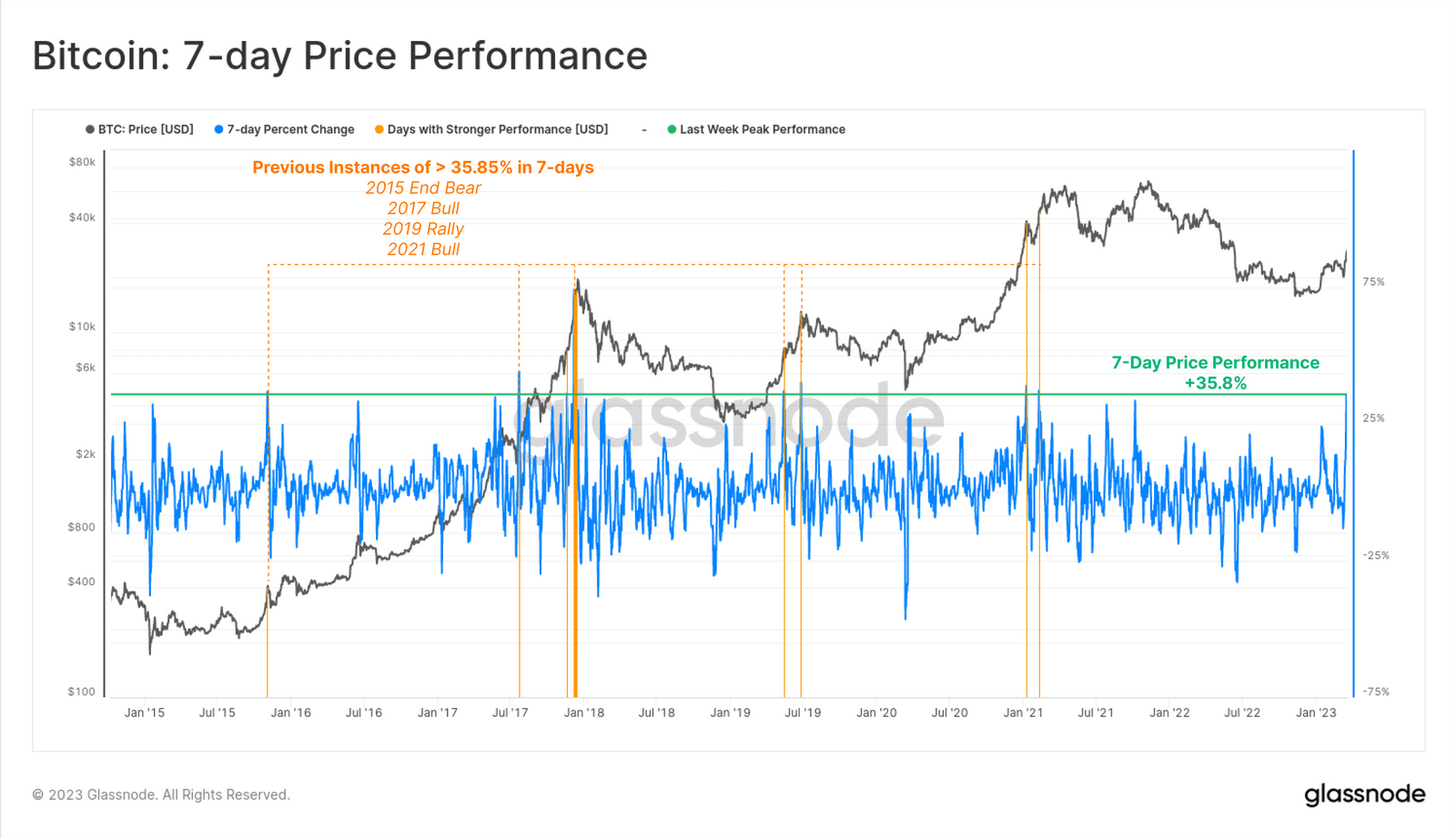

Bitcoin has had considered one of its finest weeks in historical past, with a closing enhance of 35.8%.

