Disclaimer: The data offered on this article is a part of a sponsored/press launch/paid content material, meant solely for promotional functions. Readers are suggested to train warning and conduct their very own analysis earlier than taking any motion associated to the content material on this web page or the corporate. Coin Version just isn’t answerable for any losses or damages incurred on account of or in reference to the utilization of content material, merchandise, or providers talked about.

CoinEx Analysis has launched its complete report on the cryptocurrency marketplace for August, highlighting vital volatility, restoration, and key developments all through the month. This report is important because it affords insights into the evolving dynamics of the crypto house, serving to traders and stakeholders navigate the complexities of a market in flux.

Financial institution of Japan Price Hike

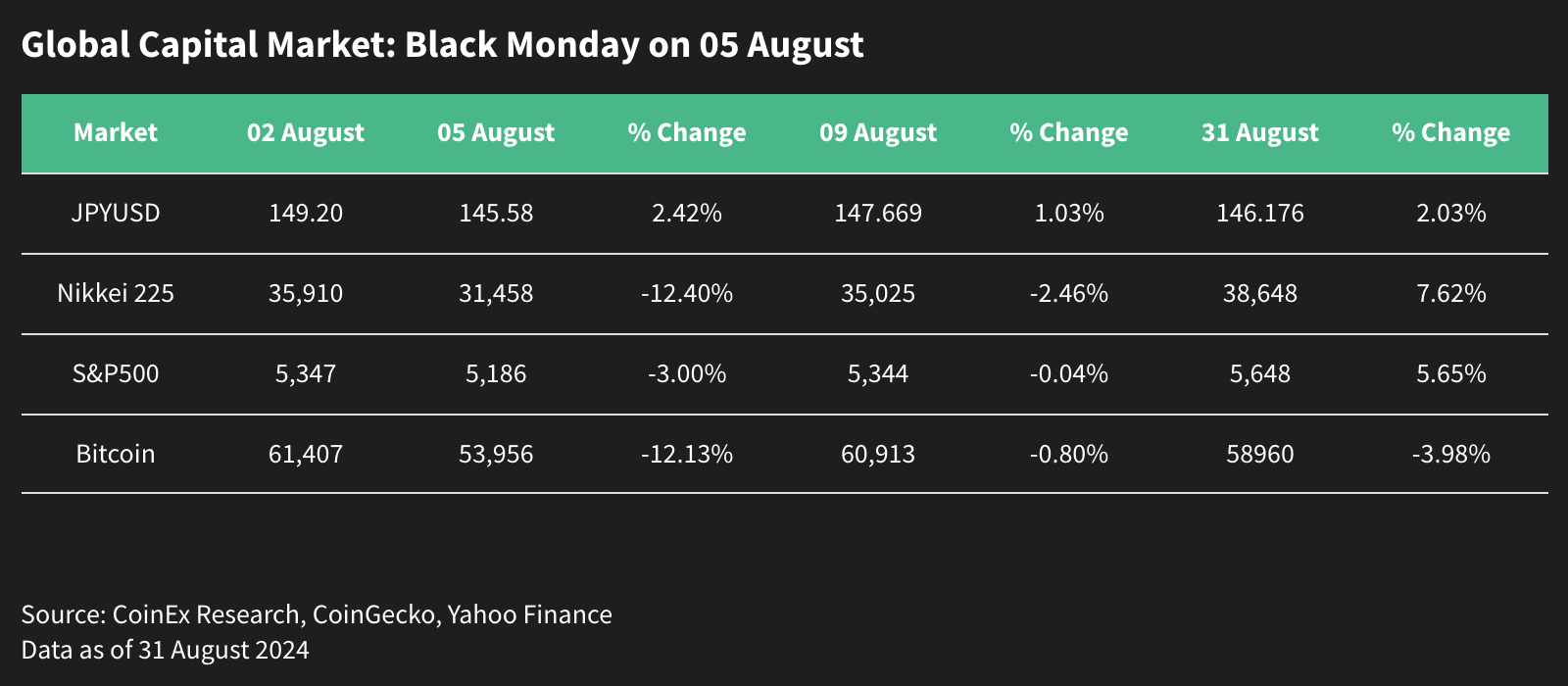

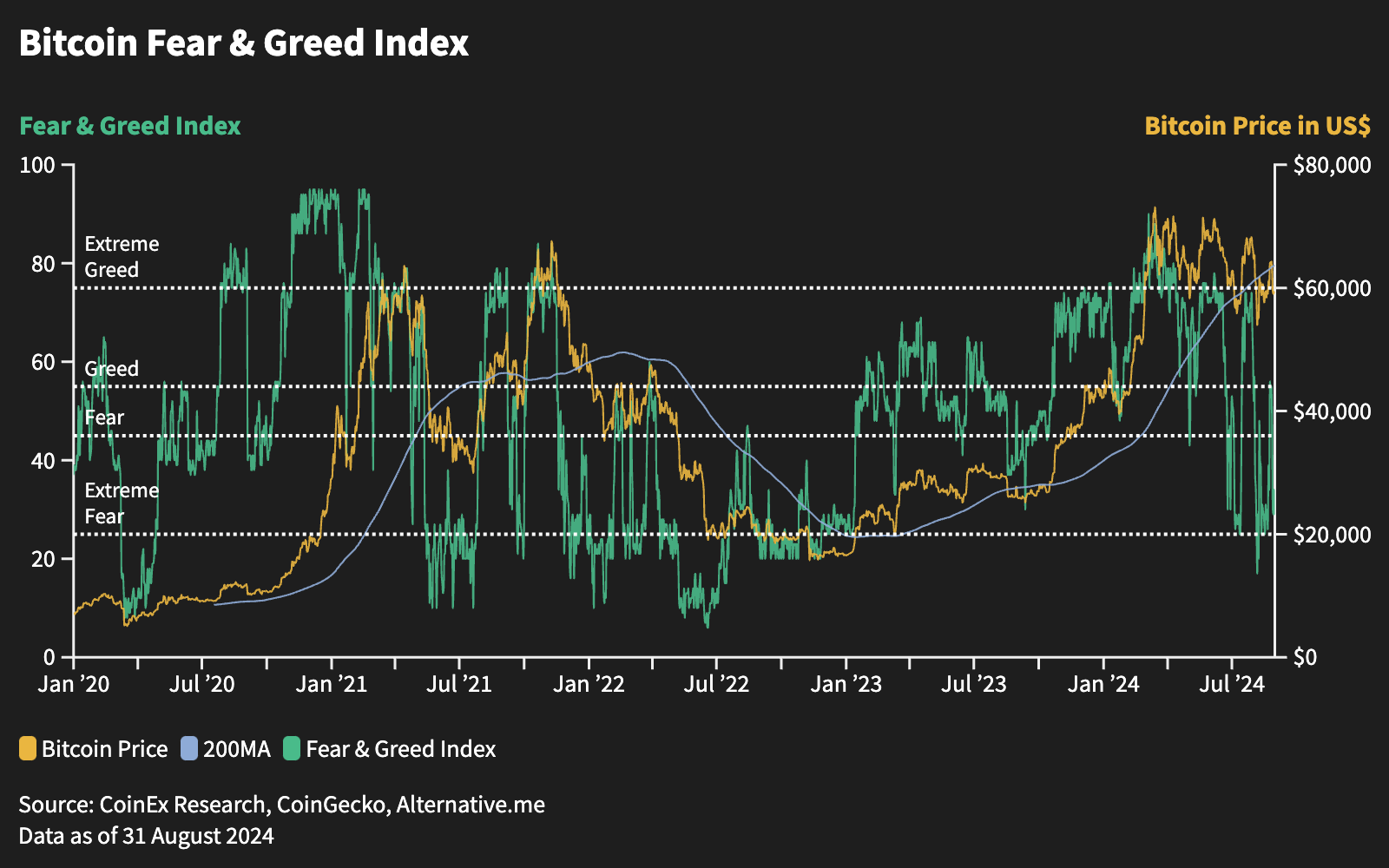

The choice by the Financial institution of Japan to extend rates of interest led to vital market turmoil, triggering a worldwide sell-off in the course of the week of 04 August. Whereas the U.S. fairness markets swiftly rebounded from their losses, the crypto market did not mirror this restoration. Bitcoin initially confirmed a gradual restoration, reaching its August opening ranges, however subsequently tumbled additional, closing the month close to the $58,000 mark. Bitcoin balances on exchanges dropped to a 2024 low of two.39 million BTC, indicating a rising tendency amongst traders to carry Bitcoin reasonably than liquidate positions.

