FTX is eyeing the completion of its chapter course of for the second quarter of subsequent 12 months, in response to its Sept. 11 court docket filings.

As per the submitting, the agency is at present concerned with ongoing negotiations and mediation with stakeholders over the approaching months to resolve open plan points involving its chapter plans. FTX additionally revealed that greater than 75 corporations, together with present crypto exchanges and monetary and strategic consumers, have proven curiosity in it.

The trade mentioned it started a advertising course of for the FTX.com and FTX US exchanges in Might. In line with the corporate, the FTX restart course of considers various potential buildings, together with an acquisition, merger, recapitalization, or different transactions to relaunch the FTX.com and/or FTX US exchanges.

In the meantime, it additional disclosed a complete abstract of its belongings in a latest court docket submission, exhibiting roughly $7 billion value of belongings, encompassing money holdings, cryptocurrency, brokerage, reclaimed authorities belongings, and varied restoration endeavors.

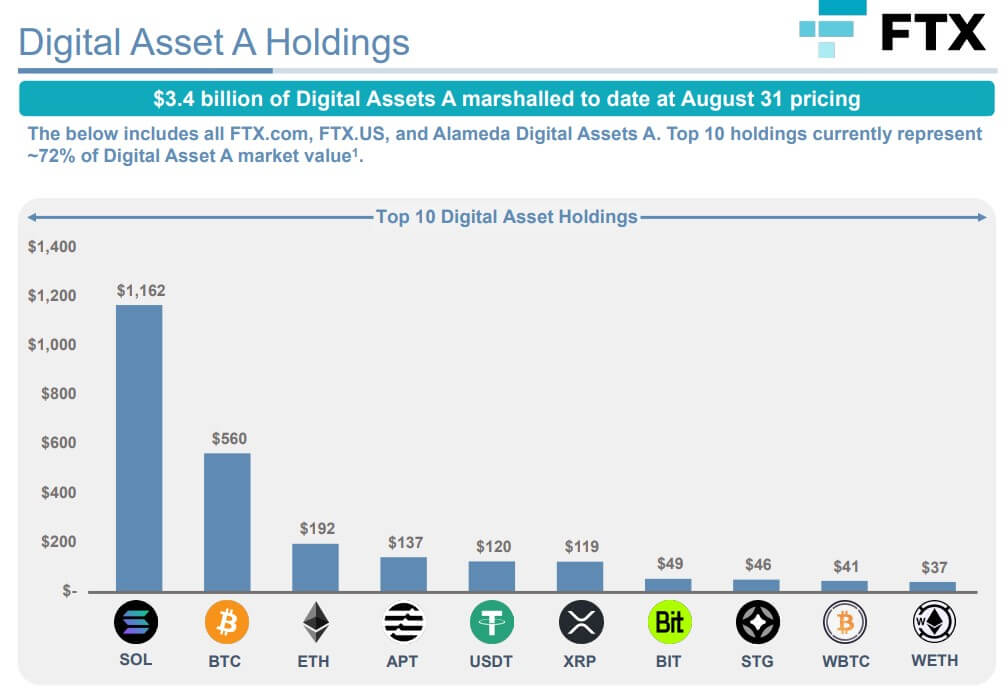

Solana dominates FTX crypto holdings

Per the submitting, the embattled cryptocurrency firm at present possesses a various portfolio of digital belongings valued at $3.4 billion, with its prime 10 holdings accounting for roughly 72% of this valuation.

This portfolio contains $1.16 billion in Solana (SOL), $560 million in Bitcoin (BTC), $192 million in Ethereum (ETH), and $119 million in XRP.

The submitting additionally confirmed that the agency had a whole bunch of hundreds of thousands of {dollars} value of over 1,300 lesser-known belongings “that fail to satisfy liquidity thresholds and are primarily managed by it.” A number of the belongings on this class embody MAPS, Serum (SRM), Bonfida (FIDA), and so forth.

starcrypto beforehand reported that the bankrupt agency is in search of court docket approval to permit it to liquidate as much as $100 million value of digital belongings weekly, with the power to extend the restrict to $200 million quickly.