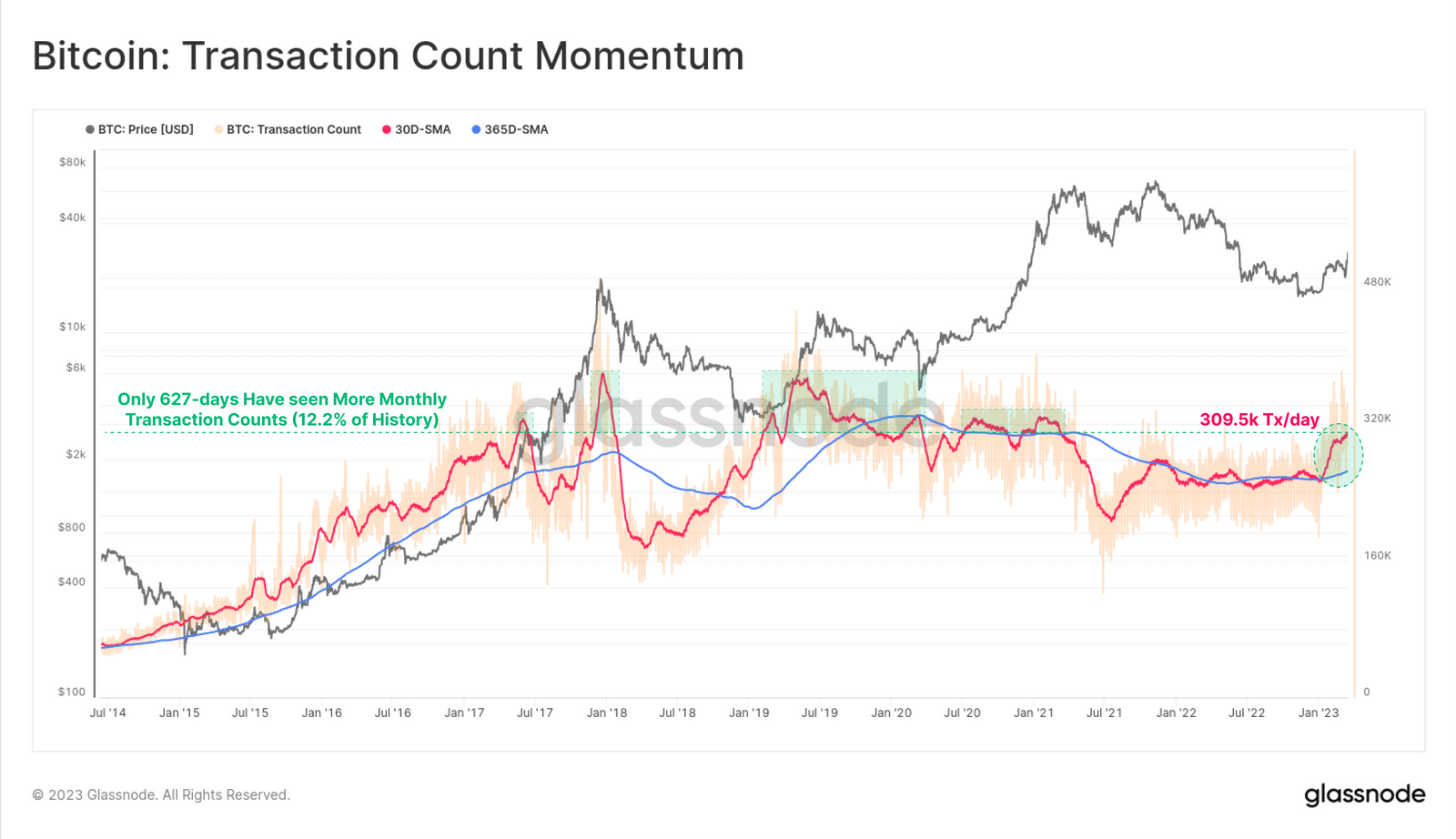

Bitcoin’s month-to-month common transaction rely has hit 309.5k per day — the very best stage since April 2021, in line with on-chain analytics agency Glassnode. Regardless of the excessive worth efficiency, the proportion of ‘sizzling cash’ continues to be near cycle lows — indicating that almost all homeowners of older cash usually are not motivated to take earnings.

However with Bitcoin’s worth now showing to shift in direction of the $30,000-32,000 vary, does the newest rally imply we’re out of bear market territory?

Glassnode information seems bullish

On the week of March 20, the month-to-month common of transaction counts reached 309.5k per day — the very best stage since April 2021 and considerably above the yearly common. Lower than 12.2% of all days have seen increased transaction exercise for Bitcoin — a optimistic indication as this metric is usually linked with rising adoption charges, community results, and investor exercise.

Glass Node approximates that the variety of distinct new entities working on the blockchain as the perfect measure for distinctive new customers. Their evaluation exhibits that this metric has hit 122k new entities per day, however solely 10.2% of days have had increased adoption charges for brand new customers — which came about through the 2017 peak and the 2020-21 bull run.