Market Situation

The market is in limbo, missing clear course, with the Concern & Greed Index slipping into “Excessive Concern” territory. The speed lower by the Federal Reserve in September is extensively seen as market consensus and seems to be largely priced in. This might current a shopping for alternative for long-term traders prepared to climate the volatility.

Bitcoin Staking

On August 22, Babylon’s launch of Bitcoin staking was met with enthusiasm, shortly reaching full subscription of 1,000 BTC, which was totally subscribed inside simply three hours by roughly 12,700 customers. This initiative briefly spiked Bitcoin gasoline charges, to as excessive as 800 sat/vB, reflecting robust demand for staking alternatives.

Ethereum’s Struggles

Ethereum ETFs noticed a constructive internet circulate in August, recording a internet influx of $6.2 million, in comparison with a big internet outflow of $541.8 million in July. Regardless of a small internet influx into Ethereum ETFs, the worth of Ethereum continues to face downward strain. That is occurring whilst Grayscale’s ETHE outflows have slowed, indicating ongoing challenges for Ethereum in sustaining worth stability. However Ethereum’s core worth propositions, significantly within the DeFi sector, stay sturdy and sustainable

Sui’s Rise

Sui is gaining traction as a robust performer, significantly within the GameFi sector. Backed by Grayscale’s launch of latest belief merchandise and powerful endorsements from key opinion leaders (KOLs) and traders. Its distinctive worth proposition units it aside, even because it attracts comparisons to Solana, highlighting the aggressive nature of blockchain platforms.

Ton Ecosystem

The arrest of Telegram founder Pavel Durov resulted in a decline in Toncoin’s worth and complete worth locked (TVL), leading to a 20% drop in Toncoin’s worth and a 30% decline in Whole Worth Locked (TVL). Nonetheless, the neighborhood has rallied, adopting the “Resistance Canine” meme coin avatar as an emblem of assist and resilience.

SunPump on Tron

SunPump is rising as a well-liked selection amongst meme coin merchants on the Tron platform, has facilitated the creation of over 63,000 meme tokens and generated over 25 million TRX in income, difficult the dominance of Pump.Enjoyable and showcasing the dynamic nature of meme coin markets.