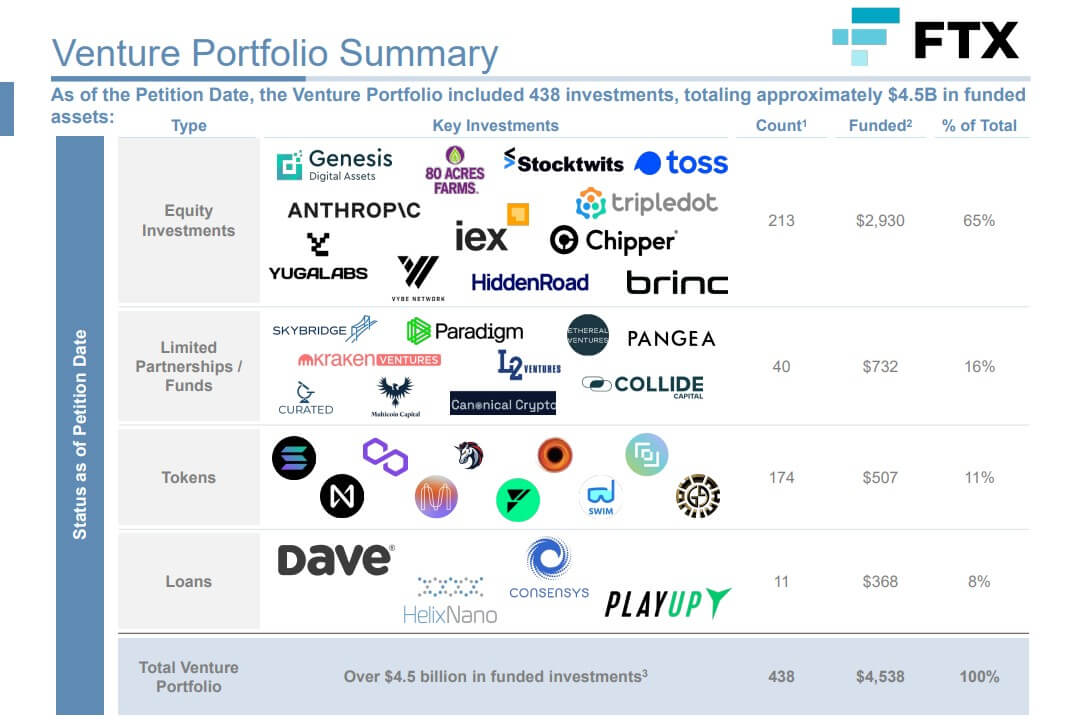

$4.5B value of enterprise investments

The court docket submitting additional confirmed that FTX had 438 enterprise investments, totaling roughly $4.5 billion in funded belongings.

These investments included fairness investments in corporations like Yuga Labs, Chipper, Toss, Genesis Digital Belongings, and so forth. It additionally revealed a partnership with main funding corporations comparable to Kraken Ventures, Skybridge, Paradigm, and so forth.

Different belongings

The submitting revealed that the bankrupt agency possesses 38 Bahamian properties, encompassing condominiums, penthouses, and different actual property belongings, with an estimated whole worth of roughly $200 million.

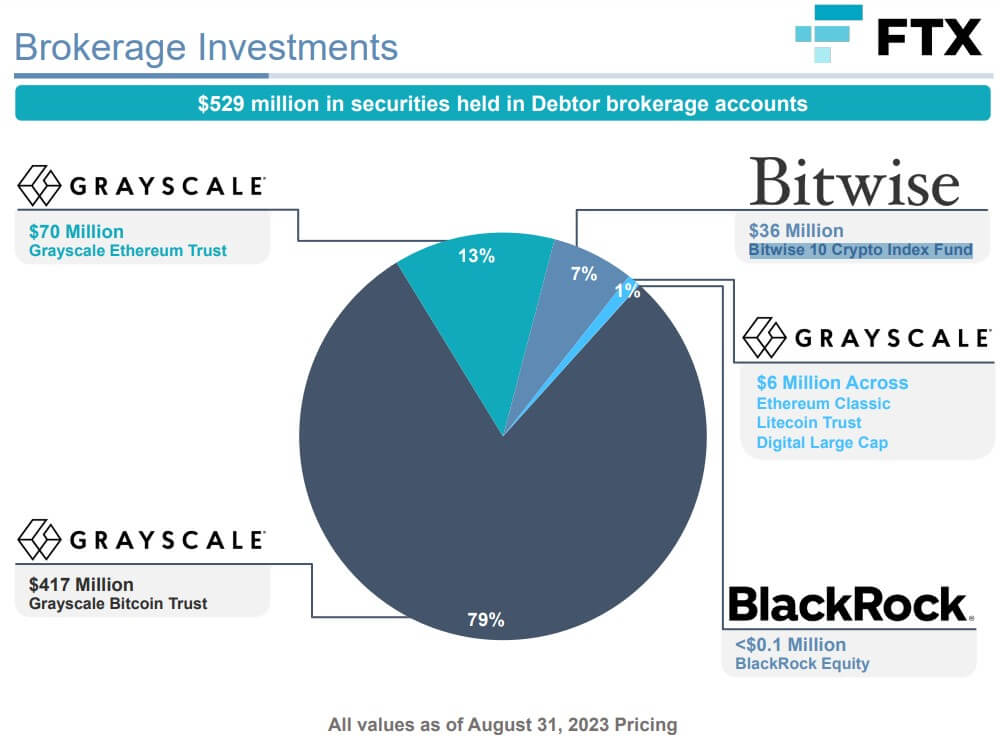

Moreover, the corporate maintains a big securities portfolio valued at $529 million, primarily held in brokerage accounts with distinguished crypto funding corporations comparable to Grayscale, Bitwise, and BlackRock, the world’s largest asset administration firm.

An in depth breakdown of those securities holdings signifies that $493 million is invested in varied Grayscale merchandise, together with their Bitcoin and Ethereum trusts. Moreover, the agency has allotted $36 million to the Bitwise 10 Crypto Index Fund and has a smaller funding of lower than $100,000 in BlackRock’s fairness choices.