token, and token holders might utilise it to vote on concepts that can assist form the trade’s future.

Token holders who stake their GMX obtain three extra prizes that the system employs to reward customers. To start, GMX stakeholders obtain 30% of all acquired protocol charges. These prices are paid in ETH or AVAX and are collected through market making, swap charges, and leverage buying and selling.

Like different digital belongings within the crypto world, GMX might be traded on many exchanges. Binance, Kucoin, Huobi World, Gate.io, and Bybit are at the moment the preferred cryptocurrency exchanges for buying and selling GMX.

Since GMX offers buyers with a number of alternatives to revenue from their crypto holdings, GMX is an effective funding in 2023. Nevertheless, GMX has a chance of surpassing its present ATH in 2023.

GMX is likely one of the few lively crypto belongings that proceed to rise in worth. So long as this bullish development continues, GMX would possibly break by way of $75 and attain as excessive as $100. If the present market favoring crypto continues, this can doubtless occur.

GMX is a superb cryptocurrency to take a position on this yr, given the current partnerships which have enhanced its acceptance.

There isn’t any information.

GMX was launched in September 2021.

Chris Larsen and Jed McCaleb based GMX.

There isn’t any information.

GMX might be saved in a chilly pockets, scorching pockets, or trade pockets.

GMX value is predicted to succeed in $76 by 2023.

GMX value is predicted to succeed in $92 by 2024.

GMX value is predicted to succeed in $107 by 2025.

GMX value is predicted to succeed in $123 by 2026.

GMX value is predicted to succeed in $140 by 2027.

GMX value is predicted to succeed in $157 by 2028.

GMX value is predicted to succeed in $176 by 2029.

GMX value is predicted to succeed in $194 by 2030.

GMX value is predicted to succeed in $250 by 2040.

GMX value is predicted to succeed in $530 by 2050.

Disclaimer: The views and opinions, in addition to all the knowledge shared on this value prediction, are revealed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates is not going to be held answerable for any direct or oblique injury or loss.