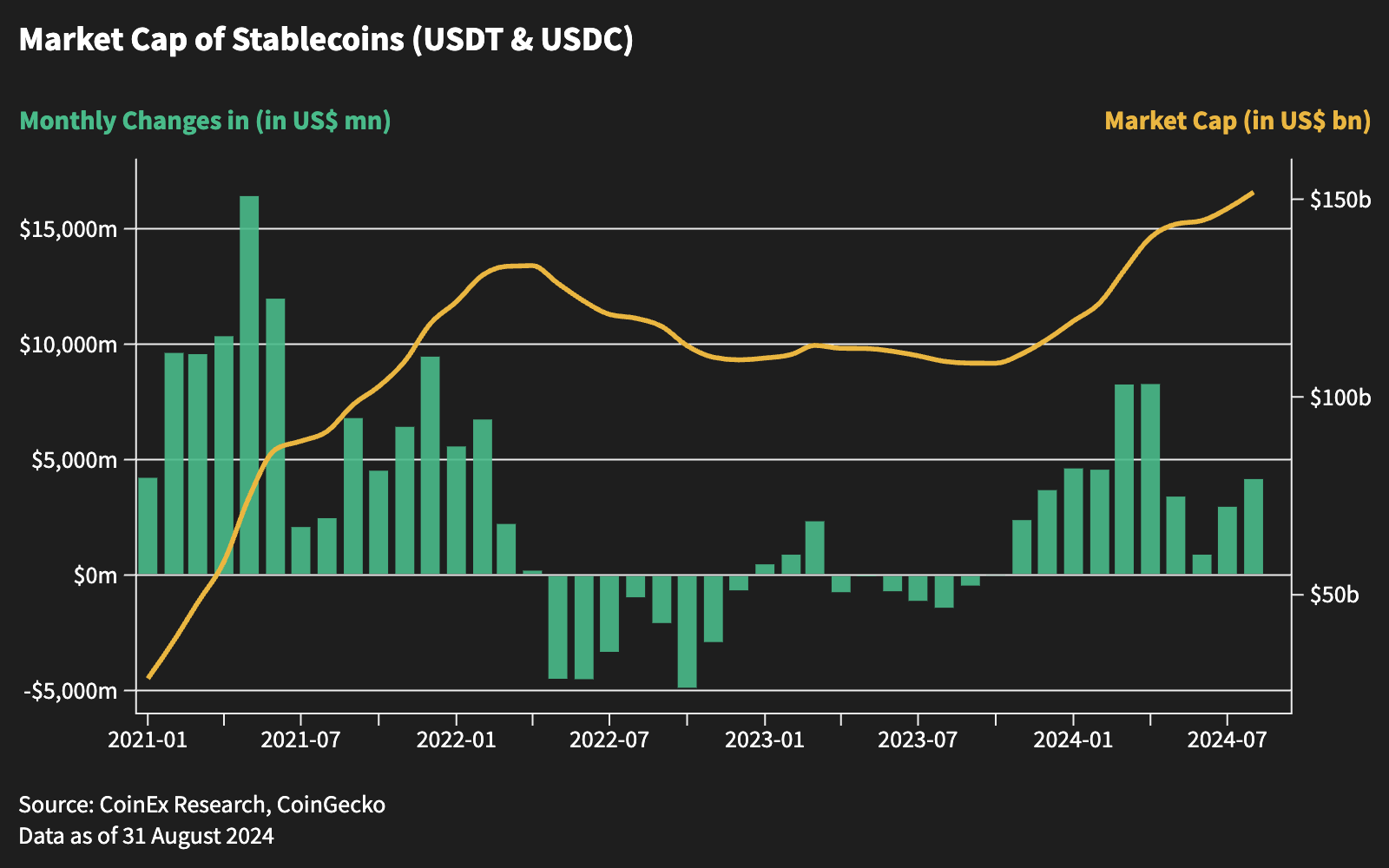

Stablecoins Issuance

In August, a further $4 billion in USDT and USDC was issued, bringing ranges again to these seen in November of final 12 months. At present, the market is in a interval of stagnation attributable to a scarcity of liquidity and market narratives. The robust influx of stablecoins means that the market has not entered an absolute bear market part akin to early 2022 when stablecoins began flowing out.

Conclusion

The CoinEx Analysis report paints an image of a cryptocurrency market at a crossroads, influenced by macroeconomic components and inside dynamics. The findings recommend that whereas the market faces challenges, there are additionally alternatives for progress and innovation. Because the business awaits new catalysts, the main target will possible stay on regulatory developments and macroeconomic shifts. Wanting forward, the potential for rate of interest cuts and different financial occasions might present the required impetus for a market rally. As stakeholders digest these insights, the emphasis can be on strategic positioning and readiness to capitalize on rising developments and alternatives.

About CoinEx

Established in 2017, CoinEx is a worldwide cryptocurrency alternate dedicated to creating crypto buying and selling simpler. The platform offers a spread of providers, together with spot and futures buying and selling, margin buying and selling, swaps, automated market makers (AMM), and monetary administration providers for over 10 million customers throughout 200+ nations and areas. Since its institution, CoinEx has steadfastly adhered to a “user-first” service precept. With the honest intention of nurturing an equitable, respectful, and safe crypto buying and selling setting, CoinEx allows people with various ranges of expertise to effortlessly entry the world of cryptocurrency by providing easy-to-use merchandise.

CoinEx Analysis stays dedicated to offering in-depth analyses and insights into the evolving cryptocurrency market, serving to traders navigate by way of the complexities and alternatives that lie forward.

To study extra about CoinEx, go to: Web site | Twitter | Telegram | LinkedIn | Fb | Instagram | YouTube