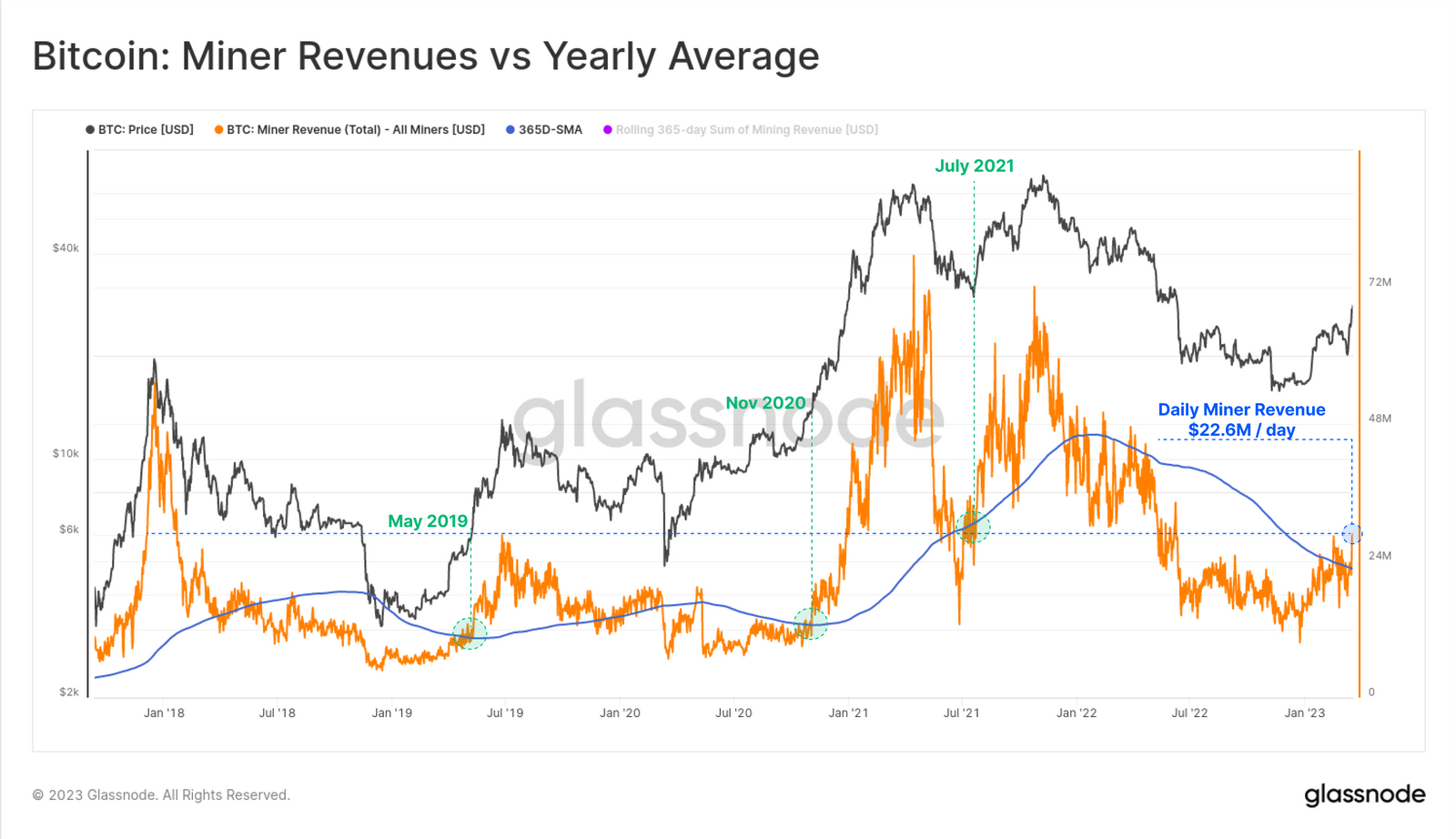

Bitcoin Miners additionally seeing inflow

Miners are among the many main beneficiaries of this inflow, with their complete income surging as much as $22.6 million per day. On the week of March 20, miner revenues have risen to their highest stage since June 2022 — firmly surpassing the yearly common.

Much like the exercise fashions talked about earlier, this pattern is often seen throughout transition factors in direction of a extra favorable market.

Mining income within the inexperienced

Miners are undoubtedly one of many lifelines of the crypto ecosystem. Nevertheless, rising mining exercise additionally results in community congestion and fuel charges, that are typical precursors to extra constructive markets.

Whereas excessive community charges could make small transactions extra pricey, they profit miners who obtain these charges for securing the blockchain.

In accordance with on-chain information, miner income has returned to its highest level since June 2022 at $22.6 million/day — indicating that Bitcoin is again in bull territory, Glassnode says. Regardless of the robust worth efficiency, the proportion of ‘sizzling cash’ continues to be near cycle lows — indicating that almost all homeowners of older cash usually are not motivated to take earnings.

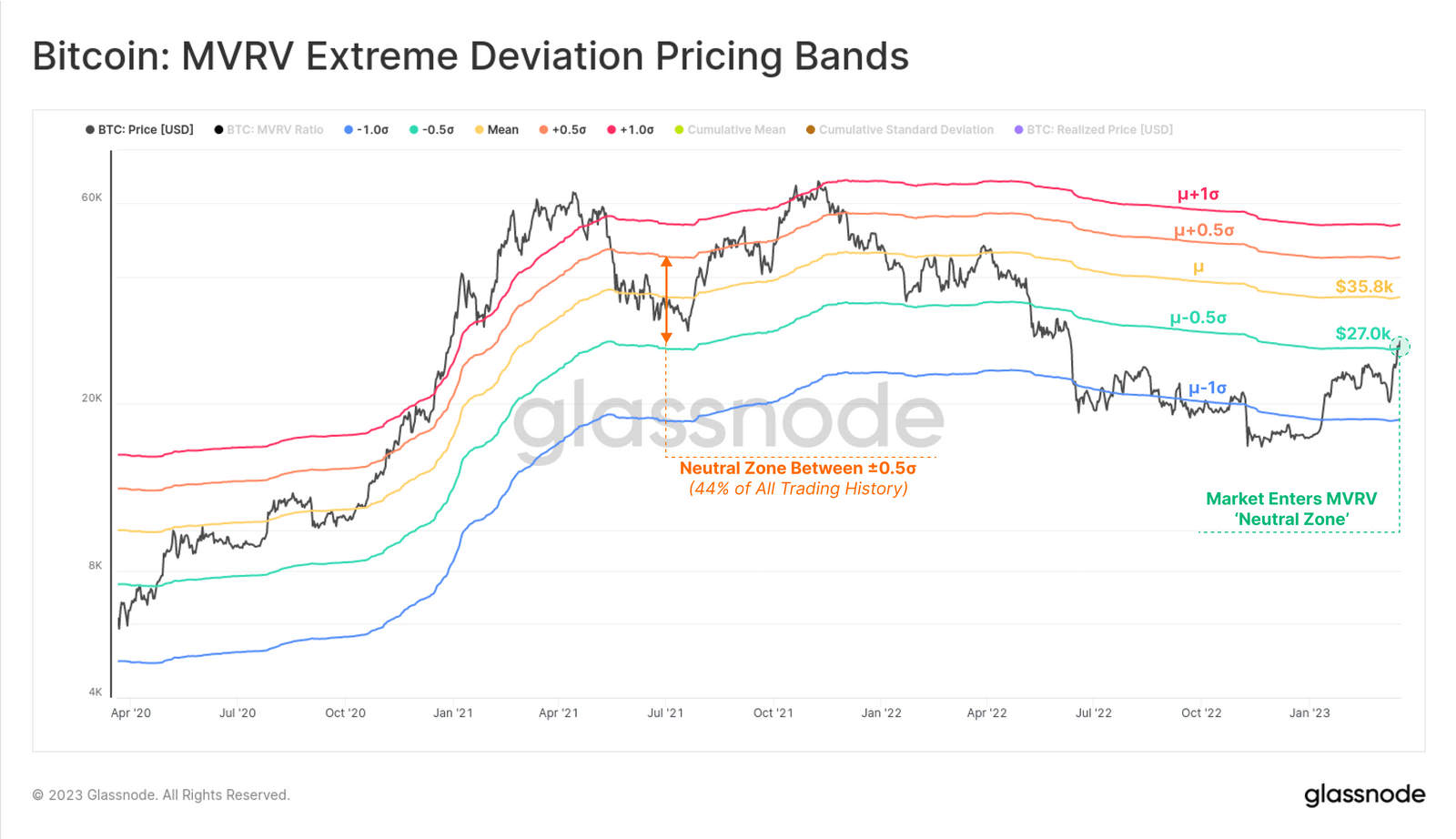

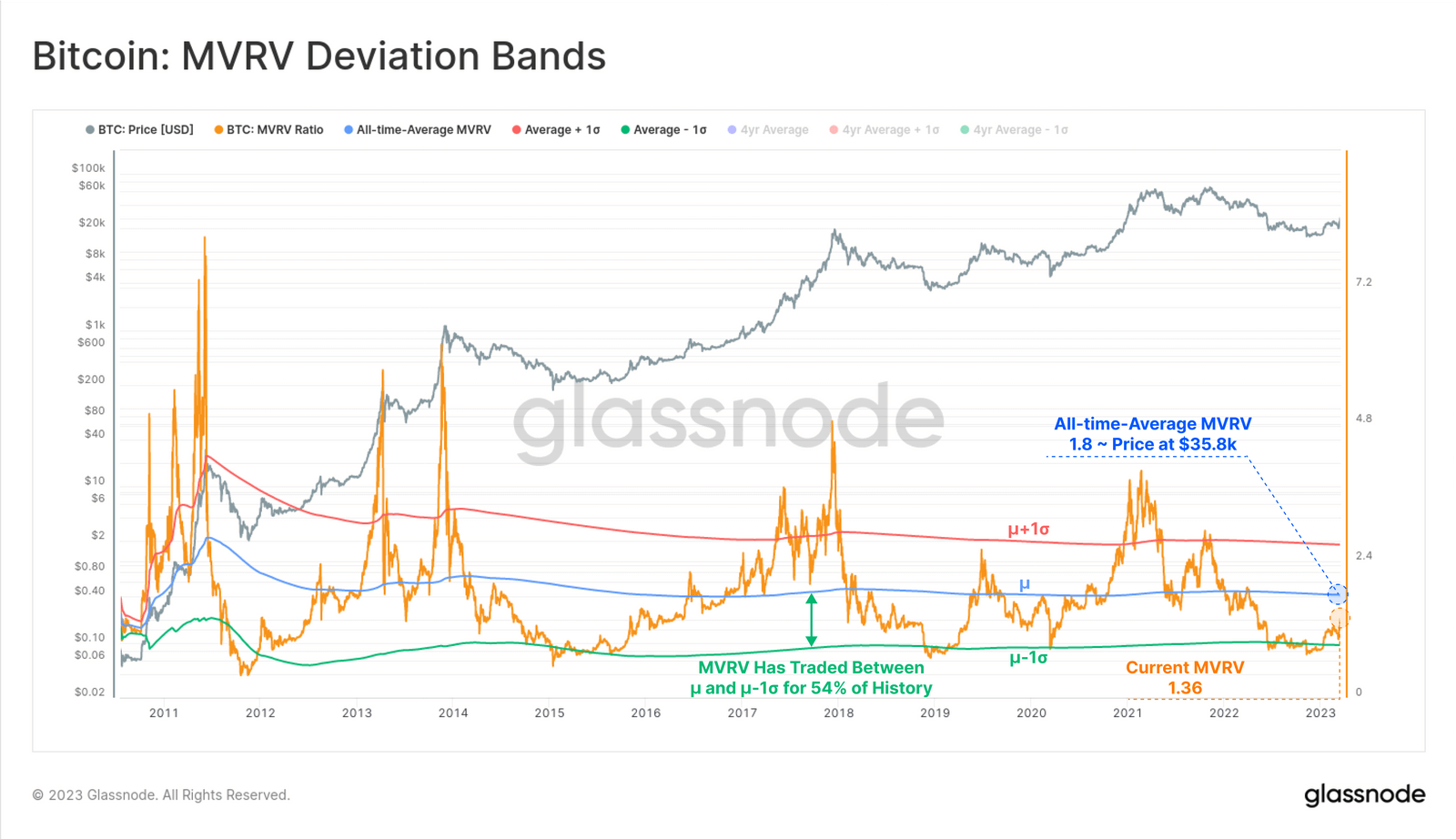

Glassnode’s report additionally analyzed Bitcoin’s MVRV (market-value-to-realized-value) ratio — which measures the unrealized revenue a number of inside the coin provide. The ratio has elevated to 1.36 after surpassing $27,000 this week and has returned to its “impartial zone.” This implies that costs are now not closely discounted compared to the common on-chain market price foundation.

Finally, Glassnode concludes that the long run seems to be vivid for Bitcoin:

“Bitcoin traders have skilled one of many strongest one-week positive factors on document, amidst a backdrop of stress, consolidation, and liquidity injections throughout the worldwide banking system. A number of on-chain indicators counsel that the Bitcoin market is transitioning out of situations traditionally related to deep bear markets, and again in direction of and greener pastures.”